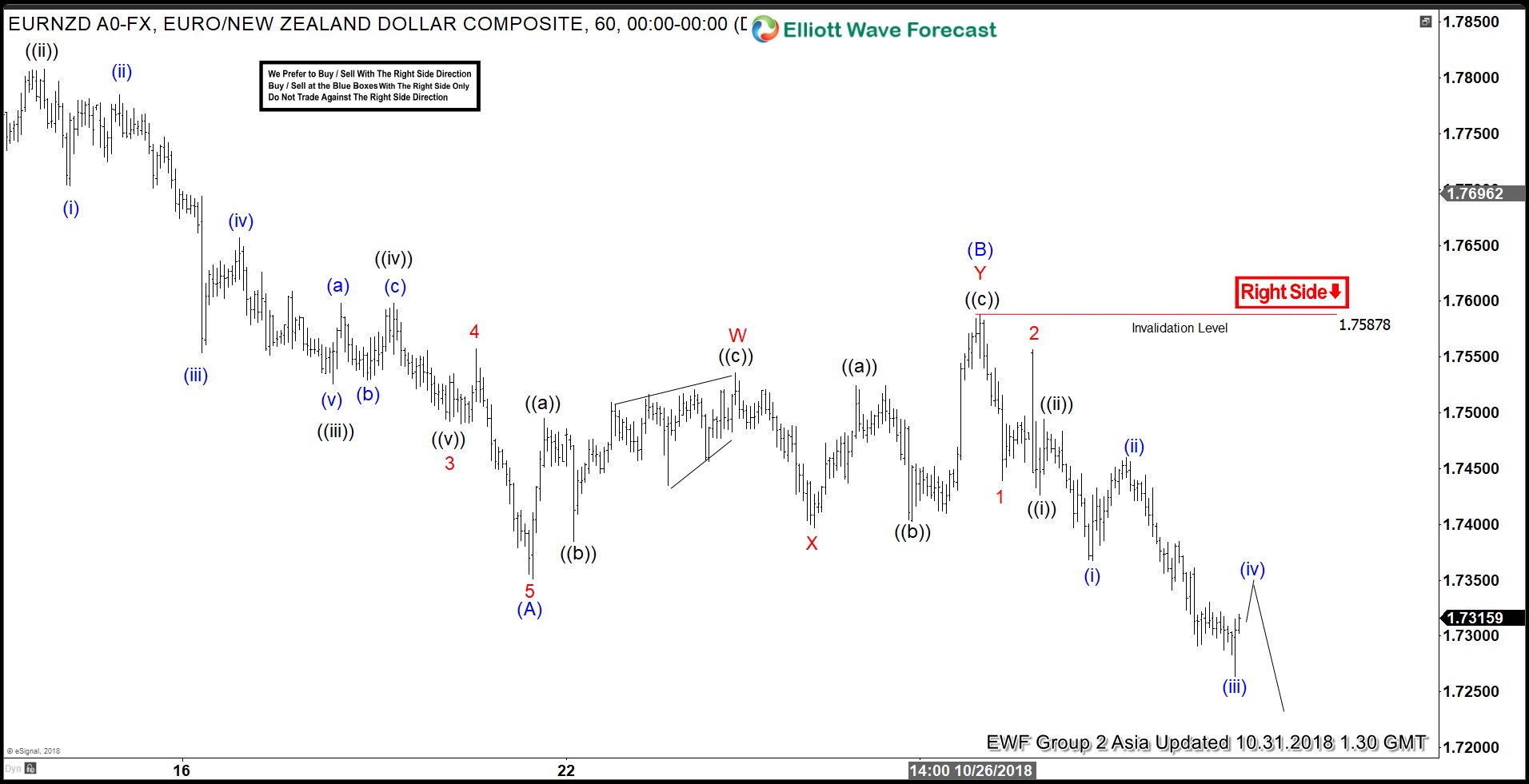

EURNZD short-term Elliott wave analysis suggests that the decline from 10/08/2018 peak is unfolding as Zigzag structure. Where a bounce to 1.7881 high ended Minute wave ((ii)), Minute wave ((iii)) ended in lesser degree 5 waves at 1.7528 low. Minute wave ((iv)) ended at 1.7596 high. And Minute wave ((v)) ended at 1.7493 low which also completed the Minor wave 3. Up from there, a bounce to 1.7556 high ended Minor wave 4 bounce. Down from there, a decline to 1.7354 low ended Minor wave 5 & finally completed intermediate wave (A) in 5 waves impulse.

Above from there, a bounce to 1.7587 high ended intermediate wave (B) bounce. The internals of that bounce unfolded as double three structure where Minor wave W ended in 3 swings at 1.7534 high. Minor wave X pullback ended at 1.7399 low and more Minor wave Y ended in another lesser degree 3 waves at 1.7587 high. Down from there, intermediate wave (C) remains in progress in another 5 waves. Near-term, while below 1.7587 high expect bounces to fail in 3, 7 or 11 swings for more downside towards 1.7004-1.6642 100%-161.8% Fibonacci extension area of intermediate wave (A)-(B) to end the cycle from 10/08/2018 peak & finding buyers again. We prefer more downside against 1.7587 high.