Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDUSD Forex Pair published in members area of the Elliottwave-Forecast . As our members know, AUDUSD s is showing lower low sequences in the cycle from the February 25th peak. Recently we got recovery which has unfolded as Elliott Wave Double Three pattern. In further text we’re going to explain the forecast and Elliott Wave Pattern and trading strategy.

Before we take a look at the real market example, let’s explain Elliott Wave Double Three pattern.

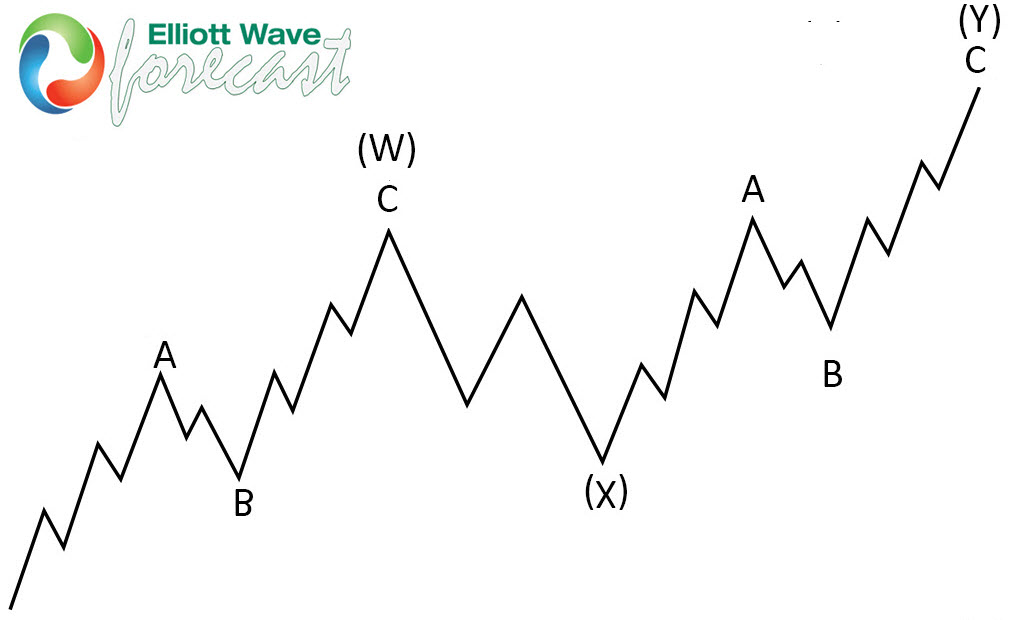

Elliott Wave Double Three Pattern

Double three is the common pattern in the market , also known as 7 swing structure. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

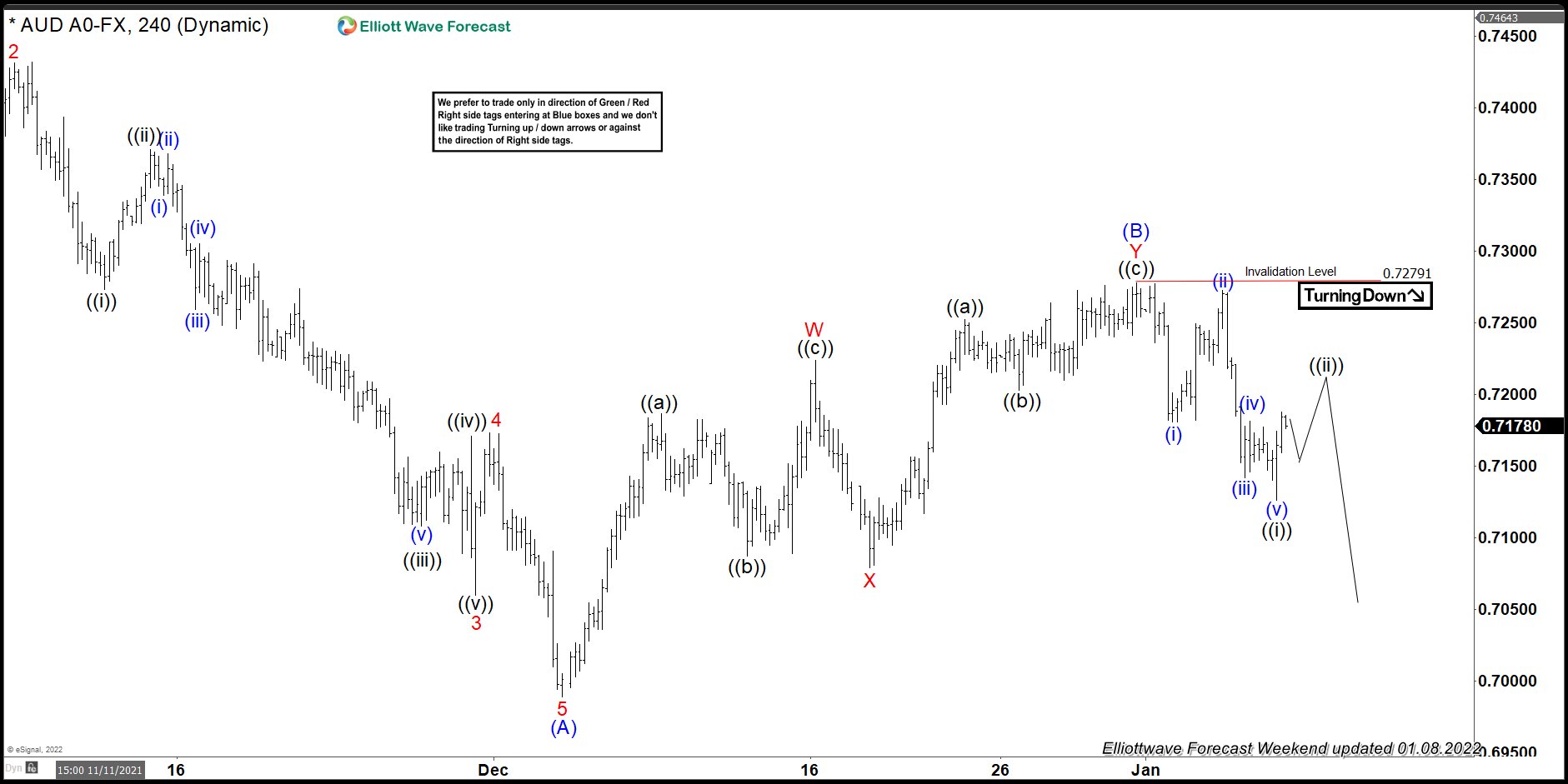

AUDUSD 4 Hour Elliott Wave Analysis 01.02.2022

AUDUSD is giving us (B) blue recovery that is unfolding as Elliott Wave Double Three Pattern. It’s having WXY red inner labeling. The main characteristic of Double Three is that all 3 legs has corrective sequences. First leg Wave W has clear 3 waves structure , Zig Zag ((a))((b))((c)) that ended as trunaction. Then we got 3 waves pull back in ((x)) connector. Currently the pair is doing last leg up Y red h is also unfolding as Zig Zag Pattern. Recovery has already reached extremes at 0.7278 area , and turn can happen any moment. incomplete at the moment. We recommend members to avoid buying, while favoring the short side as far as the price holds below 1.618 fib ext 0.7402 level and as far as 0.7559 pivot holds.

You can learn more about Elliott WaveDouble Three and Zig Zag Patterns at our Free Elliott Wave Educational Web Page.

AUDUSD 4 Hour Elliott Wave Analysis 01.08.2022

Sellers appeared at the equal legs area 0.72789 and we got good reaction from there. The decline from the blue box reached 50 fibs against the X connector, as a result members who took short positions should be enjoying profits in a Risk Free positions. At the moment we see wave (B) blue recovery completed at 0.7279. Decline from the 0.7279 high looks like 5 waves which increases chances next leg down is in progress. Currently we can be doing 3 waves bounce against the mentioned high. However if pivot at 0.7279 gives up we could see larger recovery.

Keep in mind that market is dynamic and presented view could have changed in the mean time. You can check most recent charts in the membership area of the site. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !