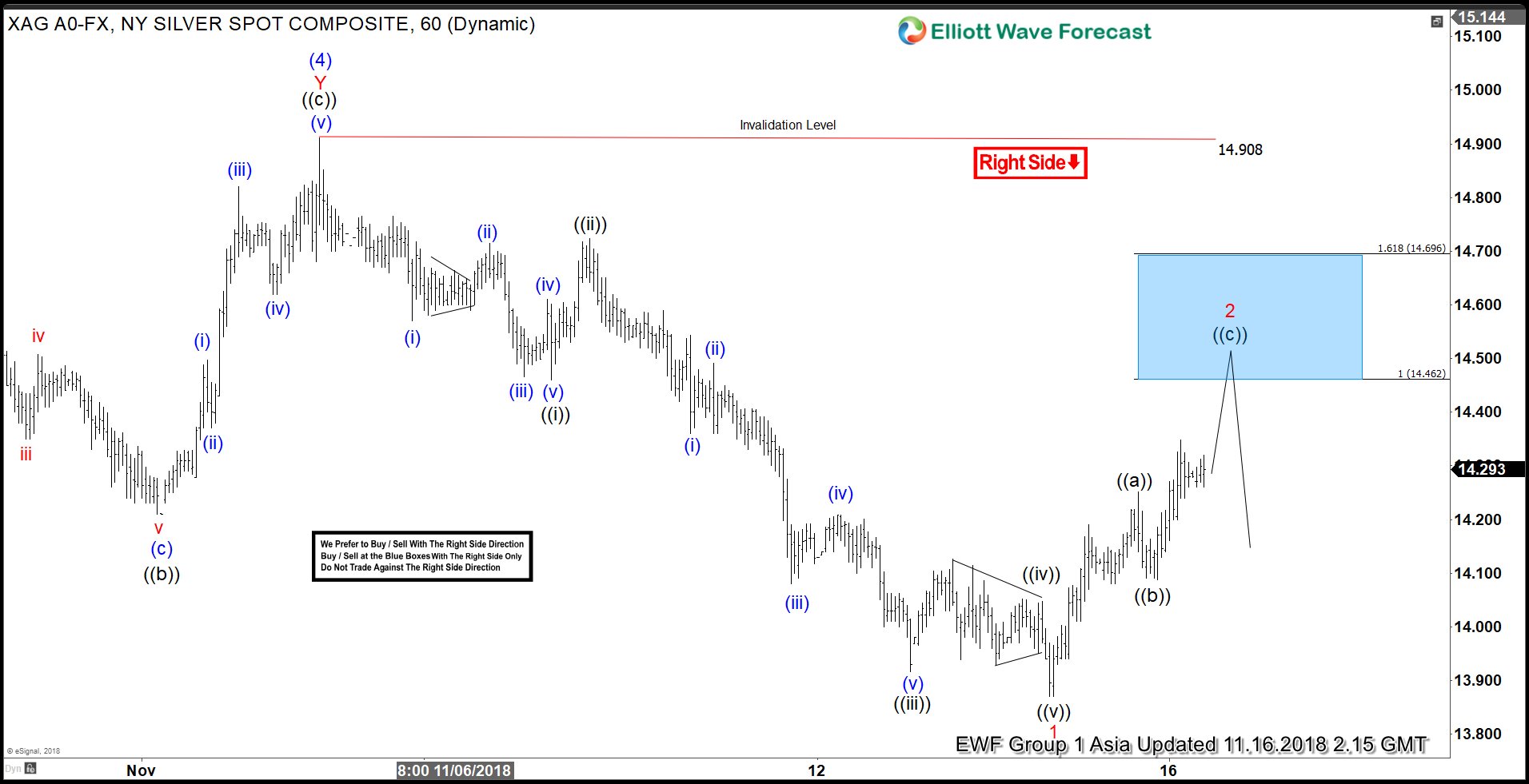

The precious metal group does not get any break in the past 7 years. The move lower has been relentless and rally has been short lived. Silver in particular has corrected 70% from the 2011 high at $50 and still has not shown any sign of serious recovery. Our short term Elliott Wave view suggests that Silver is doing a 5 waves impulsive Elliott Wave move from April 19, 2018 high where Intermediate wave (1) ended at $16.06, Intermediate wave (2) ended at $17.31, Intermediate wave (3) ended at $13.94, and Intermediate wave (4) ended at $14.91.

Intermediate wave (5) is currently in progress as an impulse where Minor wave 1 of (5) ended at $13.87. Internal of Minor wave 1 also unfolded as an impulse of lesser degree where Minute wave ((i)) ended at $14.46 and Minute wave ((ii)) ended at $14.72. Minute wave ((iii)) ended at $13.91, Minute wave ((iv)) ended at $14.05 as triangle, and Minute wave ((v)) of 1 ended at $13.87. Minor wave 2 rally is currently in progress as a zigzag Elliott Wave structure where Minute wave ((a)) of 2 ended at $14.25 and Minute wave ((b)) of 2 ended at $14.08. Minute wave ((c)) of 2 has a target of $14.46 – $14.69 and as far as pivot at 11/2 high ($14.91) stays intact, expect Silver to extend lower. We don’t like buying Silver.

Silver 1 Hour Elliott Wave Chart

Back