Hello, fellow traders! We’re excited to share key insights that will help you make the most of your Elliott Wave Forecast membership. With access to 78 instruments across three specialized groups, you’re in the perfect place to elevate your trading.

We want to emphasize the importance of using our Elliott Wave Charts, Chat Rooms, Live Sessions, Live Trading Rooms, and Educational Videos to improve your trading results. These tools help you trade smarter and more efficiently. Make the most of them to take your trading to the next level.

Now, let’s dive into the key features of our services. You’ll see exactly how you can use them to enhance your trading experience.

1. Professional Elliott Wave Analysis – Always Up-to-Date

📉 📈 Chart Updates:

- H1 charts: Updated 4 times daily

- H4 charts: Updated once a day

- Daily and Weekly charts: Updated weekly, unless significant adjustments are needed.

Important : Charts with Black Arrows doesn’t have tradable sequences and should be not traded. You can find trading setups at the Live Trading Room Page. If you want to trade on your own , the best trading idea is to focus on the charts that combine blue box with red/ green right side tag.

Our charts are easy to trade:

🟢 Green bullish stamp + 🟦 blue box = Buying Setup ⬆️

🔴 Red bearish stamp + 🟦blue box = Selling Setup ⬇️

⚫ Charts with Black stamps are not tradable. 🚫 ⬆️⬇️

You can find examples of our Trading Setups at this Trading Articles page.

Although our charts follow fixed schedules, our 24-hour chat rooms are constantly active with market insights. Our experts provide real-time updates. They will keep you informed throughout the whole day!

⚠ Did you know? 90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test.

2. 💬 24-Hour Chat Rooms :

Our chat rooms are not just about market updates—they’re an interactive learning tool where you can ask questions and engage directly with the experts!

- Talk to our Technical Analysts and Market Experts any time during the day.

- Get answers to any questions you have about trading or the market in general. Whether it’s the latest analysis, Elliott Wave, cycle/correlation analysis, or any other trading-related topic, our experts are ready to provide insightful explanations and guidance.

- A great space to learn and grow as a trader, where you can explore expert insights and technical strategies.

3. Live Analysis Sessions – Stay Ahead of the Market

We highly recommend attending these live sessions daily, or at least watching the recordings to stay up-to-date with market trends!

- Held every trading day (Monday – Friday)

- We cover the entire market, analyzing each instrument individually

- Elliott Wave counts, overall trends, and potential strategies are presented

- Q&A sessions during the webinar for personalized guidance

4. Live Trading Room – High-Probability Trades in Focus

Stay on top of the best opportunities with our Live Trading Room sessions!

- Live webinars focused solely on high-probability trades

- We provide exact entry points, stop-loss levels, and take-profit areas

- If you miss the session, no worries! You can always watch the recording later

- All trading setups are also available in the LTR Journal, which can be accessed anytime

5. Educational Videos – Learn from the Experts

As a member, you get access to our Educational Videos page, where we explain our trading strategies in detail. These videos come at no extra cost and help enhance your trading knowledge. Key videos include:

- First video: How to Use the Elliott Wave Forecast Website

- Second video: How to Trade Using Blue Box and Green/Red Right Side Tag

- Seventh Video: How to Trade 3, 7, or 11 Swing and Equal Leg Patterns

By utilizing our charts, chat rooms, live sessions, trading room, and educational videos, you’re equipped with everything you need to trade smarter and more efficiently. Take advantage of these powerful tools to elevate your trading journey!

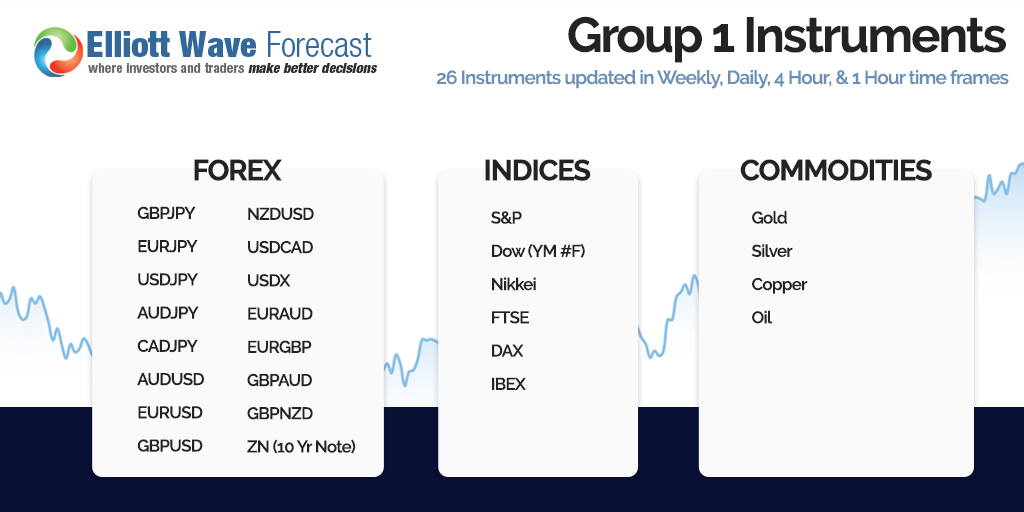

Now, let’s explore the three specialized groups of instruments we offer. Below, you’ll see images that highlight each group

1. Group Instruments:

2.Group Instruments :

3.Group Instruments :