Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

$NZDCAD Elliottwave Analysis 5.13.2016

Read MoreThis is a an Elliottwave Analysis video on $NZDCAD. Short term, the pair still has scope to extend lower to 0.8387 – 0.86517 area to end the cycle from 12/29/2015 peak, then pair should bounce in wave (X) to correct the decline from 0.958 before pair turns lower again. If you enjoy this video, feel free to browse […]

-

$GBPUSD Live Trading Room – NFP Live Trading

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. GBP/USD Live Trading […]

-

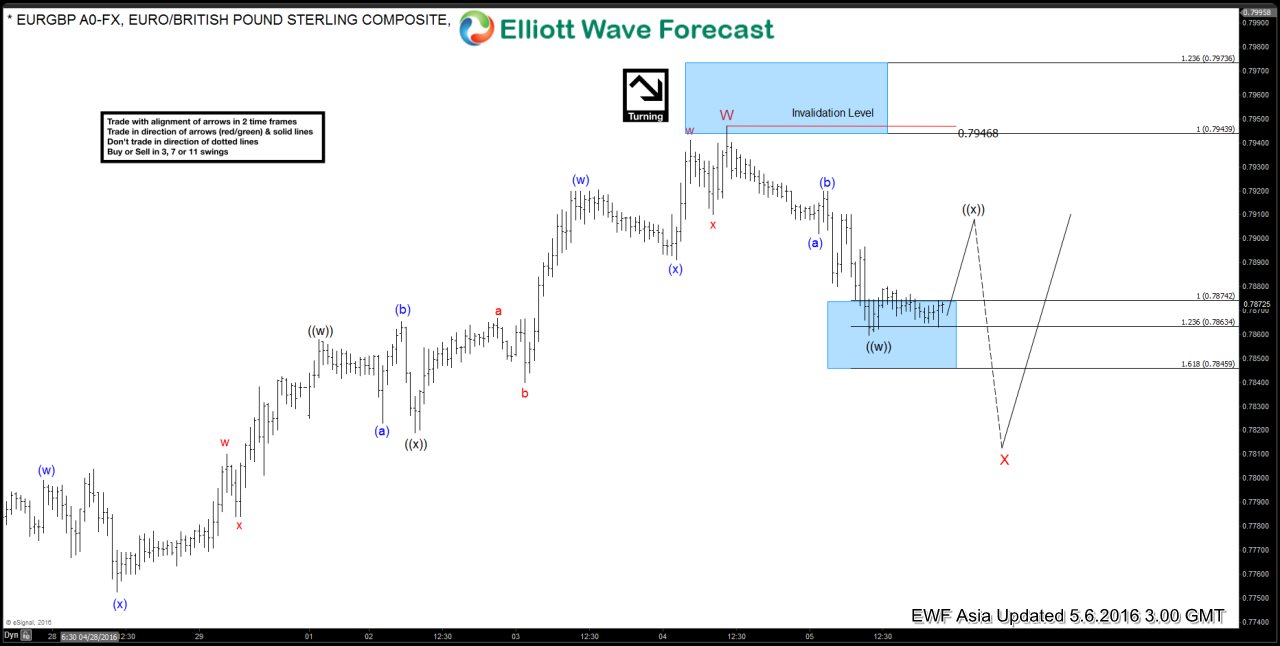

$EURGBP Live Trading Room – Trade Plan

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. EUR/GBP Live […]

-

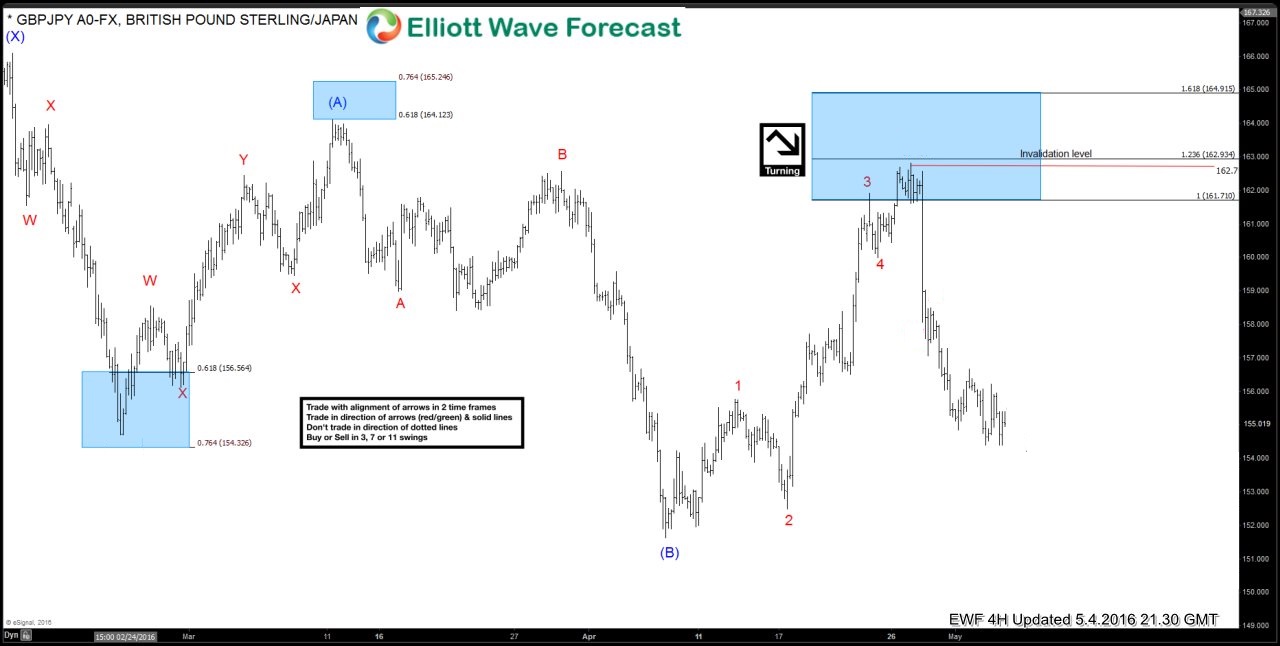

Did he fall or was he pushed? The true story of GBPJPY

Read MoreWe all think we know the story of “Humpty Dumpty”. We all have heard the tale of the Wall and his Great Fall. We know how hard the soldier tried but couldn’t get Mr. Dumpty back together again. Similarly keeping that story on mind on previous Thursday April 28th, when Bank of Japan showed up […]

-

The Disease of Me: Reason behind failure of many traders

Read MoreThe Market is the king of all kings when it comes to trading. Many traders enter the Market with the belief that they will become multi-millionaires in a very short period of time and start disrespecting the Market. As we have always said, the Market is very mysterious and most trader experience a higher degree of success during […]

-

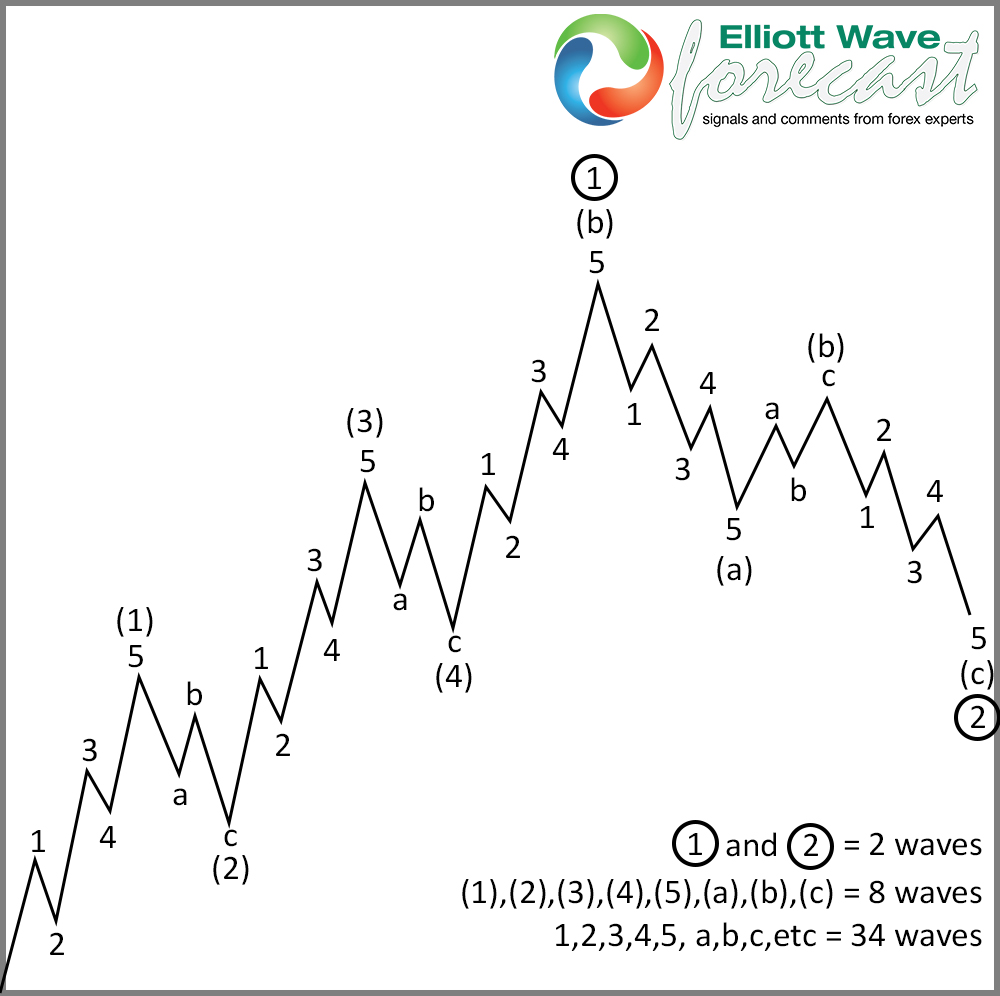

Elliott wave Theory and the right Execution

Read MoreElliott wave Principle was develop around 1930’s and since then many traders have been following the theory and applying it in their everyday trading. We all know life is not perfect and nothing is 100% correct, same applies to the Elliott wave Theory. We have been trying over the last 11 years to take away the subjective […]