Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

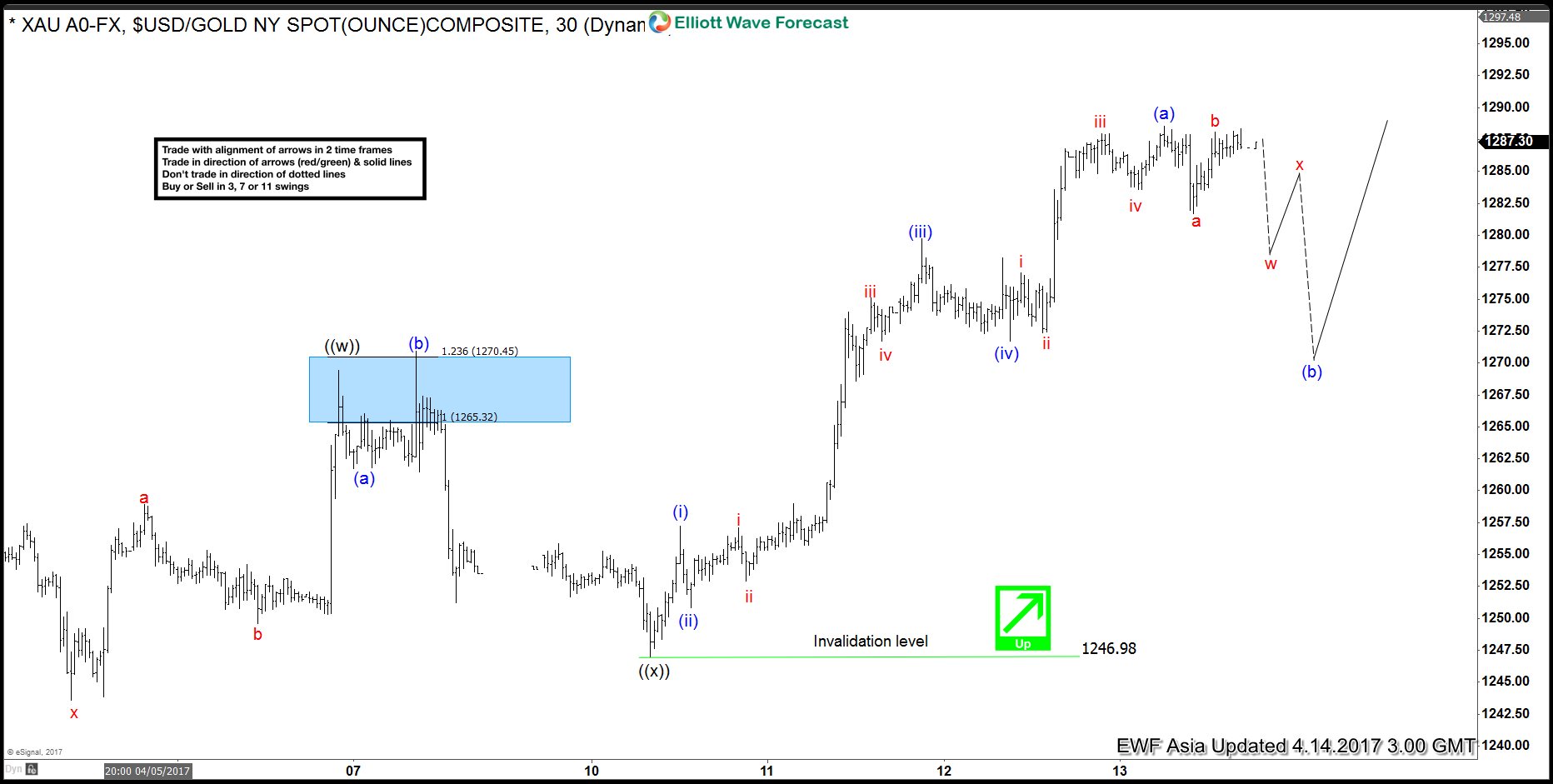

Gold Elliott Wave View: Pullback starting Elliott Wave Forecast

Read MoreShort term Elliott Wave view in Gold (XAUUSD) suggests that cycle from 4/10 low (1246.92) is unfolded as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minutte wave (iii) ended at 1279.75, Minutte wave (iv) ended at 1271.69 and Minutte wave (v) of (a) could be done […]

-

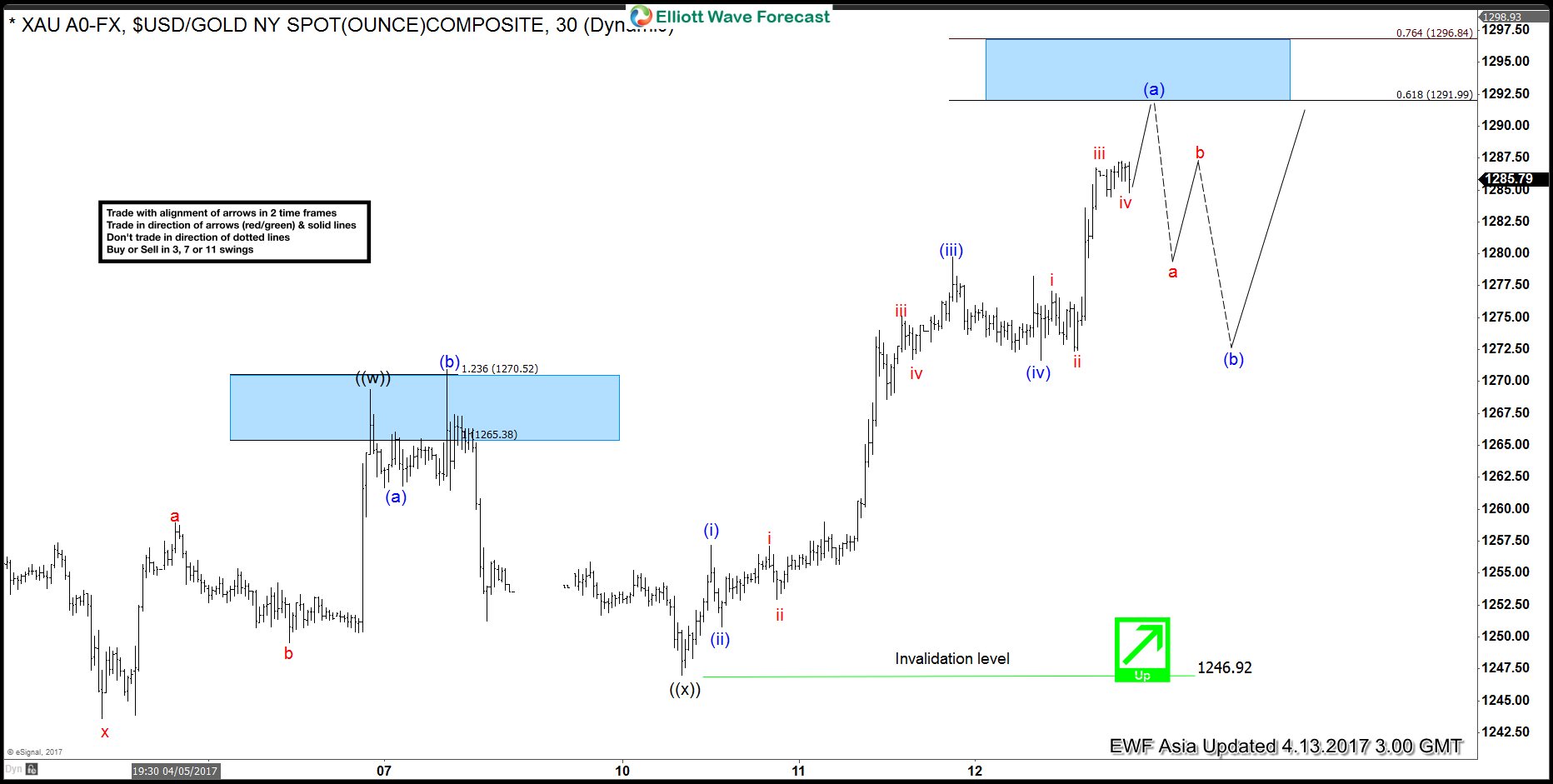

Gold Elliott Wave View : Ending Impulse

Read MoreShort term Elliott Wave view in Gold ( XAUUSD ) suggests that cycle from 4/10 low (1246.92) is unfolding as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minute wave (iii) ended at 1279.75, Minute wave (iv) ended at 1271.69 and Minute wave (v) of (a) is in progress […]

-

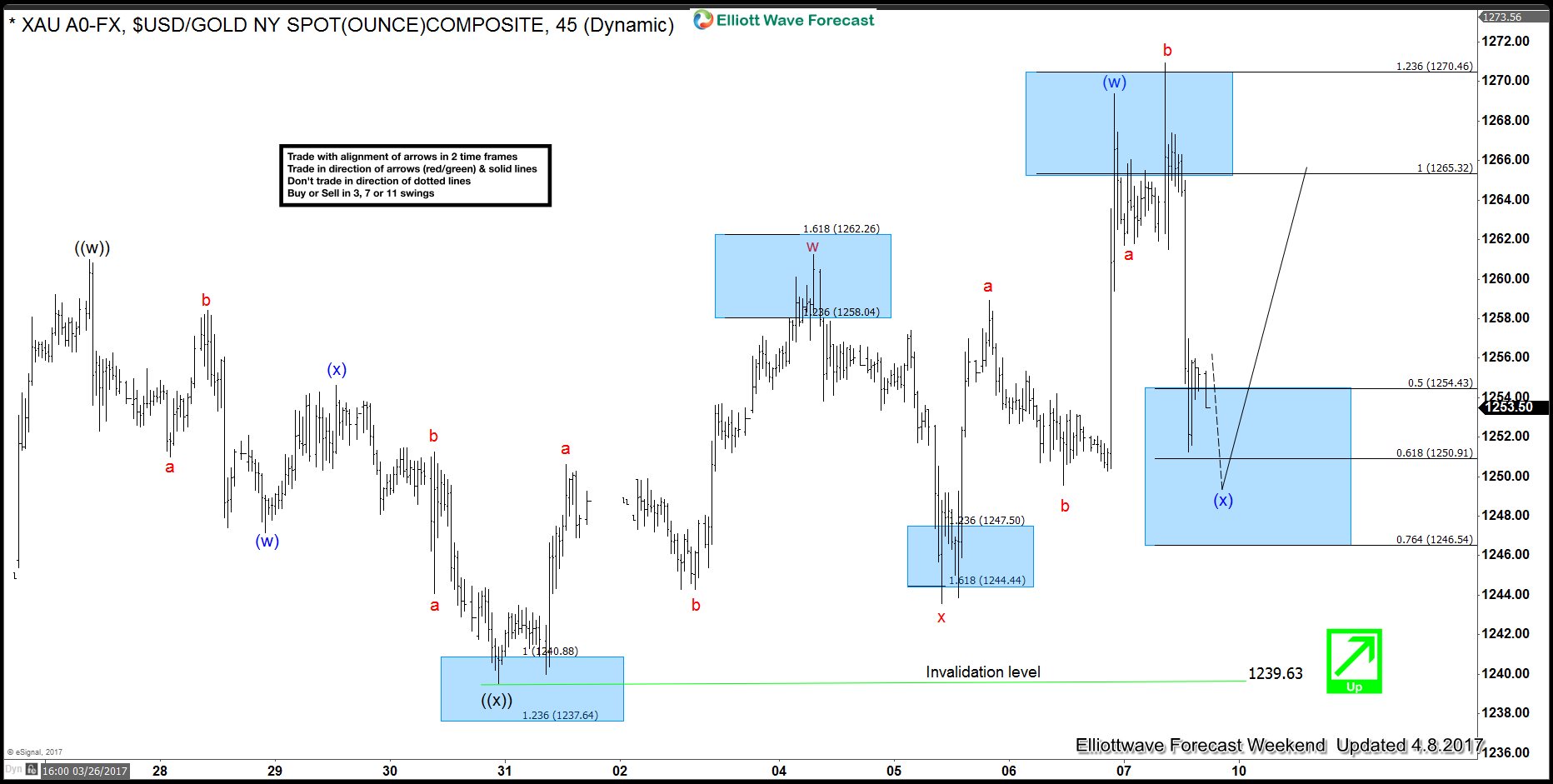

Gold rallied after Elliott Wave Flat Correction

Read MoreGold ( GC_F ) has been rallying since forming a low on 3/10 (1196). Rally from there is still incomplete and needs some more upside, so we were keep looking for buying any intraday dip in the yellow metal for continuation higher. Below is the Elliott wave 1 hour weekend updated chart from April 8, […]

-

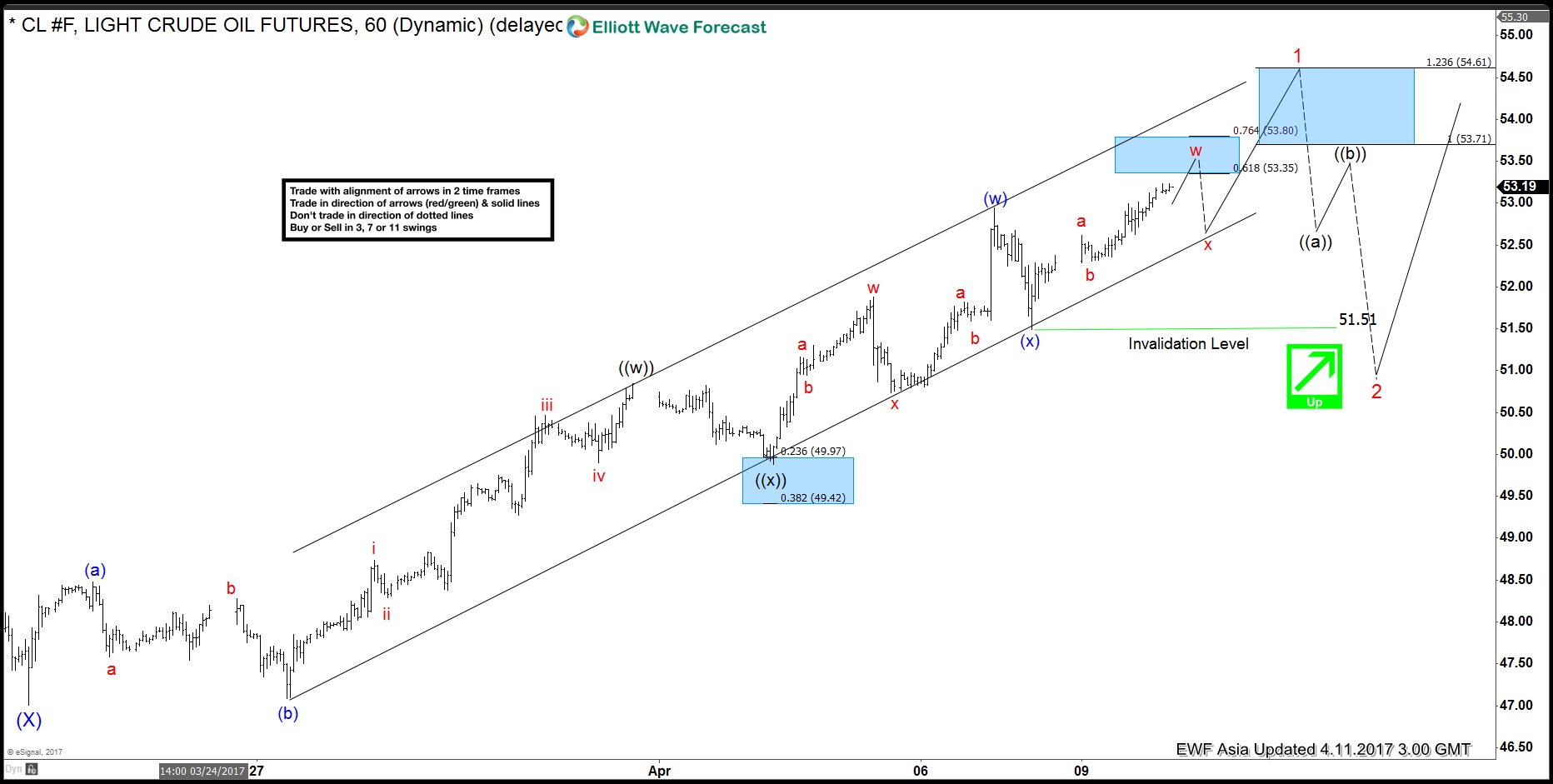

CL_F Elliott Wave View: Mature Cycle 04/12/17 – Elliott Wave Forecast

Read MoreShort term Elliott Wave view in Crude Oil (CL_F) suggests that cycle from 3/22 low (47.01) is unfolding as a double three Elliott wave structure where Minute wave ((w)) ended at 50.85 and Minute wave ((x)) ended at 49.88. Minute wave ((y)) is in progress and the internal is unfolding also as a double three Elliott wave […]

-

CL_F Elliott Wave View: Ending a cycle – Elliott Wave Forecast

Read MoreShort term Elliott Wave view in Crude Oil (CL_F) suggests that cycle from 3/22 low (47.01) is unfolding as a double three Elliott wave structure where Minute wave ((w)) ended at 50.85 and Minute wave ((x)) ended at 49.88. Minute wave ((y)) is in progress and the internal is unfolding also as a double three Elliott wave […]

-

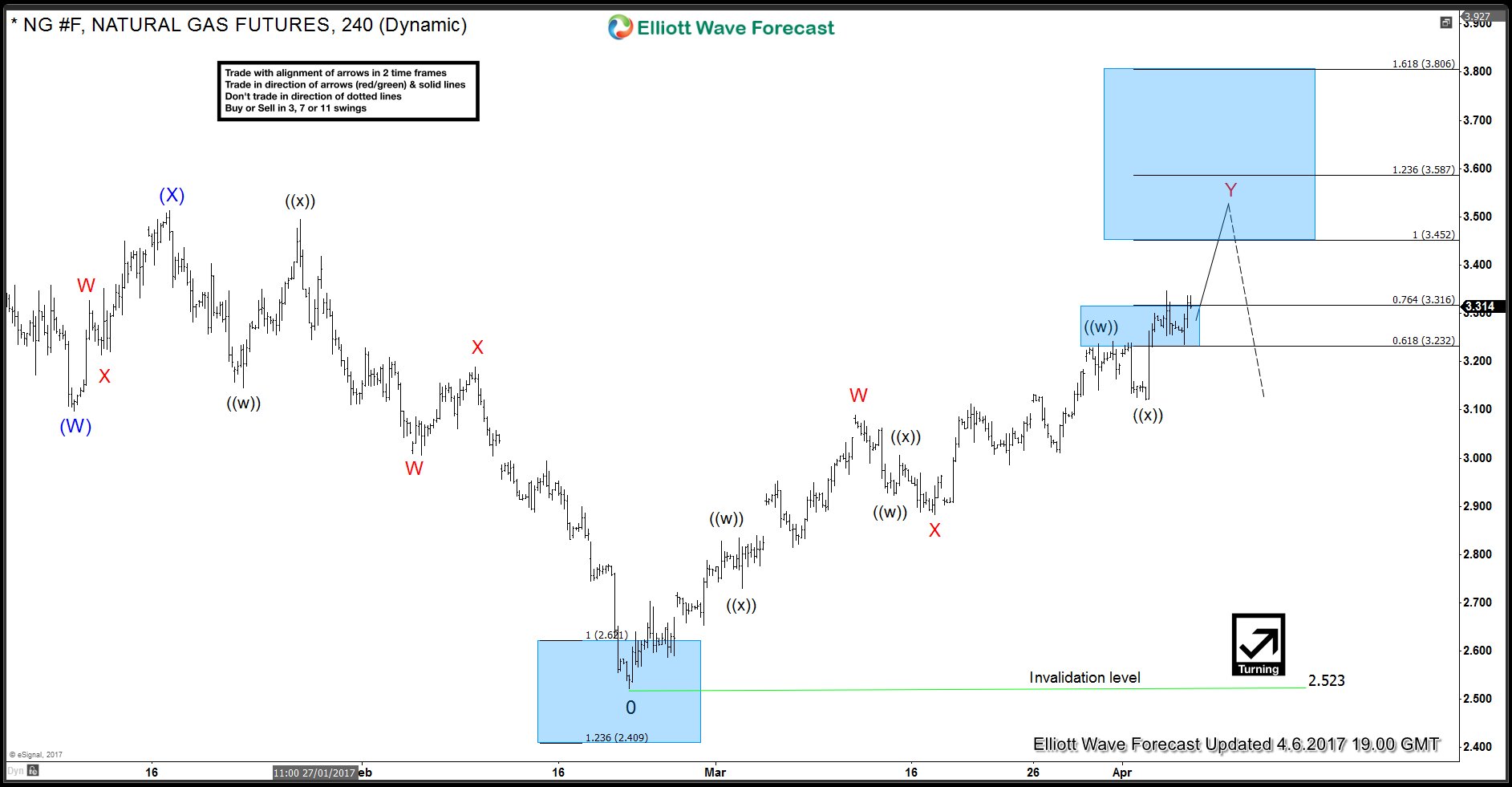

NG #F (Natural Gas) rally is not over yet

Read MoreNG #F (Natural Gas) has been rallying since forming a low on 2/22 (2.523). Rally is unfolding as a WXY or double three Elliott Wave Structure where wave W completed at 3.089 and wave X completed at 2.882. Up from red X low, Natural Gas is showing 5 swings up which means the sequence is incomplete […]