In this technical blog, we are going to take a look at the past performance of EURCAD, Daily cycle Charts that we presented to our members. In which, the major decline from 19 March 2019 peak showed an incomplete sequence to the downside. Favored for another extension lower into the buying area for a major turn around. Therefore, our members knew that the next big swing opportunity remains to buy the dip at the blue box area. We will explain the Elliott wave structure & buying opportunity our members took below:

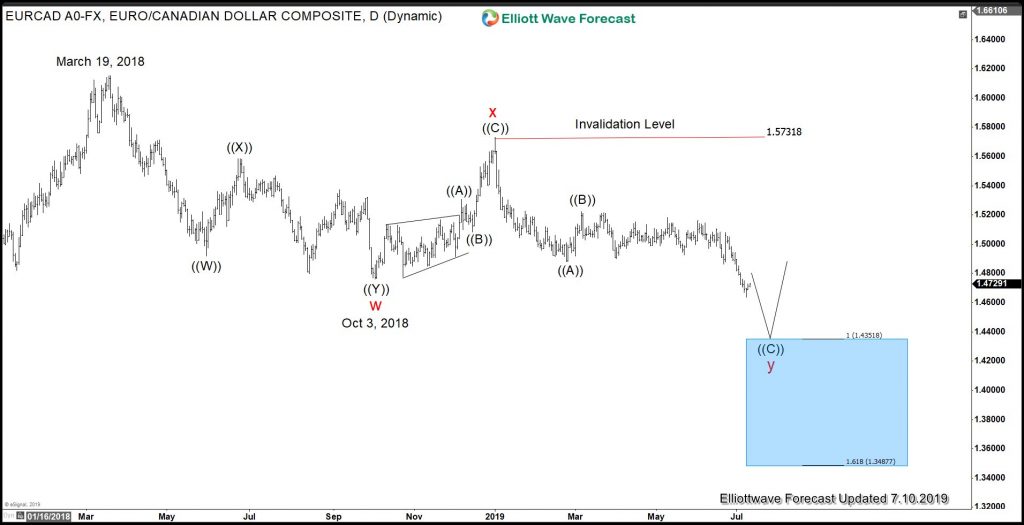

EURCAD Elliott Wave Chart From 7.10.2019

EURCAD Daily Elliott Wave Chart from July last year showed an incomplete sequence to the downside. While the internals of that pullback unfolded as Elliott wave double three structure where wave w ended in 3 swings at 1.4761. Wave x bounce ended with another 3 swing bounce at 1.5731 high. And wave y was expected to reach 1.4351-1.3487 100%-161.8% Fibonacci extension area of w-x. From there, the buyers were expected to appear to do a big 3 wave reaction higher at least.

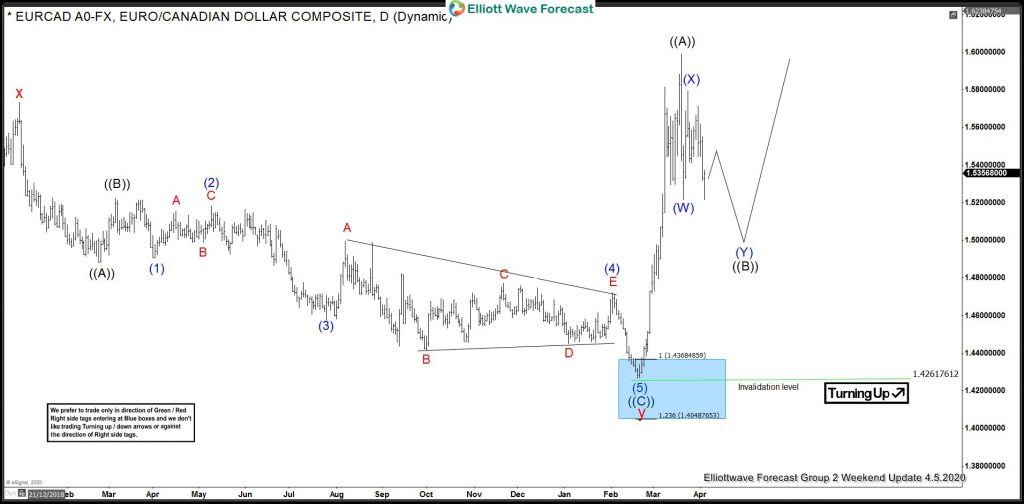

EURCAD Daily Elliott Wave Chart From 4.05.2020

EURCAD Daily Elliott Wave Chart From 4/05/2020 updated, in which the pair managed to reach the blue box area as expected. And showing the strong reaction higher taking place from the blue box area. Allowed members to create a risk-free position shortly after taking the longs at the blue box area.

If you are looking for real-time analysis in EURCAD along with other Forex pairs then join us with a Free Trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Free Trial.

Back