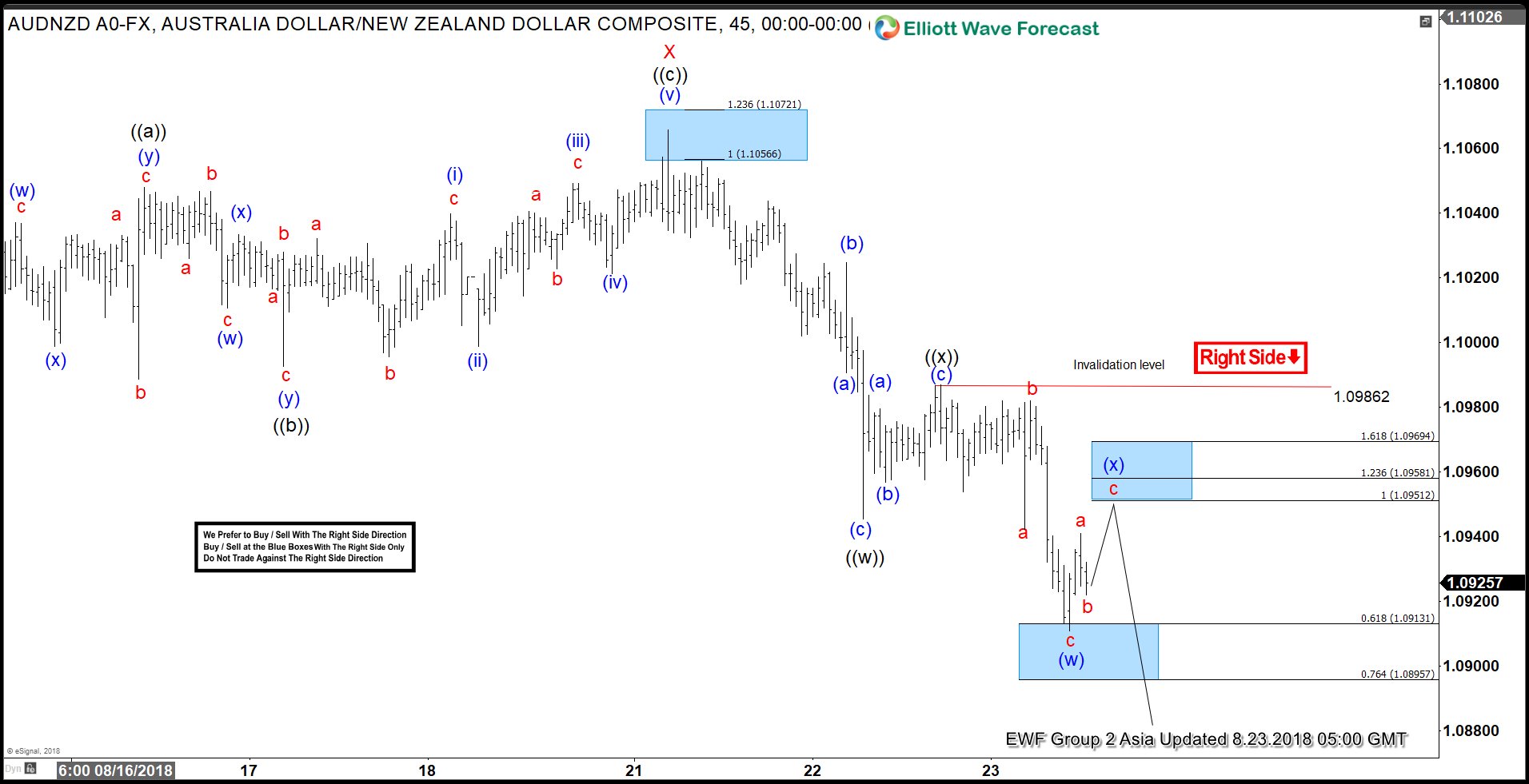

AUDNZD Short-term Elliott Wave view suggests that the rally to 1.1066 ended Minor wave X. The internal subdivision of Minor wave X is unfolding as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 1.1048, Minute wave ((b)) ended at 1.0992, and Minute wave ((c)) of X ended at 1.1066. A zigzag is a 5-3-5 ((a))-((b))-((c)) structure in which the subdivision of wave ((a)) and ((c)) is in 5 waves, either as impulse or diagonal.

Down from 1.1066, Minor wave Y is in progress as a double three Elliott Wave structure where Minute wave ((w)) ended at 1.0945 and Minute wave ((x)) ended at 1.0986. Below there, Minute wave (w) of ((y)) is proposed complete at 1.091 low as a Flat. Minute wave (x) of ((y)) is in progress to correct cycle from 8/22 high (1.0986) in 3, 7, or 11 swing before the decline resumes. The next 3 swing inflection area comes at 1.095 – 1.096 where pair can see sellers and resume to new low or at least pullback in 3 waves. We don’t like buying the proposed rally and prefer more downside in 3-7-11 swing as far as pivot at 1.0986 high stays intact.