Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

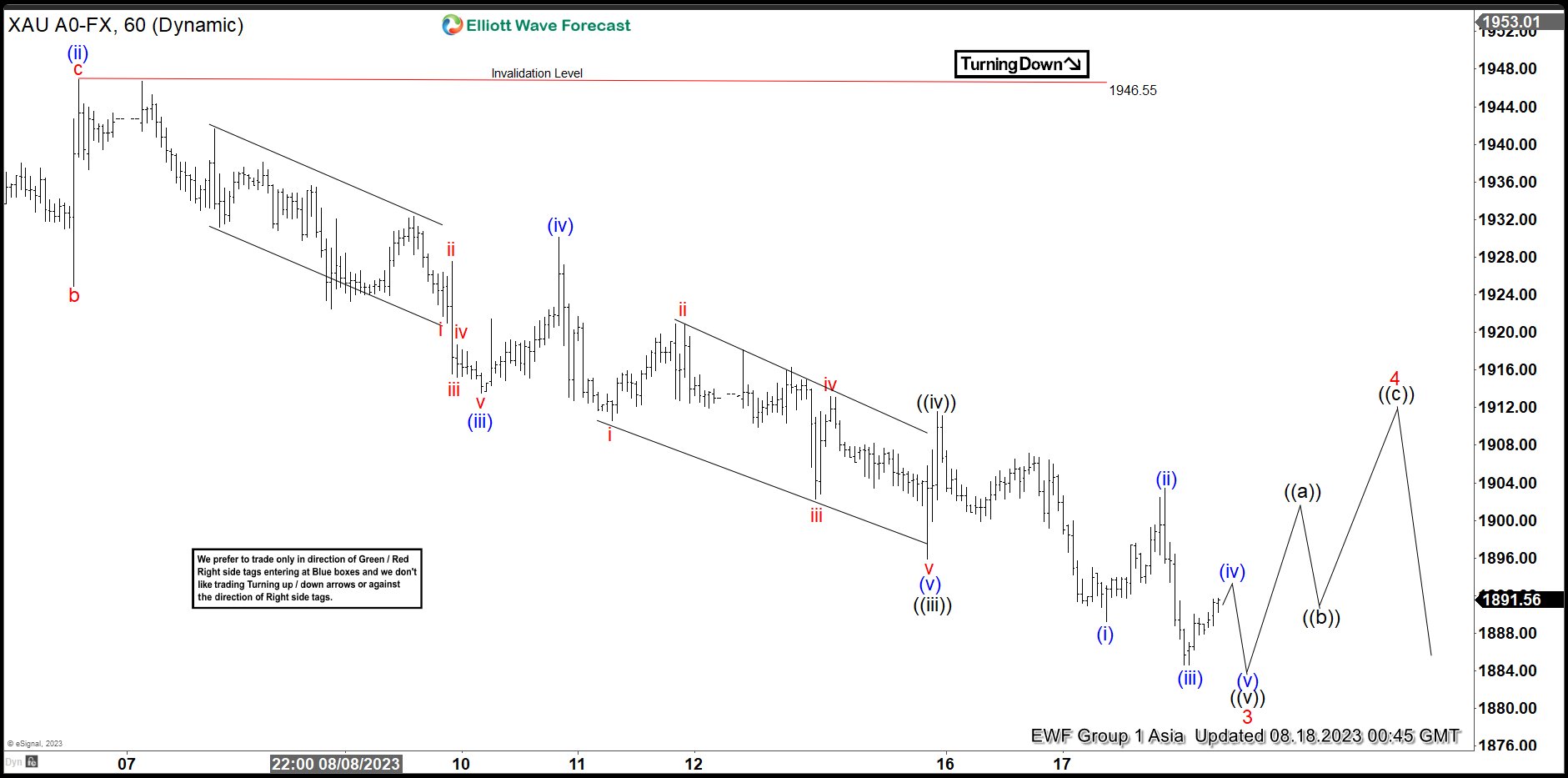

Gold (XAUUSD) Has Scope for Further Downside

Read MoreGold (XAUUSD) Correction from 5.4.2023 high remains in progress. This article and video look at the Elliott Wave path for the metal.

-

Silver (XAGUSD) Short Term Bearish Structure

Read MoreXAGUSD (Silver) cycle from 7.27.2023 high remains incomplete and can see further downside. This article and video look at the Elliott Wave path.

-

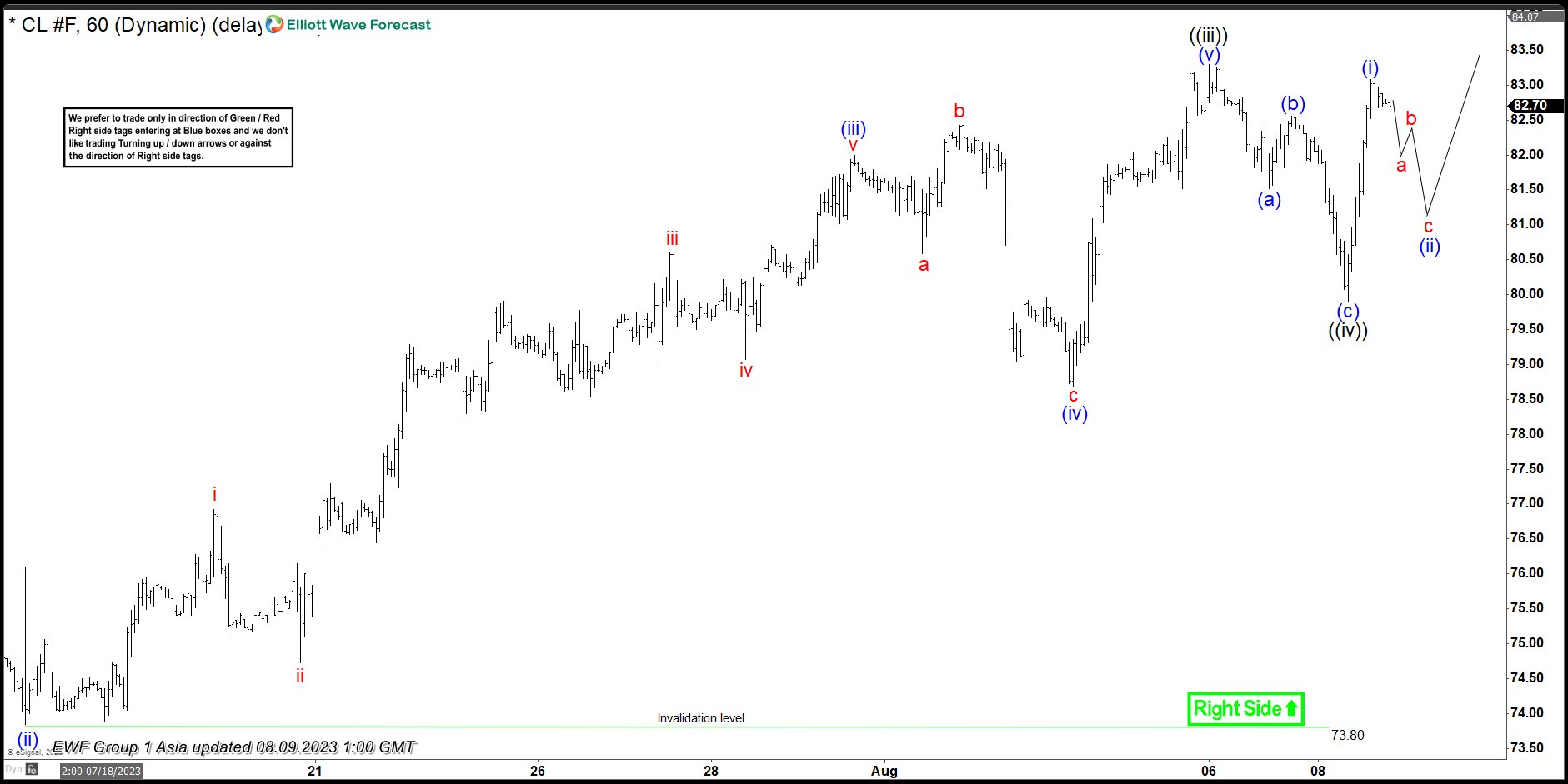

OIL ($CL_F) Impulse Sequence Supports More Upside

Read MoreOil (CL) cycle from 6/12/2023 low is unfolding in an impulse sequence supports more upside. This article and video look at the Elliott Wave path.

-

Lithium ETF (LIT) Needs One Leg Lower Before Continuing The Uptrend

Read MoreThe Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global […]

-

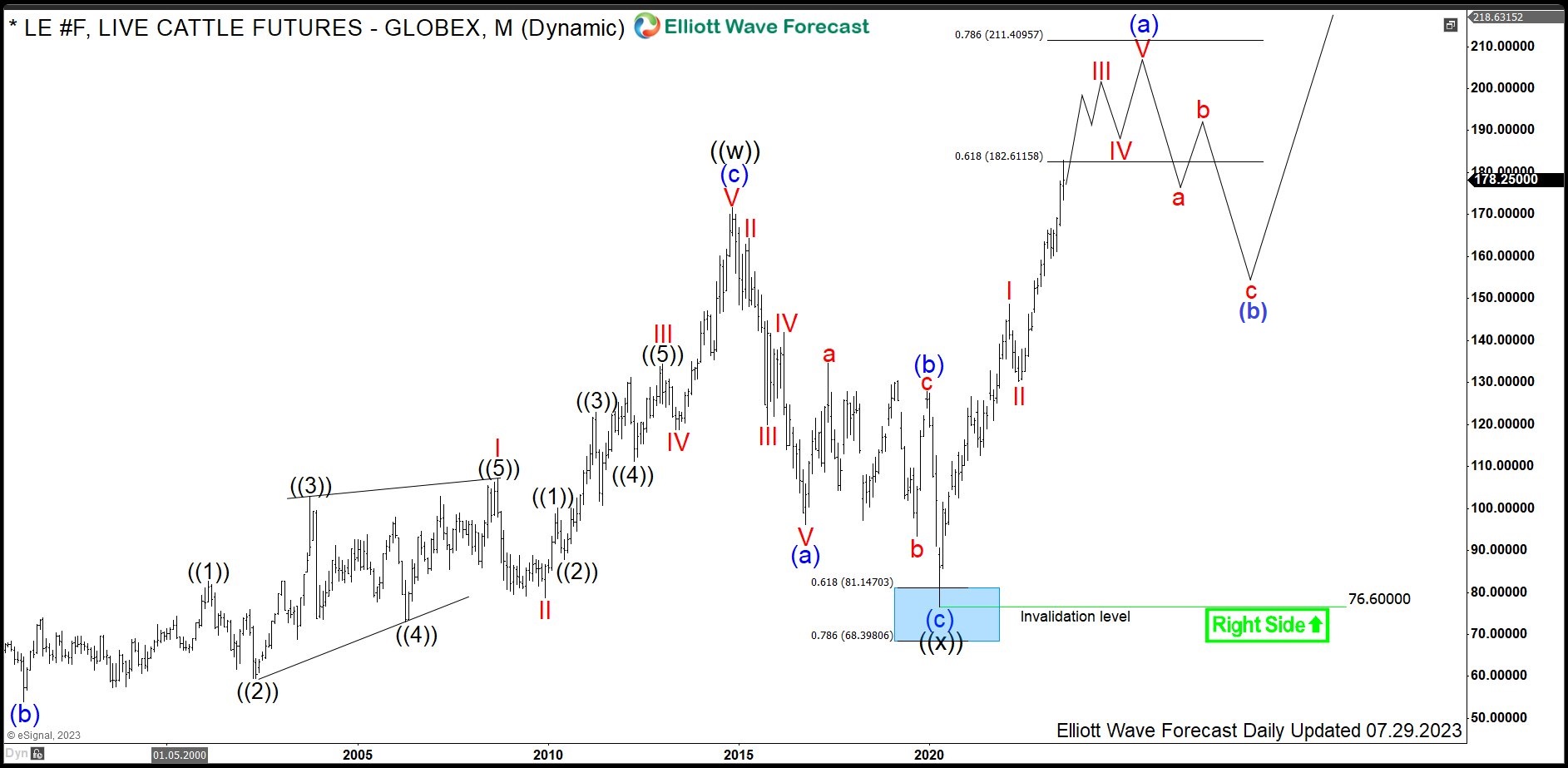

LE #F: Live Cattle Futures Trading within Monthly Bullish Sequence

Read MoreLive Cattle is a livestock commodity within the agriculture asset class, along with lean hogs, feeder cattle and porc cutouts. Once the feeder cattle have reached the target weigh of 1050-1500 pounds, they can be referred to as fed or live cattle. One can trade Live Cattle futures at Chicago Board of Trade in contracts […]

-

List of Top Energy Commodities in 2024

Read MoreEnergy has the biggest impact on our daily lives. Energy prices affect everything we consume, From the price of groceries, the clothes we wear, the electronic devices we use, to the gasoline we put in our cars, everything is affected by the energy prices. According to the US Energy Information Agency (EIA), annual worldwide energy […]