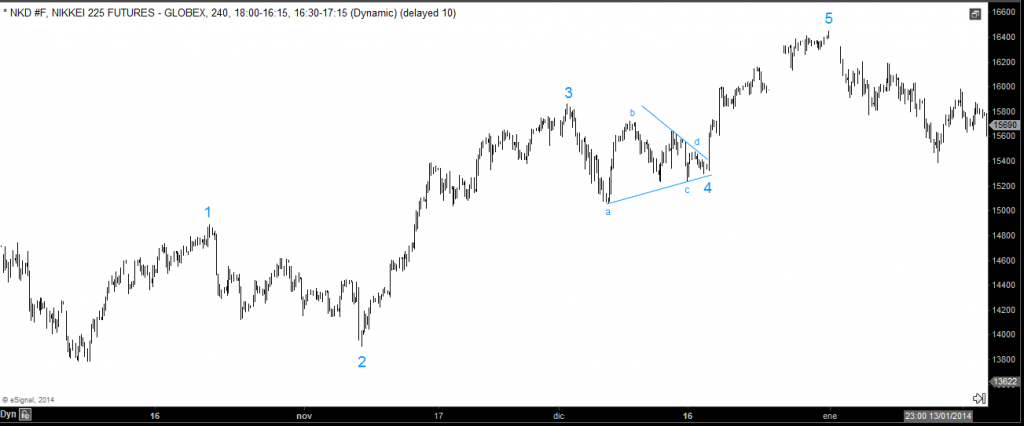

In the Chartism you could find out triangles any where using two trendlines to fix the geometric form. But there are certain triangles that are not so important by type but location and these are displayed on a wave 4 of a Elliott wave impulse. If you have a well structured impulsive count and after a strong upward movement comes on the market ranges and take the form of a triangle then you know you are in wave 4 and therefore you must expect the market to continue the trend of momentum to complete wave 5 and a cycle.

There are two important points to rescue here, with a triangle wave 4 the market should:

1. continue with the current trend in a wave 5.

2. end of a cycle soon.

For example we have the japanese index NIKKEI, we can see how after 3 waves up hard ranges forming a triangle and as we see this continue with the trend of the first 3 waves and complete the drive toward 16450 as the first point we have seen. After that the index break down strong completing the full cycle from 13780 in this case.

Therefore identifying as a triangle wave 4 brings us very good opportunities for trading to operate either the movement of the wave 5 or the end of the cycle.

By Luis Carlos Parodi

If you liked the article share it on twitter or facebook. Also you can take 14 days Trial Plan for just $9.99 and be encouraged to learn the theory of Elliott Wave with Us. Here.