The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

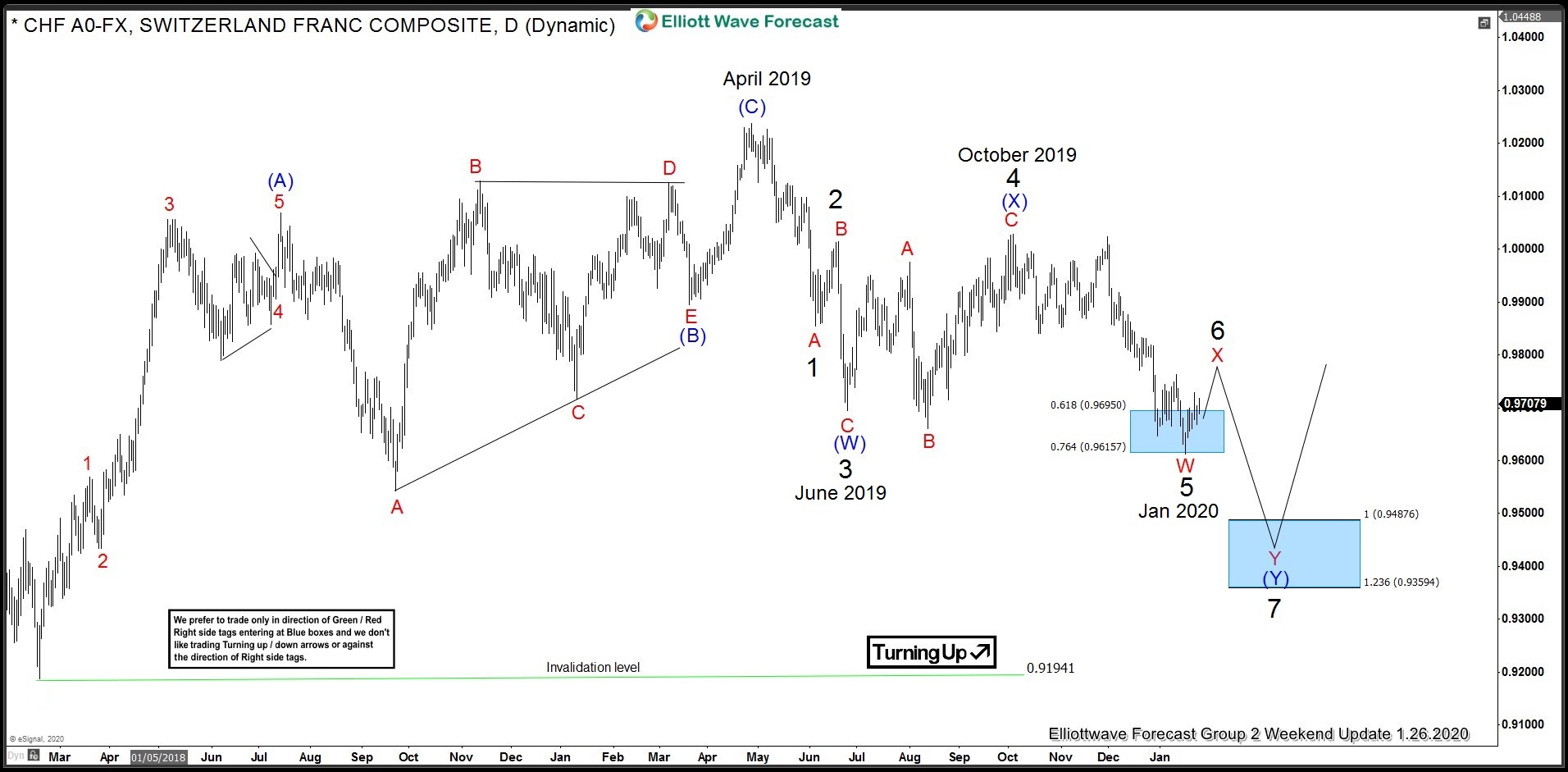

USDCHF Incomplete Elliott Wave Sequence Puts Sellers in Control

Read MoreUSDCHF found a low on 1.16.2020 (0.9610) and has been bouncing since then. Initial rally from 0.9610 to 0.9729 was in 3 waves which was followed by a pull back and pair has since then made a new high above 0.9729 and today, we would look at the structure of the bounce from 0.9610 and […]

-

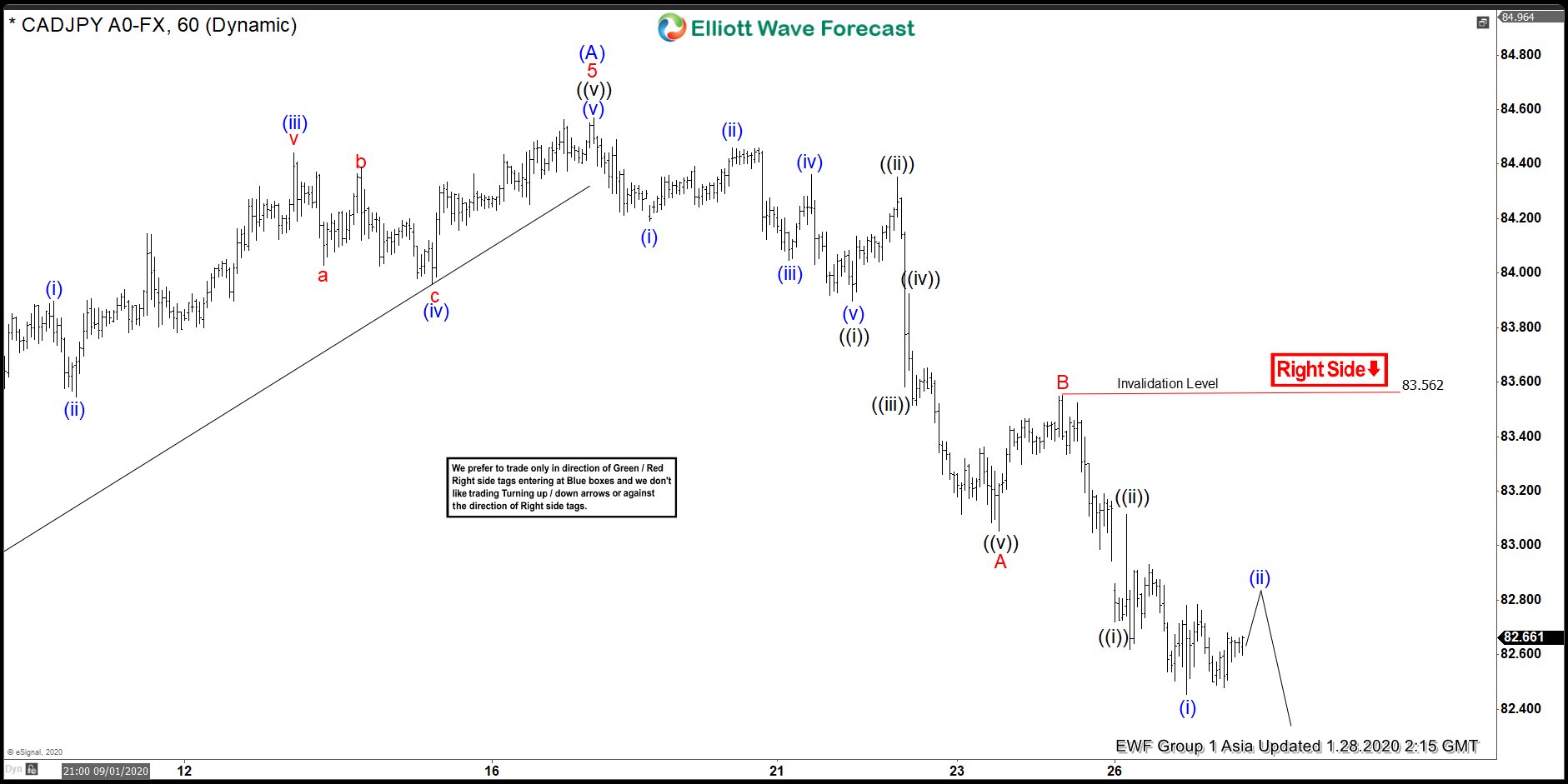

CADJPY Elliott Wave View: Pullback Another Opportunity To Buy?

Read MoreCADJPY is correcting the cycle from August 25, 2019 lows as a zigzag structure. This article & video show the Elliott Wave path.

-

Corn (ZC_F) Forecasting The Bounce From The Blue Box Area

Read MoreIn this blog, we are going to take a quick look at the Elliottwave chart of Corn (ZC_F). The chart from 1.16.2020 New York update showed that Corn was doing a pullback in wave (2). Wave A of (2) ended at 376’4 low. Wave B of (2) ended at 390’5 high. From there, we expect […]

-

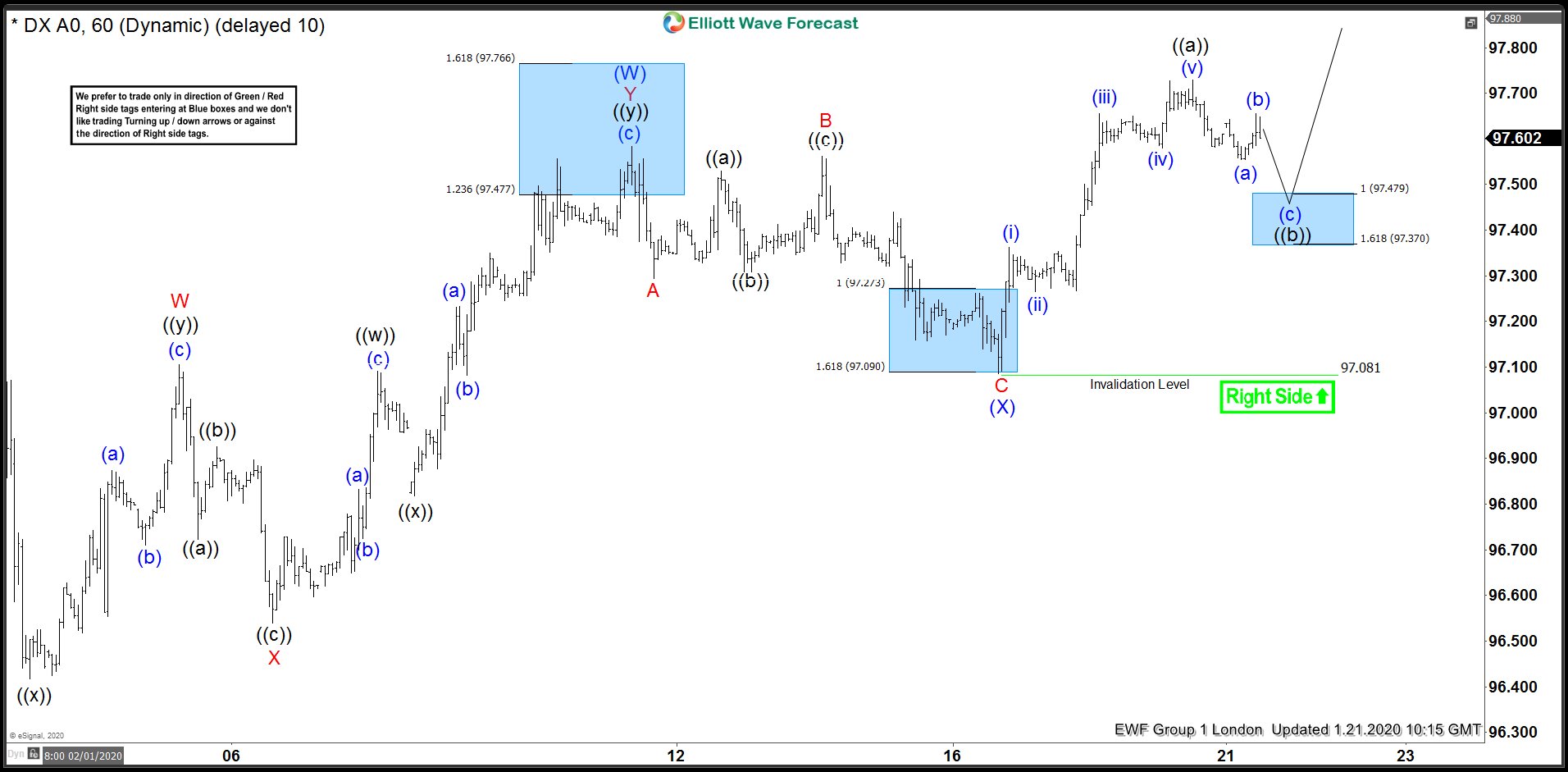

USDX Forecasting The Rally And Buying The Dips In The Blue Box Area

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of USDX, published in members area of the website. As our members know USDX has incomplete bullish sequences in the cycle from the December 31. low. Consequently, we advised members to avoid selling it and keep on buying the […]