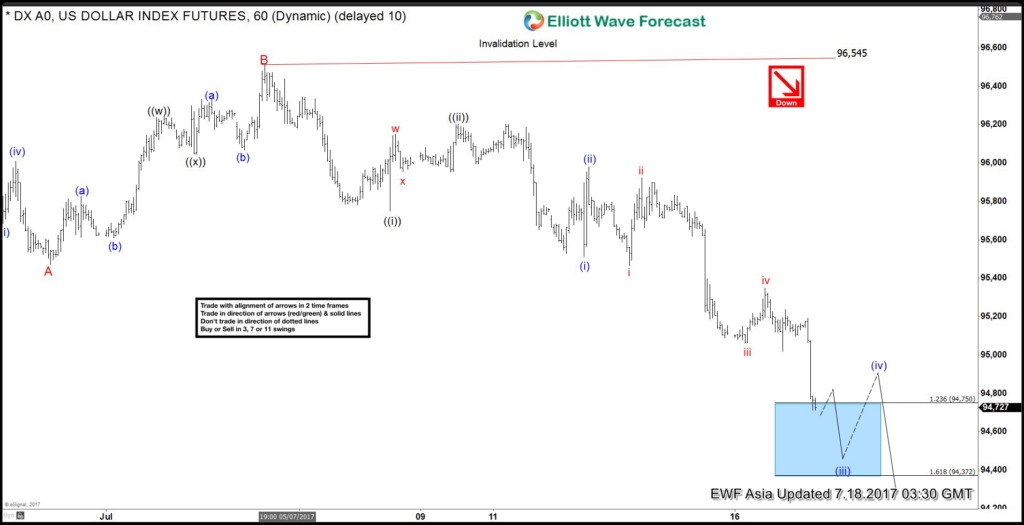

Short term DXY (USD Index) Elliott Wave view suggests the decline from 6/20 peak (97.87) is unfolding as a Zigzag Elliott Wave structure. Down from 97.87 high, decline to 95.47 ended Minor wave A, and bounce to 96.51 high ended Minor wave B. Wave C is unfolding as an Elliott wave Impulse structure with extension where Minute wave ((i)) ended at 95.75 and Minute wave ((ii)) ended at 96.2. Minute wave ((iii)) is subdivided into another impulsive wave of a smaller degree. Minutte wave (i) ended at 95.51, Minutte wave (ii) ended at 95.98 and Minutte wave (iii) is currently in progress. Expect Minutte wave (iii) to end at 94.3 – 94.7 area, then the Index should bounce in Minutte wave (iv) before turning lower again. We don’t like buying the Index and expect bounces to find offer in 3, 7, or 11 swing for more downside.

DXY 1 Hour Elliott Wave Chart

A-B-C Structure

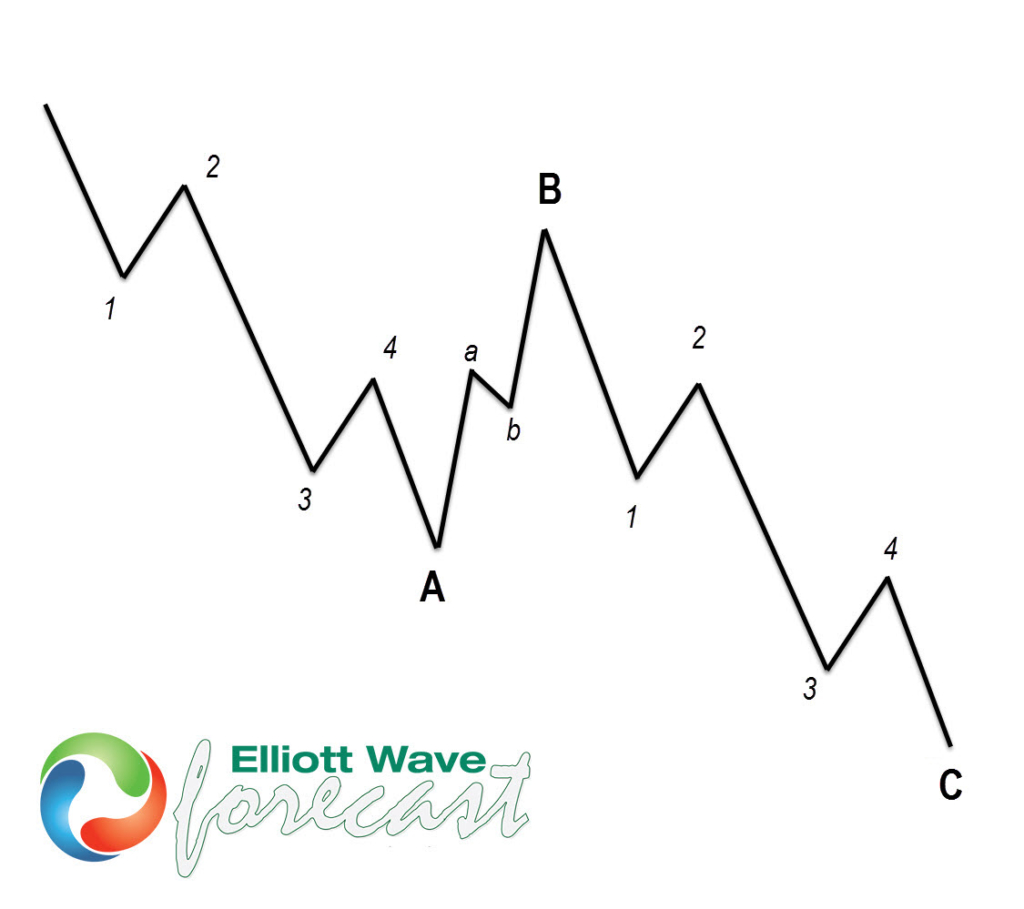

According to Elliott wave theory, Zigzag is a 3 wave structure having internal subdivision of (5-3-5) swing sequence. The internal oscillations are labeled as A, B, C where A = 5 waves, B = 3 waves and C = 5 waves. This means that A and C can be impulsive or diagonal waves (Leading Diagonal in the case of wave A or Ending Diagonal in the case of wave C). The A and C waves must meet all the conditions of 5 waves structure, such as: having an RSI divergence at the fifth wave, ideal Fibonacci extensions, ideal retracements etc.

As the graphic below shows, we can see what Elliott Wave Zig Zag structure looks like. 5 waves down in A, 3 wave bounce in B and another 5 waves down in C.

Back