In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

USDX Elliott Wave Analysis: Bullish Sequence Calling Higher

Read MoreUSDX short-term Elliott Wave view suggests that the decline to 94.18 on 6/25 low has ended correction to the cycle from 6/7/2018 low as Intermediate wave (X). The internals of that pullback unfolded as a Flat correction where Minor wave A ended in 3 swings at 94.53, Minor wave B ended in 3 swings at […]

-

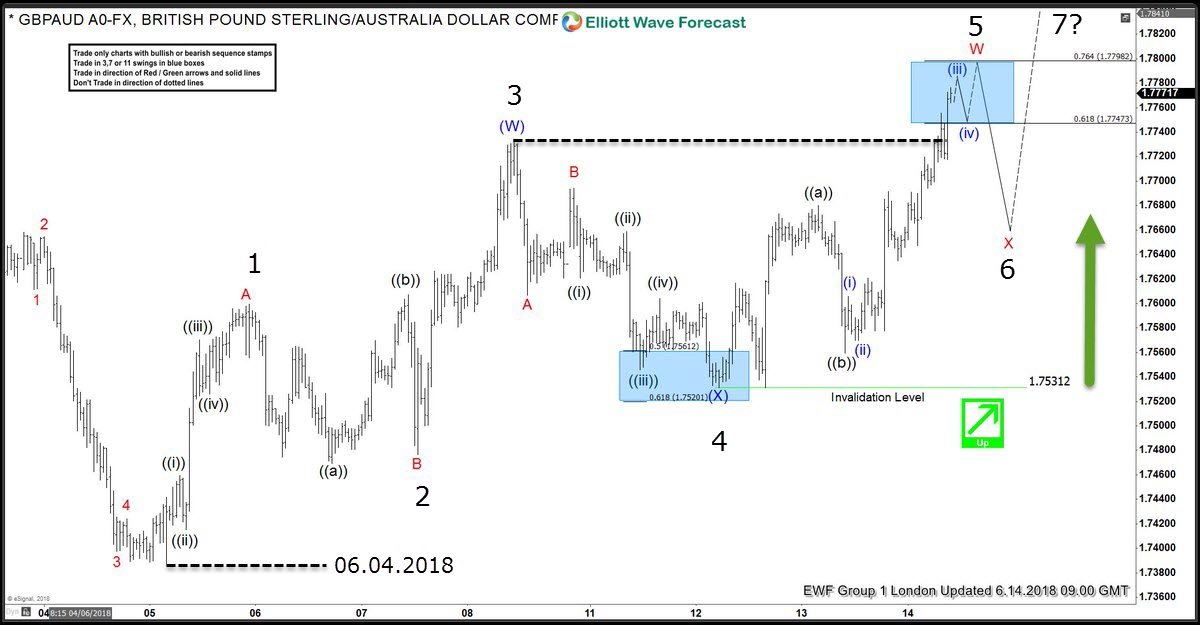

GBPAUD Incomplete Sequences Calling The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPAUD published in members area of the website. As our members know GBPAUD has been showing incomplete bullish sequence: 5 swing in the short term cycle from the June 4th low. These types of […]

-

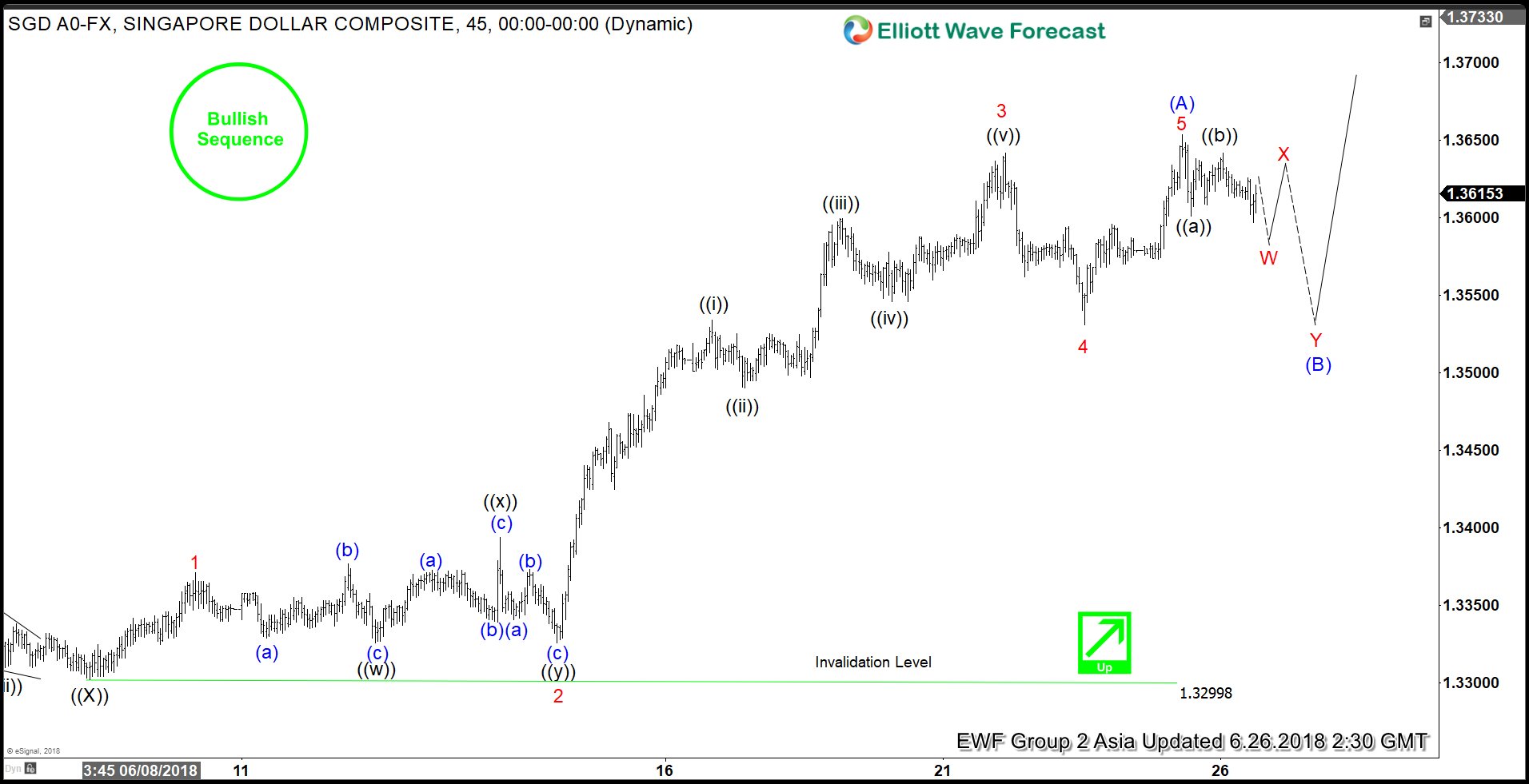

USDSGD Showing Incomplete Elliott Wave Structure To The Upside

Read MoreUSDSGD short-term Elliott wave view suggests that the decline to 1.3299 on 6/07 low ended primary wave ((X)) pullback. Above from there, the pair rallied higher and went on to make a new high for this year creating 5 swing incomplete sequence to the upside from 1/25/2018 low. This sequence is represented by the bullish […]

-

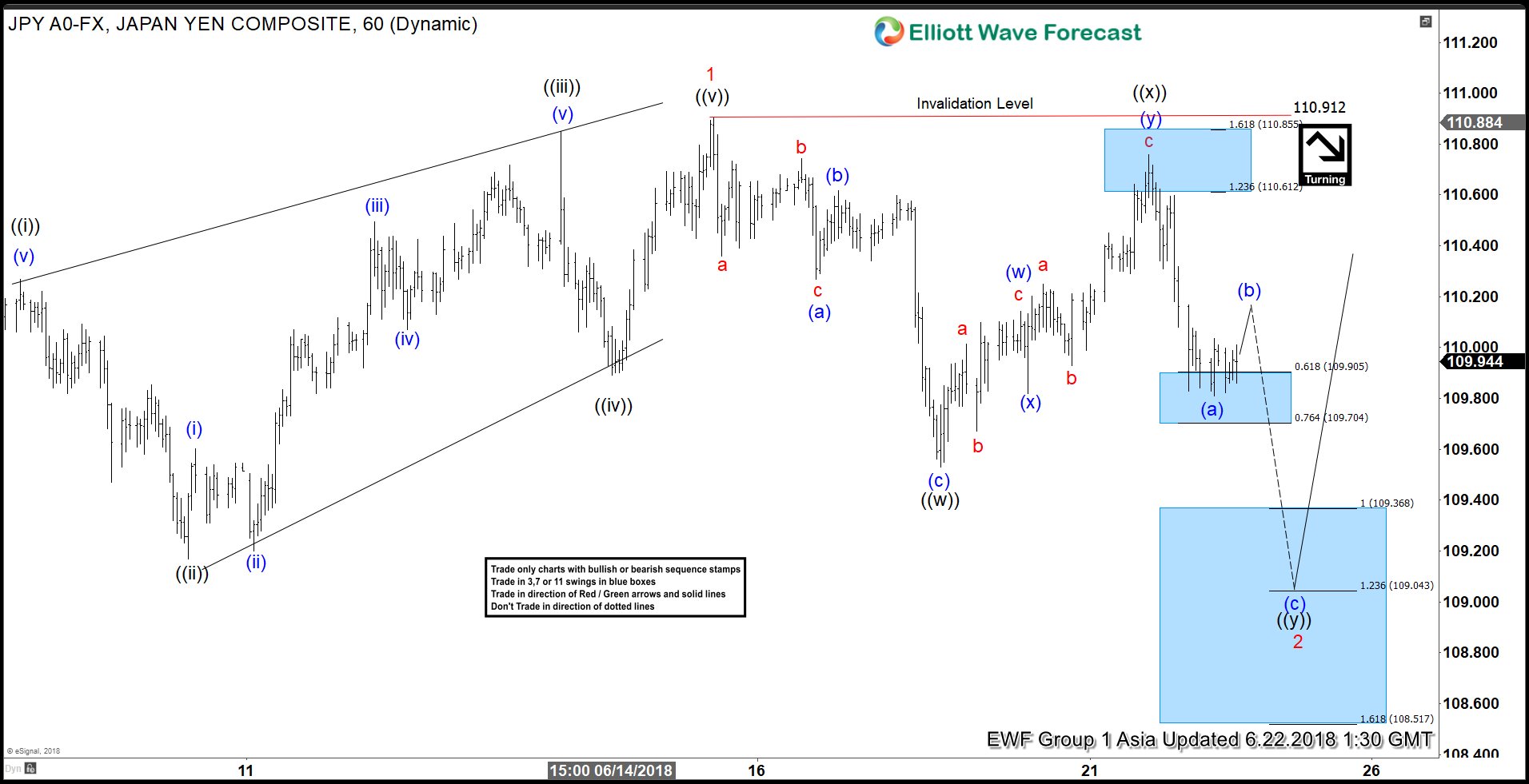

Elliott Wave View: USDJPY Support Around The Corner?

Read MoreUSDJPY short-term Elliott wave view suggests that the rally to 110.91 high ended Minor wave 1 & also the cycle from 5/29 low. The internals of that rally higher unfolded as Elliott wave leading diagonal where Minute wave ((i)) ended at 110.27 high in 5 waves, Minute wave ((ii)) pullback ended at 109.17, and Minute wave […]

-

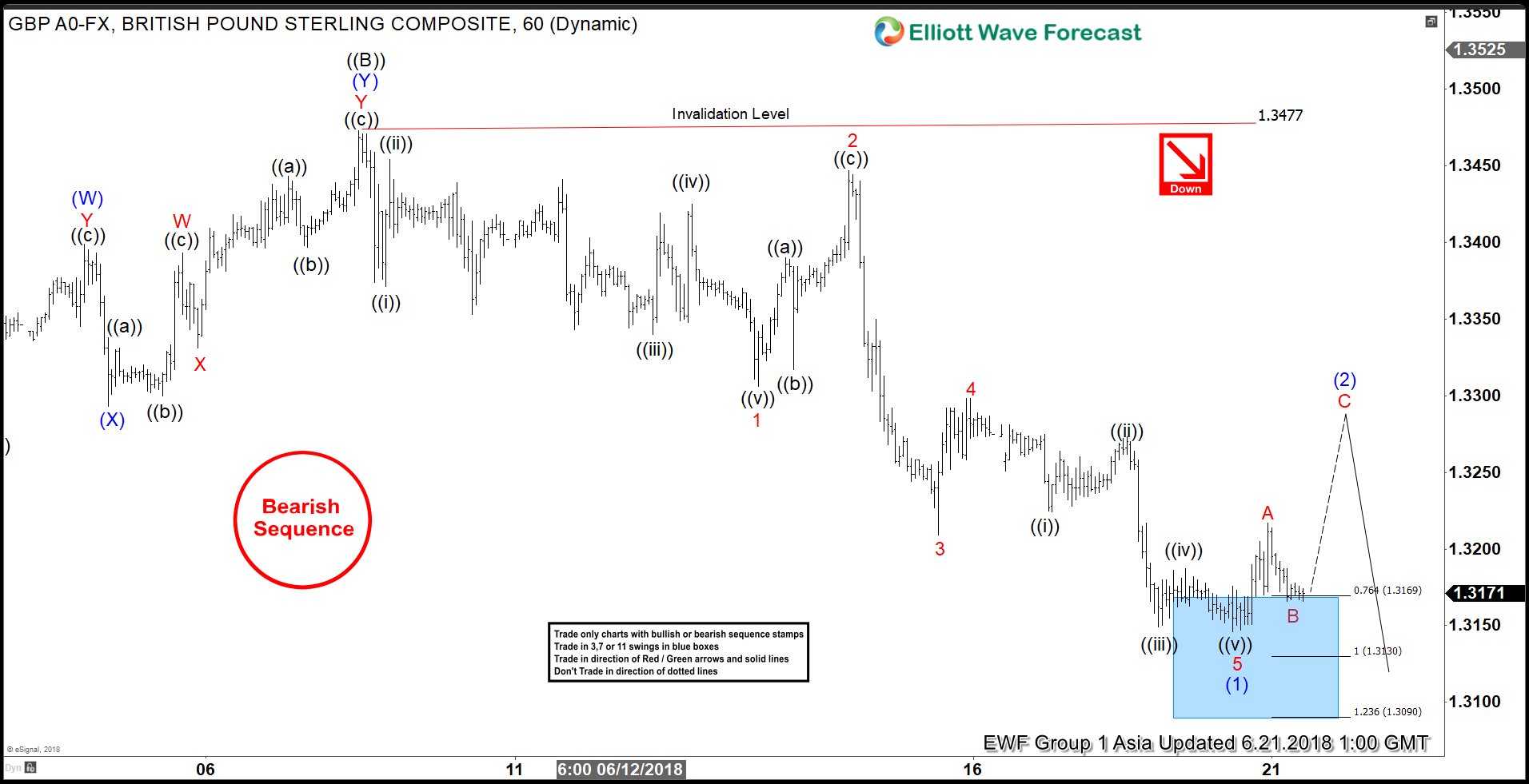

Elliott Wave Analysis: GBPUSD Showing Incomplete Sequence

Read MoreGBPUSD short-term Elliott Wave view suggests that the recovery to 1.3473 on 6/07/2018 peak ended primary wave ((B)) bounce as double three structure. Below from there, the pair has managed to break below the previous low on 5/29 (1.3203) to confirm the next extension lower in primary wave ((C)) has started. With this break lower, […]

-

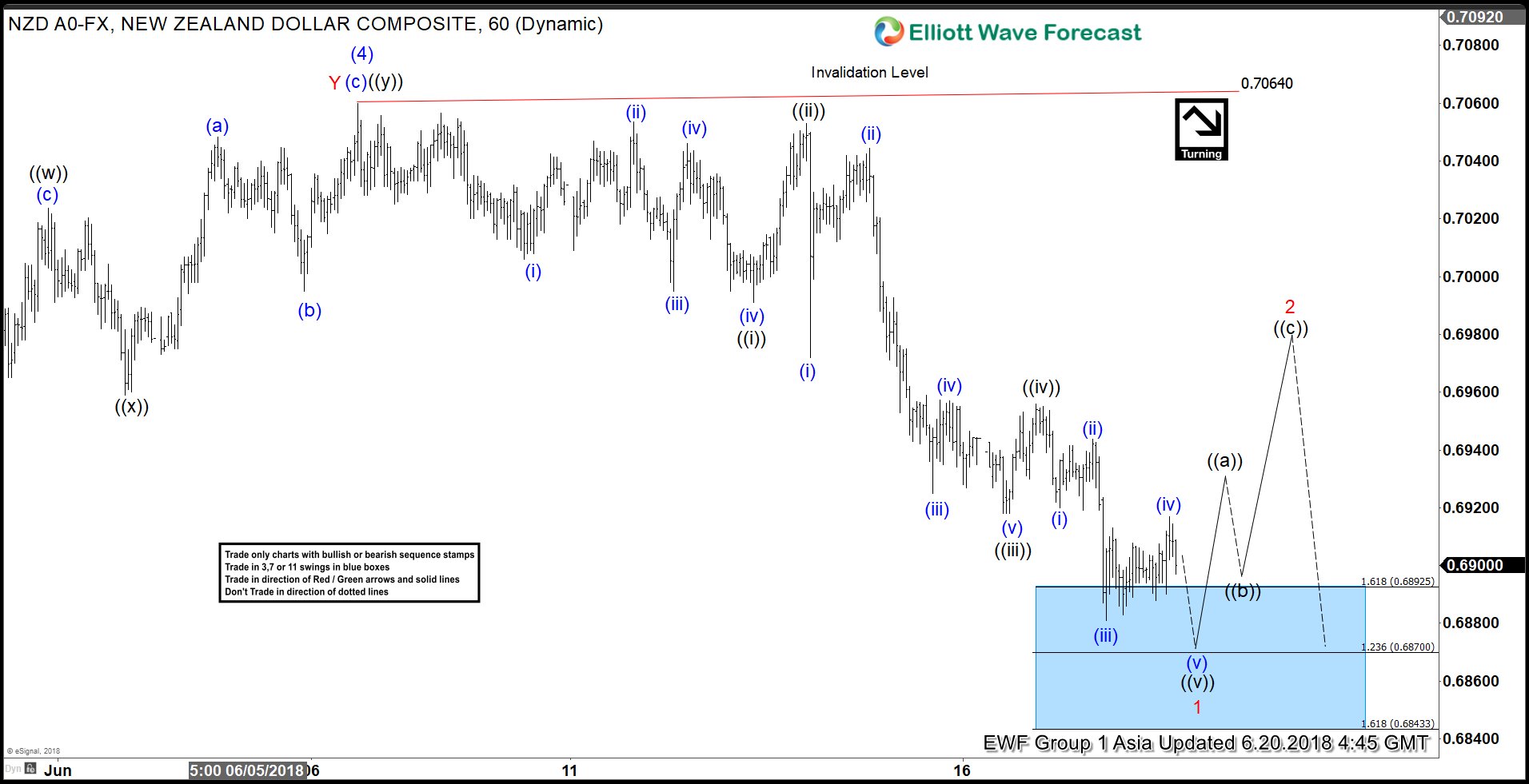

NZDUSD Elliott Wave Analysis: Ready For Recovery?

Read MoreNZDUSD short-term Elliott Wave view suggests that the bounce to 0.7060 high ended intermediate wave (4). Down from there, the decline is unfolding as Impulse Elliott Wave structure where sub-division of Minute wave ((i)), ((iii)) & ((v)) are unfolding in 5 waves within a lesser degree cycle. On the other hand, the corrective Minute degree wave ((ii)) & […]