So, in my previous blog I mentioned the reasons why wave counts must change and be adjusted. Most of it is to do with the fact that rules are violated.

Let’s go into a bit more detail on why else they may change and potentially trick you if you’re on top of the count.

When a wave count turns into a nest.

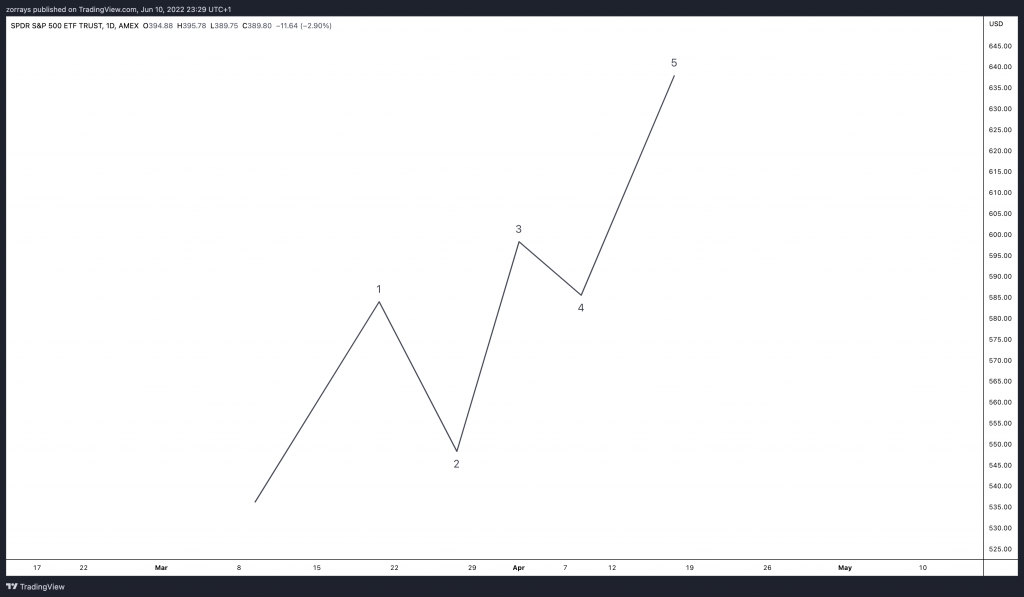

Lets see you spot a 5 wave up. Lets say you started counting this with wave 1 and 2 and then you see wave 3 unfold, you’re committed to this count. But then you end up counting it like the above. Is this right or wrong? Of course, it’s wrong, because it cleared violated a rule – wave 3 cannot be the shortest wave

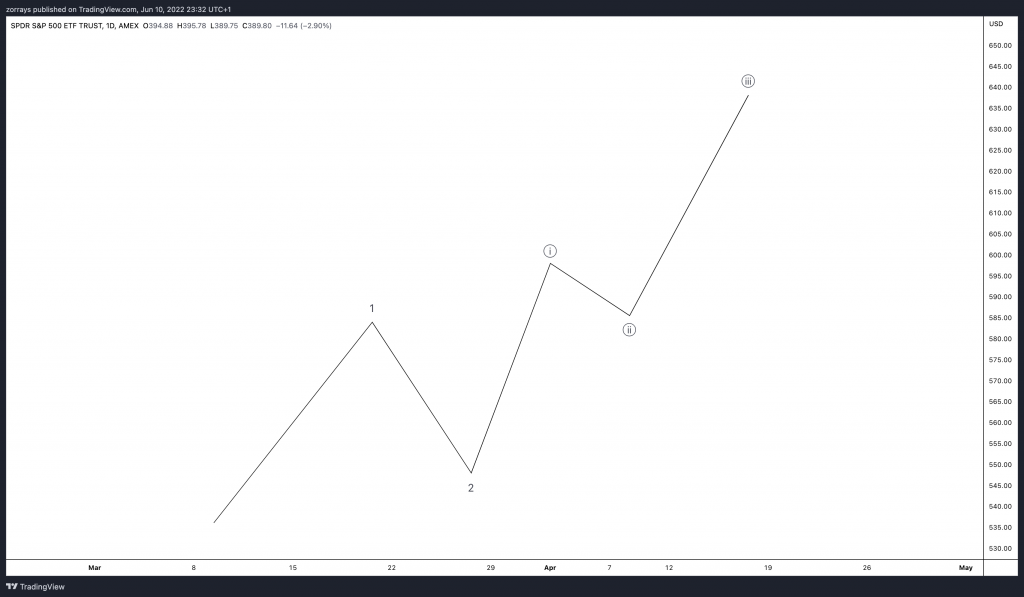

Therefore, you have to adjust your count to the following…

If you guessed this, then great! This is clearly now unfolding as a nest right now. You must be very realistic and vigilant when it comes to counting waves and always be ready to adjust your count as the market progresses. Do not marry your count!

Diagonals that potentially change into a nest

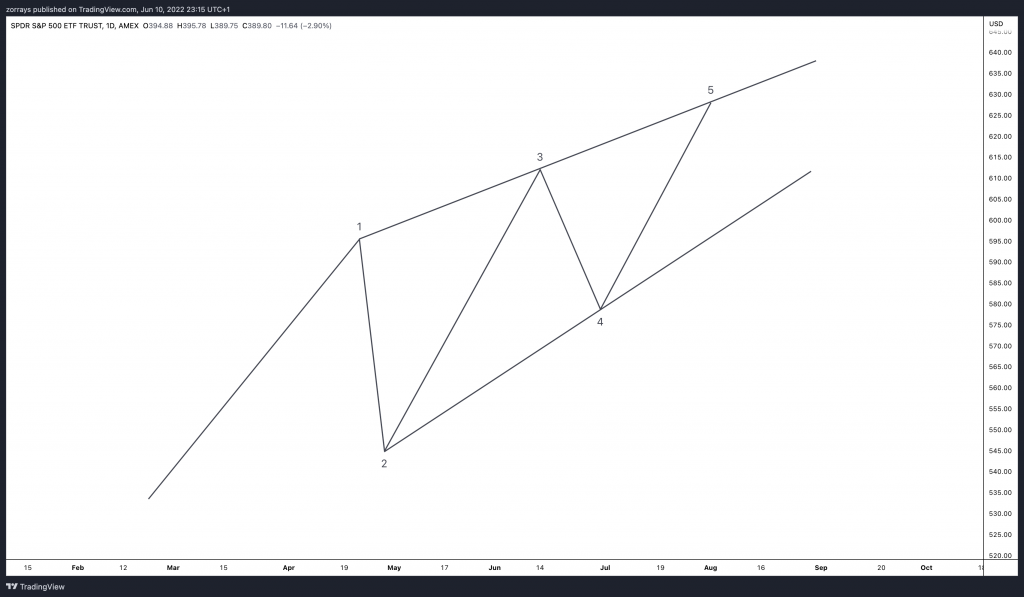

As you can see here, an ending diagonal is currently unfolding. This could either wave 1 or 2. In order for us to conclude whether this diagonal is done, we wait for a breakout and potentially wave 4 extreme to break. So, we would wait for a 5 wave down to confirm this has been completed.

What happens next?

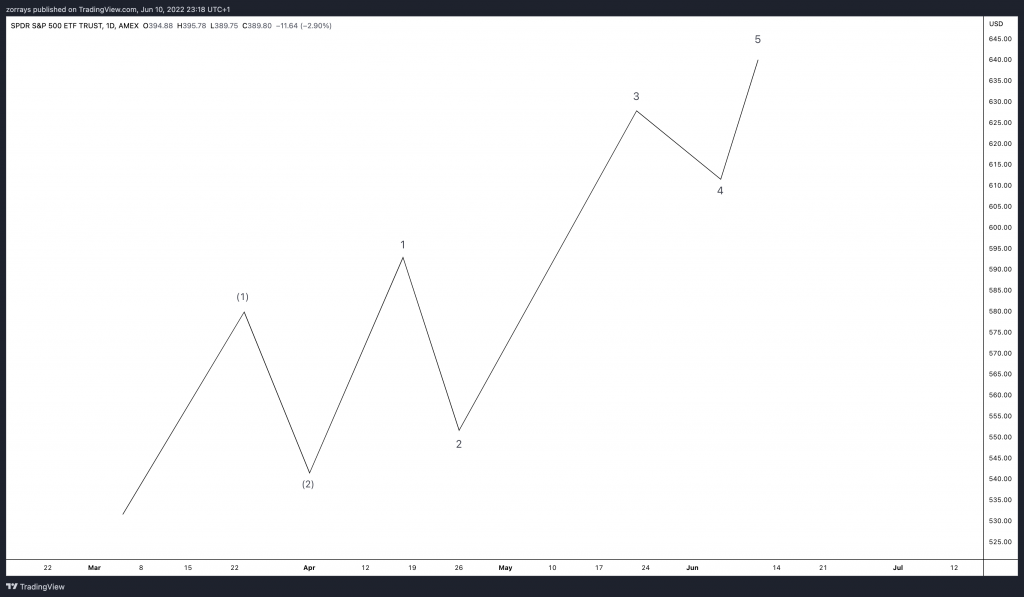

Well, we don’t see that break of wedge channel and nor do we see wave 4 break out. Instead wave 4 is not wave 2 of (3) on a higher degree and instead of a diagonal, we are unfolding a nest.

Final words

The market can progress, so can your count. You can read market structure and the structure of the market constantly changes, therefore, you should be willing to change your count too. The important think about the language of the Elliott Wave Theory is that it gives your analysis context. And context is extremely important.