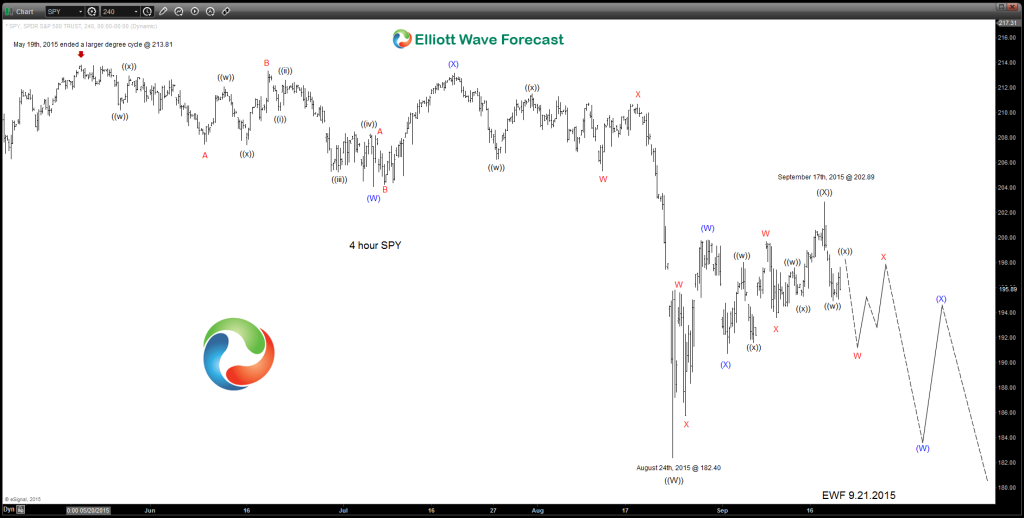

We have seen a sharp sell off in the instrument & S & P 500 Index since the 19th of May, 2015 however think it is a corrective double three decline from the 213.81 high down to the 182.40 lows of August 24th . We think this is most likely a wxy structure and part of a larger degree decline. Since the 24th of August the instrument appears to have completed another double three wave ((X)) at 202.89 on the 17th of September. While rallies fail below this level we can expect the larger pullback continues lower initially toward the August 24th lows again in the blue wave (W) degree where the .618 to .764 extension area of the larger ((W))-((X)) comes in before a wave (X) bounce to fail once again below the September 17th highs for continuation lower toward the equal legs – 1.236 extension of the ((W))-((X)) at the 171.51-164.11 region where at that time we will begin looking for a potential longer term swing buy zone & resumption of the larger uptrend.

Thanks for looking and feel free to come visit our website and take a trial subscription to see if we can be of help.

Kind regards & good luck trading.

Lewis Jones of the ElliottWave-Forecast.com Team

Back