Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

Hawkish Fed may trigger equities correction

Read MoreThe May 18th FOMC Meeting Minutes contains direct references to a potential rate hike at the next June 14 – 15 FOMC meeting. Recall in March meeting, the Fed Dot Plot chart (see below) suggests that Fed believes two rate hikes this year is the likeliest outcome, albeit with the usual data dependent clause. Since […]

-

Elliott Waves calling the rally in $USDCAD

Read MoreThe video below is a short clip captured from London Live Analysis Session held on May 5 /2016 where EWF Analyst Hendra Lau is showing Elliott Wave count of $USDCAD forecasting the rally from precisely determined technical area: 1.2806-1.2723. The pair has already given nice results, proposed (X) pull back ended as double three structure at […]

-

How sweet is SUGAR? SB#F

Read MoreGlobal consumption for 2016/17 is forecast at a record 174 million metric tons (raw value), exceeding production and drawing stocks down to the lowest level since 2010/11. Production is up 4 million tons to 169 million as gains in Brazil and the European Union more than offset a decline in India. With growing demand, imports […]

-

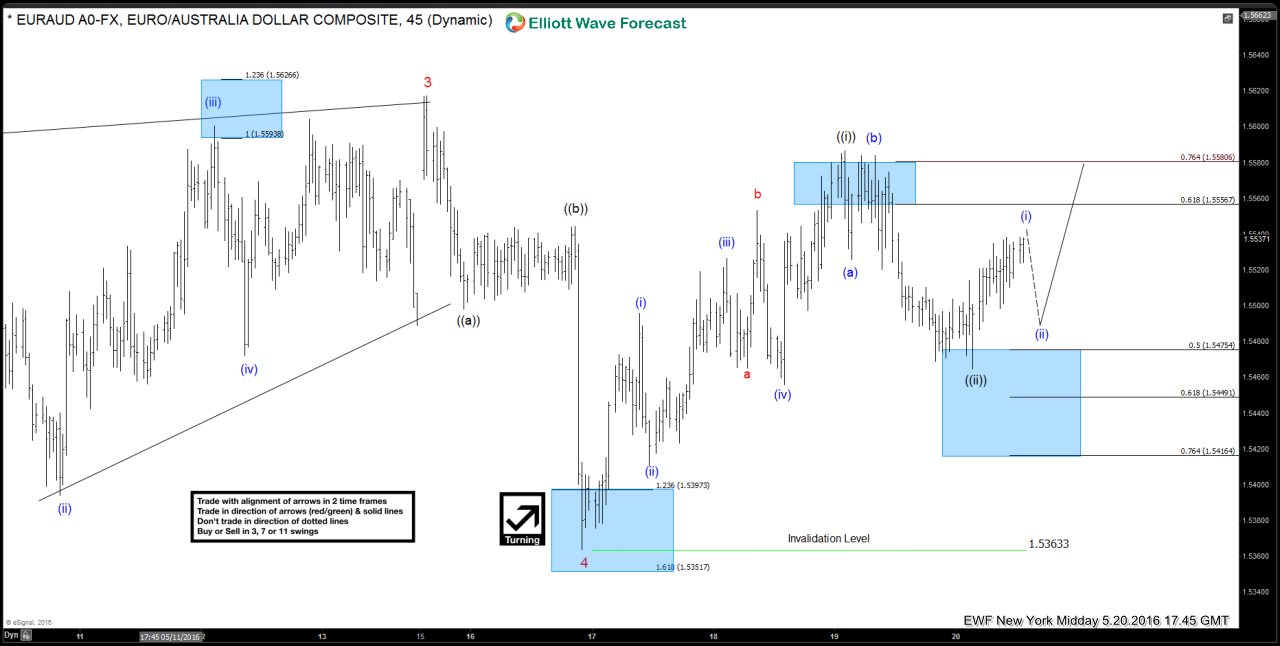

$EURAUD Live Trading Room – A Week in Review

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. EUR/AUD Live […]

-

$NZDCAD Elliottwave Analysis 5.19.2016

Read MoreThis is a an Elliottwave Analysis video on $NZDCAD. Short term, the pair looks to have ended cycle from 12/29/2015 peak, and pair should be in larger wave (X) bounce to correct the decline from 0.958 before pair turns lower again. Near term target is 0.889 – 0.893 area, then it should pullback in 3 waves before higher […]

-

A Lesson from the Maze

Read MoreHave you ever played a maze when you were a kid? In Hong Kong Disneyland, there’s a maze located at the garden outside the hotel which has a shape of a Mickey Mouse head if seen from a distance above. The height of the bushes is designed so that little children’s sight would be blocked when they go inside […]