In this technical article we’re going to take a look at the Elliott Wave charts charts of Dollar Index published in members area of the website. As our members know USDX has ended cycle from the 99.5 low as 5 waves structure. We were calling cycle completed at the 107.34 peak. Recently Dollar has reached extreme zone, equal legs area from the 107.34 peak and completed the short term cycle as Elliott Wave Flat.

Before we take a look at the real market example of Expanded Flat, let’s explain the pattern in a few words.

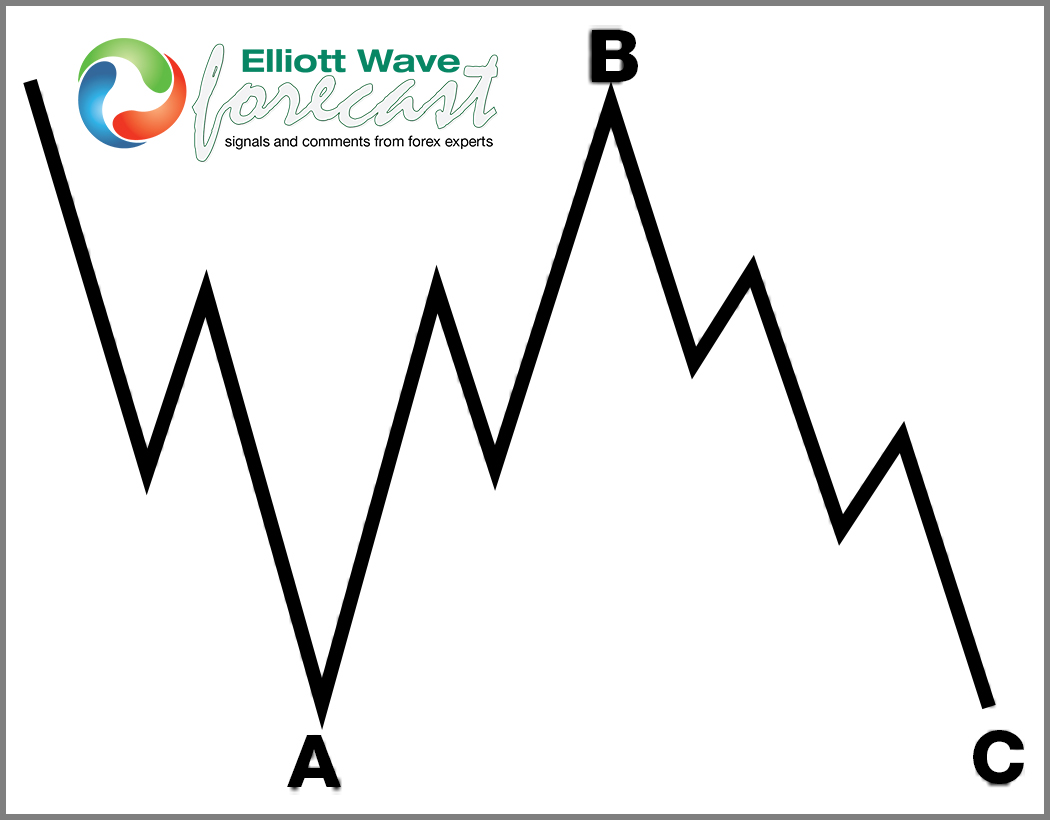

Elliott Wave Expanded Flat Theory

Elliott Wave Flat is a 3 wave corrective pattern. Inner subdivision is labeled as A,B,C , with inner 3,3,5 structure. Waves A and B have forms of corrective structures like zigzag, flat, double three or triple three. Third wave C is always 5 waves structure, either motive impulse or ending diagonal pattern. It’s important to notice that in Irregular Flat Pattern wave B completes below the starting point of wave A. Wave C ends above the ending point of wave A . Wave C of Flat completes usually between 1.00 to 1.236 Fibonacci extension of A related to B, but sometimes it could go up to 1.618 fibs ext.

You can learn more about Elliott Wave Flat Patterns at our Free Elliott Wave Educational Web Page.

At the graphic below, we can see what Expanded Flat structure looks like

USDX Elliott Wave h4 Chart 11.04.2023

Elliott wave view suggests cycle from the 107.34 peak is unfolding as Flat Pattern. We can notice that inner subdivisions of ((a)) and ((b)) black are having corrective sequences. . Wave ((c)) leg should ideally complete as 5 waves soon. Extreme zone, equal legs is already reached at 105.1 area. We expect to see short term bounce in (iv) and another leg down to complete 5 waves in ((c)) wave. We expect Dollar to complete cycle from the peak at 105.1-103.85 area as Flat Pattern. That zone should find buyers for a 3 waves bounce X red.

USDX Elliott Wave h4 Chart 11.11.2023

Dollar index made 5 waves down in ((c)) leg and completed Flat Pattern at 104.85 low. Current view suggests we are in X red connector. The price structure shows higher high sequences from the 104.85 low, suggesting we are potentially still in ((c)) of X that can see approximately 106.4-106.6 area.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Please keep in mind that we don’t make the market and our forecasts don’t have 100% accuracy. However, we do have a system which allows us to get out Risk Free + cash partial profit from the trade, even if primary analysis gets wrong. Join us now and start learning from market experts.

Welcome to Elliott Wave Forecast !