Elliott Wave Subjective Nature

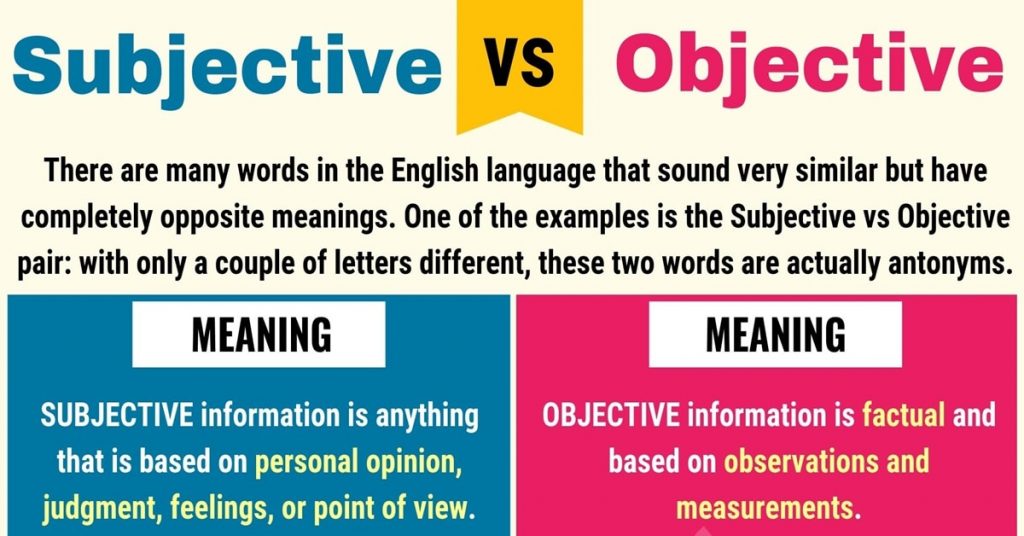

The Elliott Wave Theory, developed by Ralph Nelson Elliott in the 1930s, offers a framework for predicting market movements. Elliott Wave is based on repetitive wave patterns that nest inside of each other. While it has its merits, the subjective nature of the theory makes the use of additional indicators a huge advantage.

Elliott Wave Theory posits that markets move in similar cycles of five waves in the direction of the trend and three waves against it. However, the view of these waves can be highly subjective. Different analysts might interpret the same market data in various ways, leading to divergent wave counts and predictions. The theory’s reliance on pattern recognition causes subjectivity, which individual bias and experience influence.

Other indicators

To minimize these challenges, integrating indicators such as RSI and trend lines can provide a more objective analysis. The RSI, a momentum oscillator, measures the speed and change of price movements. It can help confirm overbought or oversold conditions, adding a layer of validation to Elliott Wave predictions. For instance, an RSI that indicates an overbought or diverging condition during a fifth wave vs three, might suggest a potential trend reversal, offering additional context to wave analysis.

Trend lines, on the other hand, help identify and confirm the direction of the market trend. By connecting significant highs and lows, trend lines can offer clear visual cues about the prevailing trend and potential support or resistance levels. This objective approach can aid in assessing whether the market is adhering to the expected Elliott Wave patterns or if adjustments are necessary.

Here at Elliott Wave Forecast we have designed a specific set of parameters that help us be objective rather than subjective. That system has helped us offer profitable trade ideas to all of our subscribers for years now.

Conclusion

In summary, while Elliott Wave Theory provides a useful framework for understanding market cycles. Its subjective nature means it can benefit significantly from the application of objective indicators like RSI and trend lines. Combining these tools can enhance the accuracy of market predictions and offer a more balanced view of future price movements.

About Elliott Wave Forecast

www.elliottwave-forecast.com Updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

Moreover, experience our service with a 14-day Trial for only $0.99. Cancel anytime by contacting us at support@elliottwave-forecast.com.

Back