Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

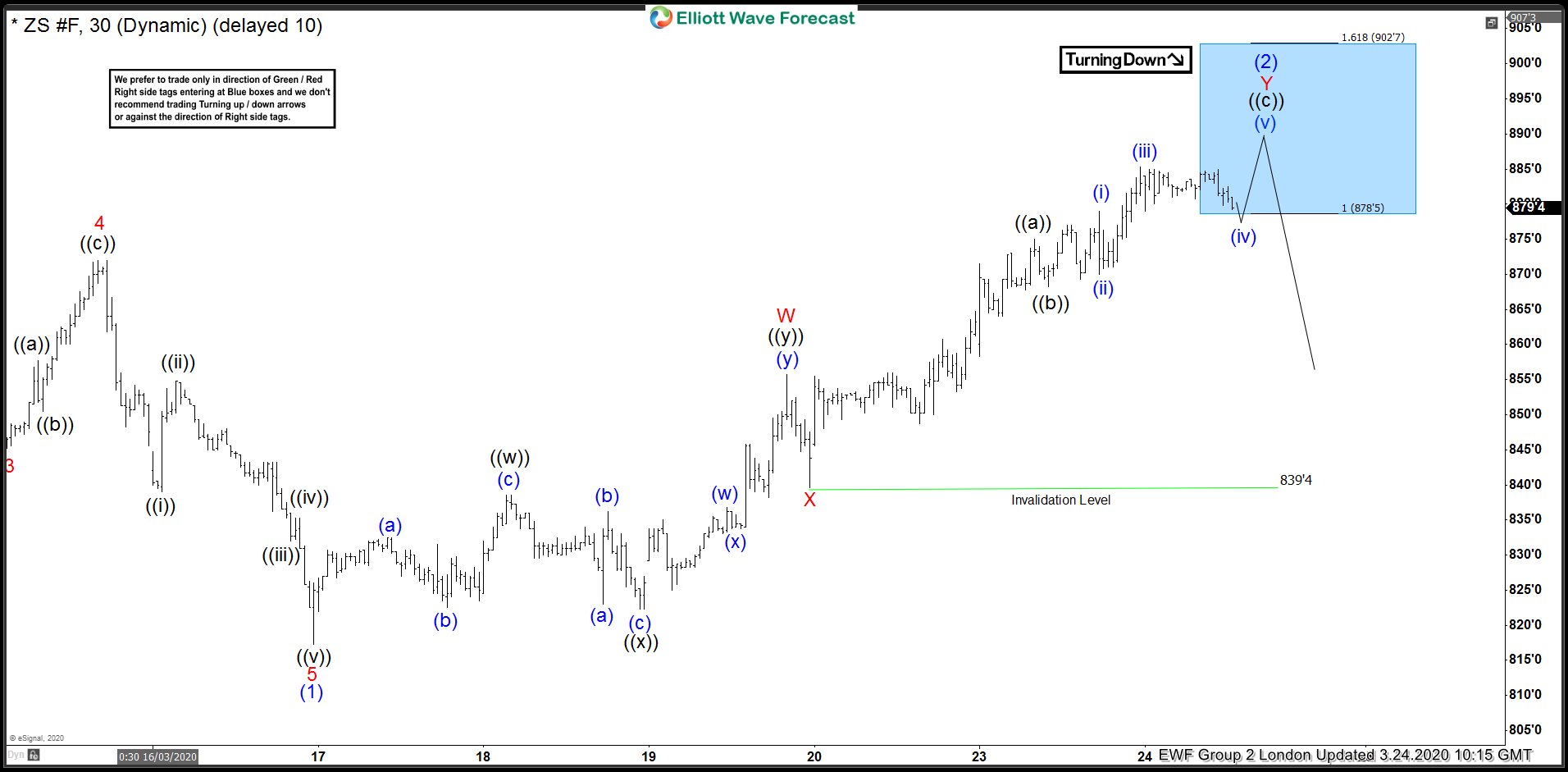

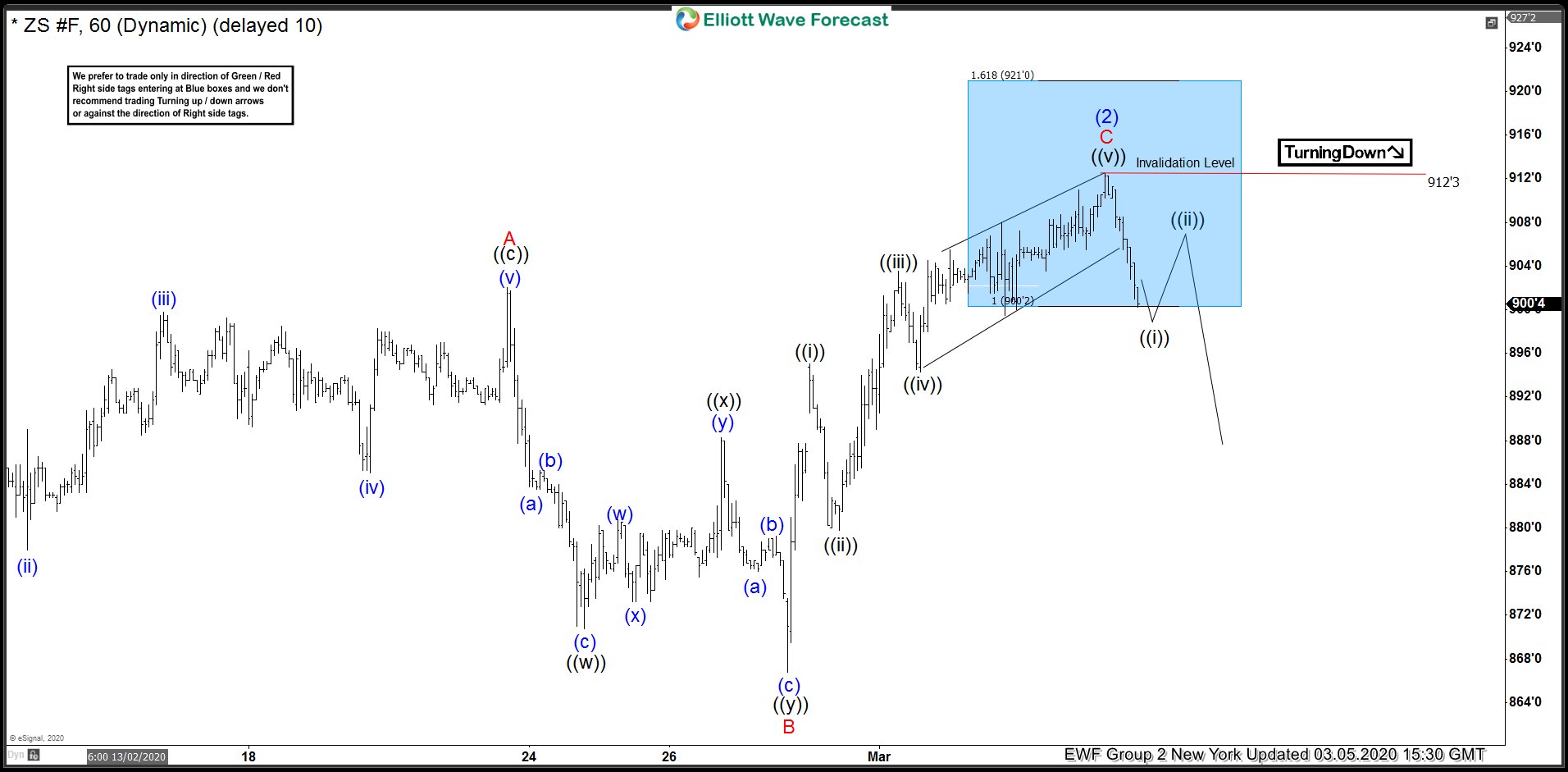

Soybean Elliott Wave View: Reacting Lower From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Soybean In which our members took advantage of the blue box areas.

-

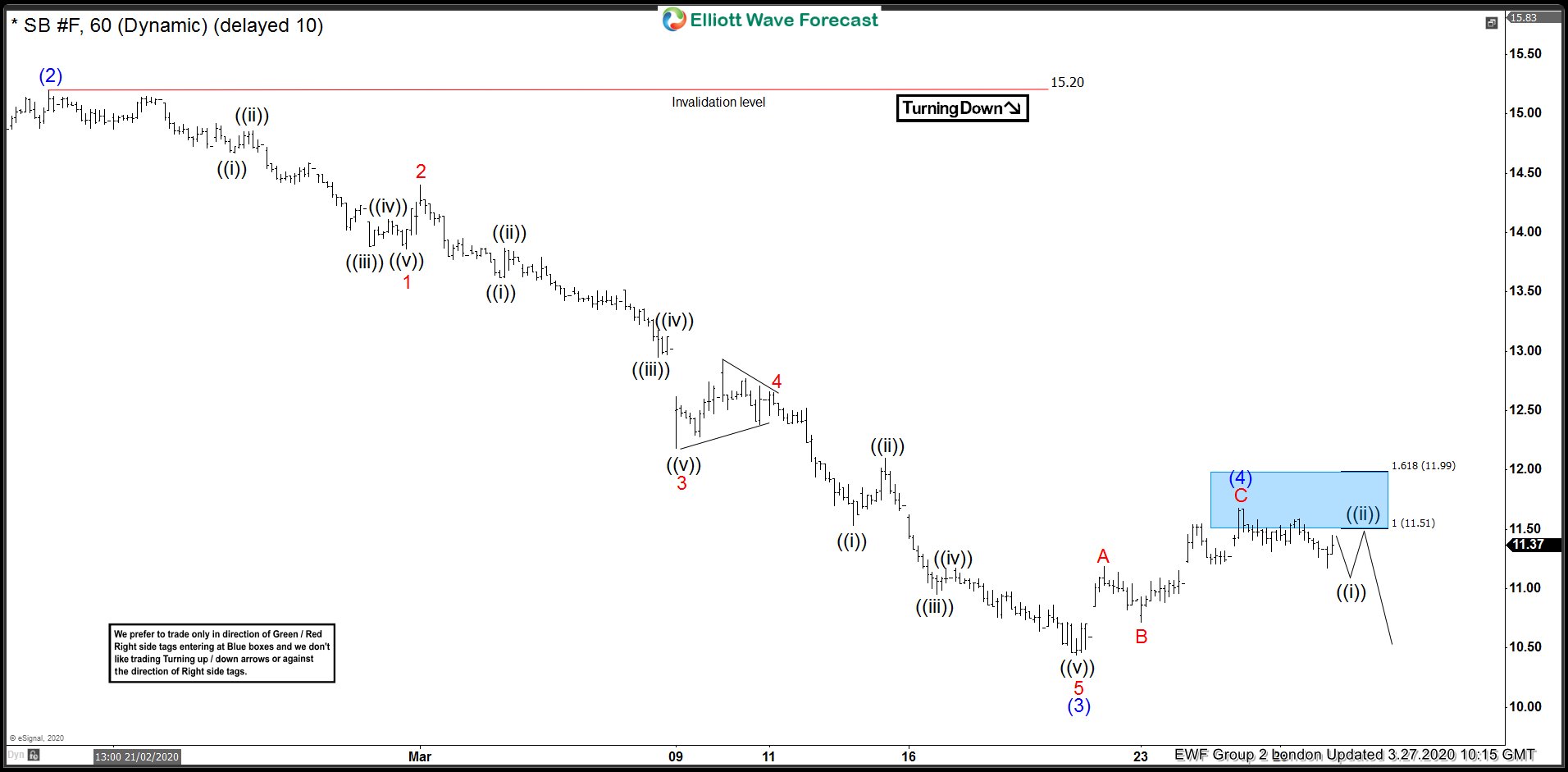

Sugar Elliott Wave View: Selling The Wave 4 Bounce

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of Sugar In which our members took advantage of the blue box areas.

-

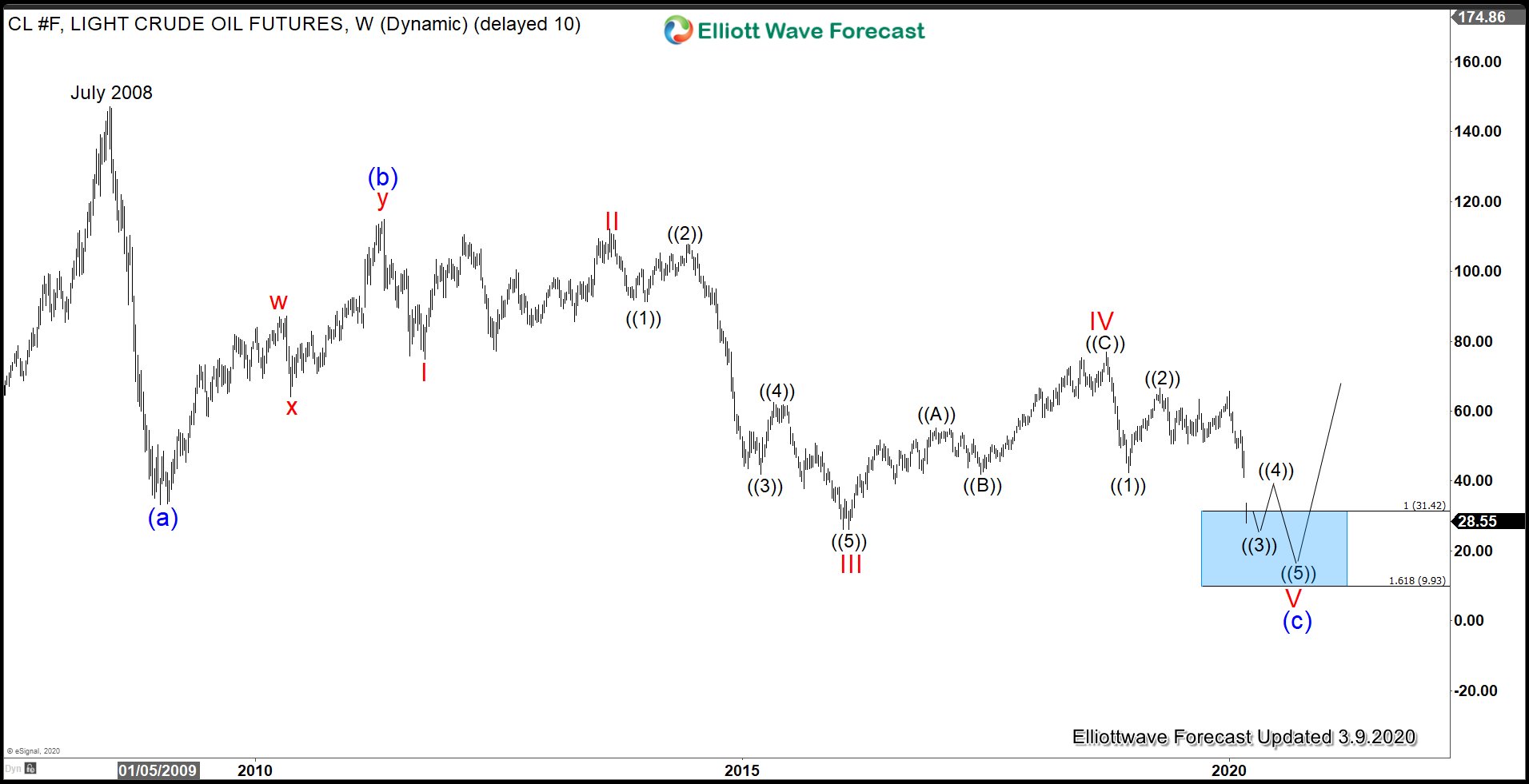

Elliott Wave View: Sweet Crude Oil (CL_F) in Ending Diagonal

Read MoreElliott Wave view in Sweet Crude Oil Futures (CL_F) suggests that the decline from April 23, 2019 high (66.6) is unfolding as a 5 waves impulse Elliott Wave structure. Down from April 23, 2019 high, wave (1) ended at 50.6 and wave (2) bounce ended at 65.65. Oil has resumed lower in wave (3) towards […]

-

ZS_F (Soybean Futures) Selling Rallies In The Blue Boxes

Read MoreZS_F (Soybean Futures) decline from 961’4 peak to 868’6 low was in 5 waves as 4 Hour chart below shows and thus, we expected bounces to fail below 961’4 peak for another round of selling in 5 waves. Soybean Futures bounced in 3 waves to 902’0 high and broke below the low at 868’6 suggesting […]

-

Oil Craters 30%, How Low Can It Go?

Read MoreOPEC’s failure to strike a deal to cut production output with Russia caused Saudi Arabia to slash oil’s prices in an all-out price war. US West Texas Intermediate Crude plunged more than 30% to $27.9 per barrel while Brent crude futures cratered 29% to $32 per barrel. On Saturday, Saudi Arabia announced a huge price […]

-

Sugar: Sellers Entered In The Blue Box As Anticipated

Read MoreWe always refer a lot to the blue boxes which are often shown on our charts and define them as High-Frequency areas which are based in a relationship of sequences, cycles and calculated using extensions. Traders are always looking for answers and news to decide what to do next, whether to buy or sell, whereas […]