Hello fellow traders. In this technical blog we’re going to take a quick look at the charts of Natural Gas published in members area of the website. As our members know, we were calling February cycle completed at the 2.911 peak. The Futures made very sideways recovery against the mentioned peak, that unfolded as Elliott Wave Double Three Pattern. We advised clients to avoid trading Natural Gas due to tricky sideways structure. Anyway, we were calling for further weakness as far as the price stays below 2.911 peak.

In the charts below, we’re going to explain the Elliott Wave structure and forecast.

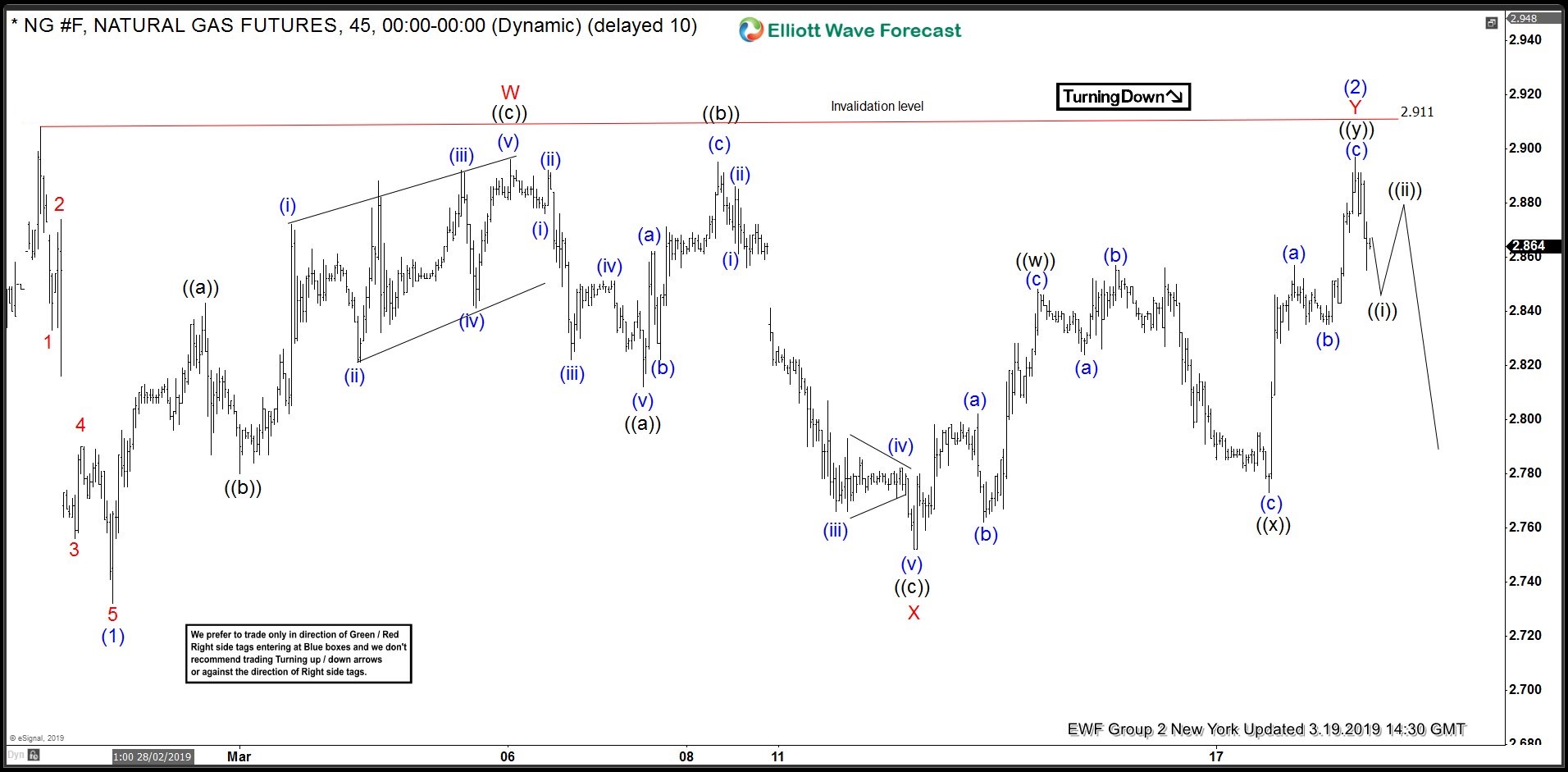

Natural Gas Elliott Wave 1 Hour Chart 3.19.2019

The Commodity has made Elliott Wave Double Three Recovery against the 2.911 peak. Correction’s subdivisions are labeled as WXY red. If we take a closer look, we can notice that waves W and X have unfolded as Elliott Wave Zig Zags: ((a))((b))((c)), while Y red is also Double Three : ((w))((x))((y)). We’re calling correction completed at 2.898 peak.

Double three is the most important pattern in New Elliott Wave theory and probably the most common pattern in the market these days, also known as 7 swing structure. Elliott Wave Double Three has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. You can learn more about Double Three Pattern at our Elliott Wave Educational Web Page.

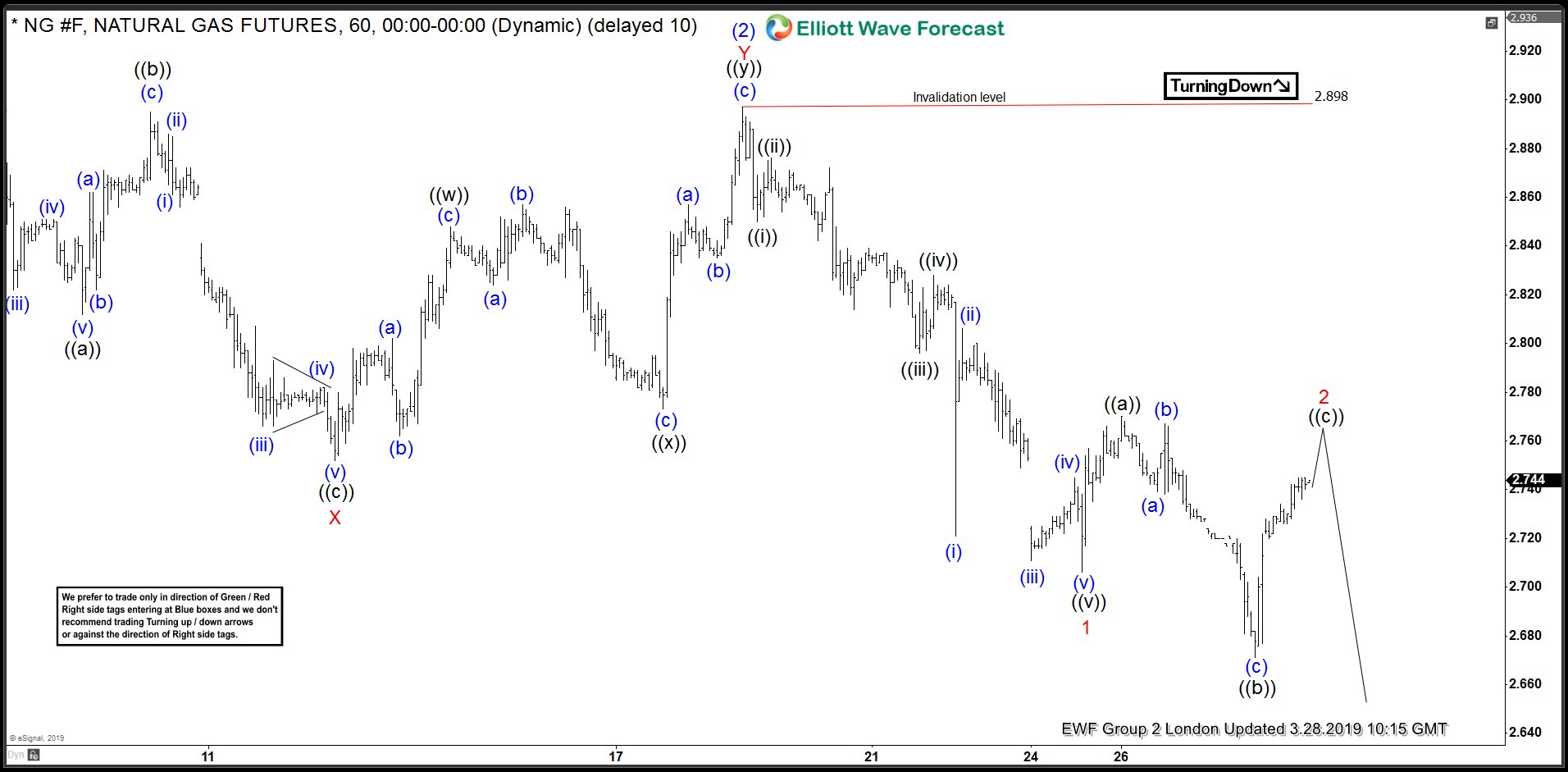

Natural Gas Elliott Wave 1 Hour Chart 3.28.2019

2.898 high held nicely, and we got expected decline. We got 5 waves down from the 2.898 peak, and currently correcting that cycle. Short term recovery is unfolding as Irregular Flat Pattern, labeled as wave 2 red. Once bounce completes we expect more downside in Natural Gas.

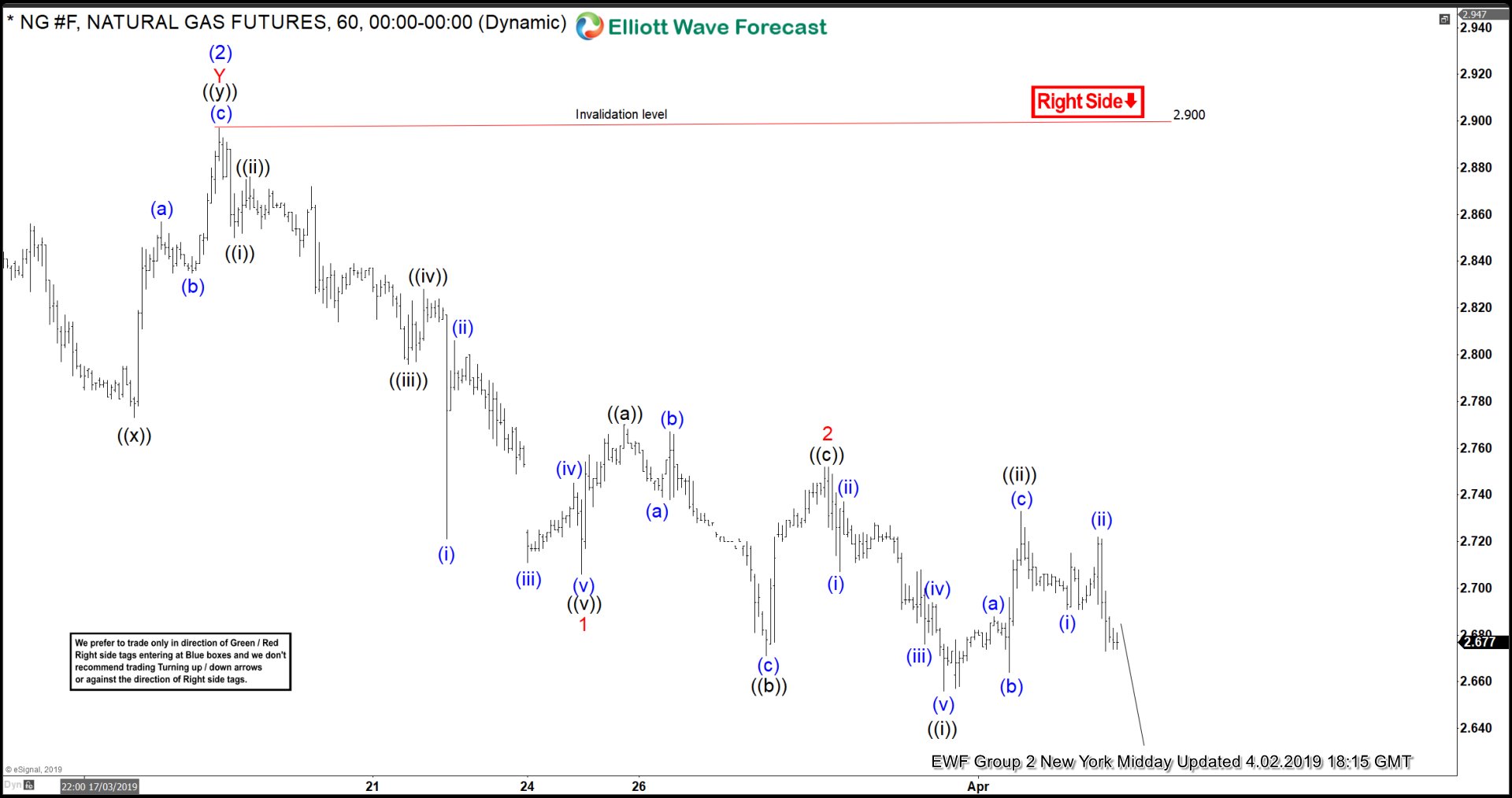

Natural Gas Elliott Wave 1 Hour Chart 4.02.2019

Finally wave 2 red ended as Running Flat and we got new short term low. Cycle from the 2.899 peak is incomplete now, the price is showing lower low sequences. Consequently , as far as the price stays below wave 2 red high, we should be ideally doing next leg lower.

Keep in mind market is very dynamic and proposed view could have ended in the mean time. You can check most recent updates in the Membersip Area of the Website . Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !

Back