Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

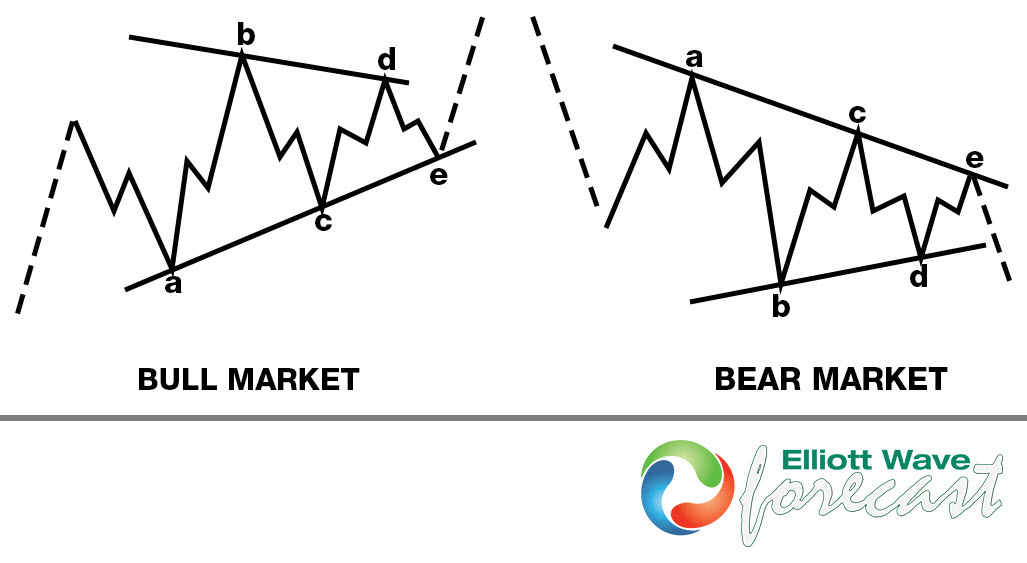

Elliott Wave Triangle Structure

Read MoreTriangle is an Elliott wave pattern seen during sideways market consolidations, it is composed of 5 corrective sequences. Triangle presents a balance of forces between buyers and sellers, causing a sideways movement that is usually associated with decreasing volume and volatility. This pattern subdivide into 3-3-3-3-3 structures labeled as A,B,C,D,E. It is a continuation pattern […]

-

$NI225 (Nikkei) Short-term Elliott Wave Analysis 4.6.2015

Read MorePreferred Elliott Wave view suggests rally to 19770 completed wave (W) and wave (X) pull back is also proposed to be over at 18980 with a test of equal legs (100% Fibonacci extension). Move up from here is taking the form of a double three or (w)-(x)-(y) structure when wave (w) ended at 19590, wave (x) ended […]

-

Impulse wave vs WXYZ

Read MoreIn this video we take a look at FTSE decline from the recent peak which visually looks to be a 5 wave move. We dissect the price action and show the viewers why we don’t see the decline as a 5 wave move and rather as a triple three (w)-(x)-(y)-(z) structure. Learn more how to […]

-

Elliott wave pattern : Double Three (WXY) Structure

Read MoreDouble three is the most important patern in New Elliott Wave theory and probably the most common pattern in the market these days, also known as 7 swing structure. It’s a very reliable pattern which is giving us good trading entries with clearly defined invalidation levels and target areas. The picture below presents what Elliott […]

-

5 wave move in Elliott Wave Theory

Read MoreIn this video we take a look at 5 wave structure. We take a look at rules to label a move as an impulse and also highlight the fact that wave 1, 3 and 5 of an impulse need to further sub-divide in 5 waves and wave 5 should provide divergence in RSI with respect […]

-

Expanded / Irregular Flat Elliott Wave Structure

Read MoreAn Elliott Wave Flat structure is a 3-3-5 structure and has three different types: Regular Flat, Expanded / Irregular Flat, and Running Flat. In this blog, we will take a look at an example of expanded / irregular Elliott Wave structure with $GBP/USD chart. Let’s take a look at the 4 hour chart below: […]