In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

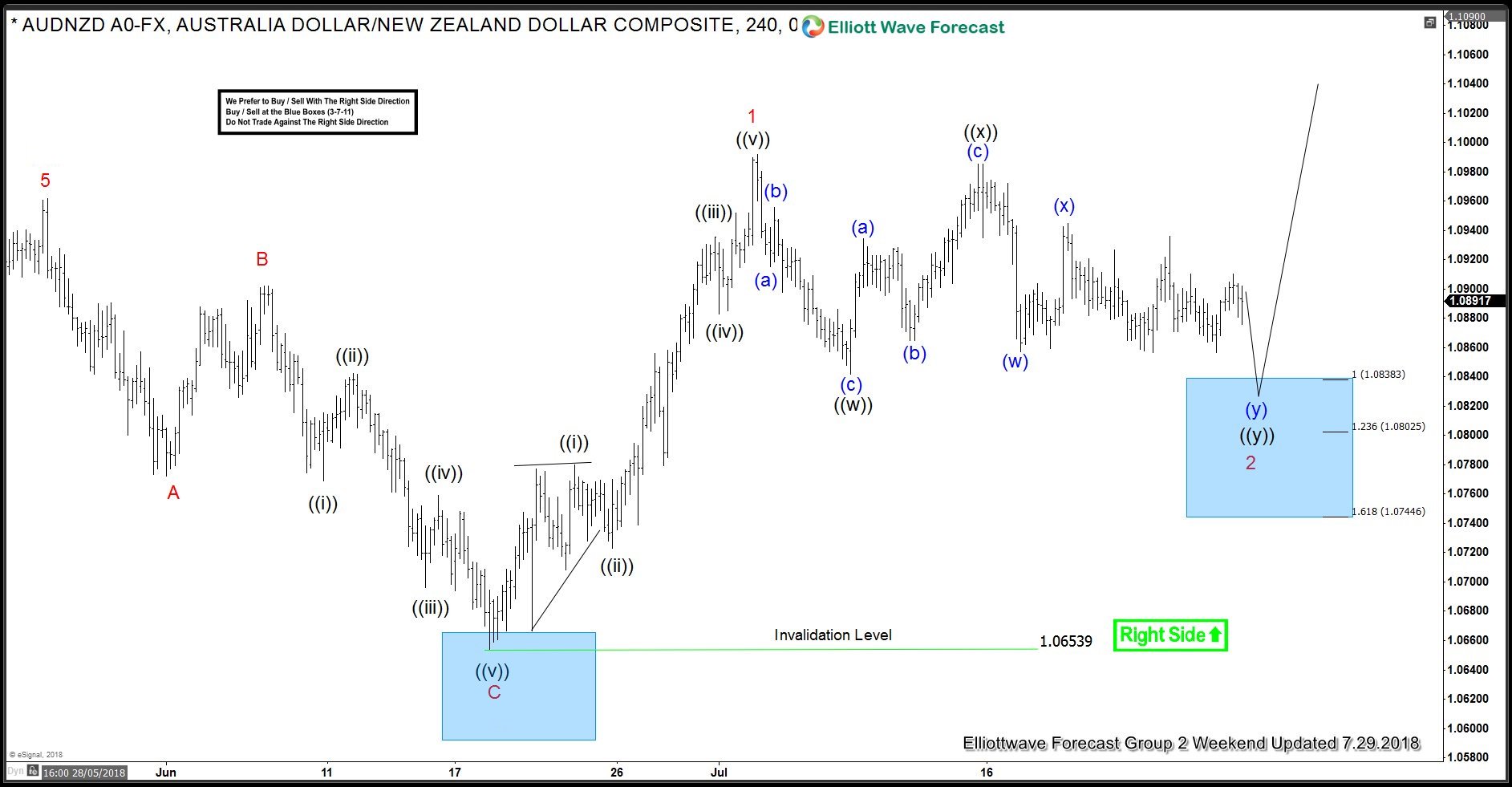

AUDNZD Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is AUDNZD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDNZD published in members area of the website. In further text we’re going to explain the forecast and trading setup. As our members know, AUDNZD have […]

-

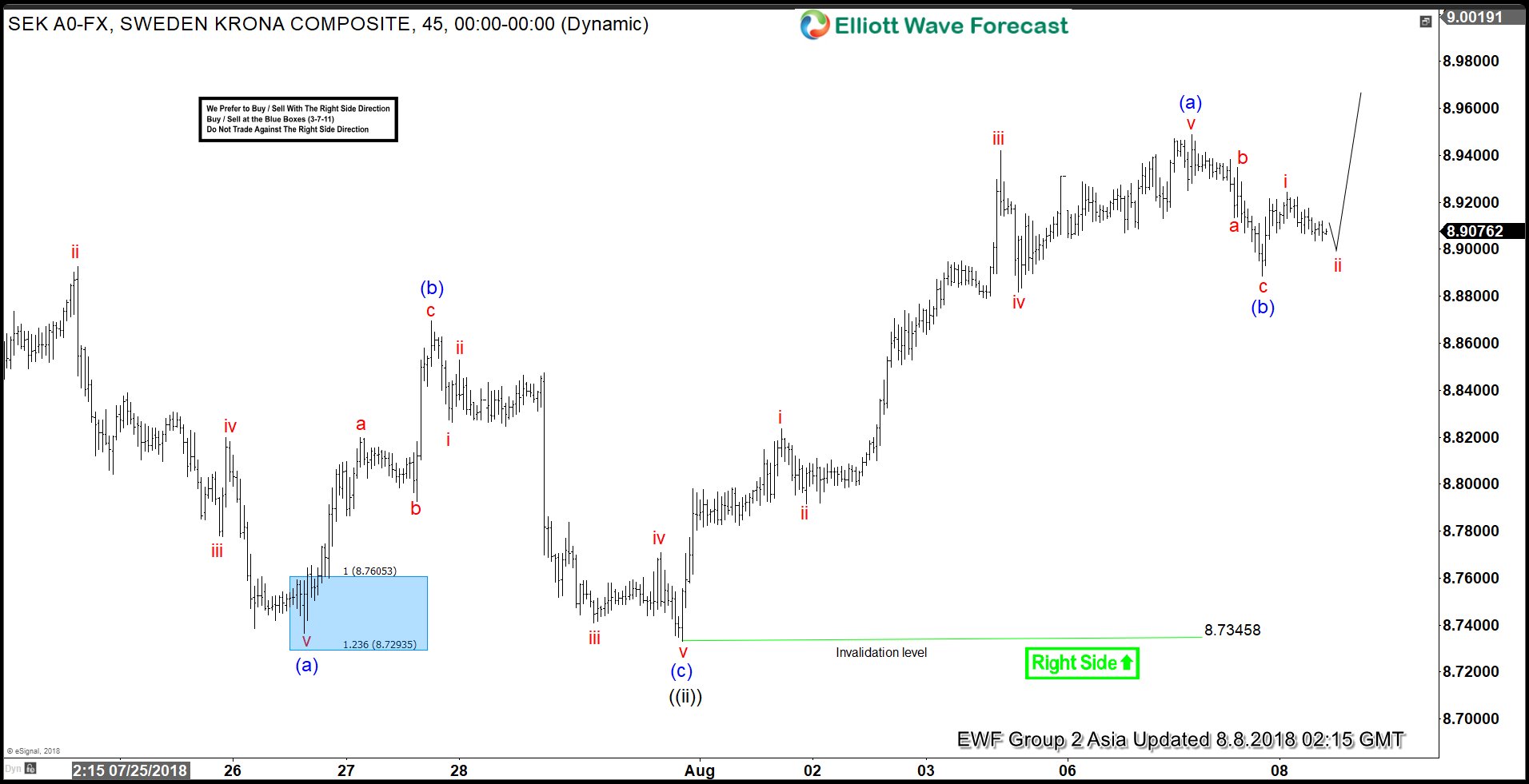

USDSEK Elliott Wave View: Starting C Leg Higher?

Read MoreUSDSEK short-term Elliott Wave view suggests that the decline to 8.7345 low ended Minute wave ((ii)) pullback. The internals of that pullback unfolded as Elliott wave Zigzag correction where Minutte wave (a) ended in 5 waves structure at 8.7377 low. Then the bounce to 8.8687 high ended Minutte wave (b) bounce in swings. The decline […]

-

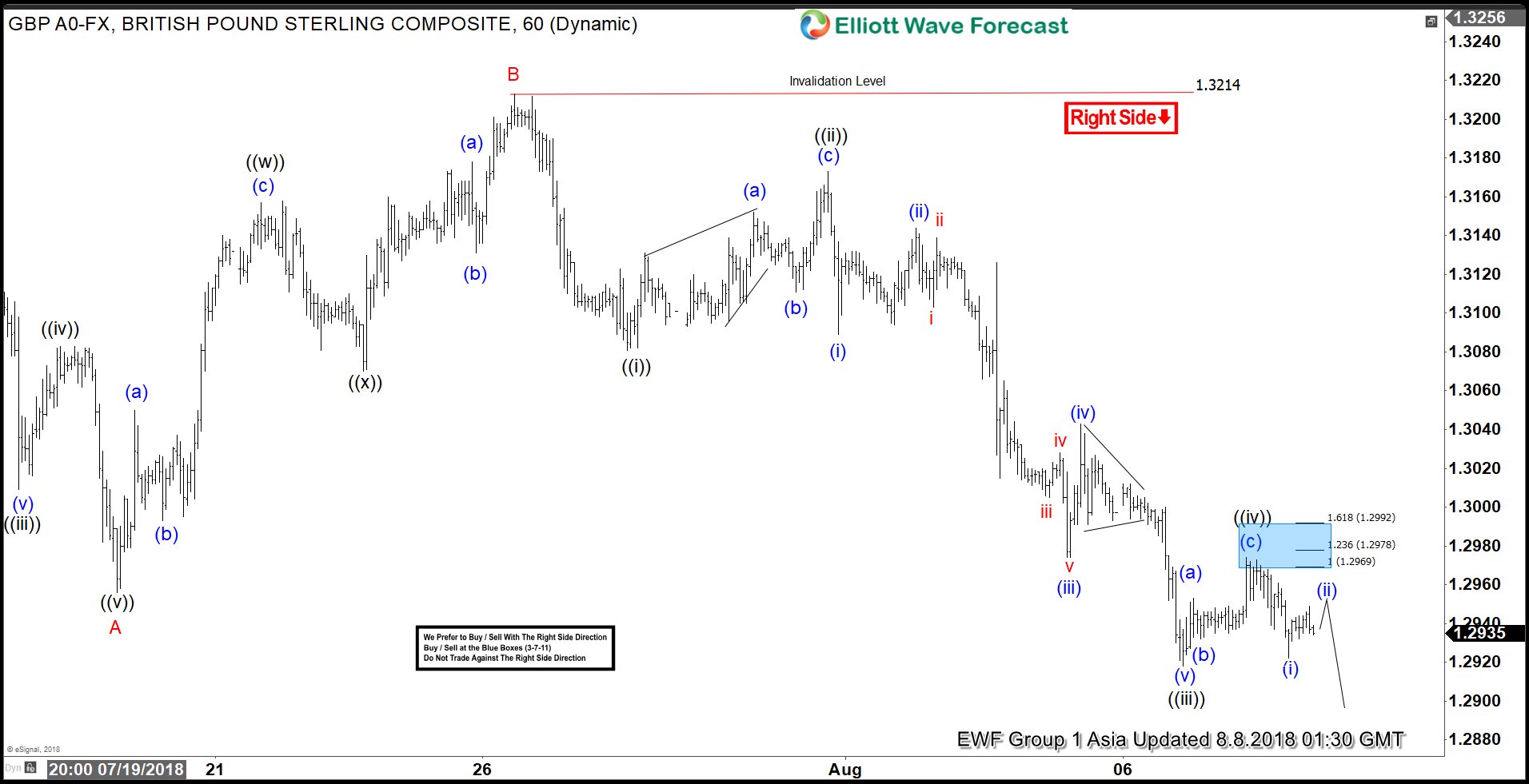

GBPUSD Elliott Wave Analysis: Right Side Calling Lower

Read MoreGBPUSD short-term Elliott Wave analysis suggests that the decline from 7/09/2018 peak (1.3361) is unfolding as Elliott wave zigzag when Minor wave A ended in 5 waves structure at 1.2956 low. Up from there, the bounce to 1.3214 high ended Minor wave B. The internals of that bounce unfolded as a Double three structure where […]

-

Poundsterling Remains Weak Despite BOE Rate Hike

Read MorePoundsterling Slumped after Rate Hike Decision The Bank of England raised benchmark interest rate to 0.75% with unanimous 9-0 vote. Poundsterling initially rallied but subsequent press briefing reversed those early gains. Despite the uncertainty in Brexit talks, BOE policy makers went ahead with the rate hike due to mounting price pressure. Governor Mark Carney suggested […]

-

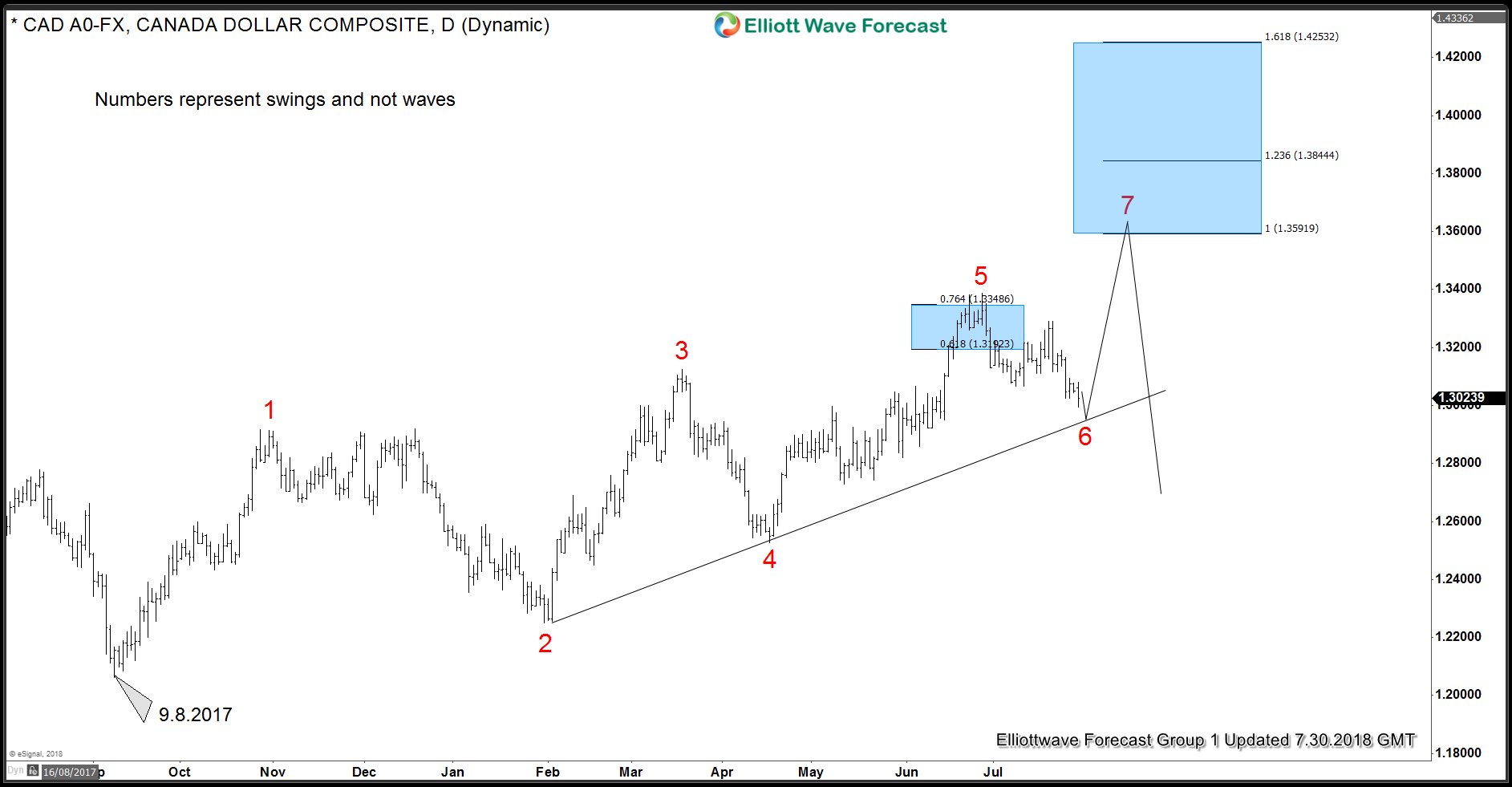

USDCAD Elliott Wave Analysis- Right Side And Inflection Area

Read MoreUSDCAD Elliott Wave Analysis and swing analysis suggests pair is showing 5 swings up from 9.8.2017 low. Impulsive sequence runs in 5, 9, 13, 17 and so on whereas corrective sequence runs in 3,7,11,15 and so on. Daily chart below shows the move up from 9.8.2017 low is overlapping and hence it’s corrective in natures […]

-

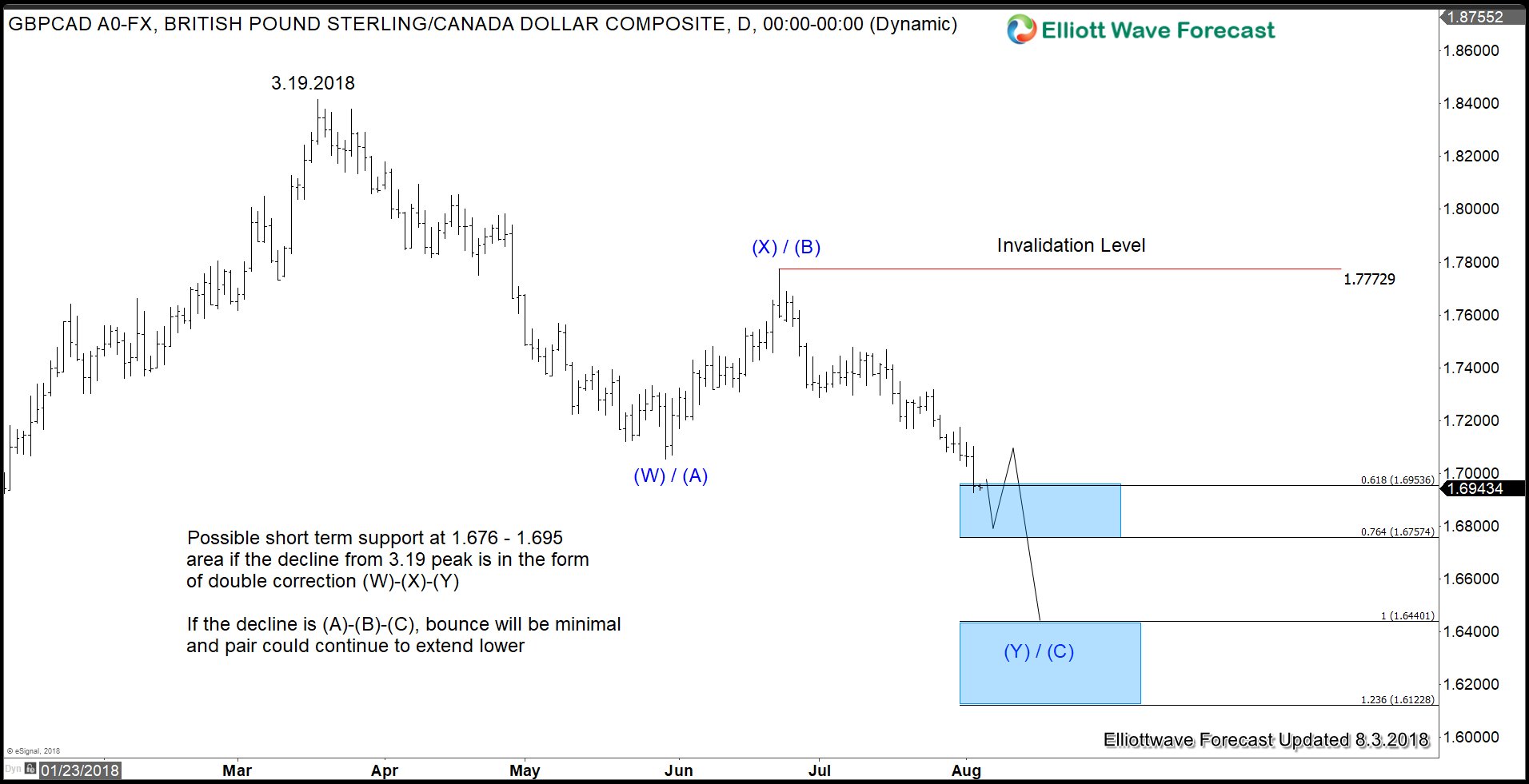

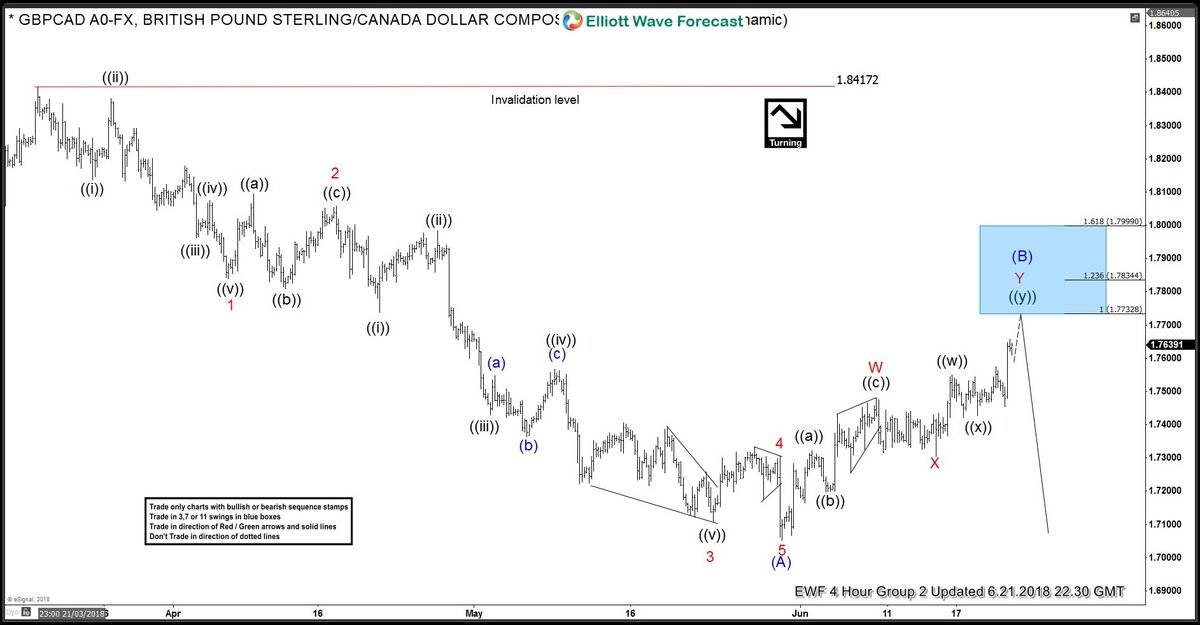

GBPCAD Elliott Wave Forecasting The Decline

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPCAD published in members area of the website. As our members know GBPCAD has ended the cycle from the 1.84172 peak on May 30th. Proposed cycle has ended as 5 waves structure while recovery against the mentioned […]