In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

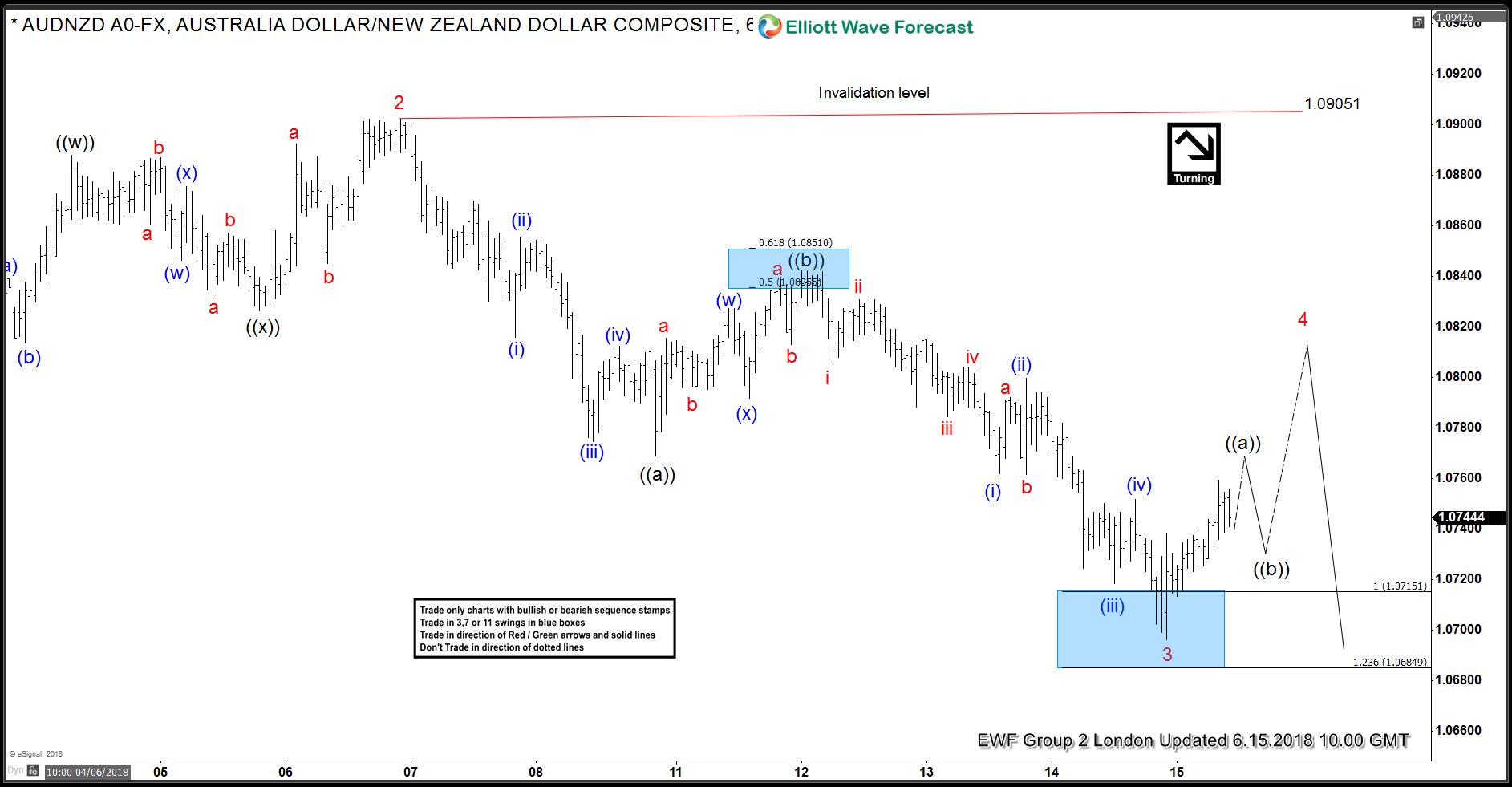

AUDNZD Elliott Wave Analysis: Selling The Rally

Read MoreHello fellow traders. Today, we will have a look at some Elliott Wave charts of the AUDNZD which we presented to our members in the past. Below, you can find our 1-hour updated chart presented to our members on the 06/12/18 calling for more downside after a Double Elliott wave correction in blue wave (w)-(x). AUDNZD had […]

-

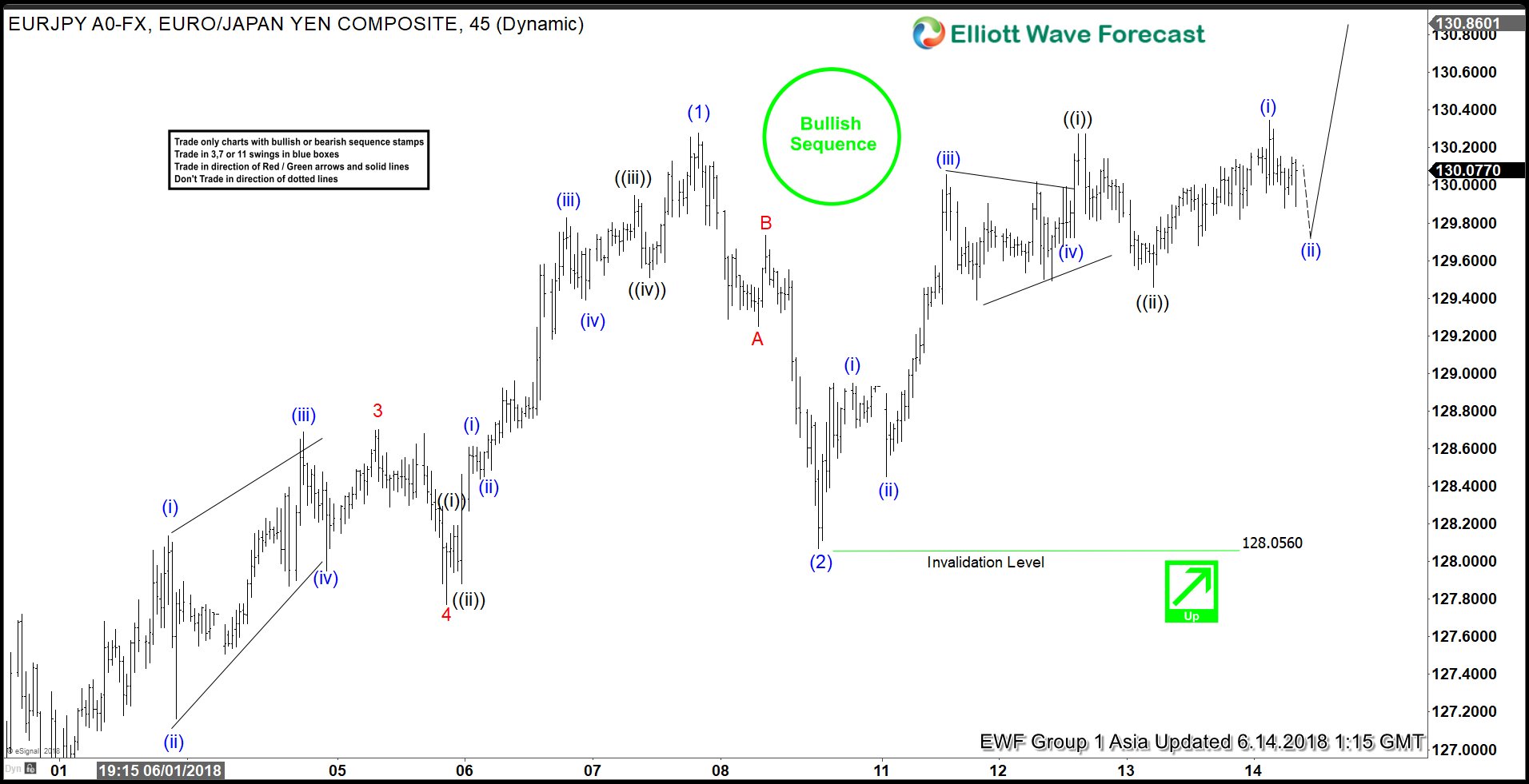

EURJPY Elliott Wave View: Starting The Next Leg Higher

Read MoreEURJPY short-term Elliott wave view suggests that the rally from 5/29 low (124.59) to 6/07 high (130.276) ended intermediate wave (1). The internals of that rally higher unfolded as Impulse Elliott Wave structure where subdivision of Minor 1, 3 and 5 unfolded also as an impulse in lesser degree. Down from there, the pair made a 3 […]

-

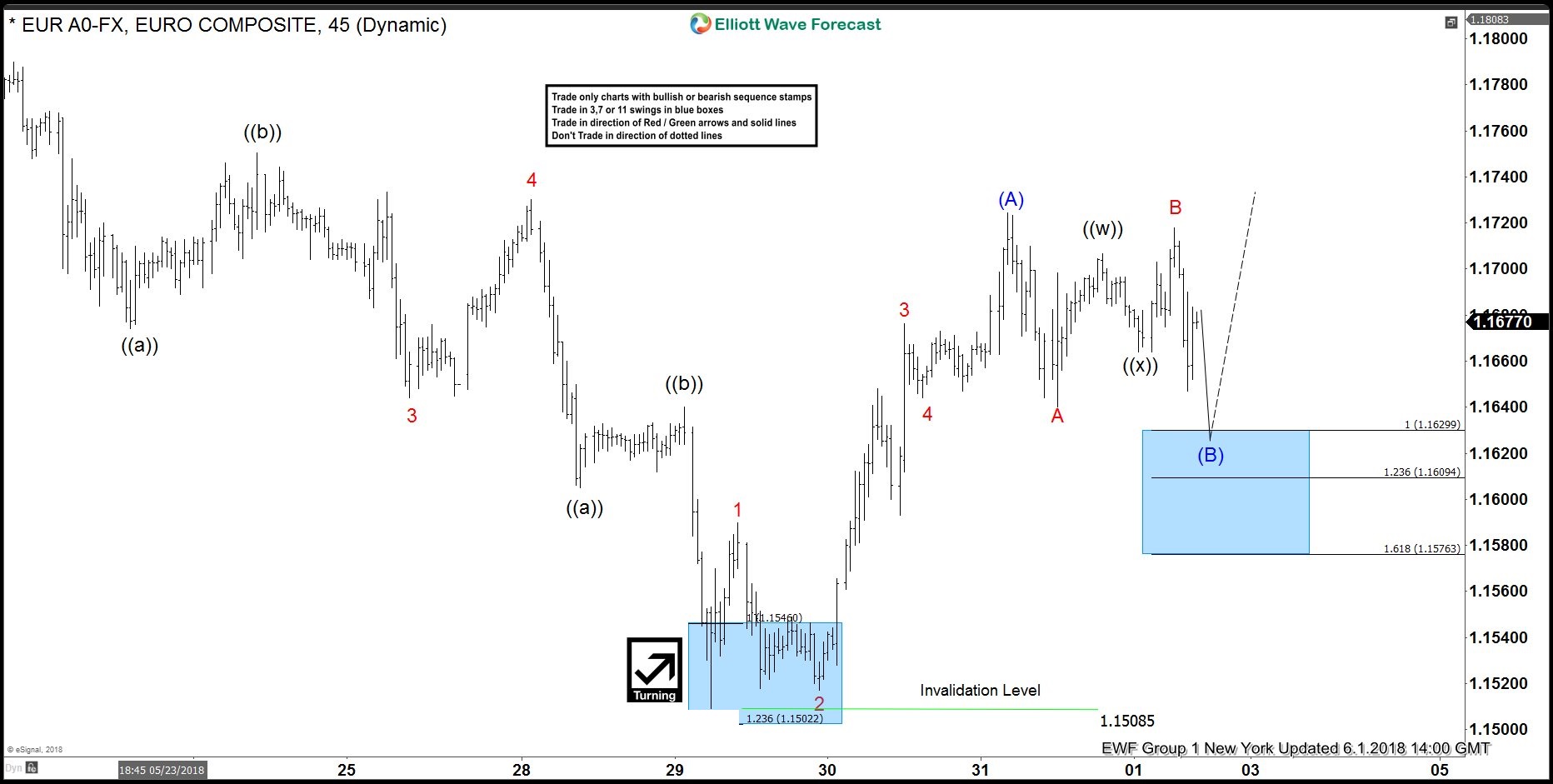

EURUSD Forecasting The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of EURUSD published in members area of the website. As our members know February cycle has ended at 1.15085 low and now we’re getting larger recovery in the pair. In further text we’re going to […]

-

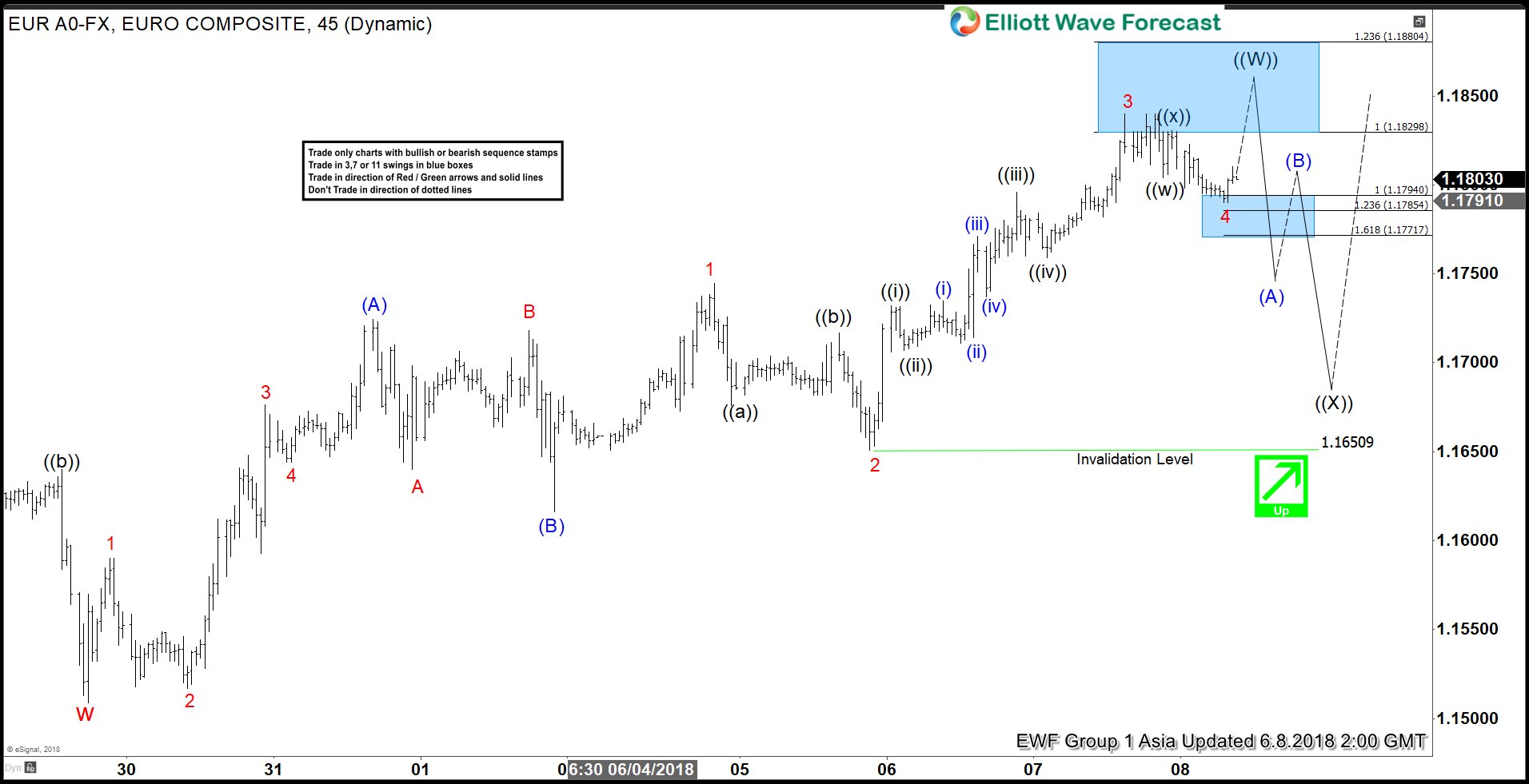

Elliott Wave Analysis: EURUSD May See Profit Taking Soon

Read MoreEURUSD short-term Elliott wave view suggests that the decline to 1.1509 on 5/29/2018 low ended Cycle degree wave “w”. Above from there, the bounce is taking place as Elliott wave zigzag structure to end the Primary degree wave ((W)) cycle. Afterwards, the pair is expected to do a pullback in Primary degree wave ((X)) in […]

-

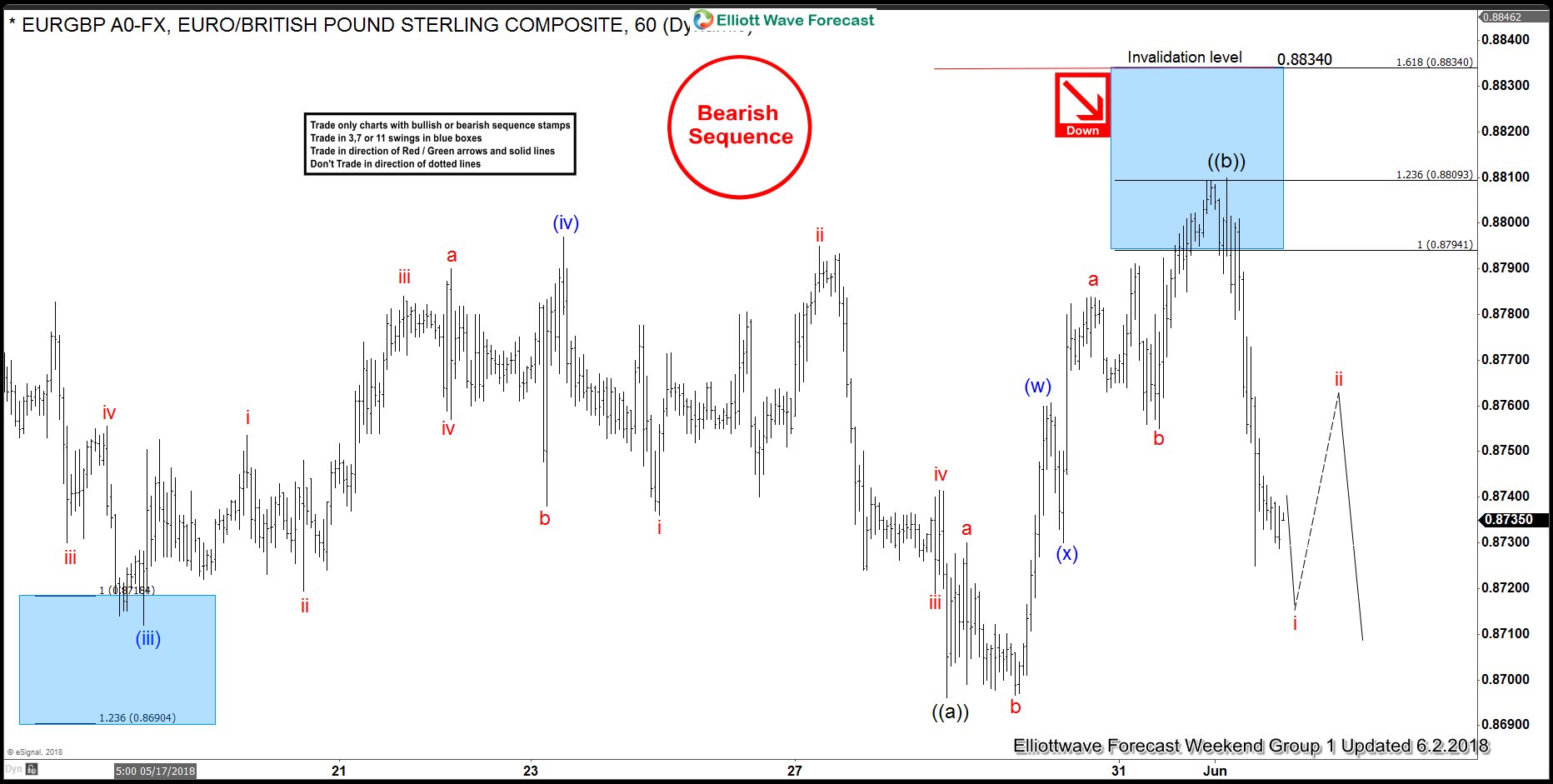

EURGBP Elliott Wave Analysis: Selling The Rally

Read MoreToday, we will have a look at some Elliott Wave charts of the EURGBP which we presented to our members in the past. Below, you can find our 1-hour updated chart presented to our members on the 05/31/18 calling for more downside after a Double Elliott wave correction in blue wave (w)-(x). EURGBP ended the cycle from […]

-

Australia Economy Beat Expectation

Read MoreAustralia Economy Posts Strong Q1 Growth Australia’s 1st quarter 2018 Gross Domestic Product is growing at 1.01%, beating the expectation of 0.9%. This is the largest increase since late 2011 and brings the year-on-year growth rate to 3.1%, up from 2.4% in the previous quarter. Chart below shows the year-on-year growth of Australia’s GDP: The […]