Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Gold-to-Silver Ratio (AUG) Can be in Triangle Consolidation

Read MoreGold-to-Silver Ratio (AUG) is a ratio of the underlying metals (i.e. Gold and Silver). The ratio is simply calculated by dividing Gold price and Silver price, thus the name Gold to Silver ratio. Since the 1970s, after the gold standard was abandoned, the long-run average gold-to-silver ratio is around 65:1. Over the past 50 years, […]

-

Elliott Wave View: Oil (CL) Short Term May See More Downside

Read MoreOil (CL) is Looking to resume lower in impulsive structure.. This article and video look at the short term Elliott Wave path of Oil

-

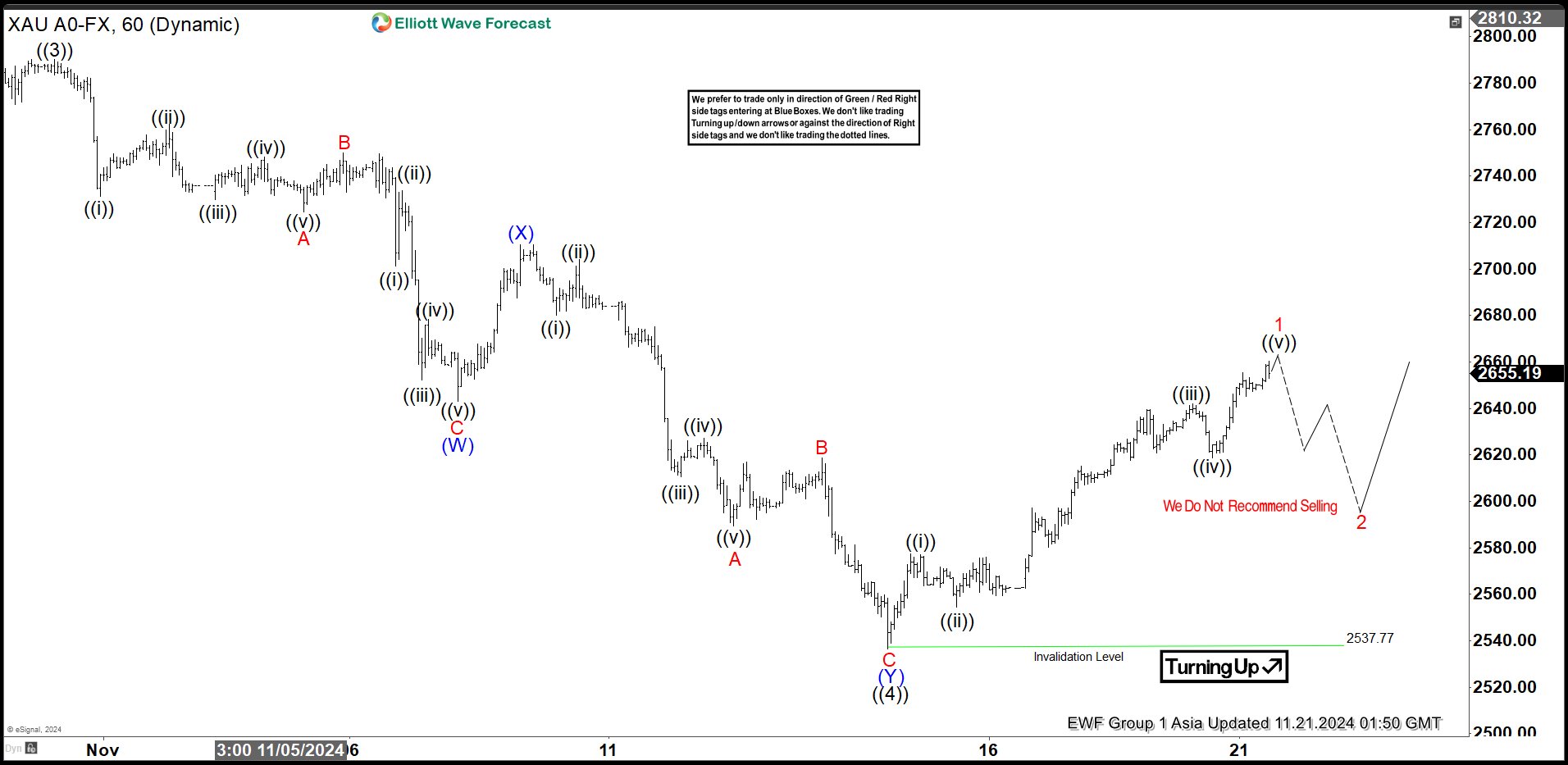

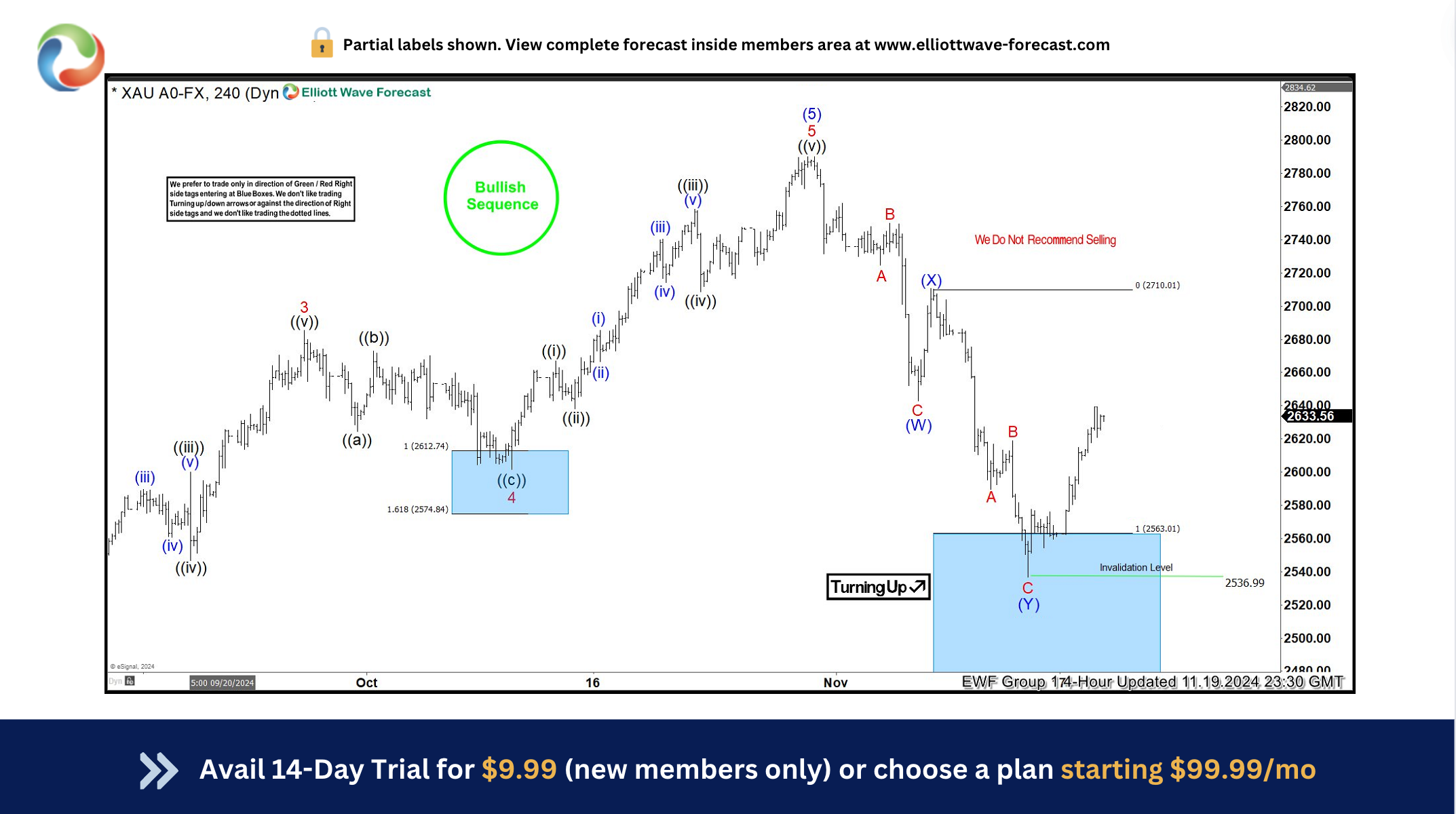

Elliott Wave View: Gold (XAUUSD) Starts Next Leg Higher

Read MoreGold (XAUUSD) Has Resumed Higher and Dips likely will find support. This article and video look at the Elliott Wave path of the metal.

-

Gold (XAUUSD) puts buyers in profit from the blue box

Read MoreHello traders. Welcome to new blog post where we discuss trade setups across the major asset classes. In this post, we will discuss a recent setup on Gold (XAUUSD) for educational purposes. Gold is in an all-time bullish sequence. The commodity continues to hit fresh record highs. It did that multiple times this year after […]

-

Short Term Elliott Wave in Silver (XAGUSD) Looking to Turn Higher

Read MoreSilver (XAGUSD) has reached the support zone and can turn higher. This article and video look at the Elliott Wave path of the metal.

-

OIL (CL_F) Selling the Rallies at the Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of OIL Futures CL_F published in members area of the website. As our members know the commodity has been showing incomplete sequences in the cycle from the 94.63 peak. Recently OIL has given us the recovery […]