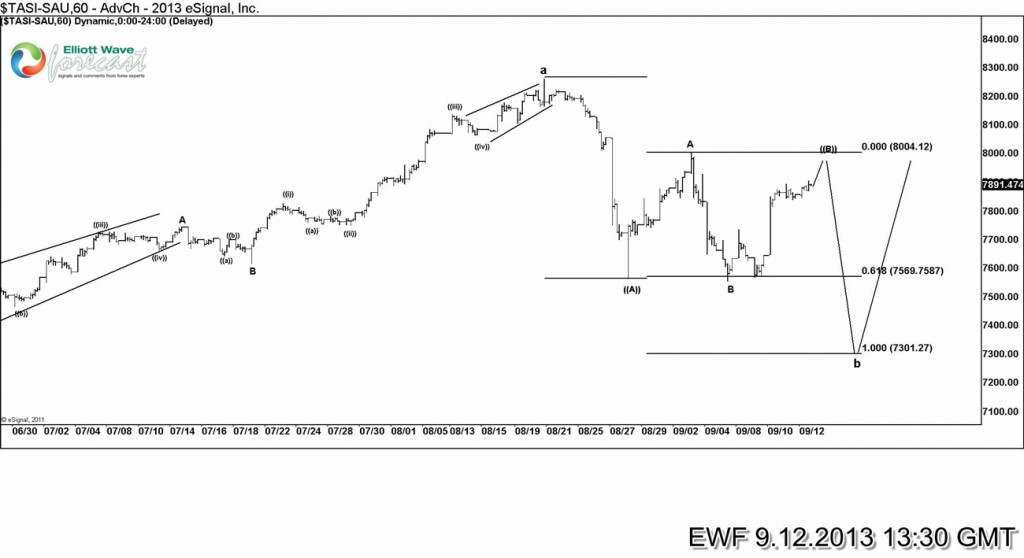

In our previous Elliott wave analysis of TASI published on 8.27.2013, we were expecting a 3 wave pull back in the Index to complete wave “b” before rally resumed. Initial leg down was in 5 waves which we have labelled as wave (( A )) of correction. Following a recovery to 61.8 fib (8004), Index made a marginal new low below the low of wave (( A )) and has bounced strongly. Recent move up looks impulsive but as the last leg lower only made marginal new lows so we are entertaining the idea of wave (( B )) FLAT. As Index avoids aggressive strength above 8004 level, another decline in 5 waves toward 7301 (equal legs) – 7326 (50 fib) could still be seen before buyers step in resume the rally for new highs. As mid-term and longer term cycles are bullish and Index has already met the minimum requirements of 3 wave correction by making marginal new lows. Shorts are not recommended but another 5 wave decline to reach 7301 – 7326 would be a very good opportunity for the bulls.

TASI 4H Chart

TASI 4H Chart

In our previous post published on 8.27.2013, we were expecting a 3 wave pull back in the Index to complete wave “b” before rally resumed. Initial leg down was in 5 waves which we have labelled as wave (( A )) of correction. Following a recovery to 61.8 fib (8004), Index made a marginal new low below the low of wave (( A )) and has bounced strongly. Recent move up looks impulsive but as the last leg lower only made marginal new lows so we are entertaining the idea of wave (( B )) FLAT. As Index avoids aggressive strength above 8004 level, another decline in 5 waves toward 7301 (equal legs) – 7326 (50 fib) could still be seen before buyers step in resume the rally for new highs. As mid-term and longer term cycles are bullish and Index has already met the minimum requirements of 3 wave correction by making marginal new lows. Shorts are not recommended but another 5 wave decline to reach 7301 – 7326 would be a very good opportunity for the bulls.

If you like this analysis and want to receive Elliott wave analysis for 25 instruments with 1 hour updated 4 times a day, 2 x live sessions, trend report, chart room with 24 hours access to moderators, why not sign up for 14 day Trial for just $9.99. There is no commitments and you can cancel at any time.

Back