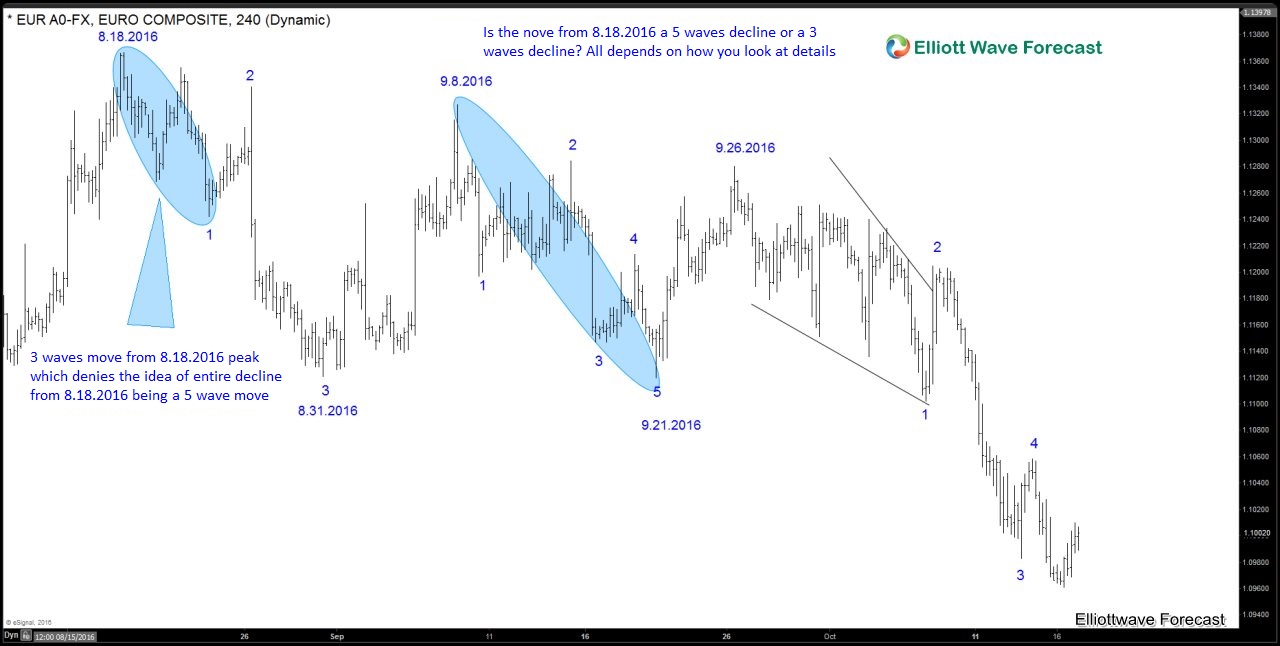

The Elliott wave theory explains that in a five waves move, every subdivision has to come in five waves three of which will advance in five waves and two would be pull backs of those against the trend. In this video, we are going to take a look at the decline in EURUSD from the peak of August 18, 2016. We are going to look at every single subdivision of EURUSD drop and try to decode if every single decline is in five waves or not and based on that we would decide if the decline from 8/18/16 should be labelled in a five waves or three waves. Now, from the peak in 8/18/2016 it is evident that the first decline which is shown as blue 1 is a clear three waves decline which makes the decline from 8/18/2016-8/31/2016 a big three wave decline. Fact that EURUSD decline to 8/31/2016 peak is a big three waves move automatically disqualifies the idea of whole decline from 8/18/16 as a five waves decline.

We do understand that many times many wavers or traders get frustrated when Elliott wave theory does not work and place all the fault in the Elliott wave theory when the reality is that sometimes it’s not the theory but we as wavers do not follow or look into the details like the ones explained in this video which invalidate the five wave sequence because each subdivision within an impulse sequence needs to be in five waves. As you saw, we at Elliottwave-Forecast , pay attention to every single detail within a sequence because every detail matters and we always try to provide the most accurate analysis which doesn’t invalidate the sequences of break or violate the rules. If you liked this video, we invite you to try Elliottwave-Forecast which is Free for 14 days, we will teach you how to look in details within the fascinating world of the Elliott wave theory.