Short Term Elliott Wave view suggests that the selloff in Bitcoin is not yet over. Rally to $4409.77 ended Intermediate wave (X). Down from there, the decline is unfolding as a double three Elliott Wave structure where Minor wave W ended at $3210. Internal of Minor wave X unfolded also as a double three Elliott Wave structure, but of a lesser Minute degree. Minute wave ((w)) of W ended at $3861 as a zigzag Elliott Wave structure. Minute wave ((x)) of W ended at $4265, and Minute wave ((y)) of W ended at $3210 also as a zigzag Elliott Wave structure.

Minor wave X bounce is currently in progress to correct cycle from Nov 29 high in 3, 7, or 11 swing before the decline resumes. Minor wave (X) bounce is unfolding as a double three Elliott Wave structure. Minute wave ((w)) of X ended at $3633.2, Minute wave ((x)) of X ended at $3292.2, and Minute wave ((y)) of X is looking for $3715.4 – $3976.94 before the decline resumes. We expect sellers to appear from this area for further downside or at least 3 waves pullback as far as pivot at Nov 29 high ($4409.77) remains intact.

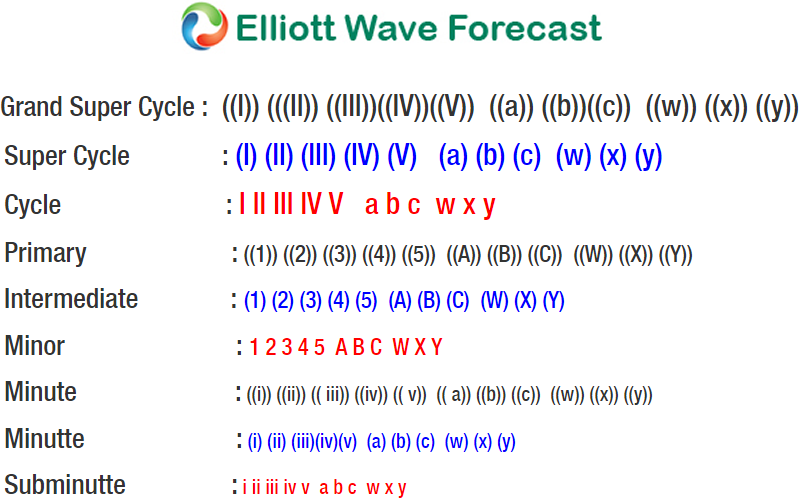

Bitcoin (BTCUSD) 1 Hour Elliott Wave Chart

Back