Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Copper Short Term Elliott Wave Update 9.10.2015

Read MoreRally from wave (W) low at 2.209 is unfolding in double corrective structure WXY where wave W ended at 2.418, wave X ended at 2.3053, and wave Y of (X) is in progress towards 2.516 – 2.64 area before turning lower at least in 3 waves. Short term, wave ((w)) is proposed complete at 2.4755, […]

-

Copper Short Term Elliott Wave Analysis 9.9.2015

Read MoreRally from wave (W) low at 2.209 is unfolding in double corrective structure WXY where wave W ended at 2.418, wave X ended at 2.3053, and wave Y of (X) is in progress towards 2.516 – 2.64 area before turning lower at least in 3 waves. Short term, wave ((w)) can extend to 2.484 – […]

-

HG #F (Cooper) 1H Elliott wave Set up .

https://elliottwave-forecast.com/wp-content/uploads/2014/09/Copper-1-Hour-Aug-26.mp4Read More -

Silver Short Term Elliott Wave Analysis 8.28.2015

Read MoreShort term Elliott Wave view suggests the decline from wave (X) at 15.65 took the form of a double corrective structure (w)-(x)-(y) where wave (w) ended at 14.59, wave (x) ended at 15.15, and wave (y) of ((w)) ended at 13.96. Wave ((x)) bounce is currently in progress and can reach as high as 14.8 – […]

-

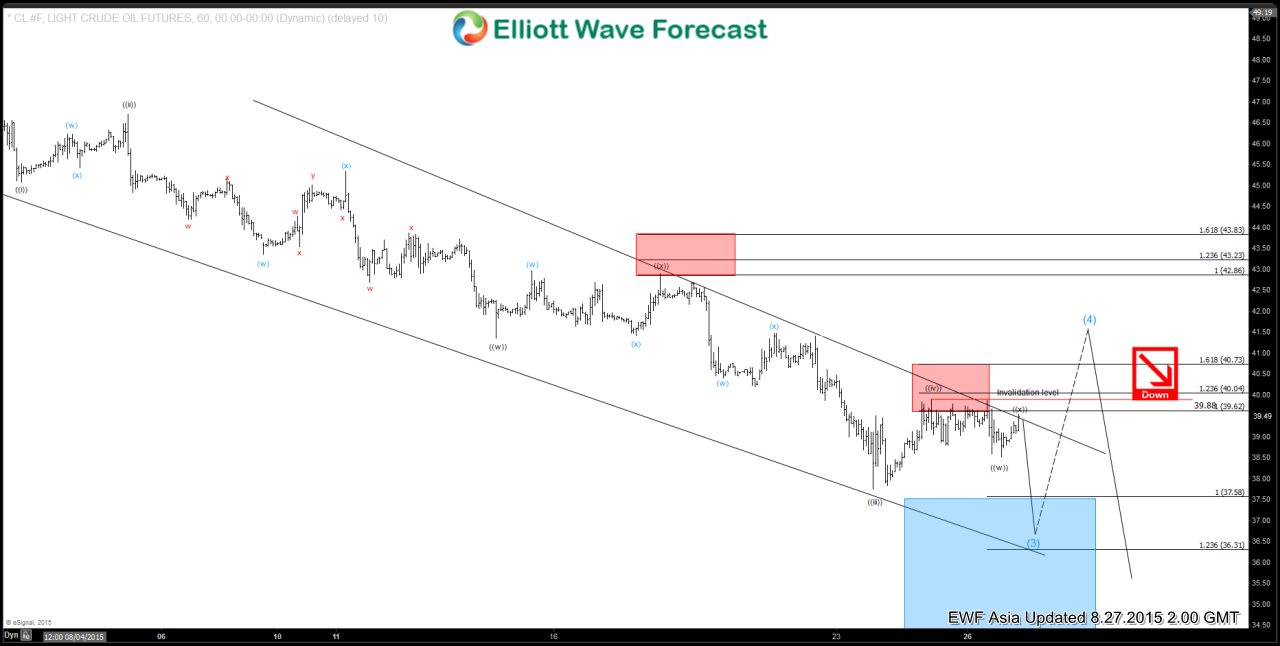

Oil (CL) Short Term Video Elliott Wave Analysis 8.27.2015

Read MoreRally to 49.5 ended wave 4. From this level, the internal of wave 5 of (3) lower is unfolding in 5 waves where wave ((i)) ended at 45.08, wave ((ii)) ended at 46.71, wave ((iii)) ended at 37.75, wave ((iv)) is proposed complete at 39.89 and oil has resumed lower in wave ((v)) of (3) towards 36.22 […]

-

Oil (CL) Short Term Elliott Wave Analysis 8.27.2015

Read MoreRally to 49.5 ended wave 4. From this level, the internal of wave 5 of (3) lower is unfolding in 5 waves where wave ((i)) ended at 45.08, wave ((ii)) ended at 46.71, wave ((iii)) ended at 37.75, wave ((iv)) is proposed complete at 39.89 and oil has resumed lower in wave ((v)) of (3) towards 36.22 […]