In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

USDJPY: Elliott Wave Forecasting The Rally

Read MoreIn this blog, we will have a look at some past Elliott Wave charts of USDJPY which we presented to our members. You see the 1-hour updated chart presented on the 09/06/18 showing that USDJPY ended the cycle from 08/21 low in black wave ((a)). From that peak. It started a pullback lower in black wave ((b)). […]

-

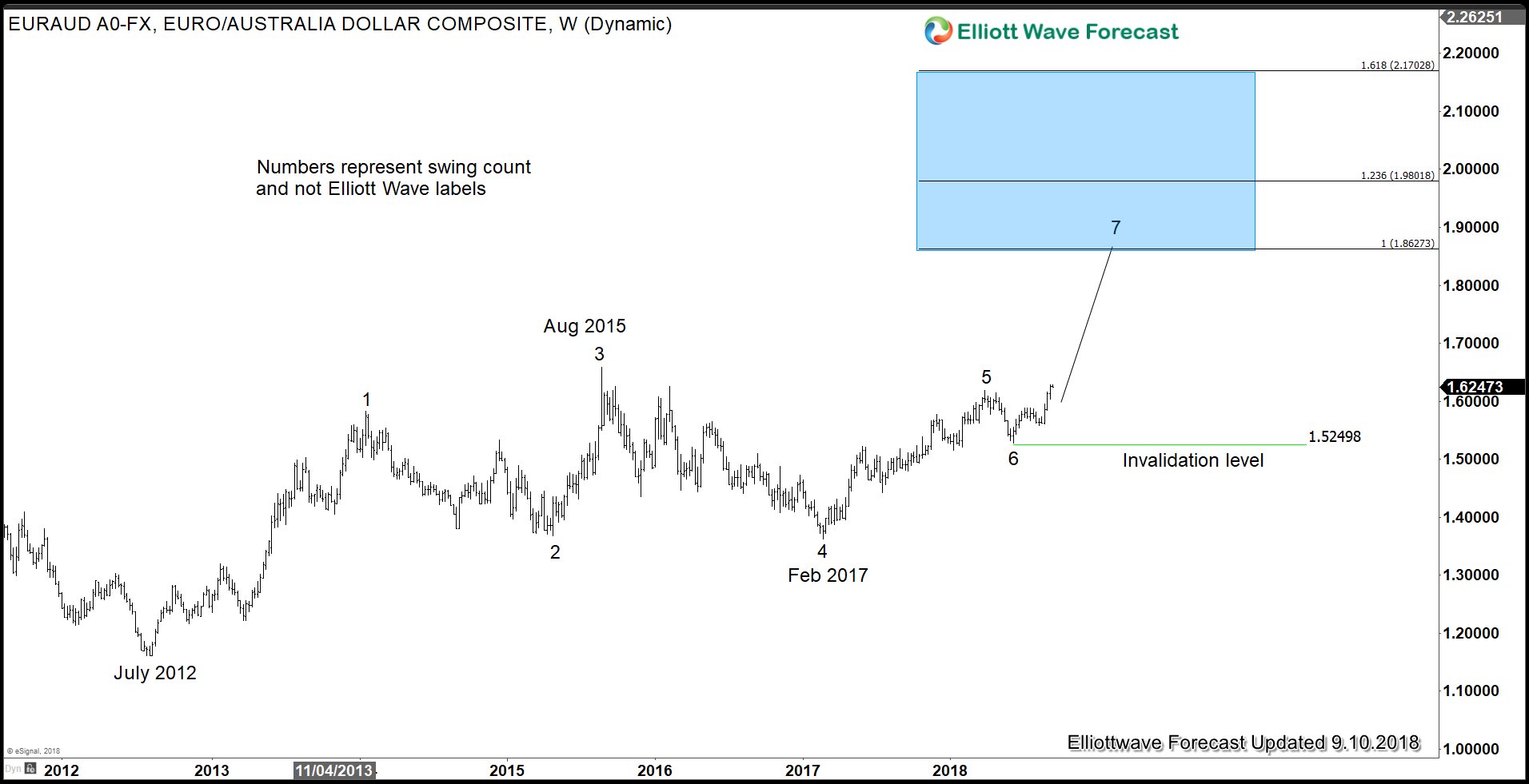

EURAUD Elliott Wave View: Reaching Support Zone

Read MoreEURAUD short-term Elliott wave view suggests that the rally to 1.6353 high ended intermediate wave (1) higher. The internals of that degree unfolded as impulse structure with lesser degree cycles showing the sub-division of 5 waves structure. Below from 1.6353 high, the pair is doing an intermediate wave (2) pullback in 3, 7 or 11 […]

-

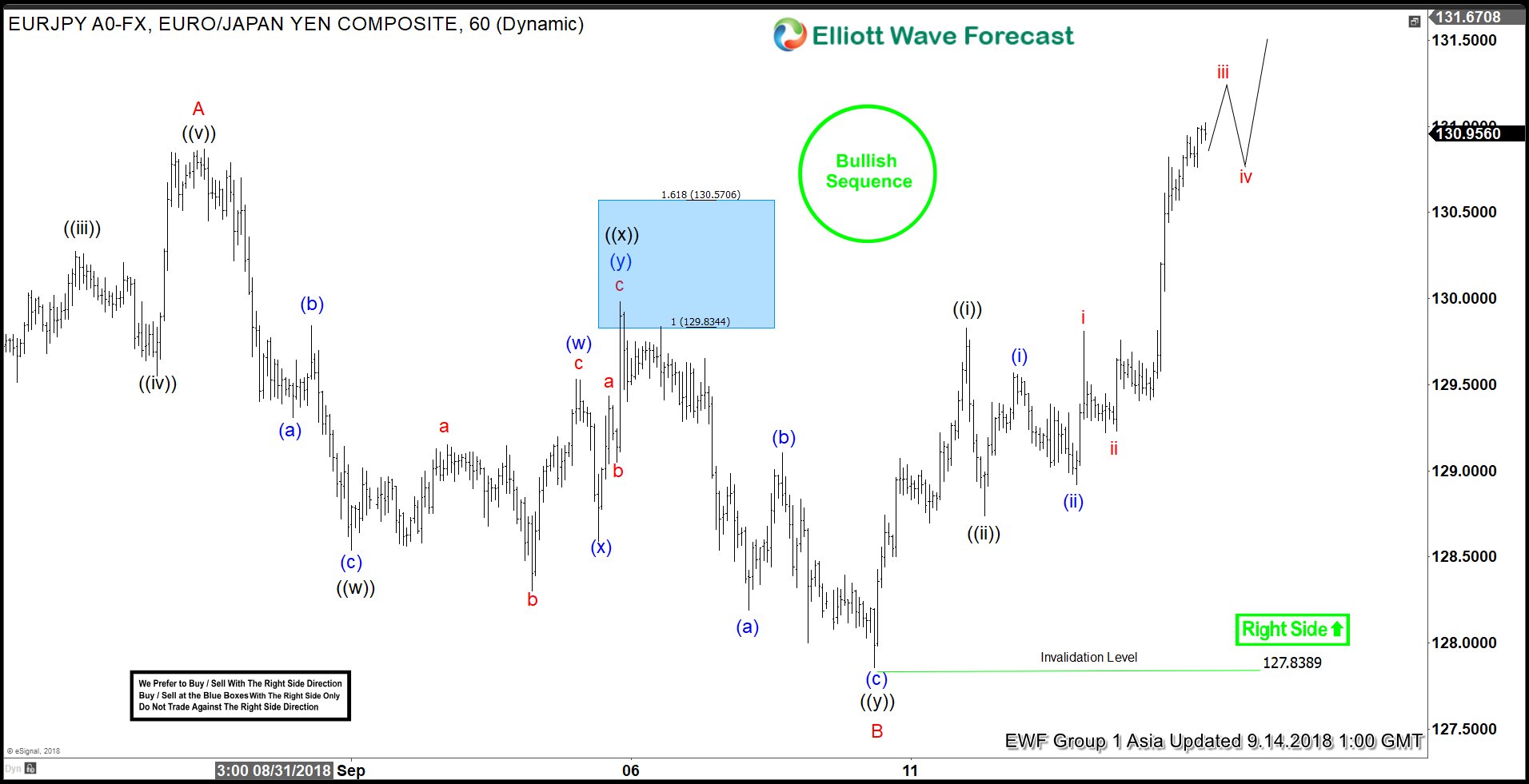

EURJPY Elliott Wave Analysis: Upside Has Started

Read MoreEURJPY short-term Elliott wave analysis suggests that the rally to 130.85 high ended Minor wave A of a Zigzag structure. The internals of that rally higher unfolded in 5 waves impulse structure with the sub-division of 5 waves structure as mentioned previously in the previous post. Down from there, the pullback to 127.83 low ended […]

-

AUDUSD Elliott Wave View: Right Side Calling Lower

Read MoreAUDUSD short-term Elliott wave view suggests that the bounce to 0.7384 high ended intermediate wave (X) bounce. Down from there, the pair has broken to new lows already confirming the intermediate wave (Y) lower. Thus suggesting that the right side in the pair is to the downside. The decline to 0.7084 low unfolded in 5 […]

-

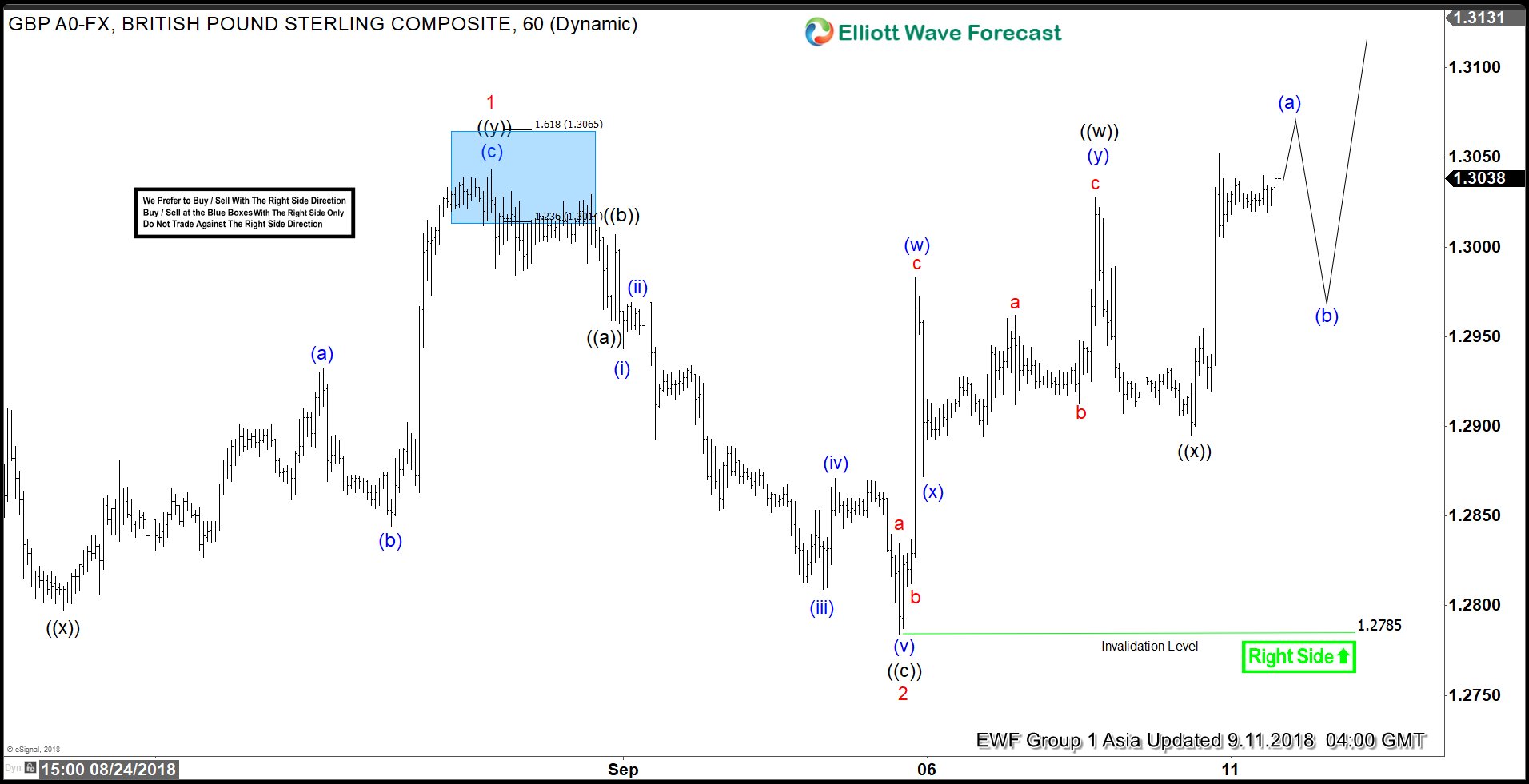

GBPUSD Elliott Wave Analysis: Calling Further Upside

Read MoreGBPUSD short-term Elliott Wave analysis suggests that the rally from 8/15/2018 low at 1.2660 to 1.3042 high ended Minor wave 1. The internals of that rally higher took place in 3 wave corrective sequence i.e double three thus suggesting that the pair can be doing a Leading diagonal structure. Up from 1.2660 low, the initial […]

-

Trade War Concern May Continue to Pressure Australian Dollar

Read MoreLast Friday Australian Dollar dipped to a two-and-a-half-year low after it broke blow 71 US cents due to a rising US Dollar and escalation in US-China trade wars. The last time the Australian Dollar traded below 71 US cents was on February 2016. The currency fell out of favor after last week’s comment by President […]