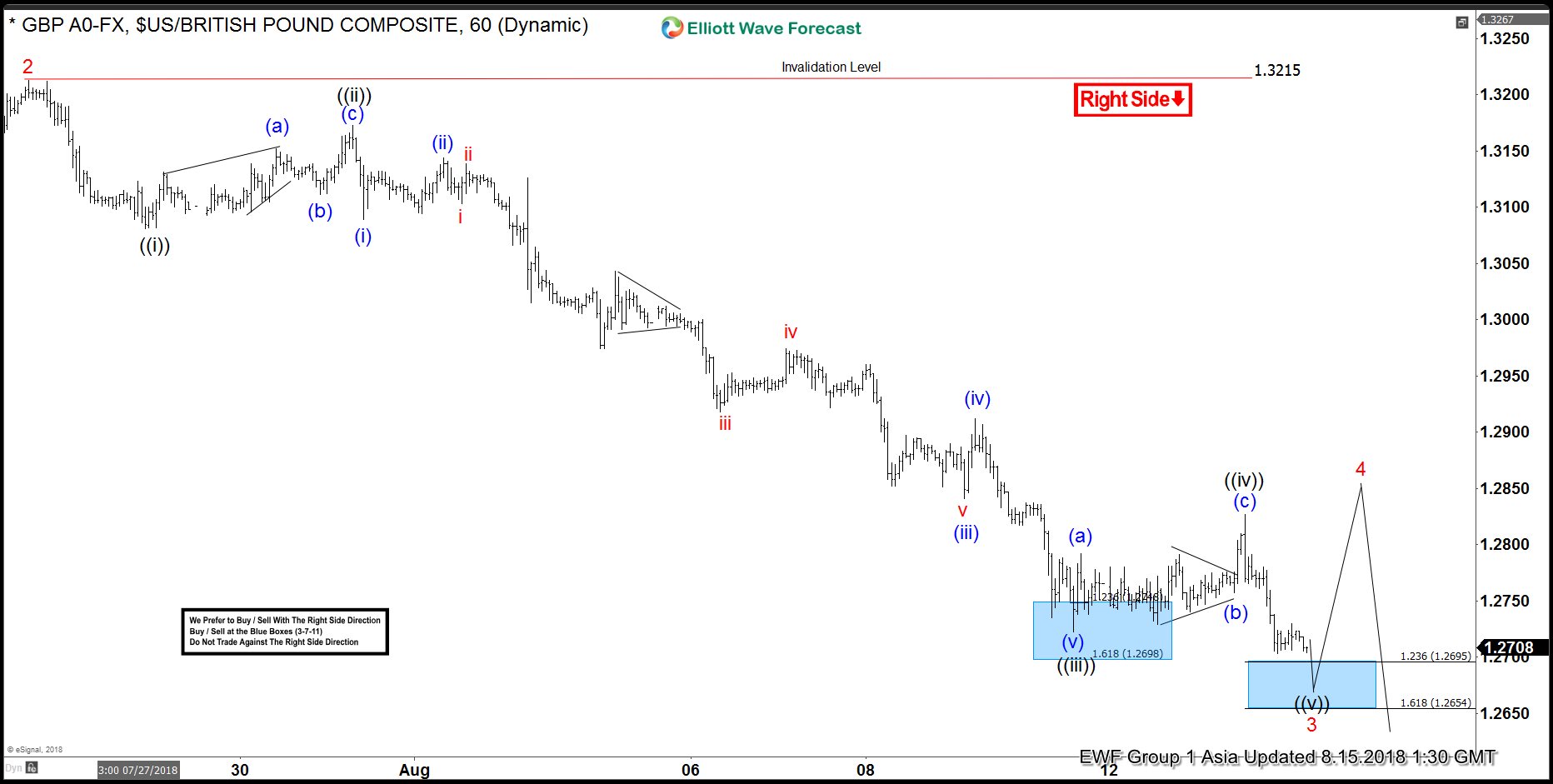

GBPUSD short-term Elliott wave view suggests that the rally to 1.3215 high ended Minor wave 2 bounce. Down from there, Minor wave 3 is taking place as impulse structure with lesser degree cycles are showing sub-division of 5 waves structure lower in it’s each leg lower i.e Minute wave ((i)), ((iii)) & ((v)). While the sub-division in Minute wave ((ii)) & ((iv)) unfolded in 3 wave corrective sequence.

Down from 1.3215 high, the initial decline to 1.3081 low ended Minute wave ((i)) in 5 waves. Up from there, the bounce to 1.3172 high ended Minute wave ((ii)) in 3 swings as Elliott wave zigzag. Below from there, the decline to 1.2722 low unfolded in 5 waves & ended Minute wave ((iii)). Above from there, the bounce to 1.2826 high ended Minute wave ((iv)) in 3 swings as zigzag. Near-term focus remain towards 1.2695-1.2654 inverse 123.6%-161.8% of Minute wave ((iv)) to end Minute wave ((v)) of 3. Afterwards, the pair is expected to do a Minor wave 4 bounce in 3, 7 or 11 swings before further downside is seen. In case of further extension in Minute wave ((v)) of 3, pair can see 61.8%-76.4% Fibonacci extension area of Minute ((i))+((iii)) at 1.2521-1.2448 area as well before bounce in Minor wave 4 takes place. We don’t like buying it and prefer more downside against 1.3215 high in the first degree.