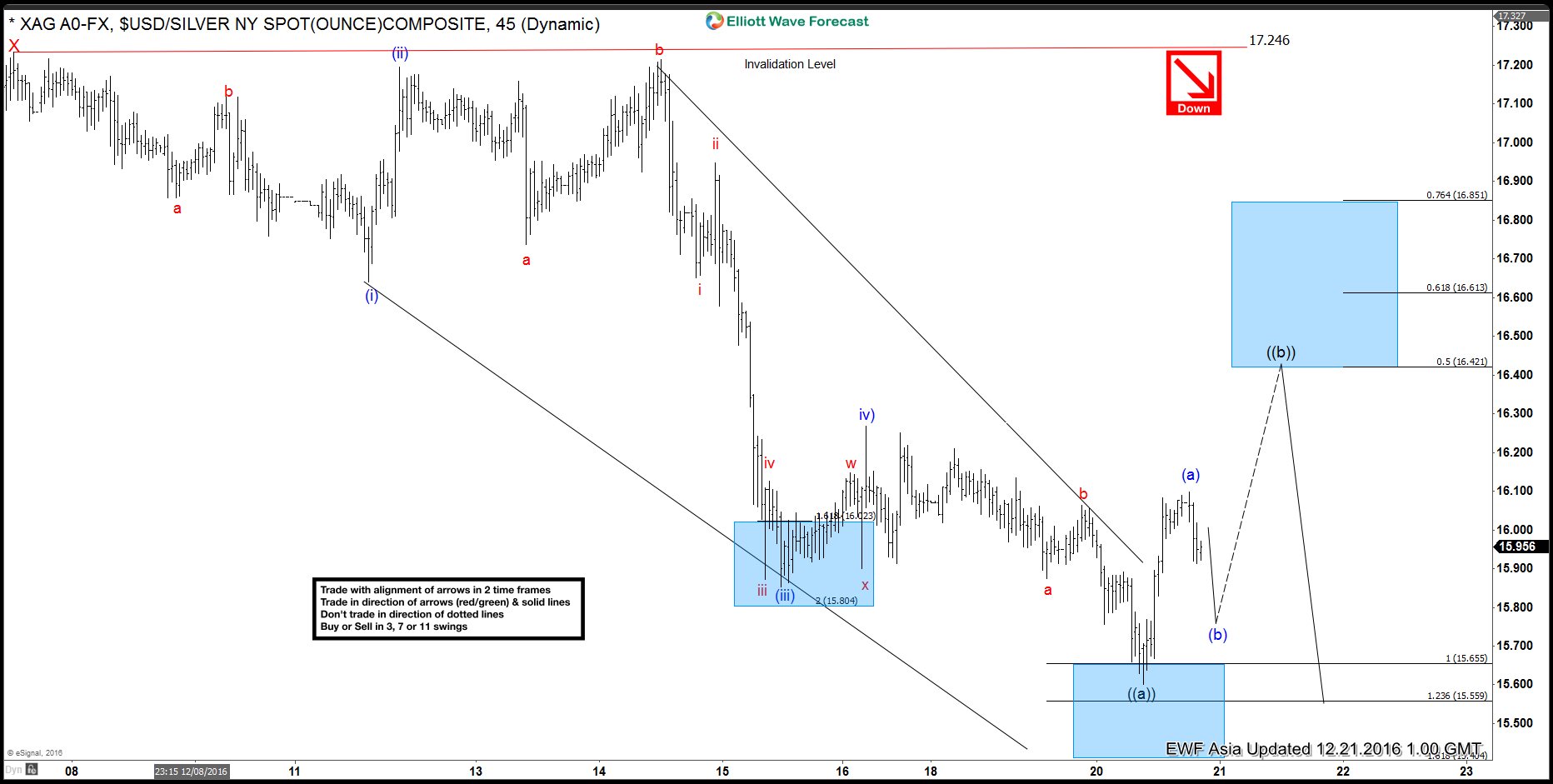

Silver metal is showing an incomplete Elliott Wave sequence from 11.9.2016 peak. There are 5 swings down from 11.9.2016 peak which makes short-term sequence bearish against 12.7.2016 (17.25) peak. Decline from 18.99 – 16.14 was a 3 wave move labelled wave W followed by a 3 wave bounce to 17.25 that completed wave X. Cycle from 17.25 is proposed to be over at 15.60 and structure of this decline was a leading diagonal wave ((a)). A bounce in wave ((b)) is now expected in Silver Metal to correct the decline from 17.25 high before metal resumes the decline towards 14.92 – 14.37 area. Move up from 15.60 – 16.09 appears to be in 5 waves so we think we have completed wave (a) of ((b)), expectations are now for a pull back in wave (b) to correct the move up from 15.60 low followed by another push higher to complete wave ((b)) bounce. 50 – 61.8 Fibonacci retracement area of wave ((a)) decline lies between 16.42 – 16.61. We don’t like buying Silver metal and expect short-term sellers to appear after a bounce in 3, 7 or 11 swings as far as pivot at 17.25 high remains intact in the first degree.

Back