In this technical blog we’re going to take a look at some Elliott wave charts of yellow metal (Gold) published in members area of the website. Gold formed a high on October 4, 2022 (1729.46) and started declining. Decline took the form of an impulse, we will explain the internals of this impulsive decline, the bounce which we expected and current forecast.

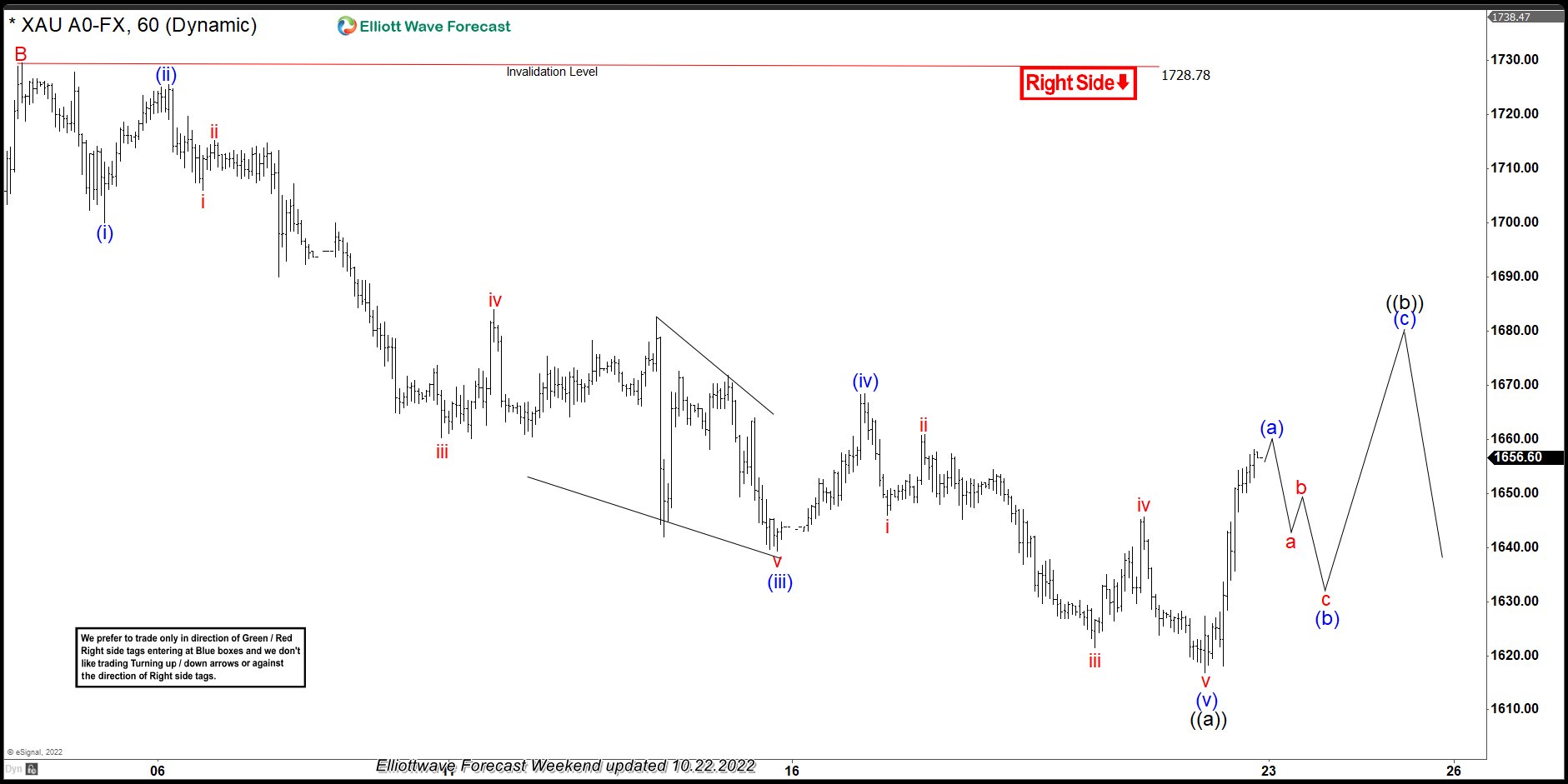

Gold: 21, October 2022: 1 Hour Elliott Wave Analysis

In the chart below we can see Gold is an impulsive 5 waves decline from October 4, 2022 (1729.46) high. Wave (i) ended at $1700, wave (ii) ended at $1725.55, wave i of (iii) ended at $1706, wave ii of (iii) ended at $1715.16, strongest part of the impulse i.e. wave iii of (iii) ended at $1660.30, wave iv of (iii) ended at $1683.94, wave v of (iii) took the form of an Ending Diagonal and ended at $1639.30, wave (iv) ended at $1668.42. We can already see 3 swings down from blue (iv) peak so expecting another low to complete wave (v) and cycle from October 4, 2022 peak before a bounce.

Gold: 22 October, 2022: 1 Hour Elliott Wave Analysis

As per Elliott Wave Theory, after a 5 waves decline, there should be a recovery in minimum 3 waves. In the chart below, we can see Gold made a new low to complete wave (v) at $1616.80 on October 21, 2022 and bounced strongly. First leg of the bounce is close to ending, after which we expect a pull back and one more leg higher to complete three waves bounce before the decline resumes.

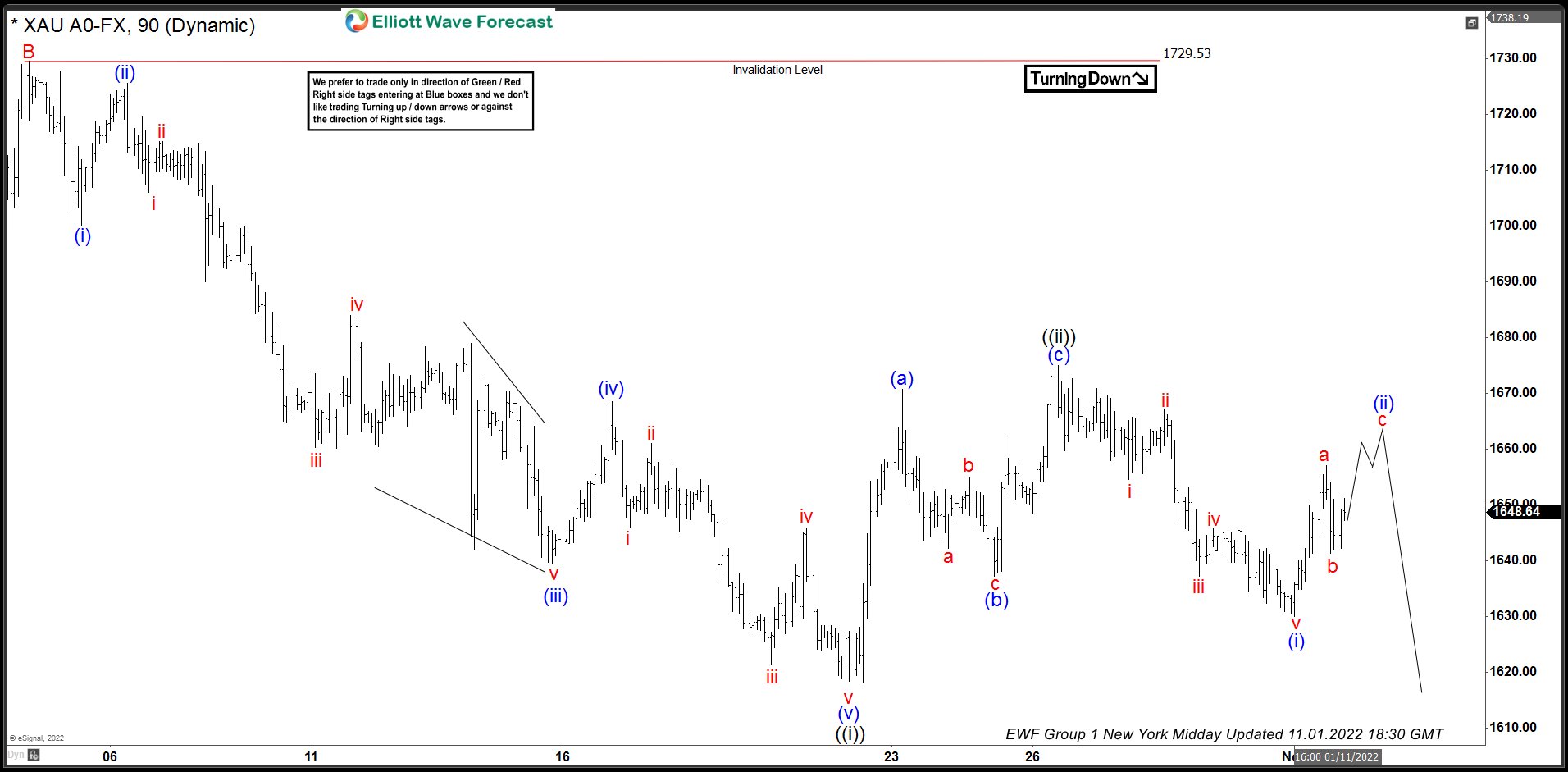

Gold: 1 November, 2022: 1 Hour Elliott Wave Analysis

In the chart below, we can see yellow metal completed 3 waves bounce on October 26, 2022 at $1674.94 and has turned lower again. Since decline from October 4, 2022 peak was an impulse, forecast is for XAUUSD to resume the decline and make a new low below October 21, 2022 ($1616.80) low. Alternate view suggests it can hold the low at October 21 , 2022 for seven swings higher before the decline resumes but as far as October 4, 2022 high remains intact, forecast is for Gold to resume the decline and break below October 21, 2022 low.

Back