Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

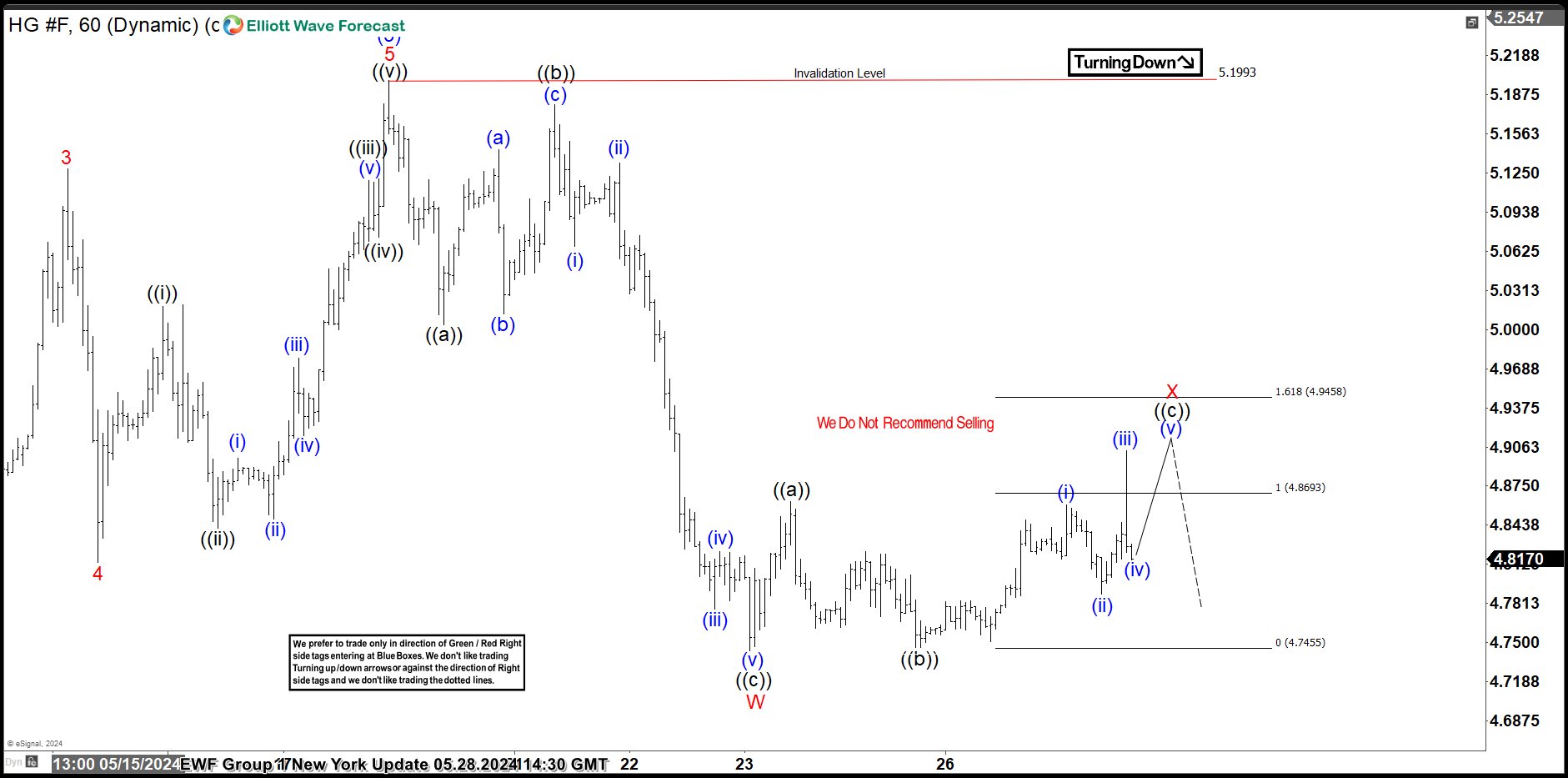

Copper Elliott Wave Analysis: shorter cycles expect further decline

Read MoreHello traders. Welcome to a new commodity blog post. In this one, we will look at the Copper Elliott wave analysis from our team of analysts. We will especially look at an Elliottwave path discussed in of one of our updates shared with members of ElliottWave-Forecast in May 2024. In conclusion, we will discuss how […]

-

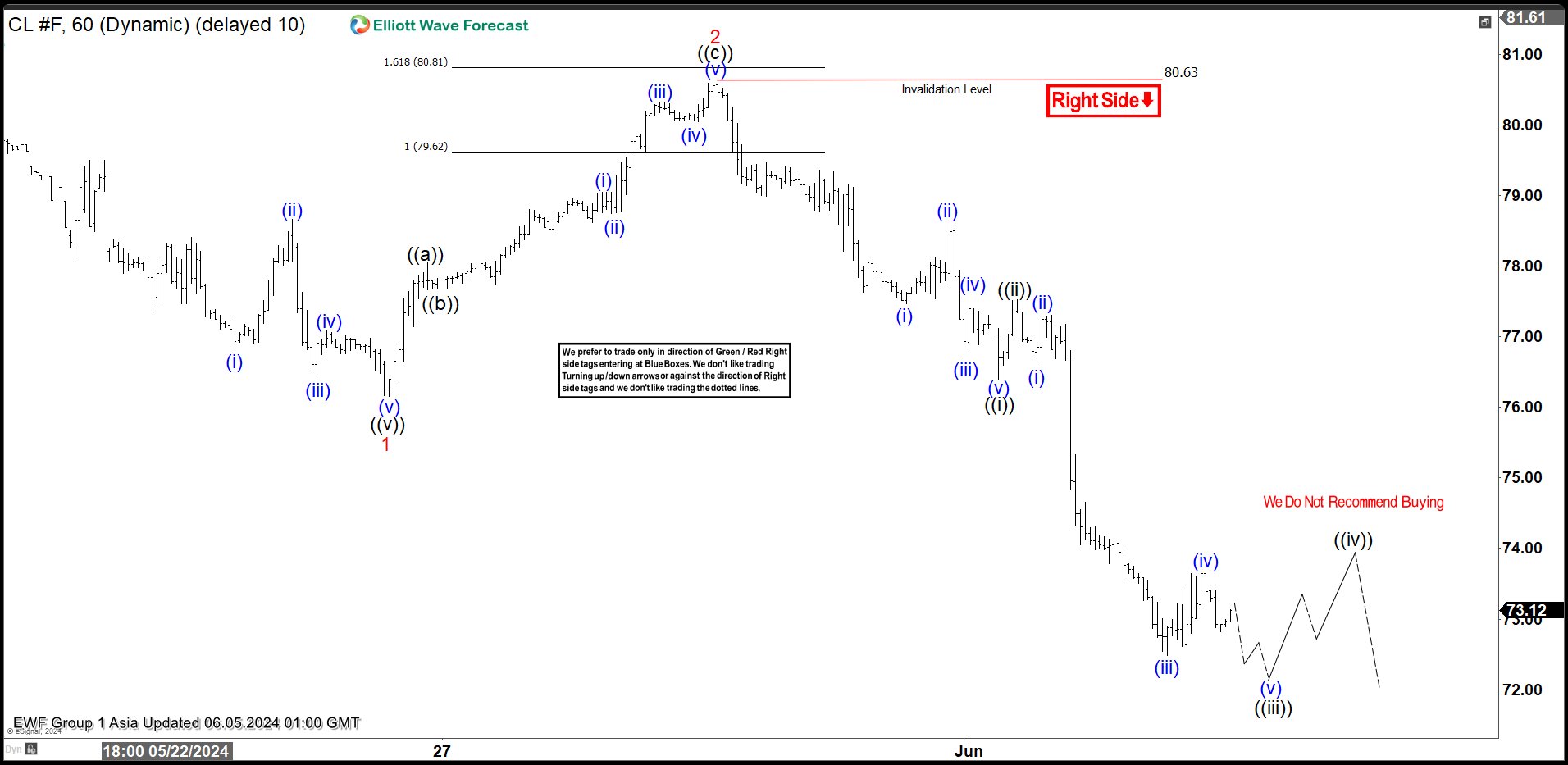

Short Term Elliott Wave Structure in Oil (CL_F) Favors Downside

Read MoreOil (CL_F) shows bearish sequence from 4.12.2024 high favoring more downside. This article and video look at the Elliott Wave path.

-

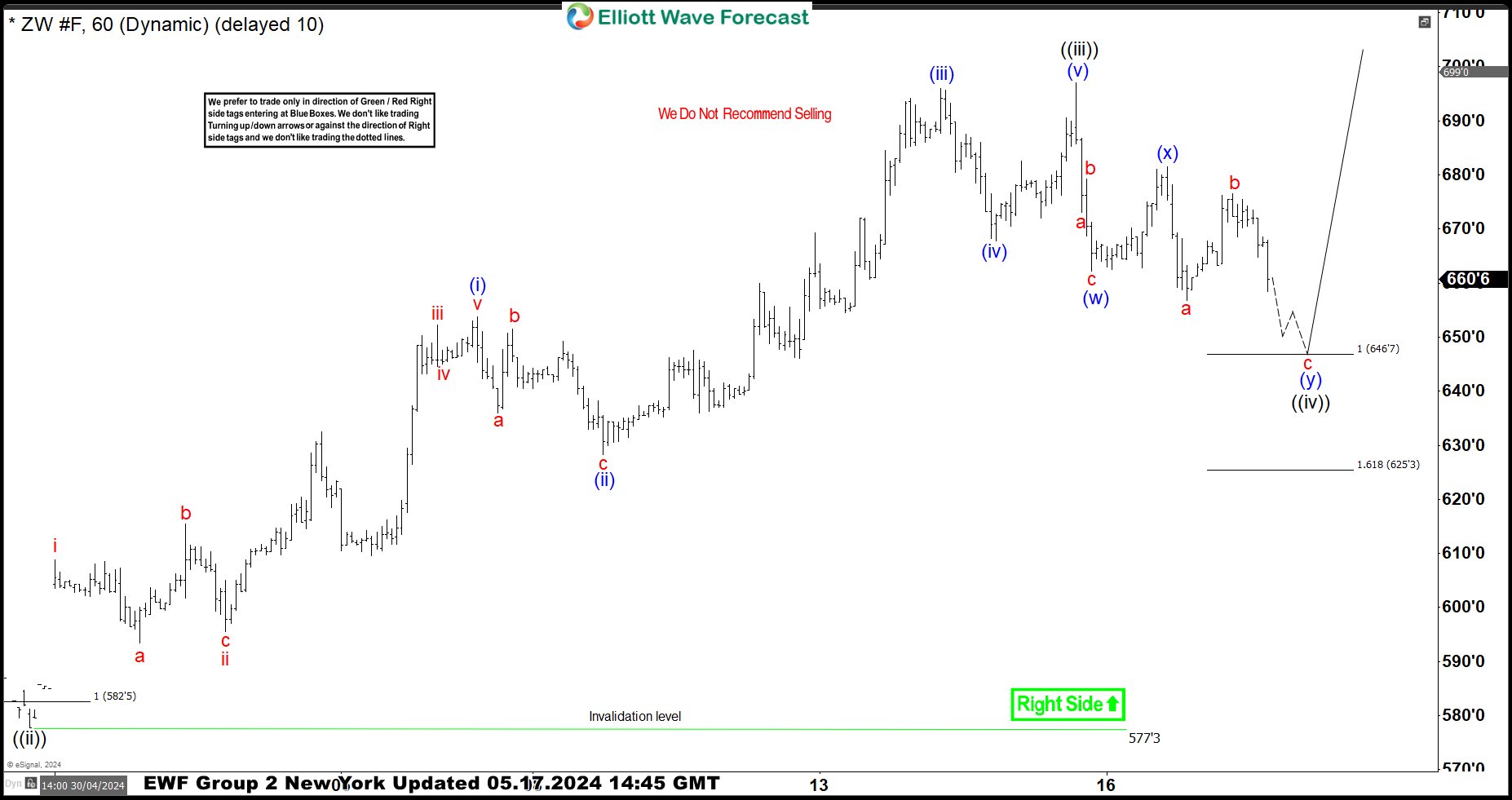

Wheat Elliott Wave Analysis shows Bullish Sequence

Read MoreHello traders. Let’s dive into the Wheat Elliott wave analysis, focusing on the bullish sequence that began in March 2024. We’ll revisit our traders’ last opportunity and explore the next one. Wheat (ZW_F) is one of the 78 instruments we analyze and share with members of www.elliottwave-forecast.com. This commodity belongs to group 2, alongside 25 […]

-

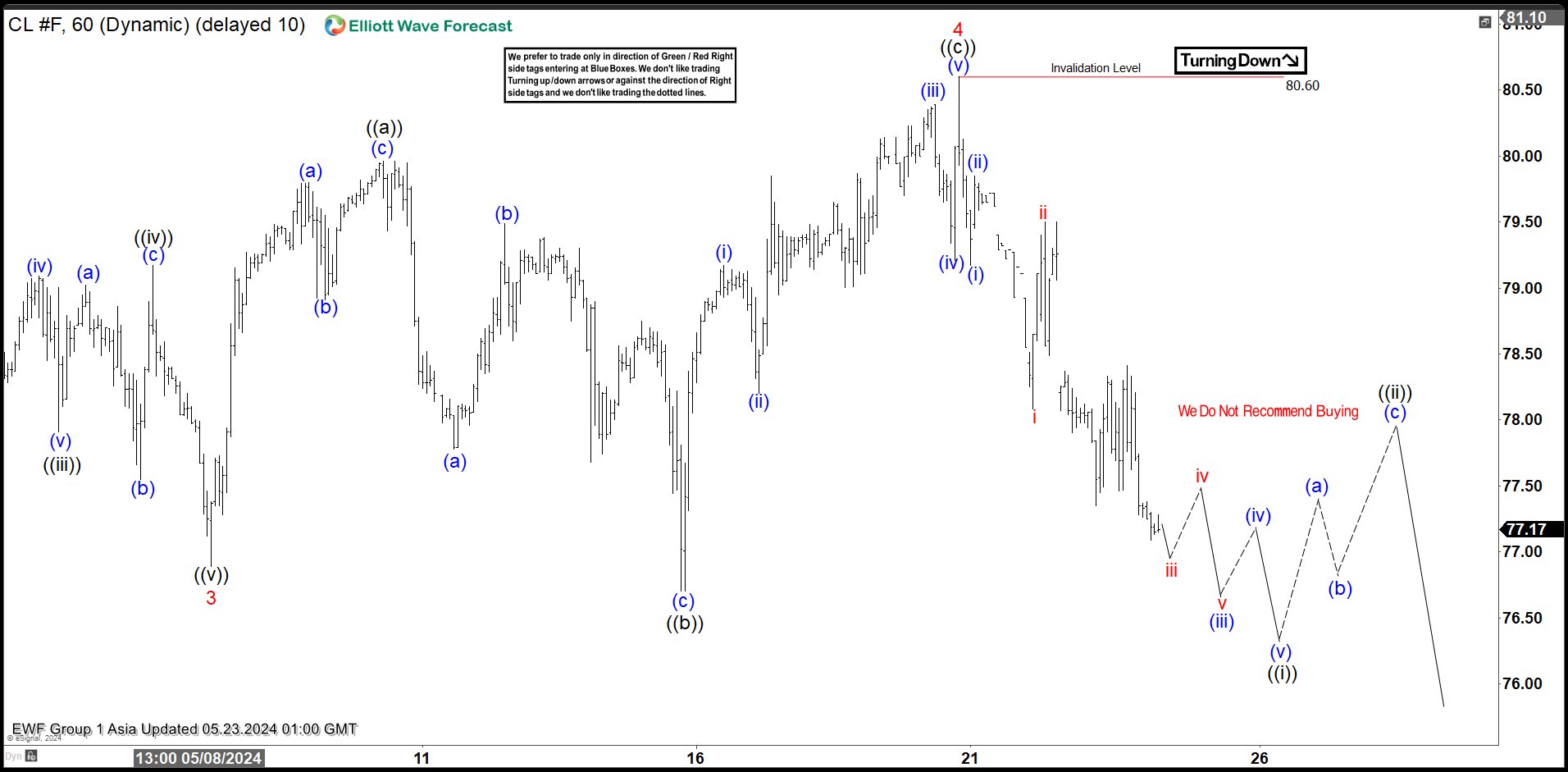

Elliott Wave Analysis on Oil (CL) Looks for Short Term Weakness

Read MoreOil (CL) shows an impulsive structure from 5.20.2024 high favoring more downside. This article and video look at the Elliott Wave path.

-

Gold to Silver Ratio Has Resumed Lower

Read MoreGold-to-Silver ratio had an overshoot to the upside during the Covid-19. It ended the all-time high on March 2020 at 126.4. The peak time is similar to the major low in World Indices. The ratio then quickly corrected lower in just 1 year to 62.51 and bottomed on February 2021. It has since traded in […]

-

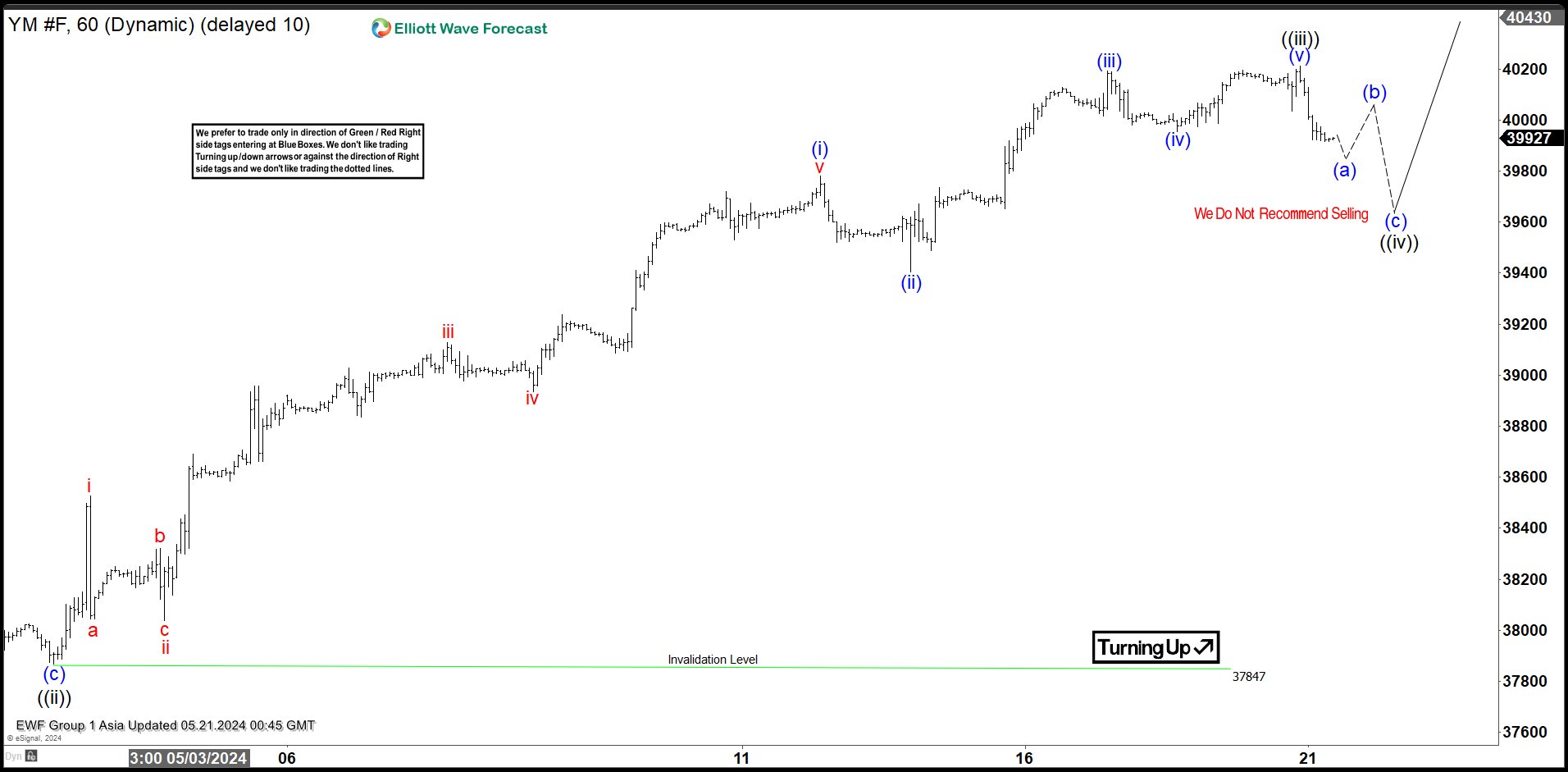

Elliott Wave Analysis Expects Dow Futures (YM) to Pullback in Wave 4

Read MoreDow Futures (YM) is pulling back in wave 4 before it resumes higher. This article and video look at the Elliott Wave path of the Index.