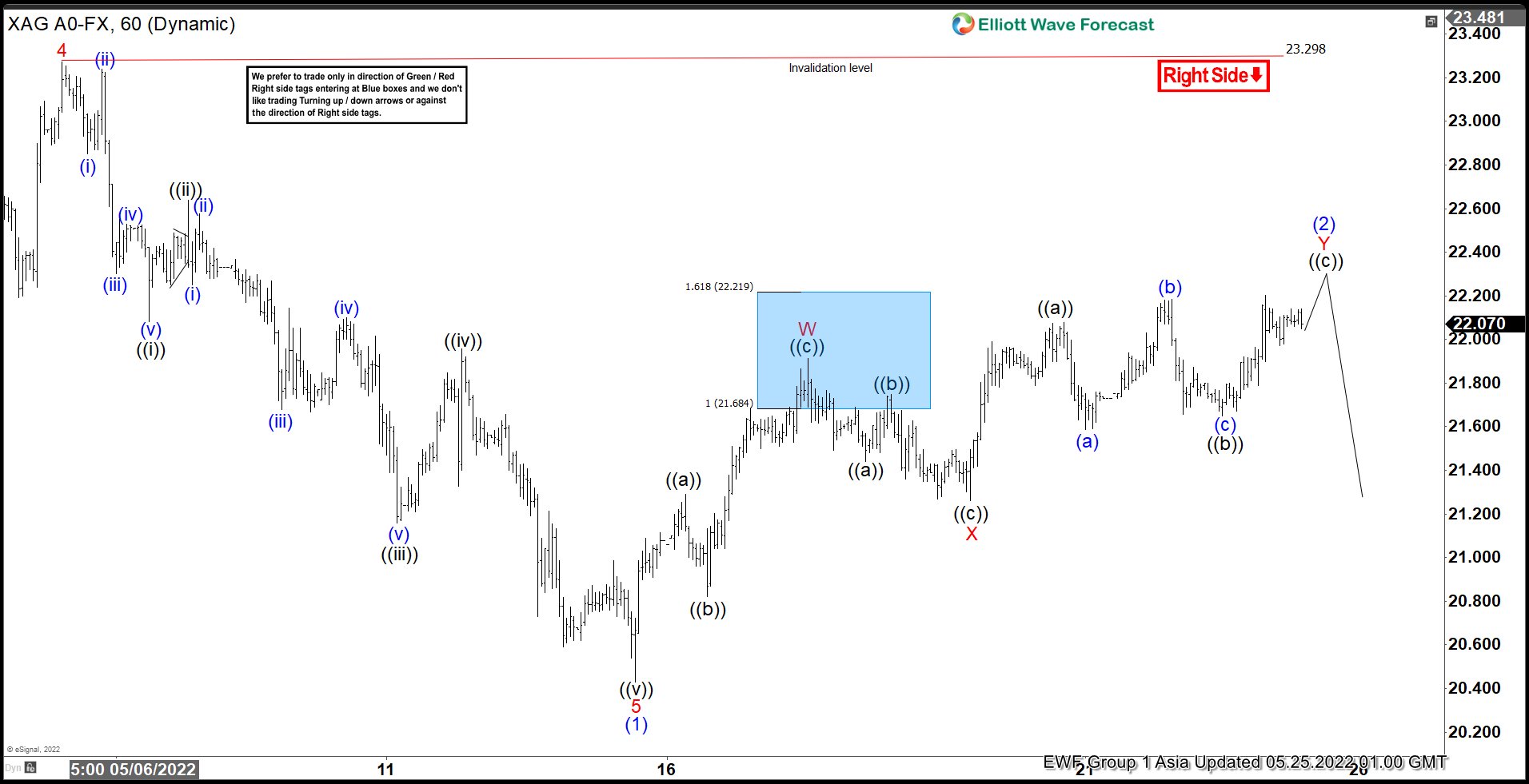

Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

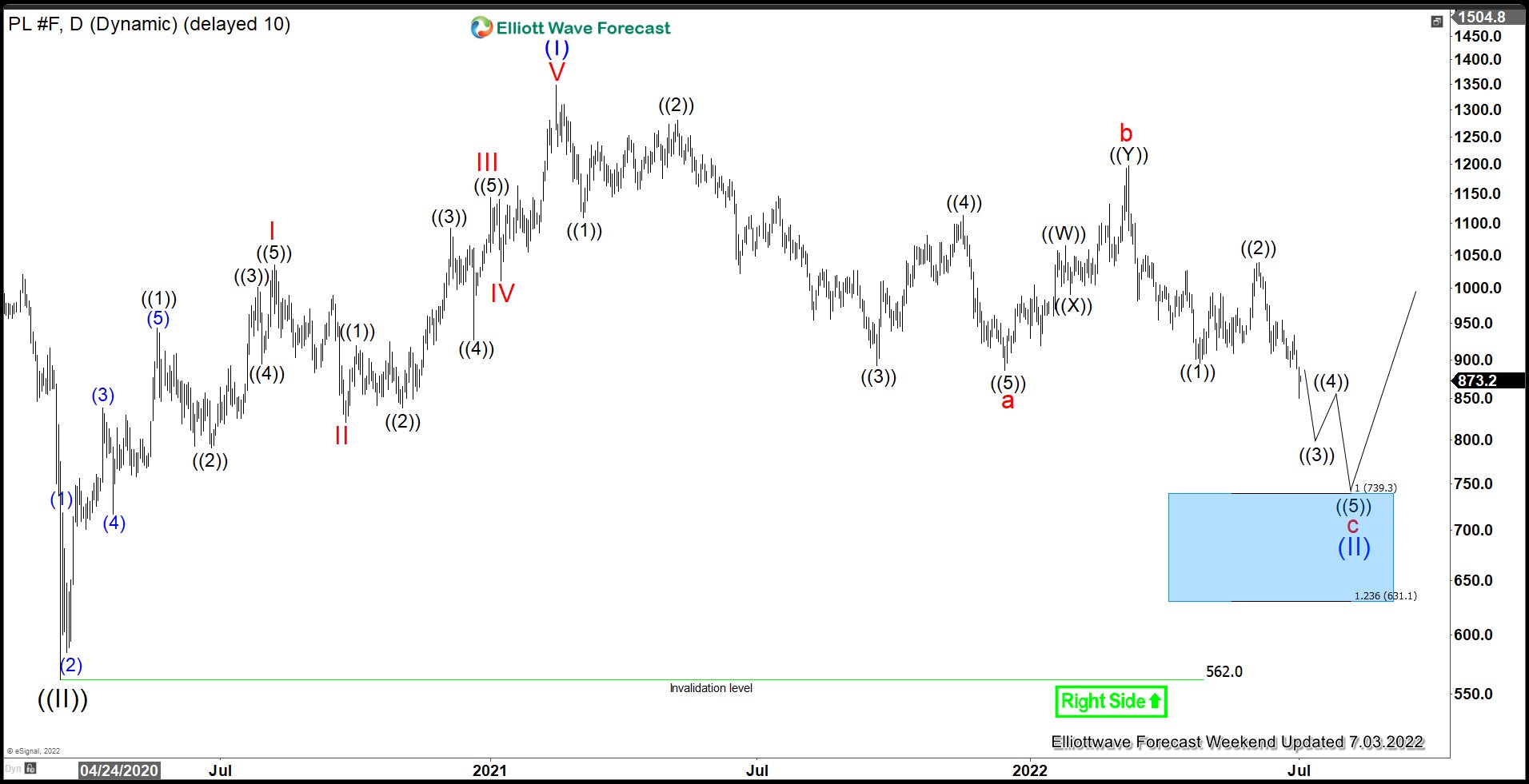

Platinum: Elliott Wave Support Area

Read MoreThe Fed’s aggressive rate hikes to fight inflation has caused deterioration in economic outlook. Atlanta Fed’s GDP gauge now sees the second quarter running at – 2.1%. With the first quarter’s decline of 1.6%, this makes it two quarters in a row with negative GDP. This fits with the technical definition of a recession. As […]

-

Elliott Wave View: Silver (XAGUSD) Has Resumed Lower

Read MoreSilver (XAGUSD) has resumed to the downside. This article and video look at the short term Elliott Wave path of the metal.

-

15 Best Commodity Stocks to Buy Now

Read MoreWhat are Commodity Stocks? Commodities are goods that are used every day such as food, energy, or metals. Commodities are raw materials used to create the products consumers buy, from food to furniture to gasoline or petrol. Commodities are Commodities have also evolved as an asset class. Today investors have the option of picking from […]

-

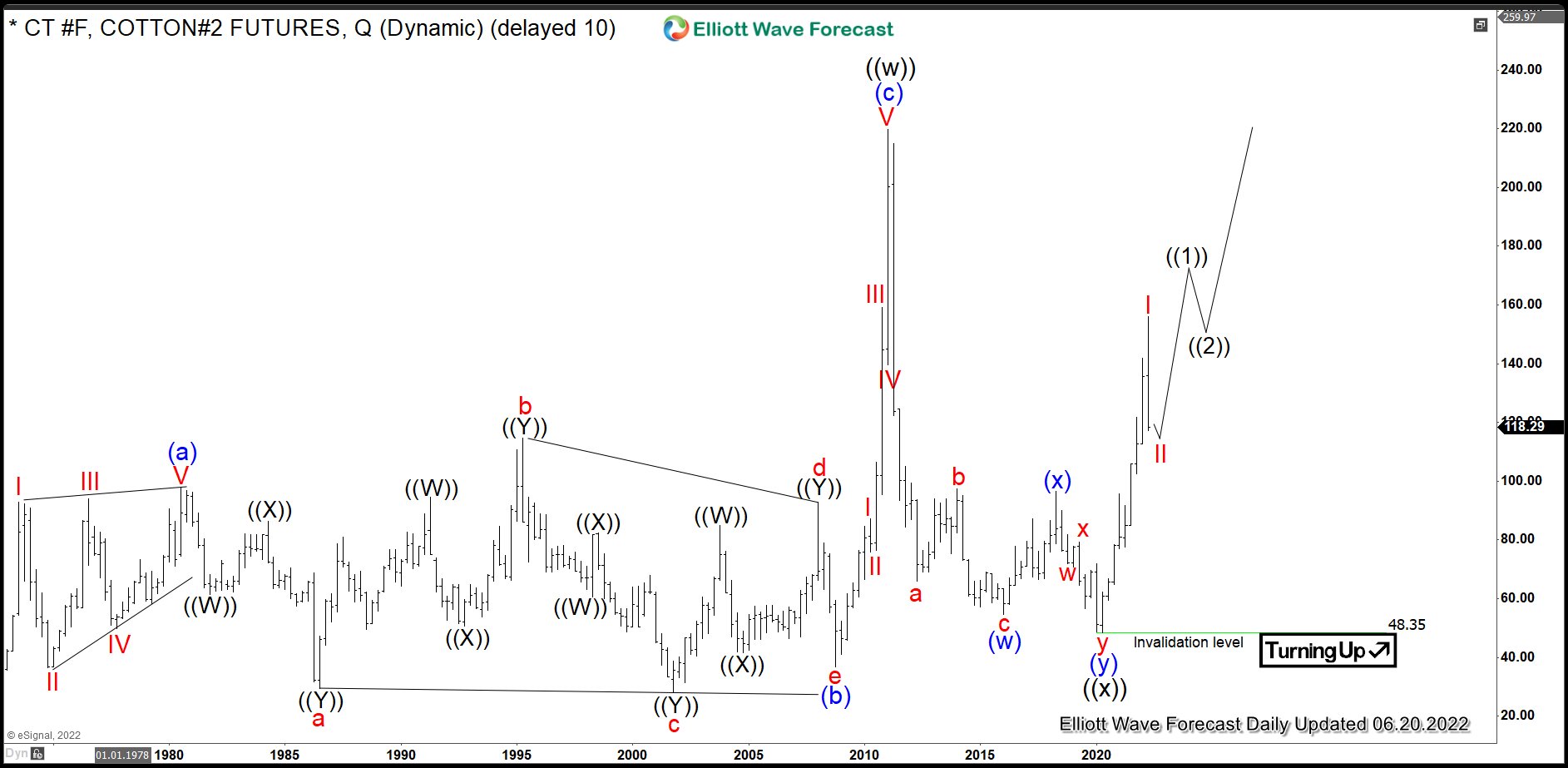

$CT #F: How to Buy Pullback in Big Rally of Cotton Prices?

Read MoreCotton is one of soft commodities, along with sugar, coffee, orange juice and cocoa. In early centuries, Alexander the Great has brought cotton from Pakistan to Europe. Much later and finally, it has obtained the dominance in textile manufacturing during the British industrial revolution in the 18th century. It was so critical that at times of Civil War […]

-

AUG (Gold/Silver Ratio): The Ratio Showing The Path Of Silver

Read MoreThe Gold to Silver Ratio (AUG) is always a good indicator of the path of commodities and the $USDX. The ratio found sellers on March.2020, and the peak agrees with the peak in the $USDX back in 03.2020. As we can see, the Ratio did a five waves decline, and now it is correcting in […]

-

Elliott Wave View: Rally in Silver May End Soon

Read MoreSilver is looking to do a 7 swing rally before the metal turns lower. This article and video look at the Elliott Wave path.