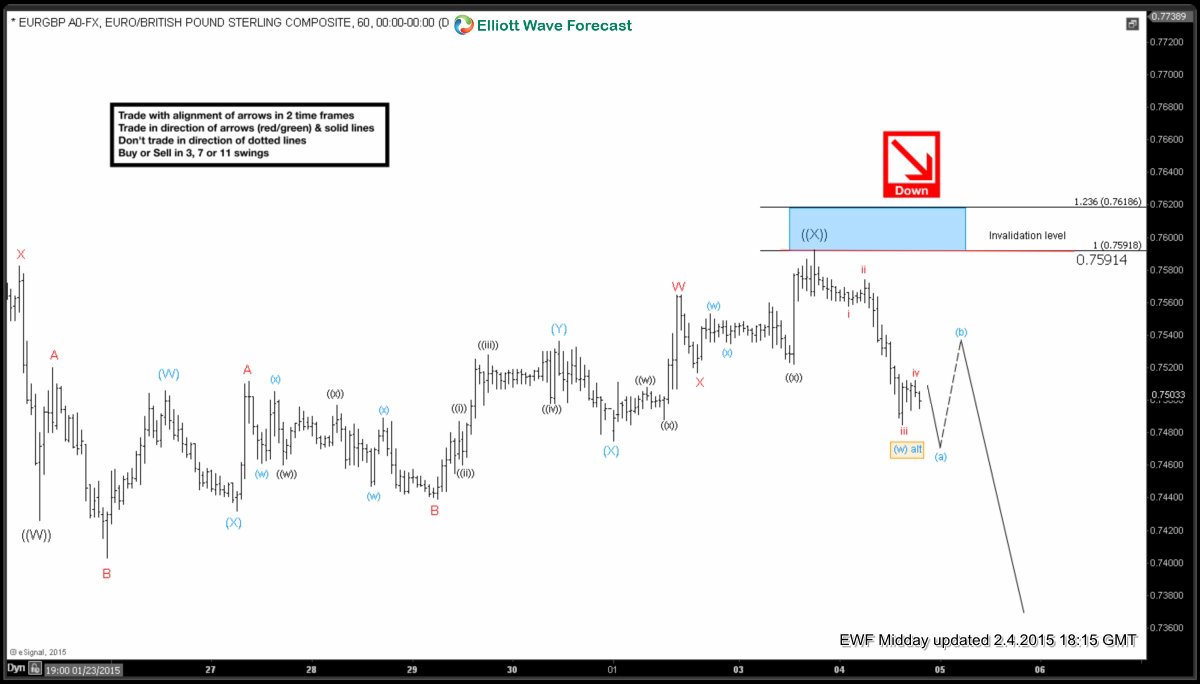

Our mid-term Elliott Wave cycles remain firmly bearish in EURGBP. Pair tested the inflection area between 0.7591 – 0.7618, got rejected and turned lower as expected. Cycle from the lows is over so connector wave (( X )) is thought to be in place at 0.7591. Decline from this high is so far in 3 waves but there is enough extension in 3rd swing that we could see another low to complete 5 waves down from the high. Once Elliott wave cycle from the high is over, we would expect a bounce in wave (b) to correct the decline from 0.7592 high in 3, 7 or 11 swings and decline should then resume for new lows below 0.7402 as per the primary Elliott wave view. Price above 0.7529 would leave the decline from 0.7592 peak in 3 waves and pair could then test 0.7538 – 0.7551 area before it turned lower again. We don’t like buying the pair and favour the short side after bounces in 3, 7 or 11 swings against 0.7591 high in the first degree. If this level breaks, that would allow for a larger (W)-(X)-(Y) correction and we should see sellers again at equal legs – 1.236 ext area.

Click here to watch this analysis in video format

We do Elliott Wave Analysis of 26 instruments in 4 time frames (Weekly, Daily, 4 Hour and 1 Hour) with 1 hour charts updated 4 times a day so clients are always in loop for the next move. Please feel free to come visit around the website and click Here to Start your 14 day Trial (No commitments, Cancel Anytime) or Get 2 months for Price of 1

Back