Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

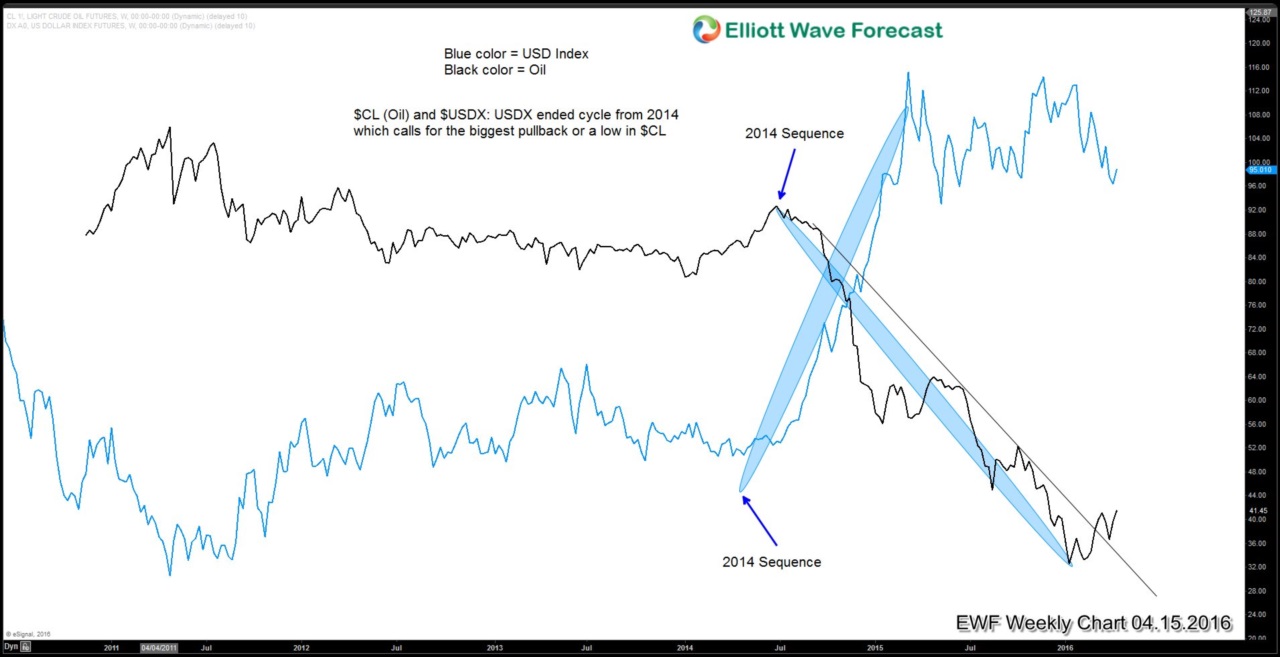

What to expect with Oil from Doha meeting on April 17

Read MoreIn our article dated Dec 13, 2015 titled “What OPEC decision means to Oil and $USDCAD” we wrote about the oil revolution; the rise of shale oil producers from North America and the OPEC cartel trying to fight against this threat by flooding the market with conventional oil to fight for market share and also drive […]

-

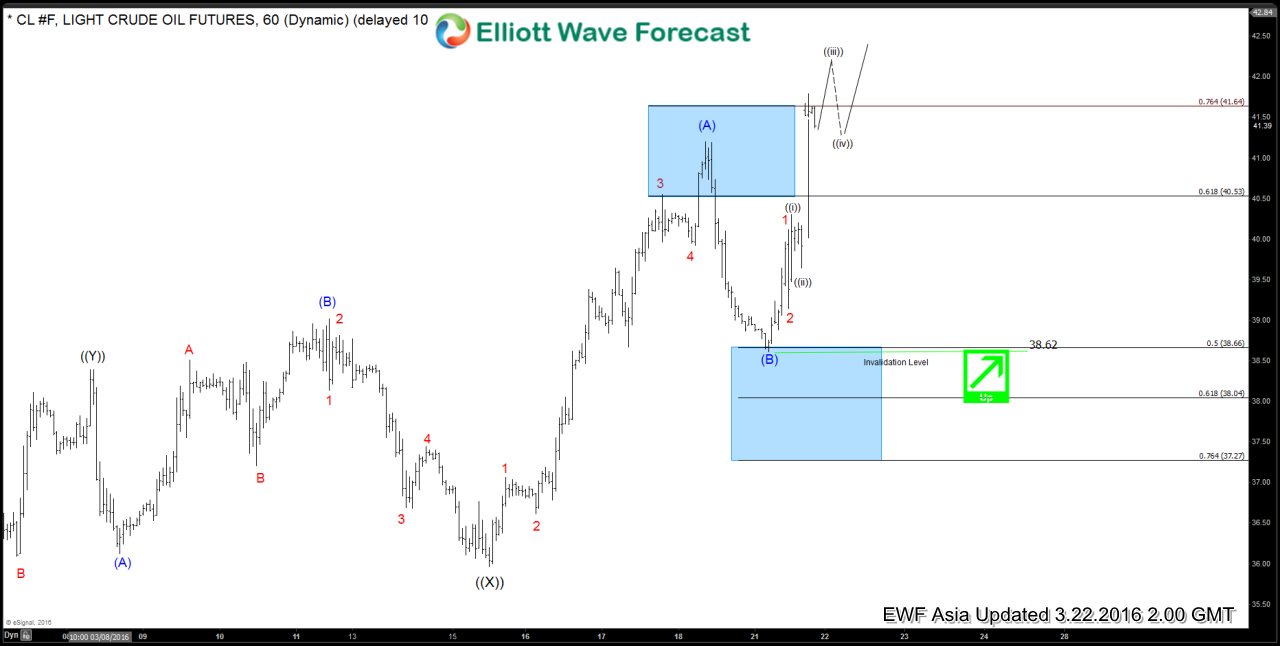

Oil $CL_F Short-term Elliott Wave Analysis 3.22.2016

Read MoreShort term Elliottwave structure suggests dips to 35.98 on March 15 ended second wave ((X)). Rally from there is unfolding in a zigzag structure where wave (A) ended at 41.2, wave (B) ended at 38.62, and wave (C) is in progress higher as 5 waves. While pullbacks stay above 38.62, Oil is expected to continue higher in wave […]

-

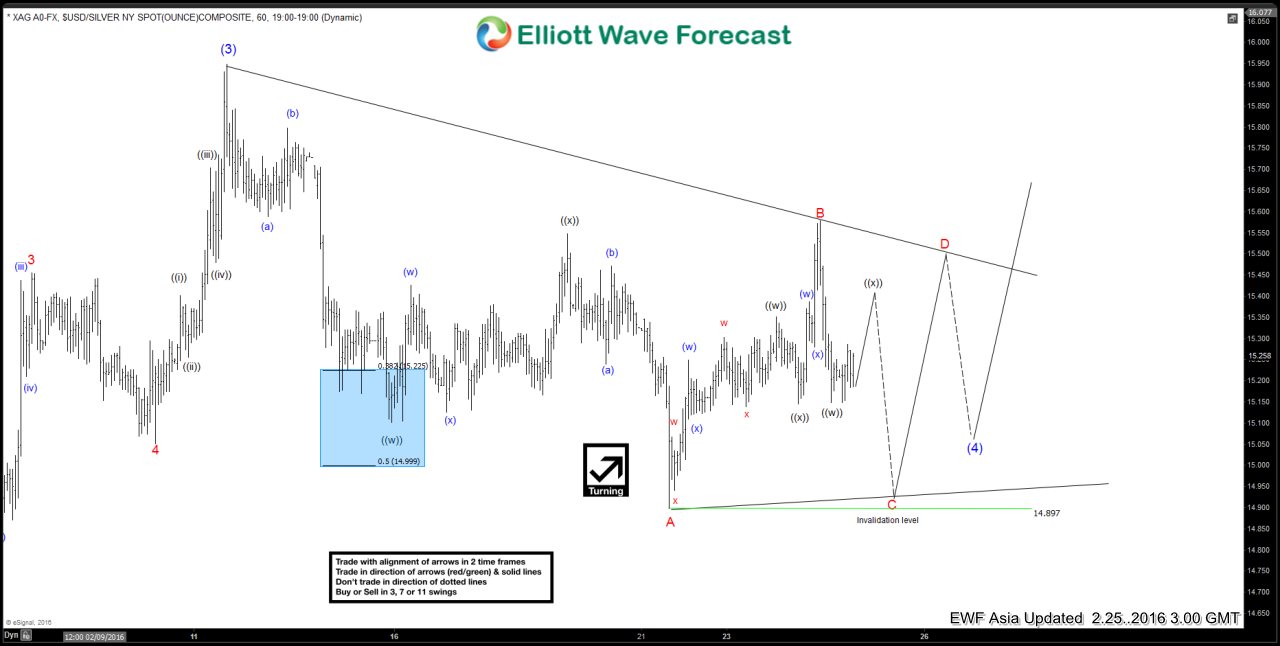

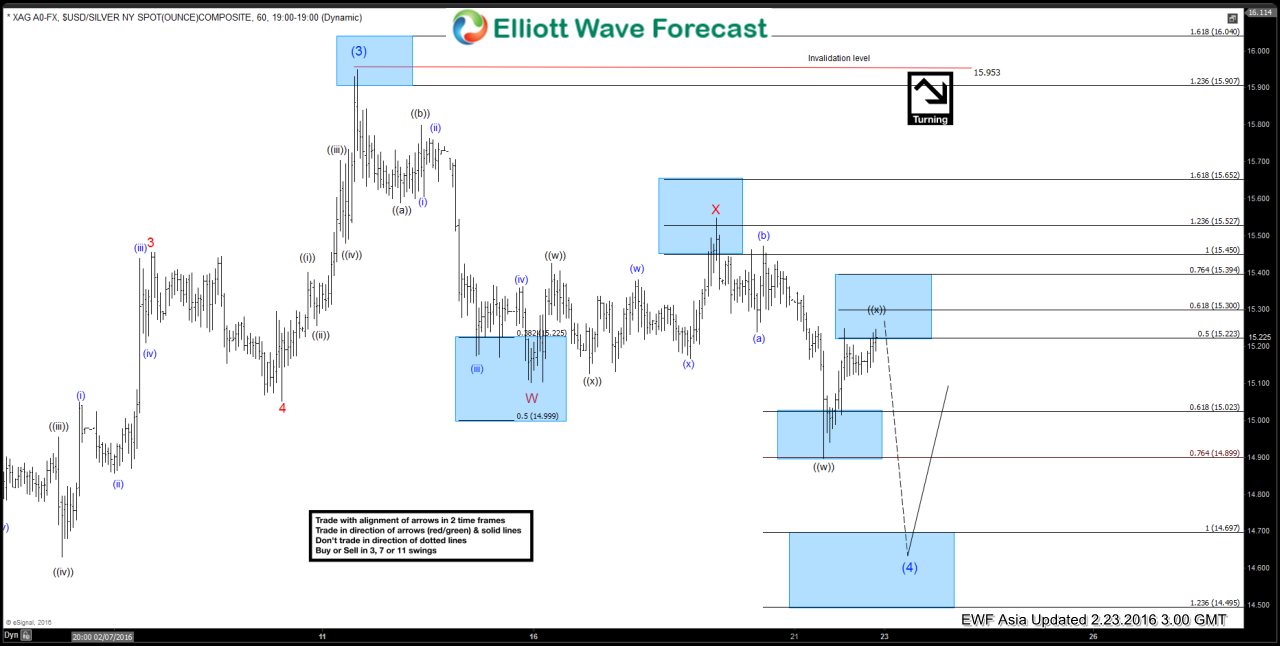

Silver $XAGUSD Short-term Elliott Wave Analysis 2.26.2016

Read MoreShort term Elliottwave structure suggests rally to 15.953 ended wave (3). Wave (4) pullback is unfolding as a triangle where wave A ended at 14.89, wave B ended at 15.57, and wave C is currently in progress. Internal of wave C is unfolding as a double three where wave ((w)) ended at 15.15, wave ((x)) ended at 15.318, and wave […]

-

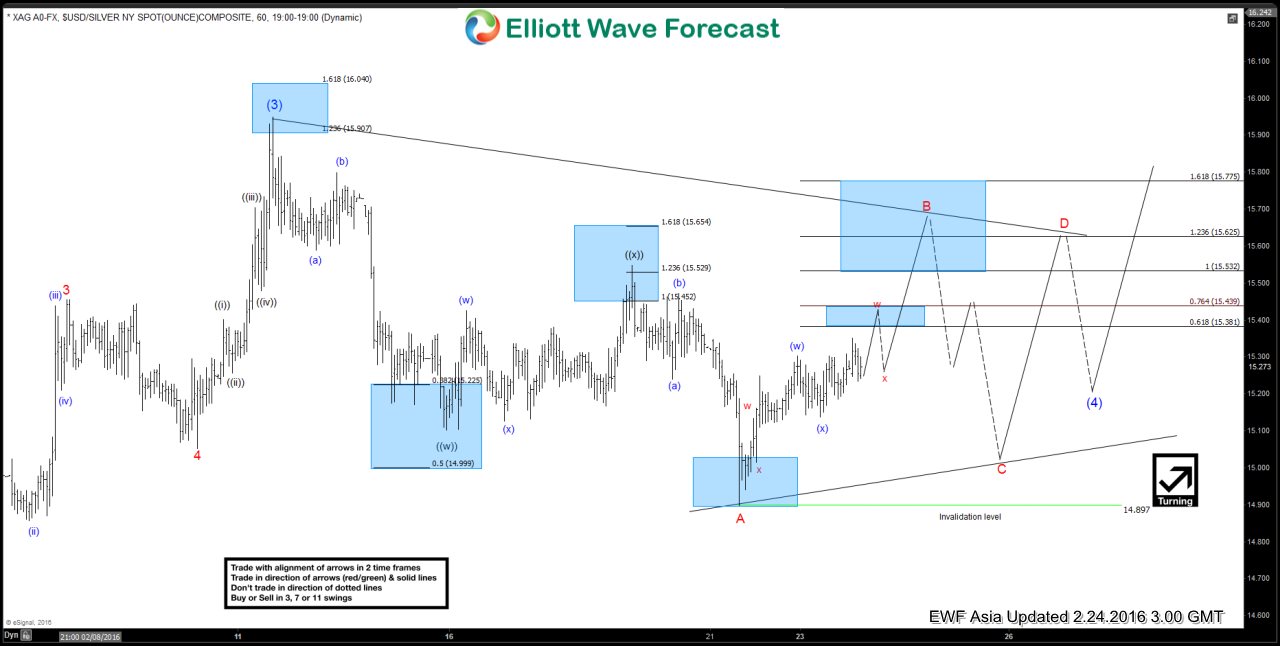

Silver $XAGUSD Short-term Elliott Wave Analysis 2.25.2016

Read MoreShort term Elliottwave structure suggests rally to 15.953 ended wave (3). Wave (4) pullback is unfolding as a triangle where wave A ended at 14.89, wave B ended at 15.57, and wave C is currently in progress. Internal of wave C is unfolding as a double three where wave ((w)) ended at 15.15, and wave ((x)) bounce is expected to […]

-

Silver $XAGUSD Short-term Elliott Wave Analysis 2.24.2016

Read MoreRevised short term Elliottwave structure suggests rally to 15.953 ended wave (3). Wave (4) pullback is unfolding as a triangle where wave A ended at 14.89, and wave B is currently in progress. Internal of wave B is unfolding as a double three where wave (w) ended at 15.3, and wave (x) ended at 15.13. While above this level, the […]

-

Silver $XAGUSD Short-term Elliott Wave Analysis 2.23.2016

Read MoreShort term Elliottwave structure suggests rally to 15.953 ended wave (3). Wave (4) pullback is unfolding as a double three structure where wave W ended at 15.1, wave X ended at 15.54, and silver has resumed lower in wave Y. Wave ((x)) bounce is now expected to fail below 15.54, but more importantly below 15.95, for another leg lower […]