Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Gold Soars Above $1300 as Concerns Mount

Read MoreGold has tested $1300 level 3 times since April and it finally broke above the level on Monday and rose to the highest level this year. The trigger of the break seems to be the North Korea firing a ballistic missile over Japan, which boosts the safe haven demand. The yellow metal then extended the […]

-

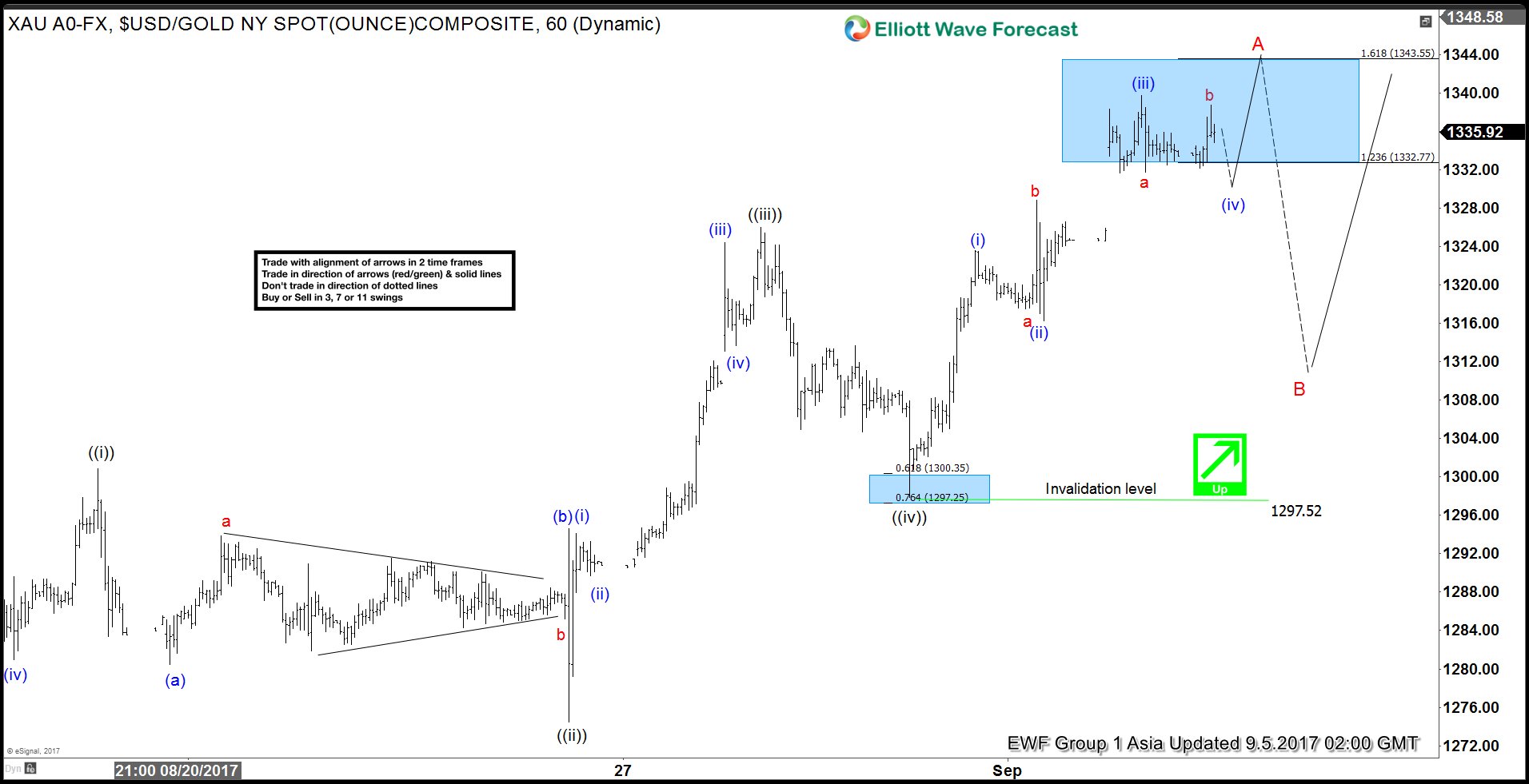

Gold Elliott Wave View: 5 Waves Up

Read MoreShort Term Gold Elliott Wave suggests that the rally from 8/15 low is unfolding as a zigzag. The first leg Minor wave A is subdivided as an impulse. Minute wave ((i)) of A ended at 1300.83, Minute wave ((ii)) of A ended at 1274.45, Minute wave ((iii)) of A ended at 1326, and Minute wave ((iv)) […]

-

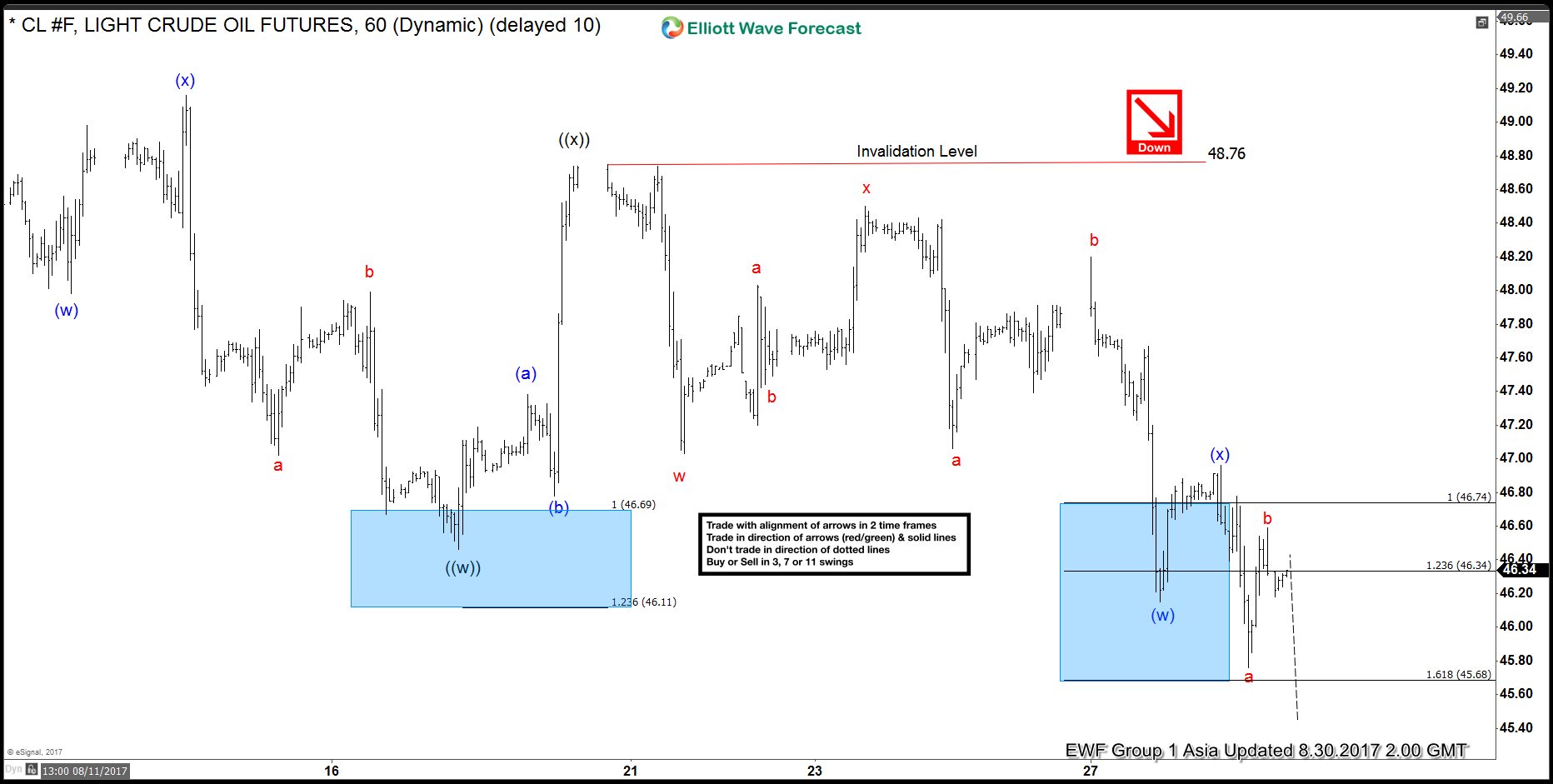

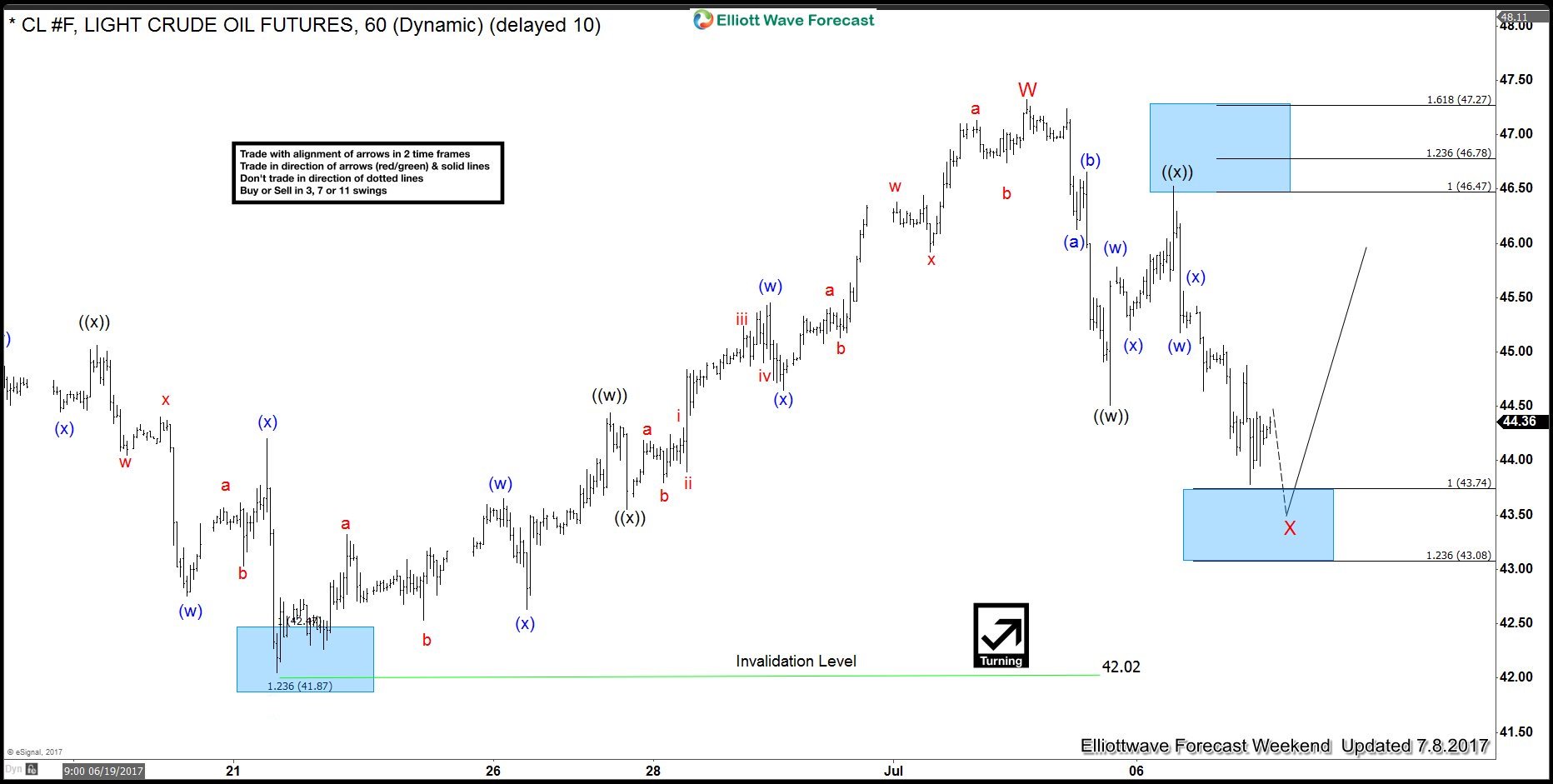

CL_F Oil Elliott Wave View: Pullback in progress

Read MoreOil Short Term Elliott Wave suggests that the decline from 8/1 peak is unfolding as a double three Elliott Wave Structure where Minute wave ((w)) ended at 46.46 and Minute wave ((x)) ended at 48.76. Oil has since made a new low below Minute wave ((w)) at 46.46 suggesting the next leg lower has started. Wave […]

-

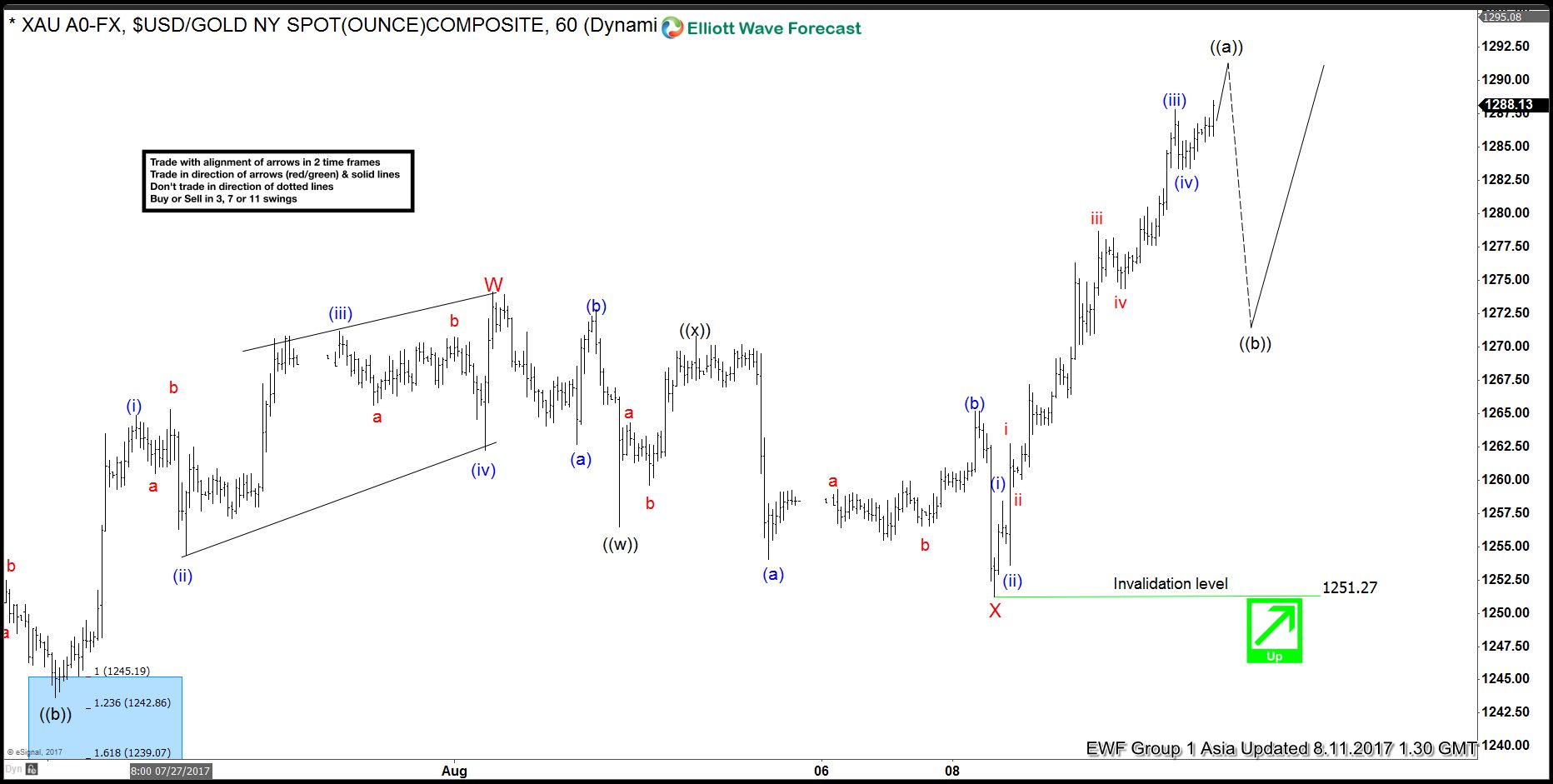

Gold Elliott Wave View: 8.11.2017

Read MoreShort term Gold (XAUUSD) Elliott Wave view suggests that rally from 7/10 low is unfolding as a a double three Elliott wave structure. Up from 7/10 low (1204.69), Minor wave W ended at 1274.11 and pullback to 1251.27 ended Minor wave X. Wave Y is currently in progress as a zigzag Elliott wave structure where Minute wave […]

-

OIL ( CL_F ) Elliott Waves forecasting the rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave chart of OIL ( CL_F ) published in members area of www.elliottwave-forecast.com. In further text we’re going to explain the structure and to see how we forecasted the path. Let’s start with 4 hour chart. OIL ( […]

-

XAUAUD Mid-term Elliott Wave Analysis

Read MoreBack in November 2016, we mentioned that Gold should find buyers in 1540 – 1487 area and bounce ideally to resume the rally for new highs or in 3 waves at least. 3 weeks later, XAUAUD reached the mentioned area, it then found a low at 1525 on 12/15/2016 and started rallying. Yellow metal has […]