In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

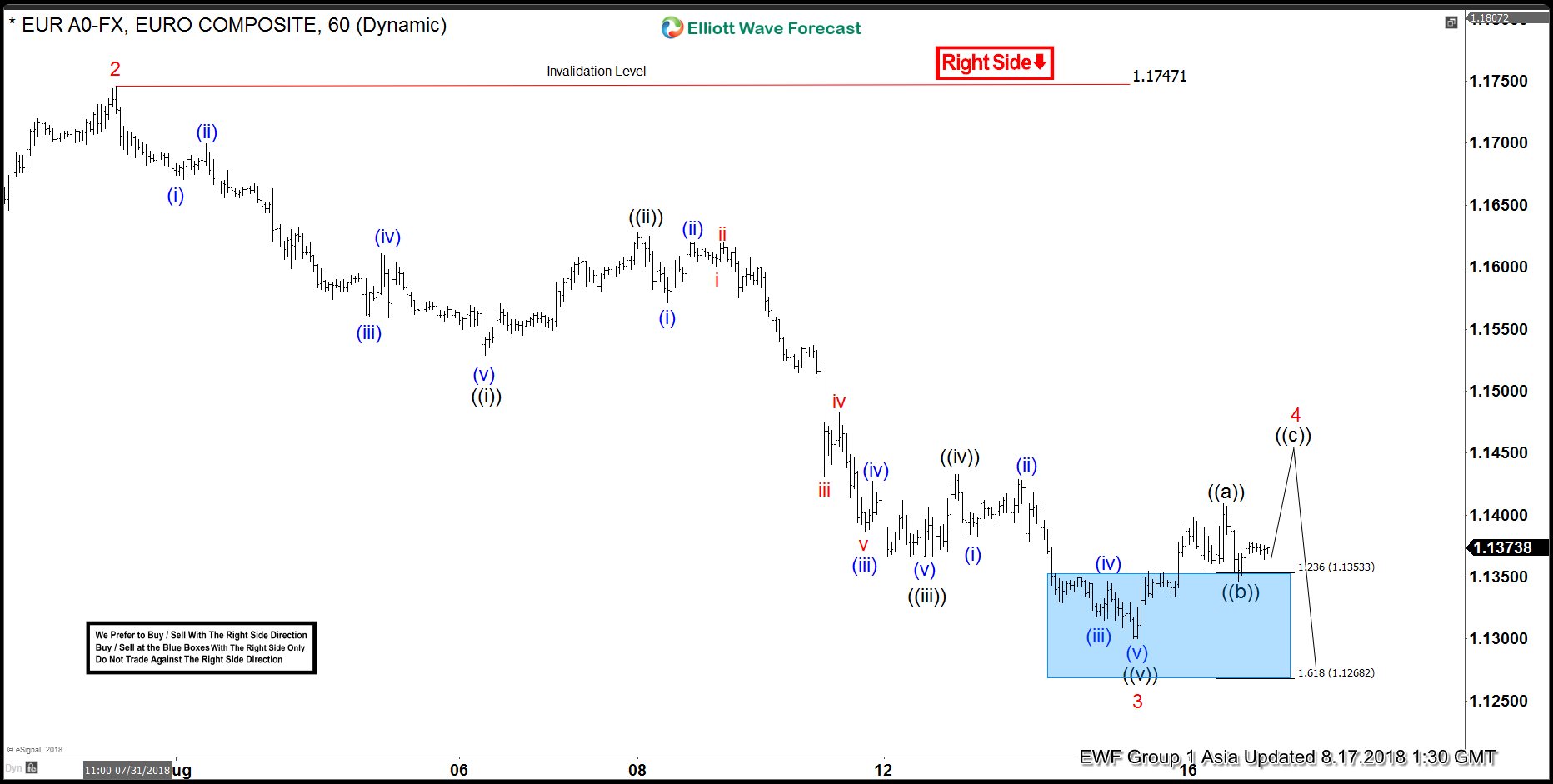

EURUSD Elliott Wave Analysis: More Weakness Expected

Read MoreEURUSD short-term Elliott Wave analysis suggests that the bounce to 1.1747 high ended Minor wave 2. Down from there, Minor wave 3 ended at 1.1299 low. The internals of that decline unfolded as impulse structure with lesser degree cycles are showing sub-division of 5 waves structure lower in it’s each leg lower i.e Minute wave ((i)), […]

-

USDNOK Elliott Wave View: Dips Should Remain Supported

Read MoreUSDNOK short-term Elliott wave view suggests that the pullback to $8.1165 low ended Minute wave ((ii)). Up from there, the rally higher is taking place as Elliott wave impulse structure where Minute wave ((i)), ((ii)) & ((iii)) unfolding in 5 waves structure & wave ((ii)) & ((iv)) are expected to unfold in 3 swings corrective sequence. […]

-

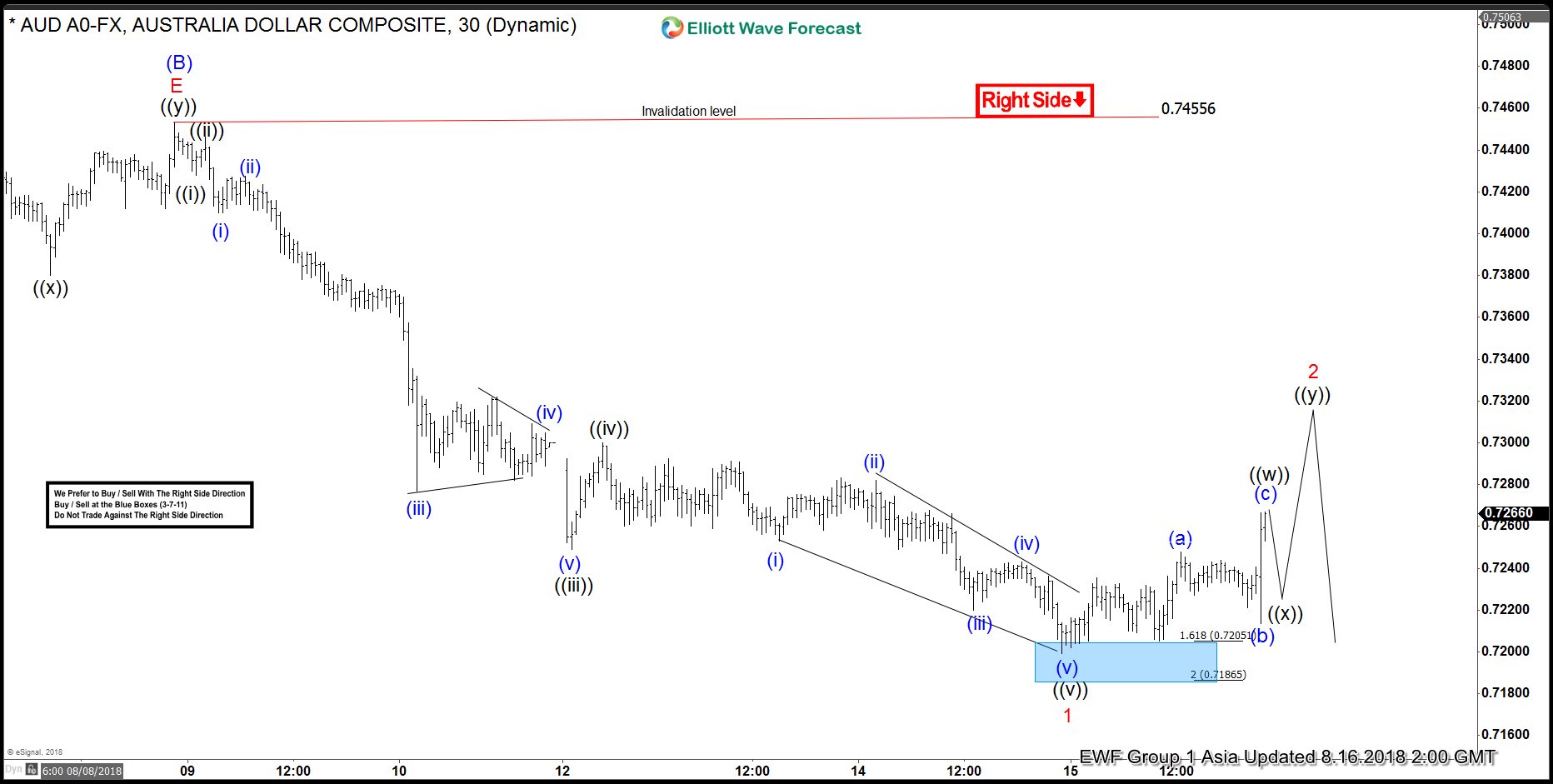

AUDUSD Elliott Wave View: More Downside Is Expected

Read MoreAUDUSD short-term Elliott wave view suggests that the bounce to 0.7455 high ended intermediate wave (B). Down from there, the pair has broken to new lows confirming the intermediate wave (C) lower. The internals of the decline is unfolding as impulse where Minor wave 1, 3 & 5 are expected to unfold in 5 waves […]

-

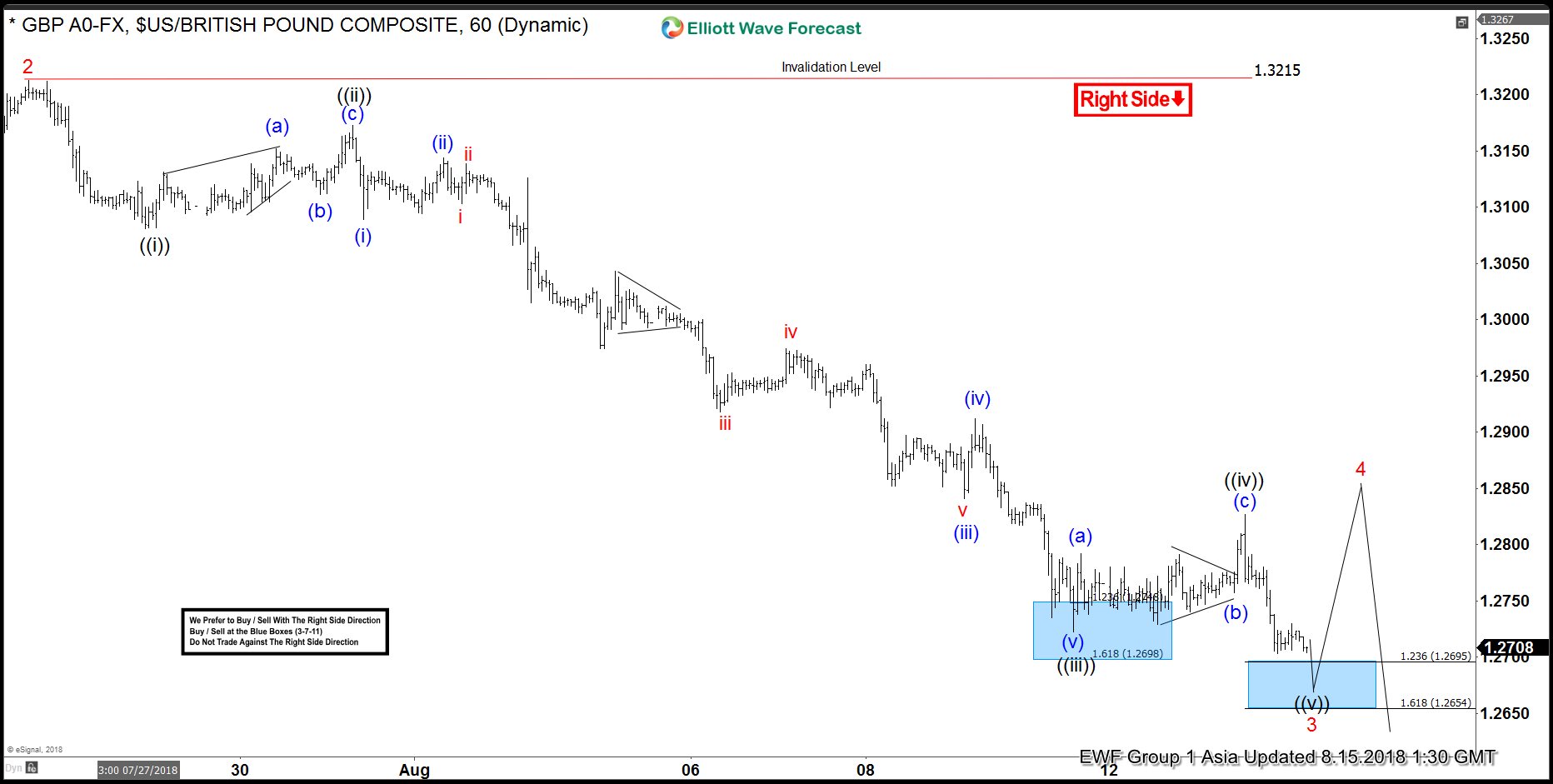

GBPUSD Elliott Wave View: Calling For More Downside

Read MoreGBPUSD short-term Elliott wave view suggests that the rally to 1.3215 high ended Minor wave 2 bounce. Down from there, Minor wave 3 is taking place as impulse structure with lesser degree cycles are showing sub-division of 5 waves structure lower in it’s each leg lower i.e Minute wave ((i)), ((iii)) & ((v)). While the […]

-

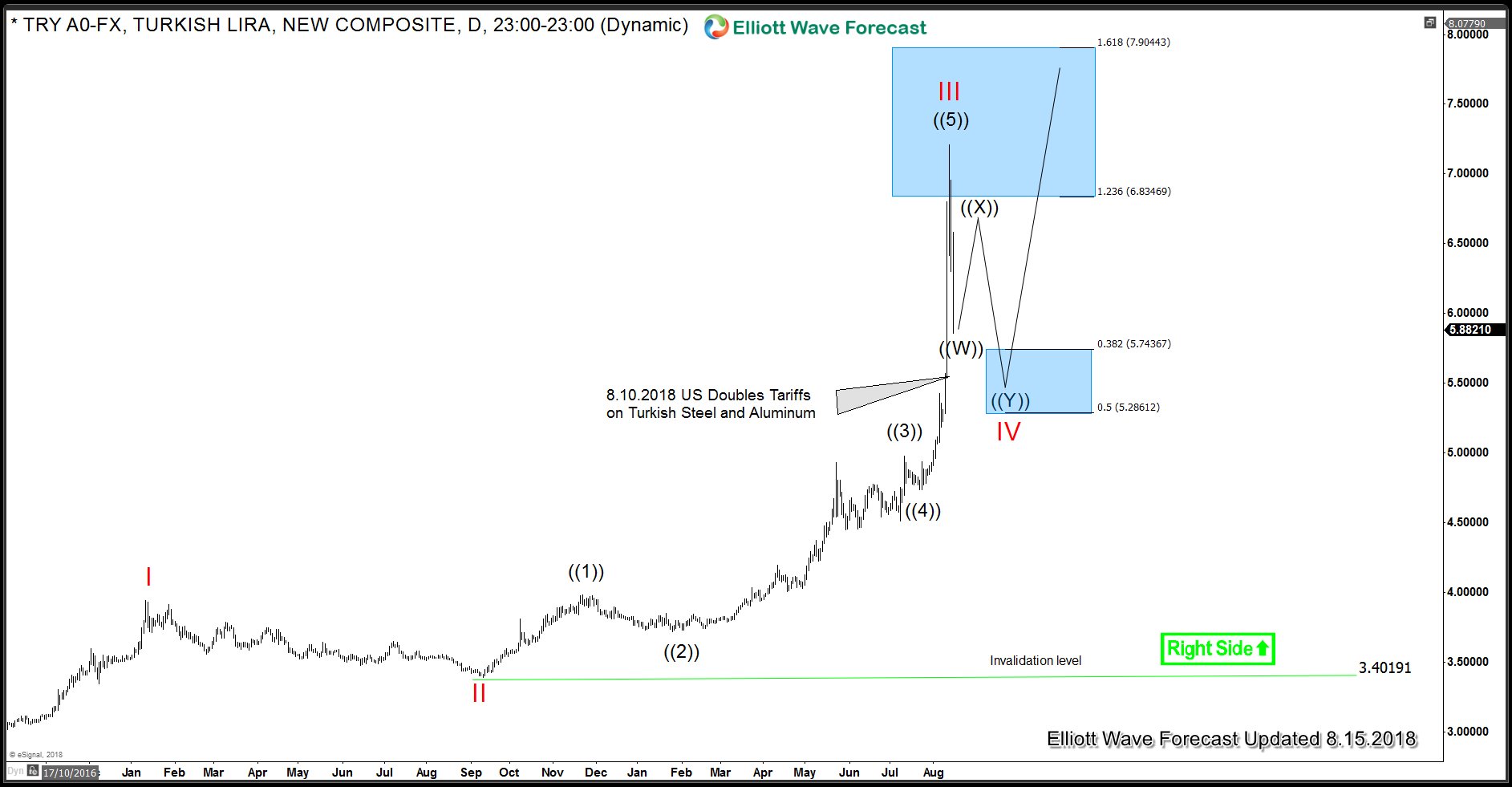

What Is The Future Of Turkish Lira?

Read MoreTurkish Lira dropped nearly 30% since Friday, 10th August 2018 and one stage and has since recovered nearly half of the losses and now trading at 6.4093 which is still nearly 15% below where it was last Friday. We know that US President Donald Trump doubled Tariffs on Steel and Aluminium Imports from Turkey on […]

-

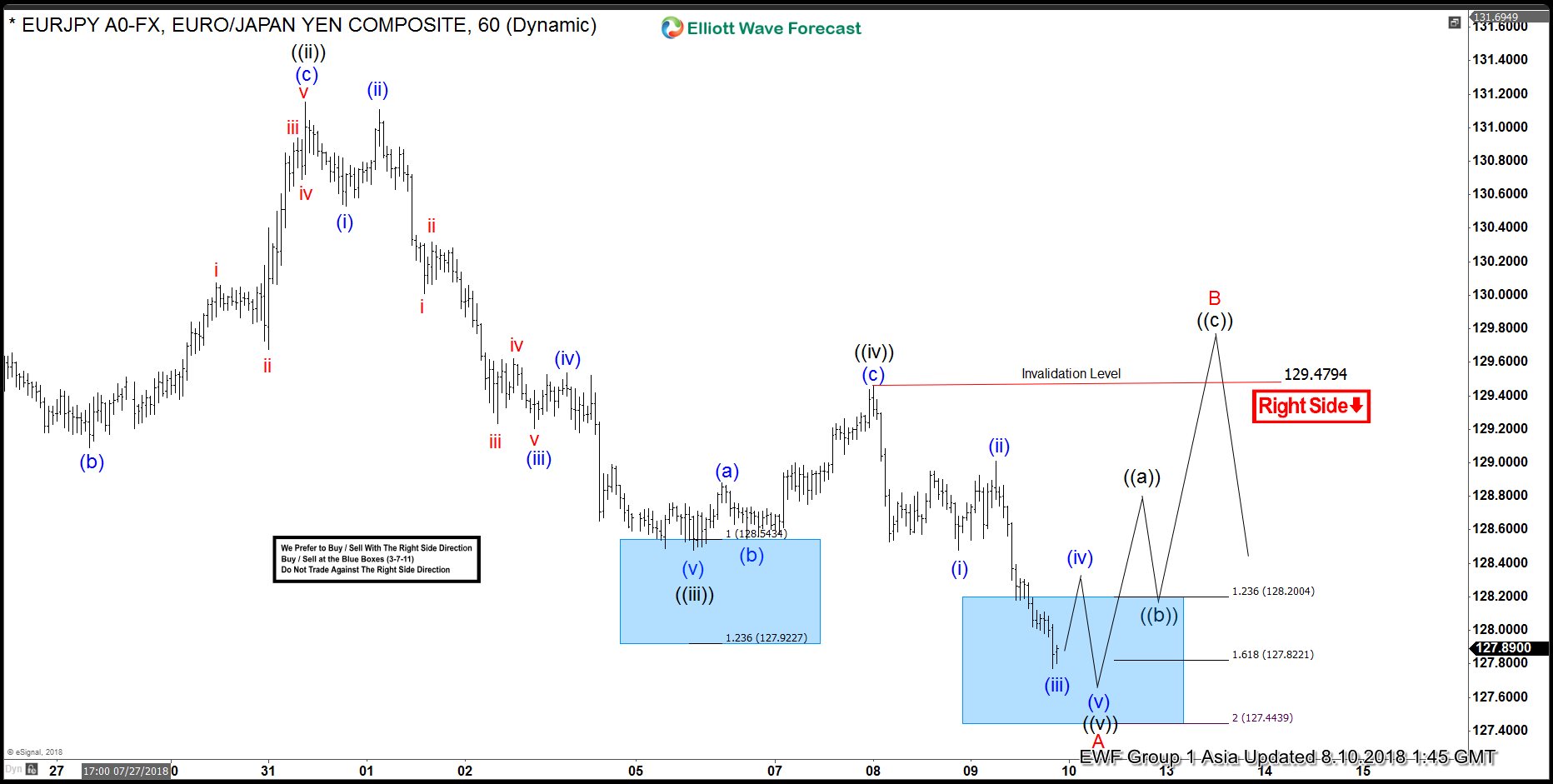

EURJPY Elliott Wave Analysis: Nearing 3 Wave Bounce?

Read MoreEURJPY short-term Elliott wave analysis suggests that the decline from 7/17/2018 peak (131.97) is unfolding as 5 leading diagonal structure in Minor wave A of a possible zigzag correction. The initial decline to 129.39 low ended Minute wave ((i)). Then Minute wave ((ii)) bounce ended at 131.13 as a Flat. Down from there, Minute wave […]