Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

$CL_F (US Oil) 10.23.2013

Read MoreOil is nearing completion of a cycle from 104.37 peak which would complete 5th swing down from 112.25 peak. As Oil avoids aggressive weakness below 95.97, expect a pullback in wave B toward 100.00 – 101.00 area from where Oil should turn lower in 7th swing. Hourly cycles remain negative so we don’t like buying […]

-

$CL_F (10.14.2013)

Read MoreOil has turned lower after completing wave ( b ) @ 102.50. Expect a test of 99.60 – 100.37 to complete wave A after which Oil should correct the entire drop from 104.37 and trade lower again. We don’t like chasing weakness at current levels as cycle from 104.37 would be ending soon and we […]

-

$CL_F (US Oil) 10.11.2013

Read MoreOil has broken below 101.06 low suggesting rally to 103.59 was wave (( b )) and we should be completing 5th swing soon after which Oil should make a pull back in wave ( b ) and trade lower 1 more time to complete 7 swings down from 104.37 peak. Hourly cycles are negative so […]

-

$XAG/USD (Silver) 10.8.2013

Read MoreMetal has broken higher from wave (( b )) triangle and while above 21.59, expect another push higher toward 22.74 – 23.01 area to complete a cycle from 20.59 low after which metal should pull back at least in 3 waves. Hourly cycles are negative but we don’t like selling the metal unless of course […]

-

$CL_F (US Oil) 10.3.2013

Read MoreExpect marginal new highs to 105.00 to complete wave A as a FLAT. This should result in a wave B pull back and further strength toward 106.67 – 107.99 to complete wave ( B ). Hourly cycles are negative but we don’t recommend selling in wave B as more upside would be expected after that. […]

-

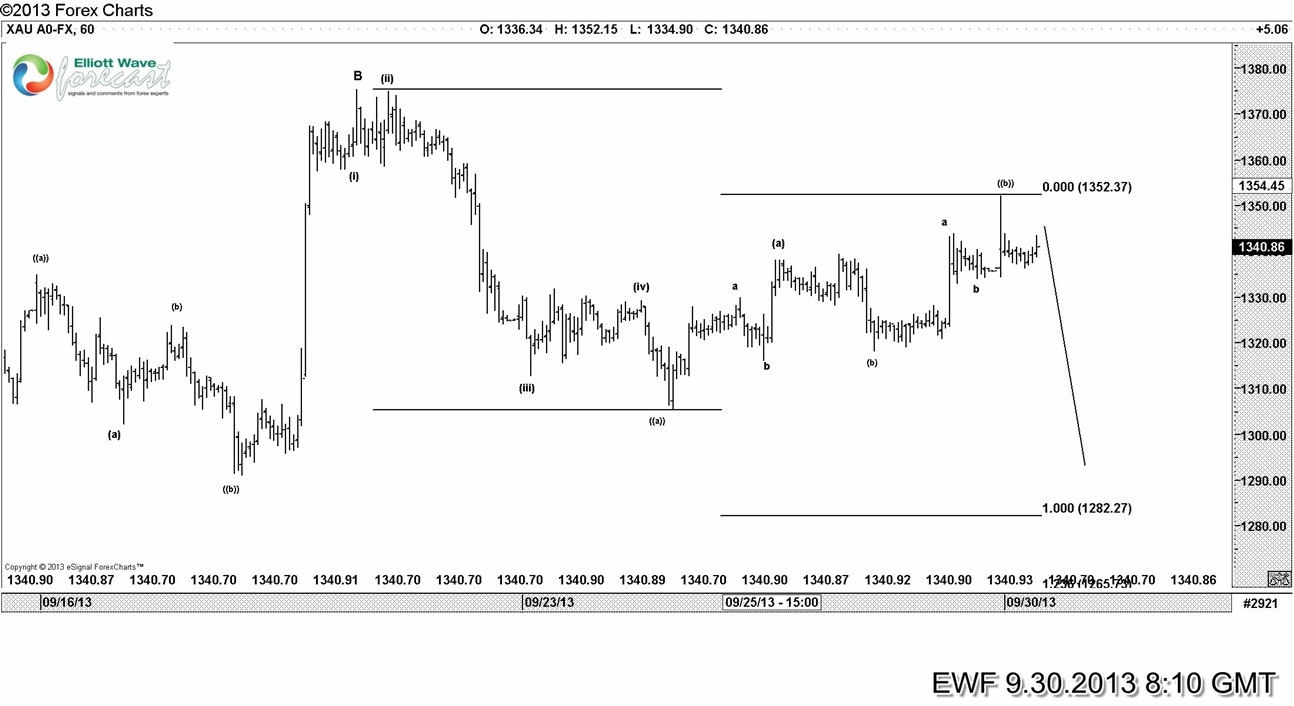

$Gold breaks lower

Read MoreGold faces a perfect rejection at 1351 (equal legs) as forecased in this 1 hour Elliott wave analysis presented to members on September 28 2013. Let’s take a look at some charts 9.28.2013 9.30.2013 10.1.2013 If you would like to receive frequent , timely updates, stay on top of changes in […]