The Trading Reality Check

Many traders come to the Marketplace with the illusion of becoming rich and following the steps of successful people in movies or TV series when they see the private jets, boat, and big houses. Some come with the humble idea of providing for their family using trading as a form of Income. The truth is it is possible to do both and grow into either a powerhouse and making millions or providing for your family and have a decent way of living. However, in between, there is a lot of things to learn, a lot of steps traders need to do, suffer, and control. Many successful traders always tell the side of the history when they finally made it, but the in-between or early stages is the most important aspect to be told.

The Capital Requirement

Traders need to understand that to make money, first of all, a lot of Capital is needed, and either you have the backup to allow you to grow when you started trading, or you need to start with a huge capital to be able to learn, and not over-leverage the risk. Today, we will explain the right side in the Elliott wave Theory and how it works. Elliott wave Theory by itself is a rather subjective tool to forecast the Market and therefore it’s not enough to be a successful trader solely relying on it.

The Challenge of Wave Counting

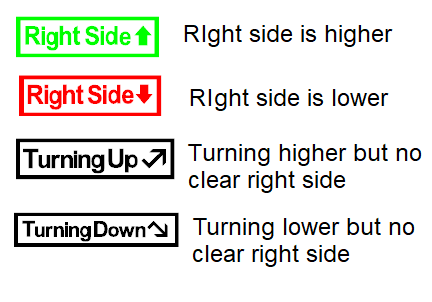

Every waver has seen the count changes many times when the Market does not do the projected path, and the reason is because the Market always does what the Market wants, but there are ways to use Elliott wave and be successful, which we call it the right side. The right side in Elliott wave is the combination of trend, time, distribution and correlation of the Market applied together using the Elliott wave patterns as a language to communicate the idea.

Avoiding Common Trading Mistakes

When trading the right side, traders can avoid being burned. A common example is traders observe 5 waves up and they buy 3 waves pullback thinking they will get another 5 waves extension up, only to find out the Market instead goes lower and take out the beginning of the 5 waves. This happens almost every day, and people blame Elliott wave Theory. Traders who trade the right side of the market understand the Trend and cycles in different time frames, and they only trade one side because they realize that at the end, it’s not easy to forecast a pullback and how deep they will be.

The Discipline of Trading One Side

Traders who trade the right side will not buy or sell into bounces, and consequently, will eliminate a lot of bad trades in between. Each trader can develop different ways or methods to locate the right side, but the trading execution is the key.

The 3-7-11 Swing Methodology

In Elliott Wave Forecast, we trade the right side using 3-7-11 swings. The application is pretty simple. Let’s suppose we believe the $SPX is bullish and thus the right side is the longside. In this case, we will buy a 3 swing pullback hoping for an extension to a new high. If it fails to extend to new high after a 3 swing pullback, then we buy the dips again in 7 swing, Again, if it fails to extend to a new high after 7 swing pullback, we buy the dips again in 11 swing. As you see, we never sell the Instrument because we have analyzed and concluded the right side is the long side. Someone can say if $SPX is expected to trade lower in 3 swing or 7 swing, wouldn’t that mean the Index is bearish in the shorter cycle. Although this thinking is correct, it still does not make it a sell order. Thus to trade the right side of the market, you keep trading in the direction where you think is the real trend, avoiding trading the correction in-between.

Timeframe Alignment Strategy

If trading the Weekly chart, then traders can buy/sell the 3-7-11 swing in Daily chart. If trading the Daily chart, traders can buy/sell the 3-7-11 swing in 4 Hour chart. Finally, if trading the 4 Hour chart, traders can buy/sell the 3-7-11 swing in 1 Hour chart. Staying and trading only the right side is key.

The Impact of Market Oscillations

Another important factor is the oscillations of market. The higher the time frame, the easier to see the right side. A yearly chart has 52 weekly oscillations. 365 daily oscillations, 1460 four hour oscillations, and 8760 hourly oscillations. Obviously, it will be more difficult to get on the right side when trading the lower time frame due to the higher oscillation.

The Path to Trading Success

As we said, in the early stage of your trading career, the first steps is to create a trading technique to locate and execute trading at the right side. We can use Elliott wave theory as a language to communicate the idea, but not to trade every single bounce and blame it when it is not working. Traders who are willing to learn these tips can live the dream that many traders live around the world, otherwise the traders can become part of the 95% who end up losing money.

Final Thoughts on Right Side Trading

In conclusion, before dreaming big, it is better to understand the nature of the right side, how locate it, and trade using a proper execution to be able to make money and live the dream. Be reasonable and understand that it’s not possible to forecast the Market with 100% accuracy. Only the right side will make you money while the oscillation and the complex correction in the shorter cycle will take your money.