Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Gold (XAUUSD) in Correction Within Bullish Trend

Read MoreGold (XAUUSD) ended cycle from 6.29.2023 low as impulse. It is pulling back before the next leg higher. This article & video look at the Elliott Wave path.

-

List of Top Metal Commodities to Invest in Now

Read MoreMetal commodities are rare, naturally-occurring metallic elements in the Earth’s strata and have high economic value. Manufacturers use metal commodities for a variety of products like electronic parts, jewelry, and dental equipment. High-Value commodity metals include: Gold – It is the most essential metal in the precious metals trading industry. Amongst the precious metals, gold […]

-

Silver (XAGUSD) Rallies in Elliott Wave Diagonal

Read MoreSilver (XAGUSD) rallies as a 5 waves diagonal from 6.23.2023 low favoring more upside. This article and video look at the Elliott Wave path.

-

Platinum’s Correction in the Form of Expanded Flat

Read MorePlatinum (PL) is still correcting cycle from 9.1.2022 low and the correction is likely in the form of expanded flat. In this article, we will update the longer term Elliott Wave outlook for Platinum. We also present an alternate view if the pivot at September 2022 low (803) fails, which suggests a bigger correction against […]

-

ZO #F: Will Next Bullish Cycle in Oats Inflate the Breakfast?

Read MoreOats are one of the grain commodities, along with soft red wheat, hard red wheat, corn, soybeans and others. The oat (Avena sativa) is a species of cereal grain grown for its seed. While oats are suitable for human consumption as oatmeal and rolled oats, one of the most common uses is as livestock feed. Oats are a nutrient-rich food associated with lower blood cholesterol when consumed regularly. Since this cereal […]

-

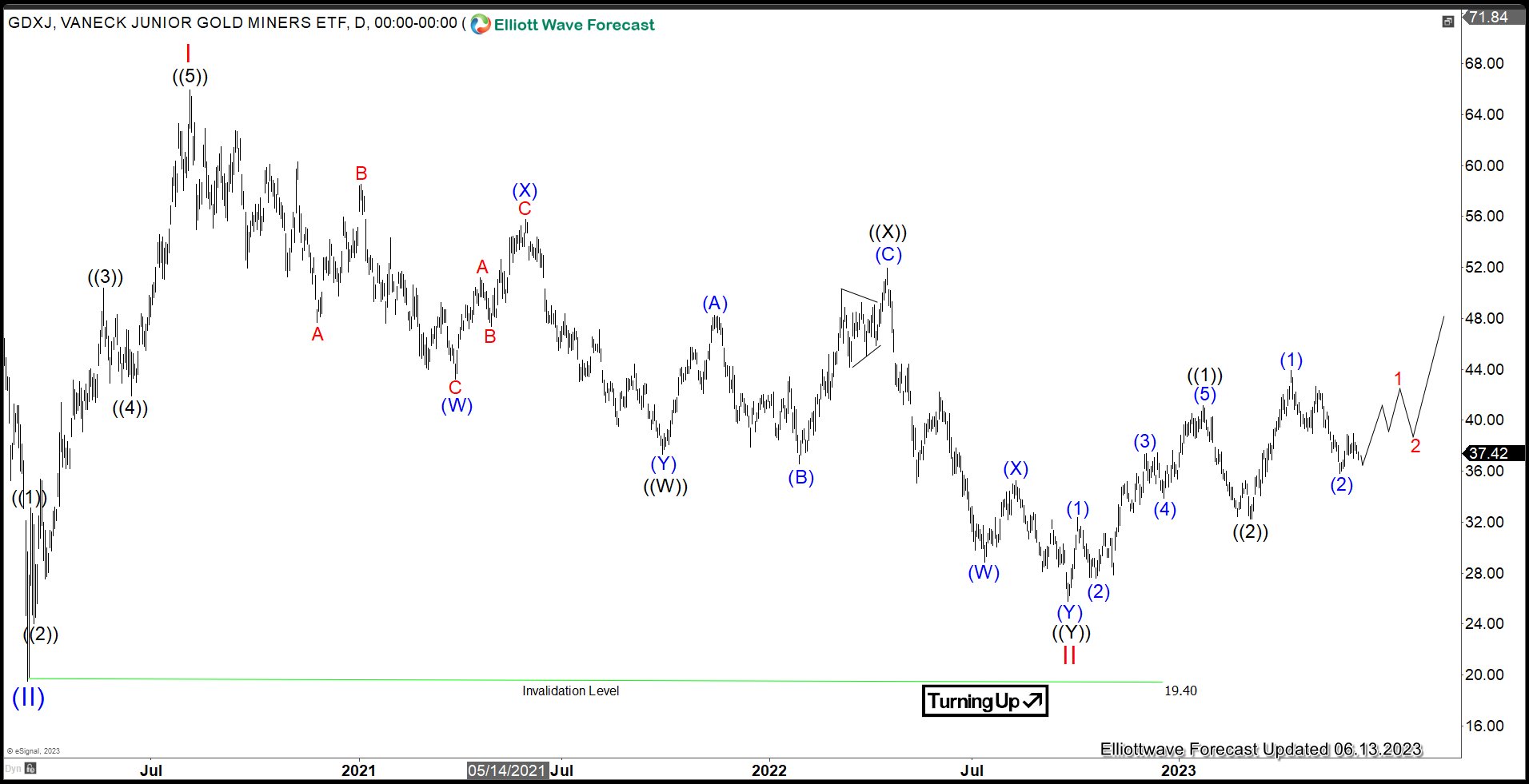

Gold Miners Junior (GDXJ) Preparing for the Next Move Higher

Read MoreGDXJ ETF, also known as the VanEck Vectors Junior Gold Miners ETF, is an exchange-traded fund that tracks the performance of small-cap companies involved in the gold mining industry. The ETF is designed to provide investors with exposure to junior gold mining companies. Typically these companies are smaller in size and are involved in the […]