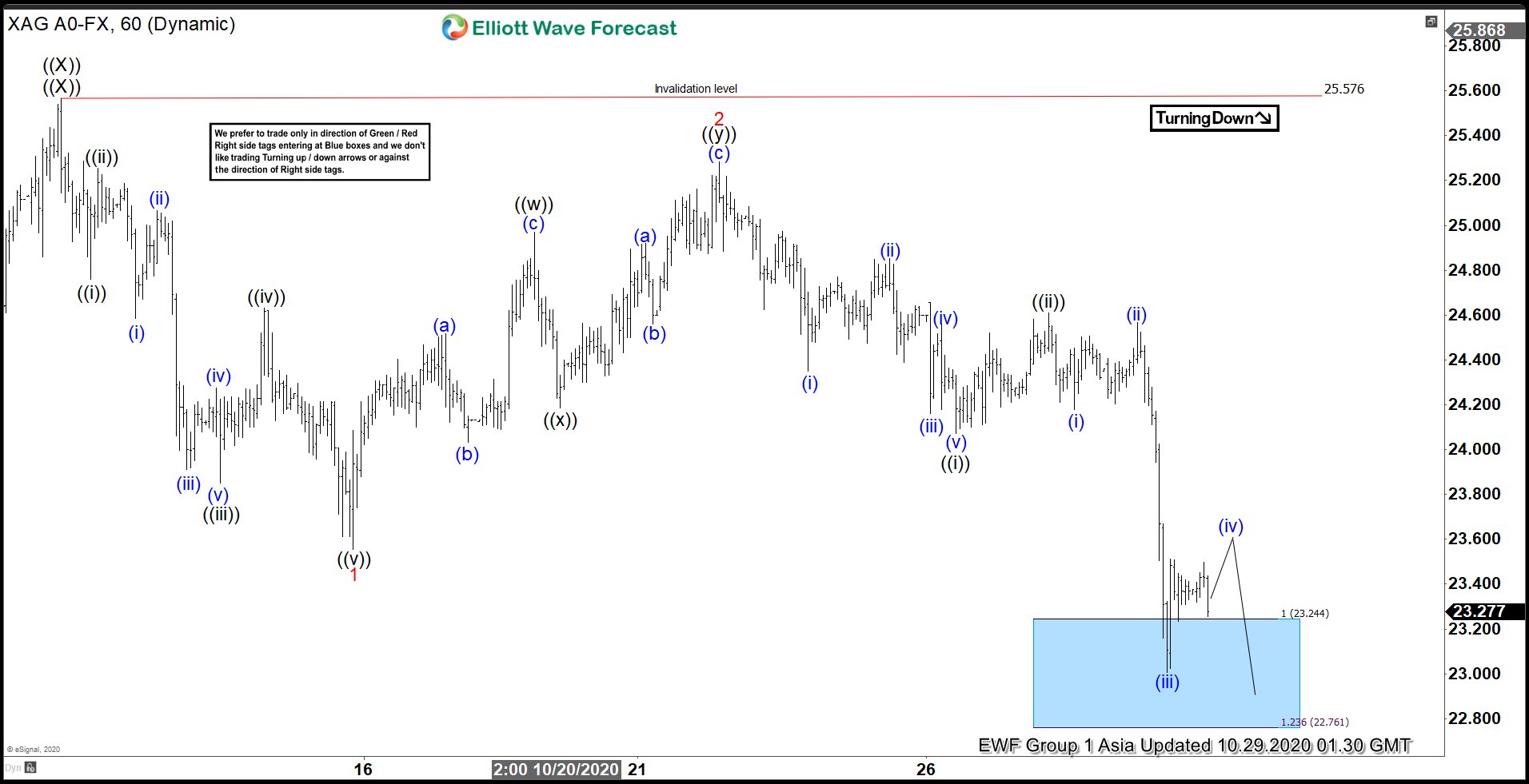

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Elliott Wave View: Silver (XAGUSD) Correction May Extend

Read MoreSilver (XAGUSD) is correcting cycle from March low in a triple three and can see further downside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Copper (HG) Correction in Progress

Read MoreCopper (HG) is correcting cycle from March 23 low before the metal resumes higher again. This article and video look at the Elliott wave path.

-

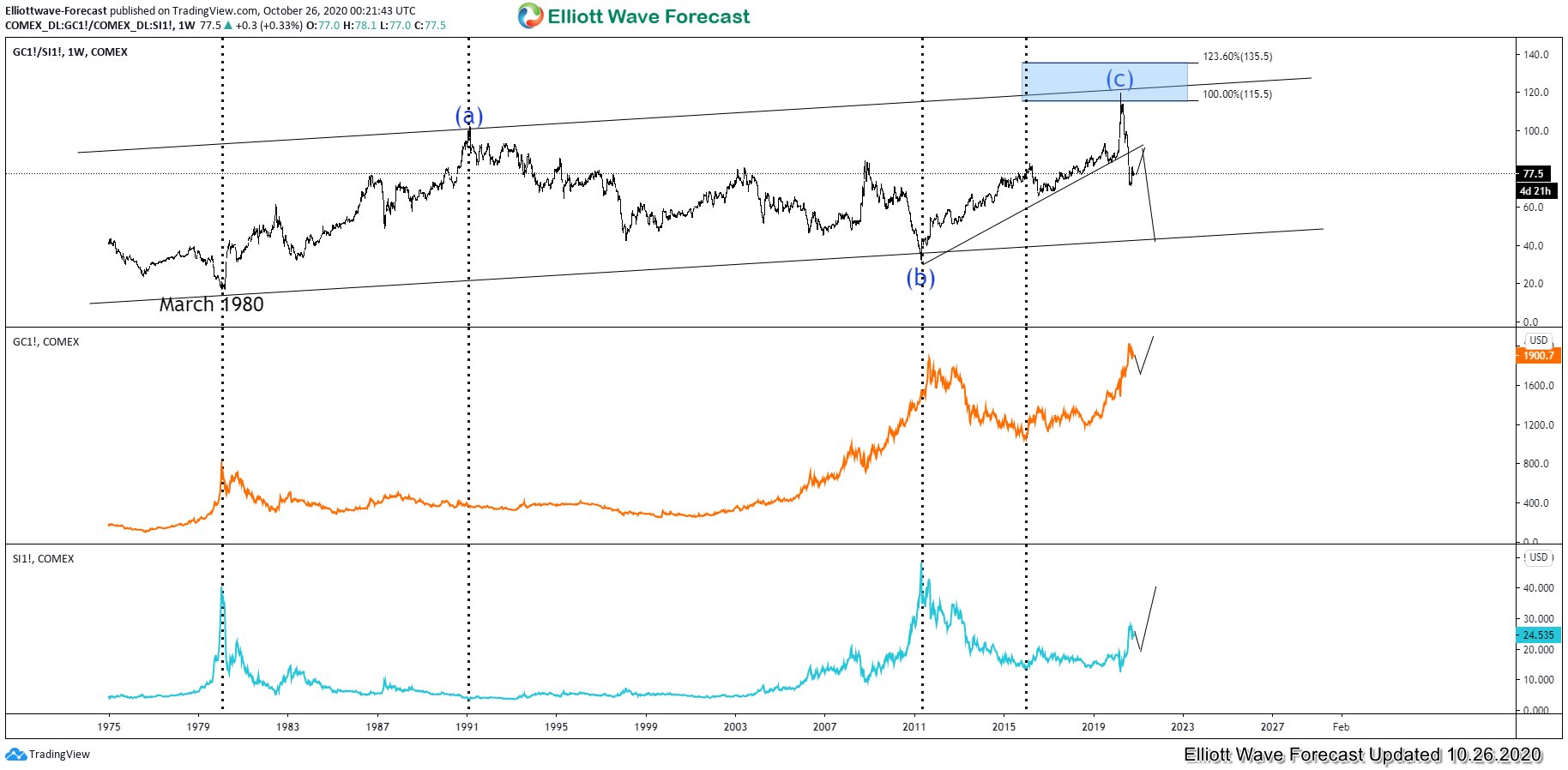

Gold-to-Silver Ratio Suggests Further Upside in Precious Metals

Read MoreGovernment and corporations around the world continue to accumulate unsustainable debt. Since it’s unthinkable for developed countries such as the United States to default on the obligation, the only way out of this situation is to continue to debase currencies. This environment is very supportive for Gold and Silver in coming years. Indeed, Gold has […]

-

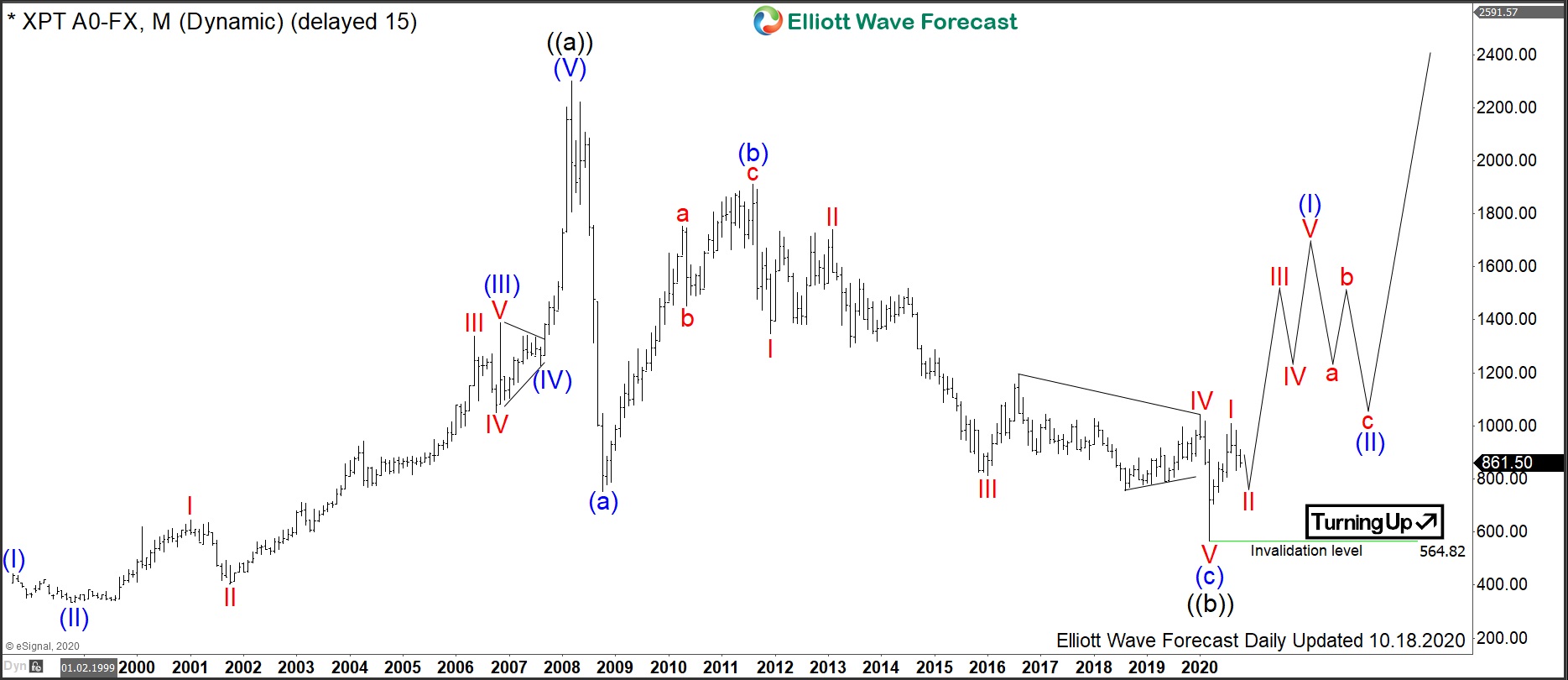

XPTUSD: Platinum Should Explode Targeting 2860

Read MorePlatinum is one of the major precious metal commodities, along with gold, silver and palladium. As one of the least reactive materials, it is a noble metal which is highly appreciated and used in jewelry. The main functionality, however, remains within the industrial applications such as vehicle emmisions control devices, chemical production and petrol refining, electrical […]

-

Elliott Wave View: Gold Correction Lower Taking Place

Read MoreGold has extended lower the correction from August this year’s peak. While below $1933.25 high expect a bounce to fail in 3,7,11 swings for more downside.

-

AUG (Gold/Silver Ratio) Showing A Five Waves From 03.18.2020

Read MoreGold to Silver Ratio ( AUG) is showing 5 waves decline from the 18 March 2020 peak. This article & Video explains the Elliott wave path.