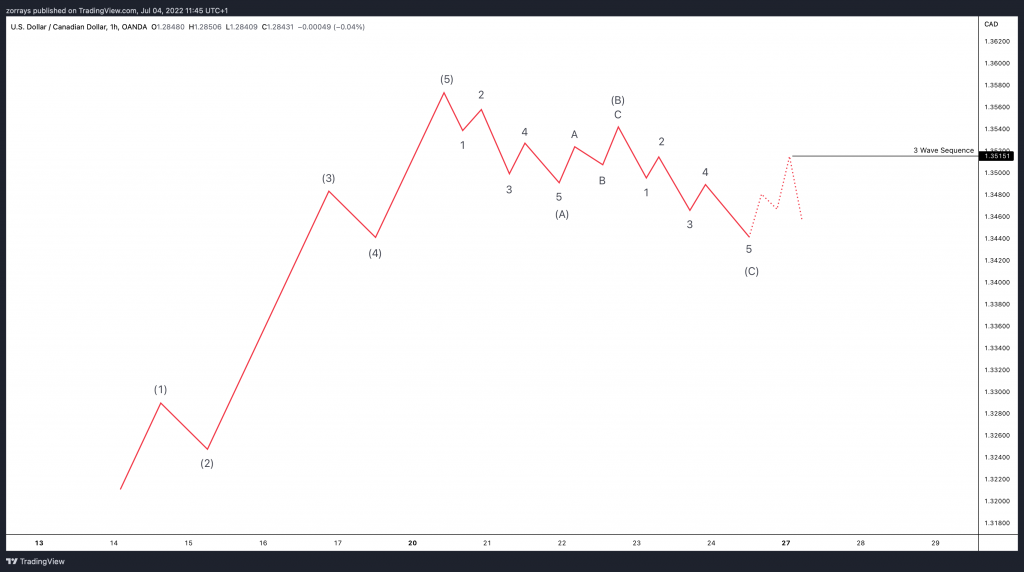

Most exciting as an Elliott Wave trader is when you see a nice clean impulse wave and then develops a clean Zig Zag Pattern. A Zig Zag is one of Elliott Wave Theory’s corrective pattern, also known as when the market takes a bit of a breather.

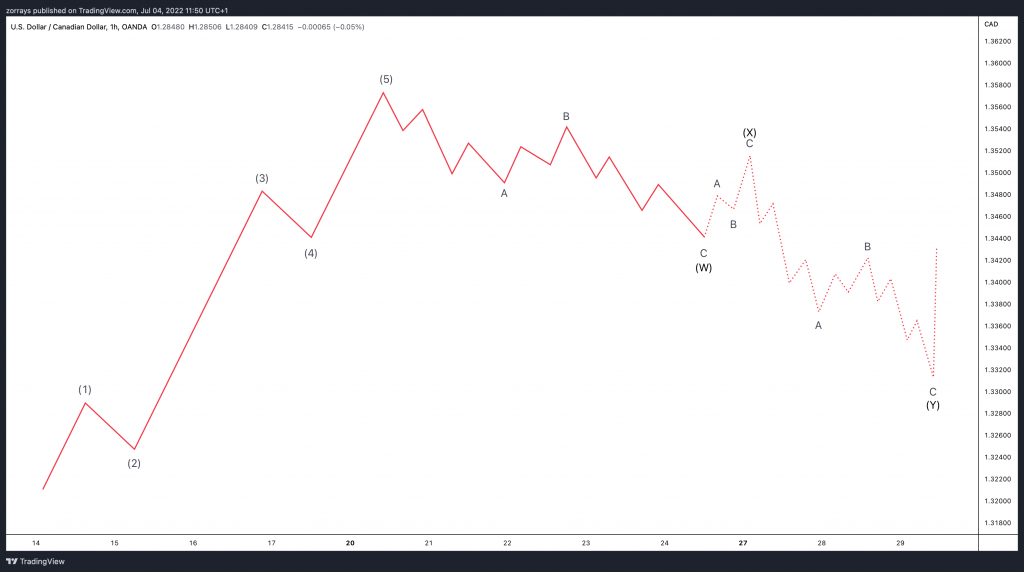

So, a Zig Zag consists of a 5 – 3 – 5 sequence and it is labelled as ABC. A – 5 waves, B – 3 waves and C – 5 waves. When a Zig Zag is completed, it doesn’t necessarily mean the corrective wave is done and we can we expect the cash register to ring as the market forms a new impulse wave. The market can continue correction and form a Double Correction, where two corrective patterns are combined with a connector. This unfolds in a 7 – swing structure and it is labelled as W X Y.

The question is, how do we spot this early to prevent any losses?

As you can see from the dotted lines, one of the best ways to spot this early on is when a market forms a 3-wave sequence prior to a decline. This is a strong clue that the 3-wave sequence we just witnessed is probably an X-connector the move thereafter is wave Y. As opposed to if we saw a continuous 5 wave sequence to the upside prior to a short-term stall, we have a good conviction that the Zig Zag is done.

What can we expect the market to do now?

There is a good chance that the market will continue onto forming another corrective pattern such as another Zig Zag into wave (Y).

Wave X can be any corrective pattern, it is known as the connector, to connect wave W and Y. Realistically speaking, wave W and Y can form any pattern and it would be known as a Complex Correction. However, more often than not, if we see a Double Correction in wave 2, it is usually two Zig Zags combined. Whereas in wave 4, we can see a variety of combinations such as, Triangles, Flats and Double Corrections inside double corrections.

I trust this quick and easy guide helped you save some pennies in the near-term future the next time you trade a Zig Zag pattern.

Please check out our Elliott Wave Theory guide that we have on our website for free to use!

Elliott Wave Theory : Rules, Guidelines and Basic Structures

We pride ourselves to providing real-time analysis on asset classes such as FX, commodities, stocks, ETFs and Indices. To get an exclusive deep dive into our content, we suggest signing up to our 14 day trail! Our strategy has been proven successful within the professional world of trading.

Please click below to join our 14 day trail! Cancel anytime!

Back