Many traders are of the mind set that they should follow only one or a very few instruments and therefore, you would come across many traders who trade just EURUSD, GBPUSD, ES_F or Gold (XAUUSD) for example. We at www.elliottwave-forecast.com believe that market works as a whole and as a forecaster we need to analyse the market as a whole and find a path which fits all the groups / instruments in the market rather than analysing the instruments individually. In this article, we will talk about why it’s important to follow Forex crosses and how traders could use them in different ways to gain an edge in their trading.

1. Look for trend in crosses when major forex pairs are consolidating

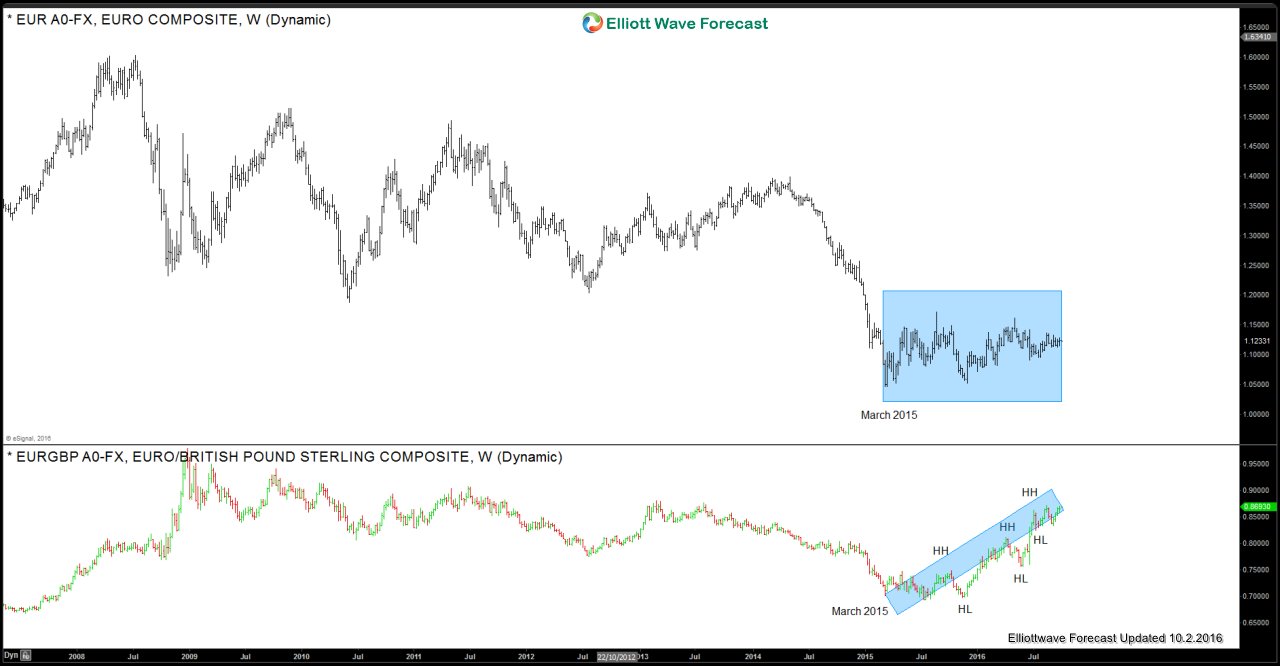

It’s a good practise to look find a trending instrument in the market and then use that instrument to buy the pull backs in an uptrend and sell the rallies in a downtrend. However, market is not always in a trending mode and most markets spend majority of the time consolidating. Consolidations can be very frustrating for traders as they result in a range which can often given many false break out signals causing traders to jump in using break out strategies and then getting hurt as the market falls back within the range. This is where crosses can come in handy because when major forex pairs are consolidating, traders could look at crosses to find a cross which is trending to trade that cross. For example, EURUSD has been consolidating in a sideways range since March 2015 and December 2015 lows but EURGBP on the other hand has been making a series of higher highs and higher lows since seeing a low back in March 2015. Therefore, a trader who only trades EURUSD or DXY would have seen a lot of frustration over the last year and a half whereas someone who keeps an eye on crosses could have done well by buying the dips in EURGBP after it making a series of higher highs and higher lows.

2. Use the crosses to decide which major pair to trade

Let’s say the trend in US Dollar is down and both EURUSD (57.6% weight) and GBPUSD (11.6% weight) or trending higher or expected to end a down cycle and bounce. Some forex traders would pick EURUSD to trade and others would pick GBPUSD to trade, selection could be based on personal preference, past trading results or which pair rallied the most in the last session, last few days / weeks etc. However, a smart trader would analyse EURGBP cross to determine the trend in EURGBP and then decide whether to buy EURUSD or GBPUSD to play the downtrend in US Dollar. If the trend in EURGBP is up, then EURUSD would be a better option to buy in the pull backs and if trend in EURGBP is down, then GBPUSD would be a better option to buy in the pull backs.

3. Use synthetic pairs to build a synthetic cross pair to trade

Donald Trump’s presidency campaign has had some impact in the FX markets, especially in the Mexican Peso and (more slightly) in the Russian Ruble. The RUB/MXN cross pair has been re-named by some as the “Trump Trade”. This is a very odd cross, hardly offered to be traded by the main brokers, but it can be operated indirectly as a synthetic pair using the USD/RUB and the USD/MXN. Let’s say you wanted to buy RUB/MXN but as it is not offered by most of the brokers and it’s a very hard cross to find in a trading platform, you could initiate a long position in RUB/MXN by buying USD/MXN (which means you are short MXN and long USD) and then by opening a short position in USD/RUB (short USD and long RUB), this will effectively give you a long position in RUB/MXN.

We hope you found this article helpful and could use the tips and tricks explained here in your trading. If you would like to know about other techniques that we use to analyse and forecast the markets, try us Free for 14 days as we cover 52 markets so you don’t have to.

Back