Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

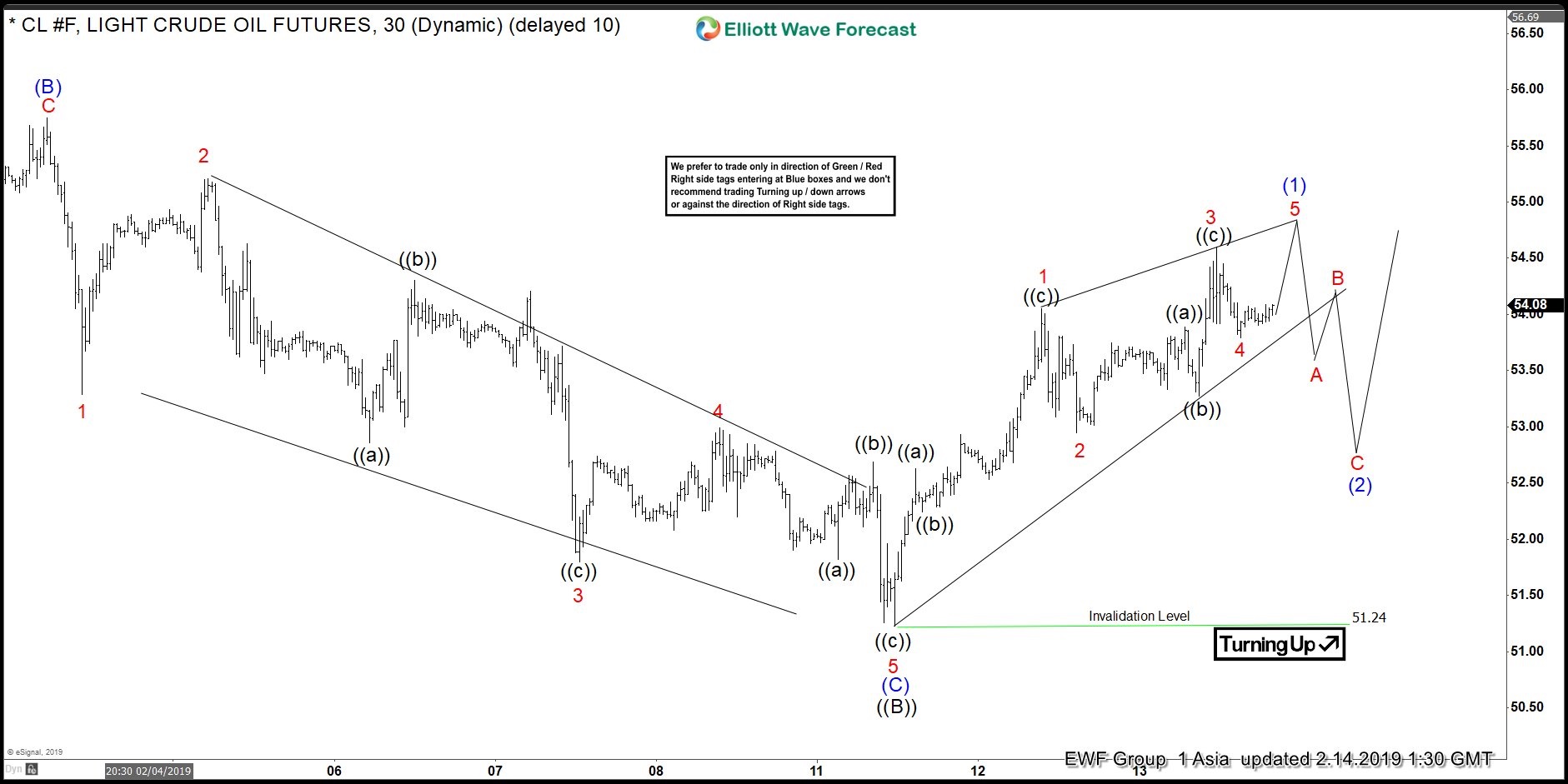

OIL ($CL_F) Elliott Wave Forecasting The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL. As our members know we were calling for further strength in OIL lately. Pull back against the December’s 26th low ended at 51.24 low as Irregular Elliott Wave Pattern and we’re now in the […]

-

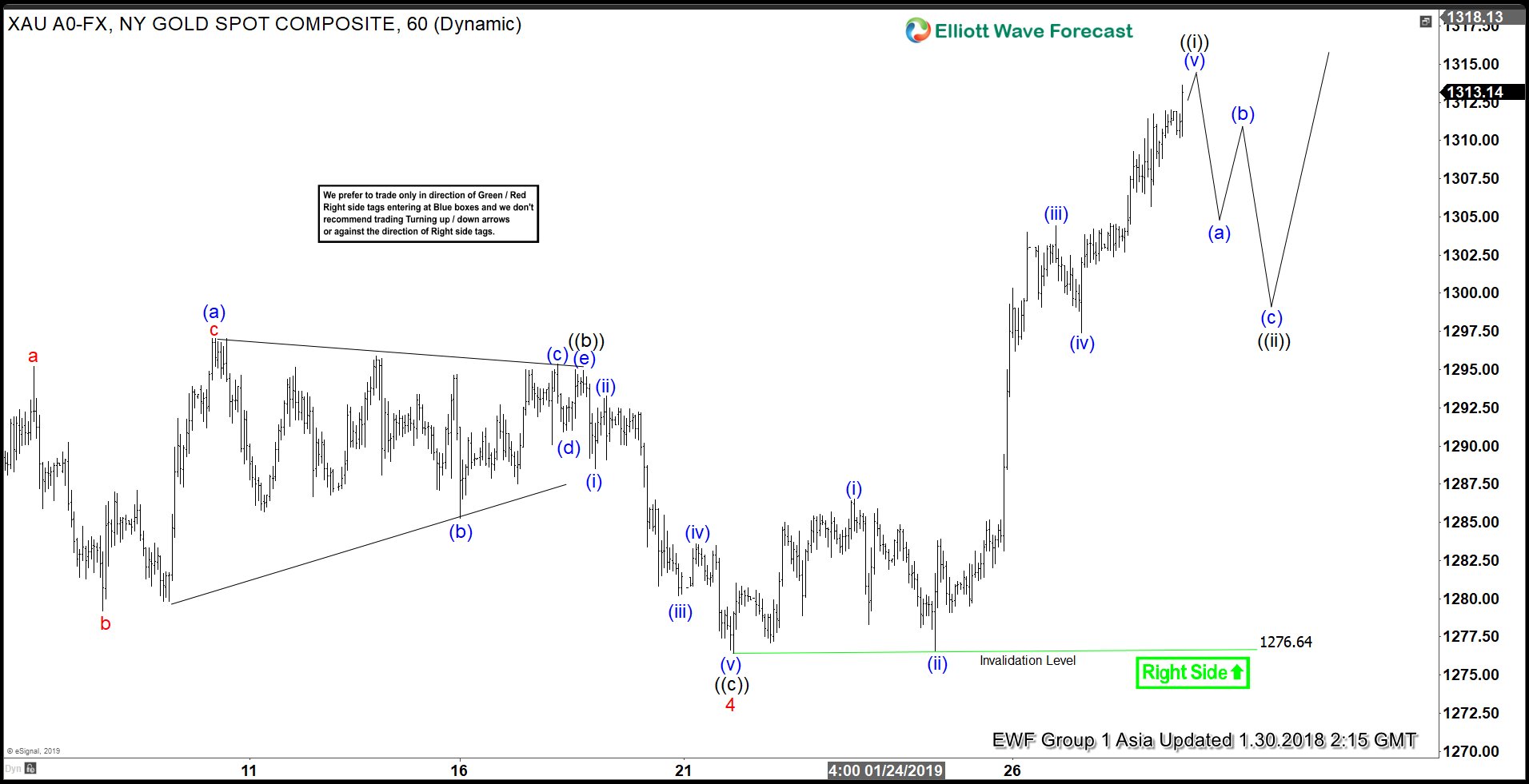

Elliott Wave View: Gold Looking to break 2018 High

Read MoreThis article and video explains the long term and short term view of Gold. Near term, the yellow metal still has scope to extend higher to retest 2018 high

-

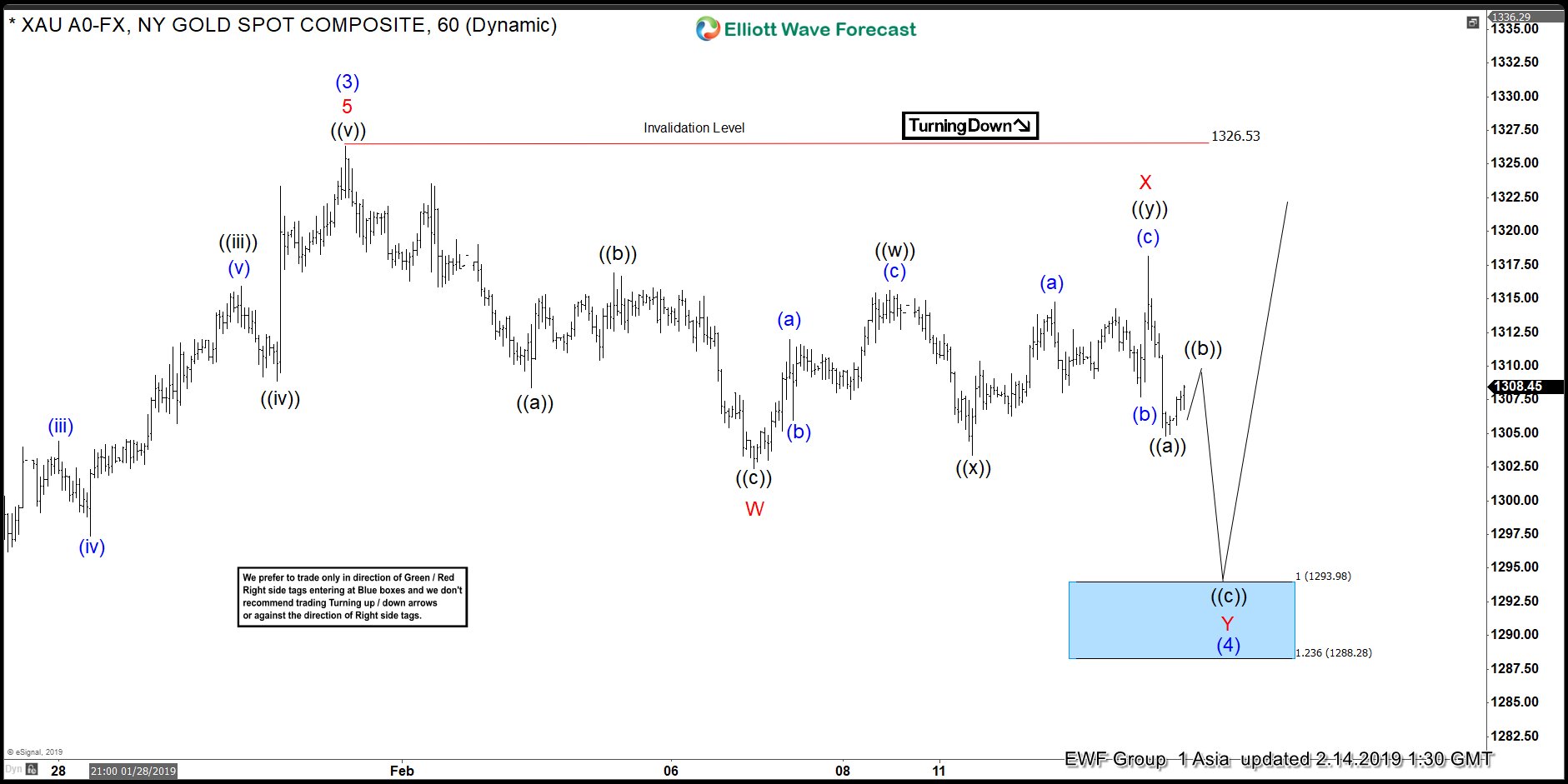

Elliott Wave View: Gold Buyers Should Appear Soon

Read MoreThis article and video explains the short term Elliott Wave path for Gold. The pullback should soon see buyers for further upside or 3 waves bounce at least

-

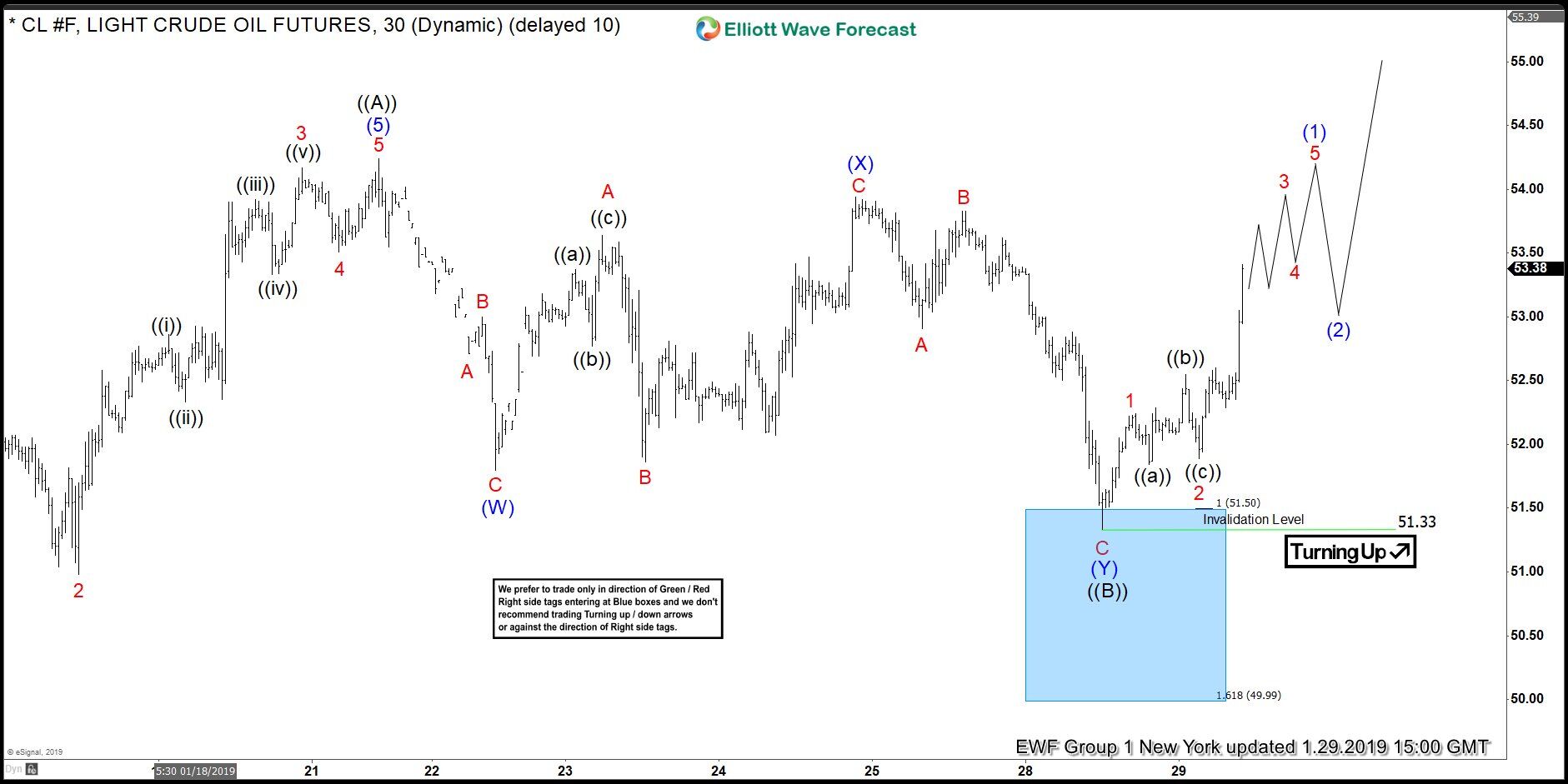

Elliott Wave Expects Limited Pullback in Oil

Read MoreElliott Wave expects Oil to see limited pullback and resume the rally higher. The article and video shows potential area for the pullback and alternate view

-

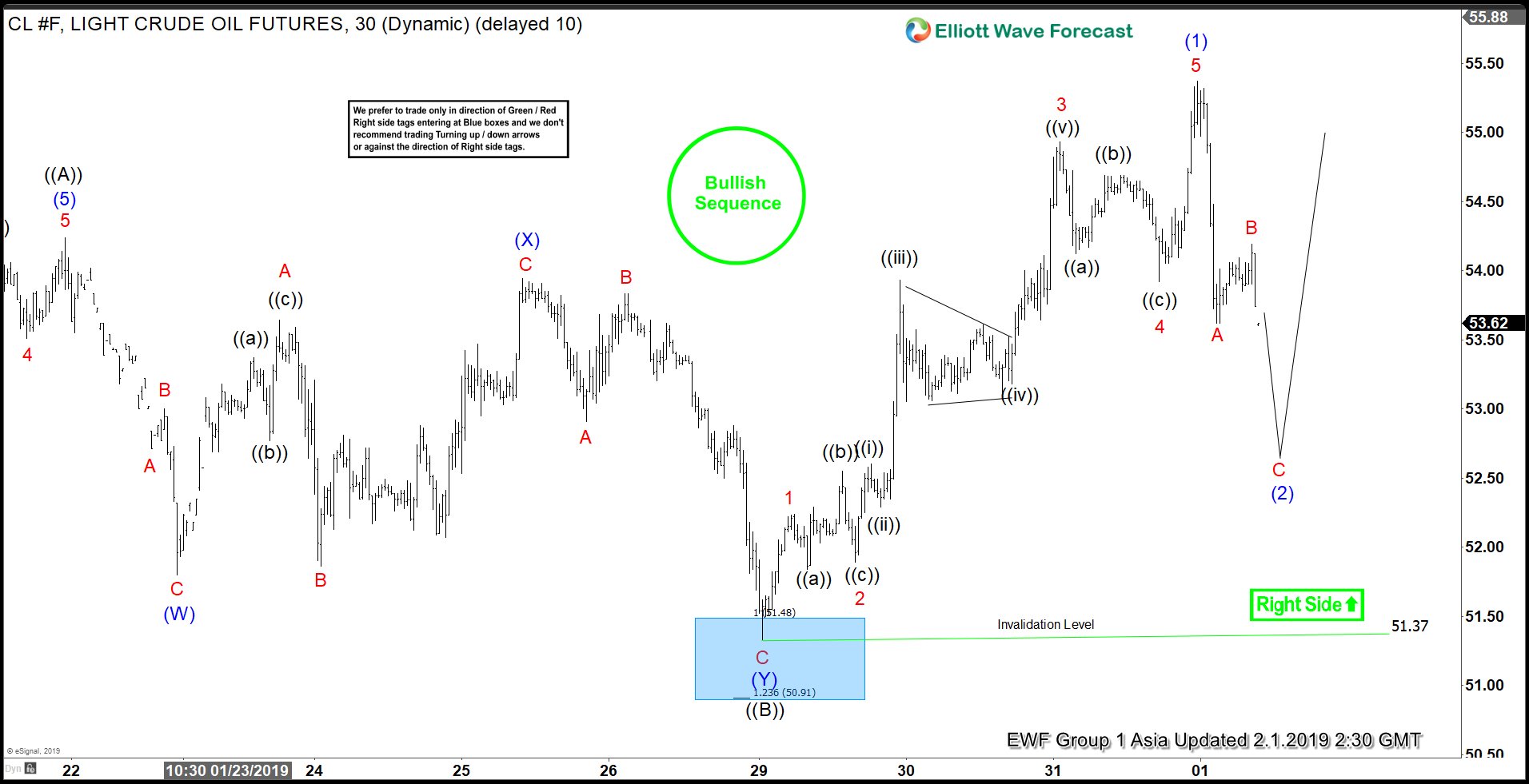

Elliott Wave Analysis: Wait for the Setup and Bet on Oil

Read MoreWelcome traders, today we will look at a couple of Oil futures (CL #F) charts. After reaching a short term top, patience leads us to a trading opportunity. See how profitable and efficient it can be to trade with basic Elliott Wave analysis and our defined blue box target areas. First of all, we start […]

-

Elliott Wave View: Gold Should Continue Higher

Read MoreThis article and video explains the short term Elliott Wave structure for Gold. The yellow metal is rallying in an impulse, and it should find support in any pullback in 3, 7, 11 swing for more upside.