Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

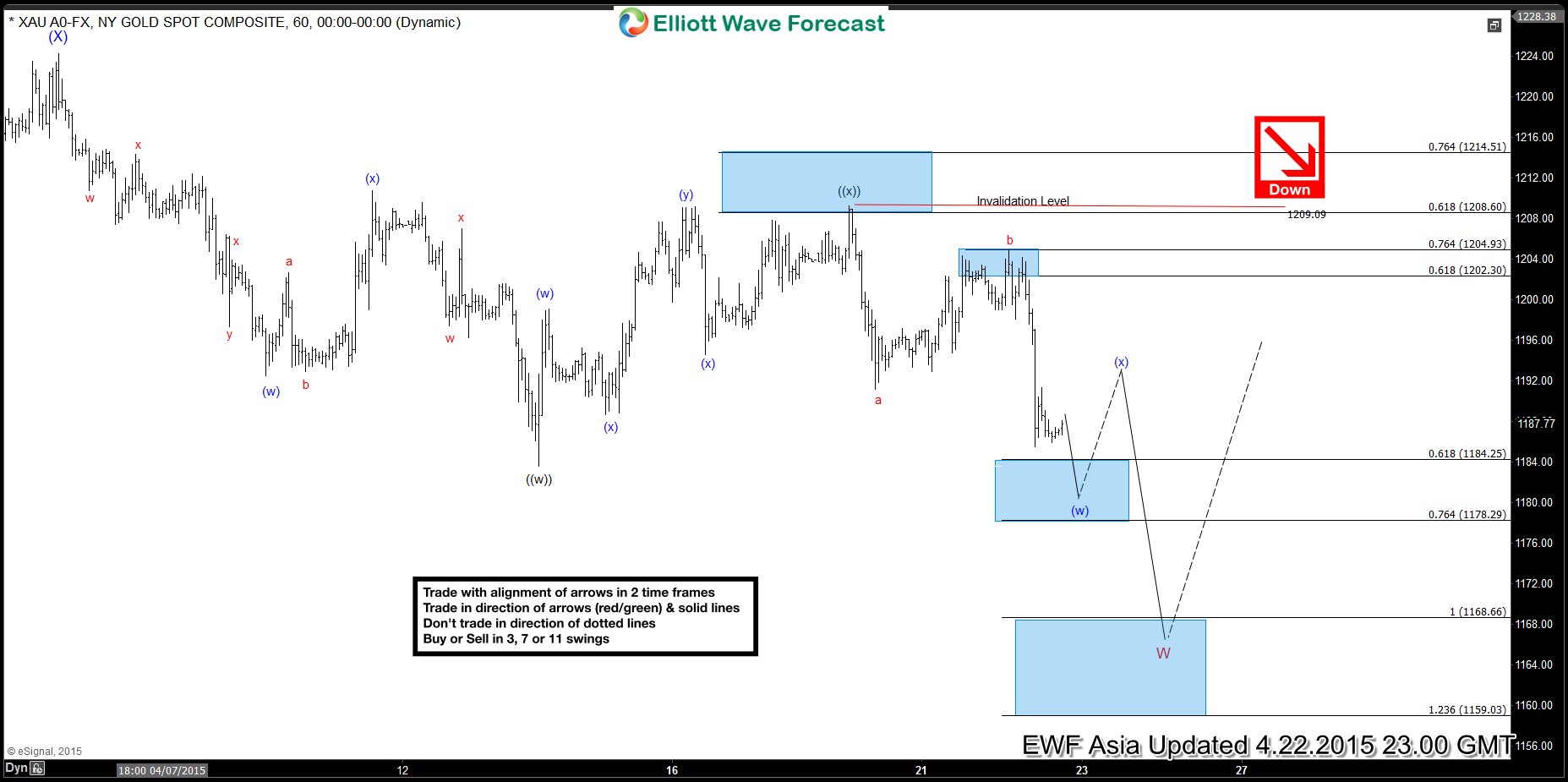

XAU (Gold) Short-term Elliott Wave Analysis 4.22.2015

Read MoreGold is proposed to be doing a ((w))-((x))-((y)) Elliott wave structure 1224 (4/6) high. Wave ((w)) ended at 1183.60, wave ((x)) completed at 1209.09 and wave ((y)) lower is proposed to be in progress. We need to see a break below 1183.60 (4/14) low to add more conviction to this view as that would make it […]

-

Crude Oil – CL – 240m Technicals and Trade Plan

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily from 12:30 PM EST (5:30 PM BST), join Dan there for more insight into these proven methods of trading. EURJPY – […]

-

$HG_F (Copper) Short-term Elliott Wave Analysis 2.4.2015

Read MoreMetal made a marginal new low below 2.423 and started recovering we are going with the idea of a double correction in wave (( X )) as per preferred Elliott Wave view and expected to test 2.633 – 2.684 region before decline resumes. Ideally expected price to stay below 1.618 ext at 2.766 for a turn lower. […]

-

Oil and SPX simple correlation using Elliott wave cycles.

Read MoreIn today’s video we are going to take a look at relation ship between Oil (blue) and SPX (black). Followers of fundamentals often argue that lower Oil means higher Indices. Looking at charts, we can see huge correlation between the 2 instruments. We use another dimension correlation in which 2 instruments could be moving in […]

-

$HG_F (Copper) Short-term Elliott Wave Analysis 1.8.2015

Read MoreLooking at Elliott wave swing sequence, Copper (HG_F) metal is showing 5 swings down from 12/9 high (2.95) which is an incomplete swing sequence so our preferred Elliott wave view is that wave B high at 2.866 would hold for another swing lower toward 2.67 (100% ext) followed by 2.61 which is 100% ext of […]

-

$HG_F (Copper) Short-term Elliott Wave Analysis 1.7.2015

Read MoreLooking at Elliott wave swing sequence, Copper (HG_F) metal is showing 5 swings down from 12/9 high (2.95) which is an incomplete swing sequence so our preferred Elliott wave view is that wave B high at 2.866 would hold for another swing lower toward 2.67 (100% ext) followed by 2.61 which is 100% ext of […]