-

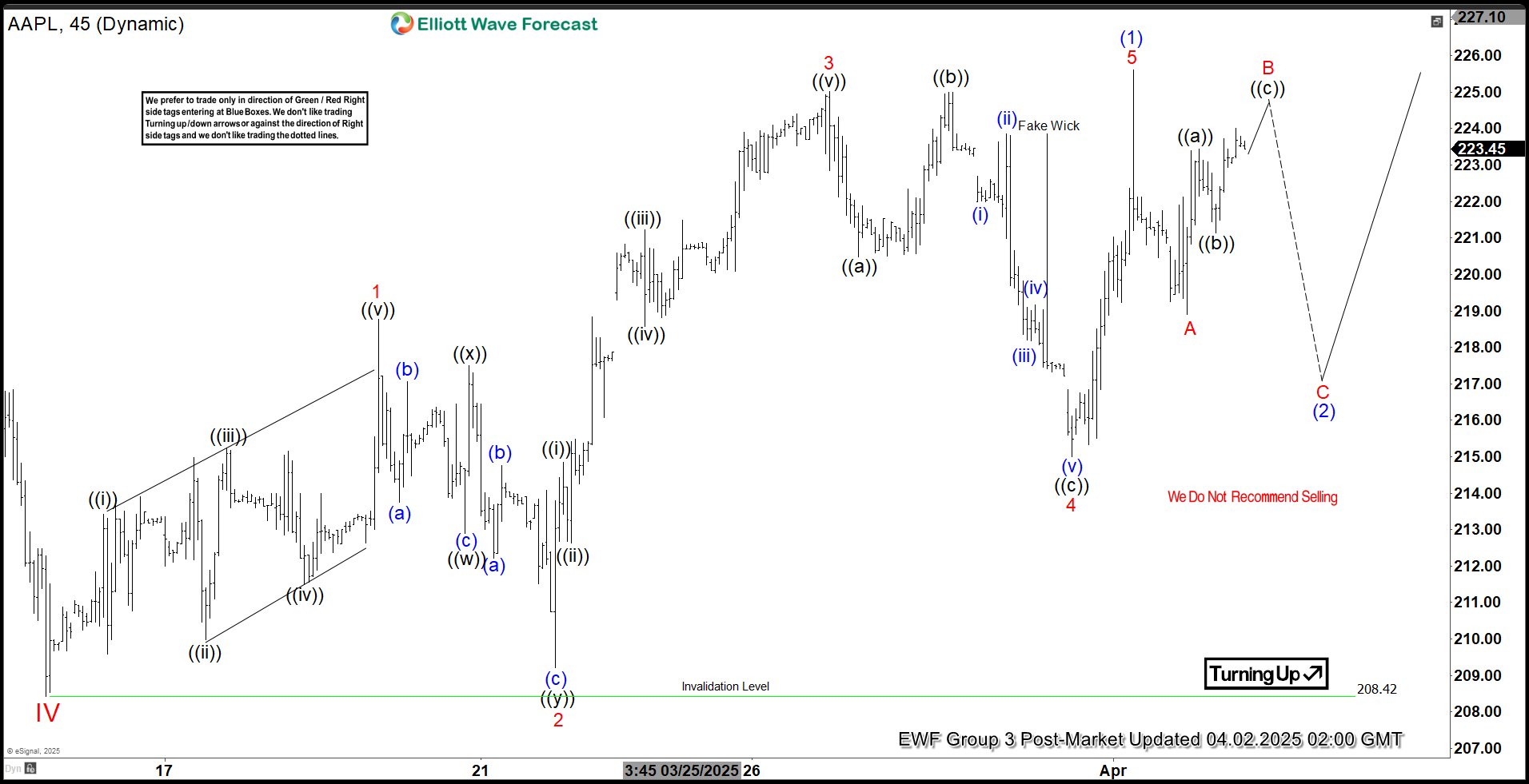

Apple (AAPL) Gains Momentum with 5 Swing Rally, Upside Likely

Read MoreApple (AAPL) Posts 5-Swing Rally from March 14, 2025 Low, Hinting at Further Gains; Article and Video Explore Elliott Wave Path

-

The DAX is declining in an impulsive structure, according to Elliott Wave perspective

Read MoreDAX decline from March 18, 2025 high is progressing as a 5-wave impulse, suggesting further downside. This article & video explore Elliott Wave trajectory.

-

Elliott Wave Perspective: Dow Futures (YM) Poised to Continue Its Rally

Read MoreDow Futures (YM_F) completed correction & is beginning to trend upward. This article & accompanying video explore the Elliott Wave trajectory of the Index.

-

Elliott Wave View: EURUSD Correcting in Zigzag Structure

Read MoreEURUSD is correcting in zigzag structure before it resumes higher again. This article and video look at the Elliott Wave path of the pair.

-

Elliott Wave View: CADJPY Looking to Rally in 7 Swing WXY Structure

Read MoreCADJPY is looking to correct cycle from 11.20.2024 high in a double three. This article and video look at the Elliott Wave path.

-

Elliott Wave View: USDJPY Rallying in Double Zigzag

Read MoreUSDJPY rally from 3.11.2025 low is unfolding as a double zigzag structure. This article and video look at the Elliott Wave path.