The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: AUDUSD in 3 Waves Correction

Read MoreShort term Elliott wave view in AUDUSD suggests the pair ended the cycle from January 1, 2020 high in wave (1) at 0.6658 low. Down from January 1, wave 1 ended at 0.6845 low and wave 2 ended at 0.6934 high. The pair continues to the downside and ended wave 3 at 0.6675 low and […]

-

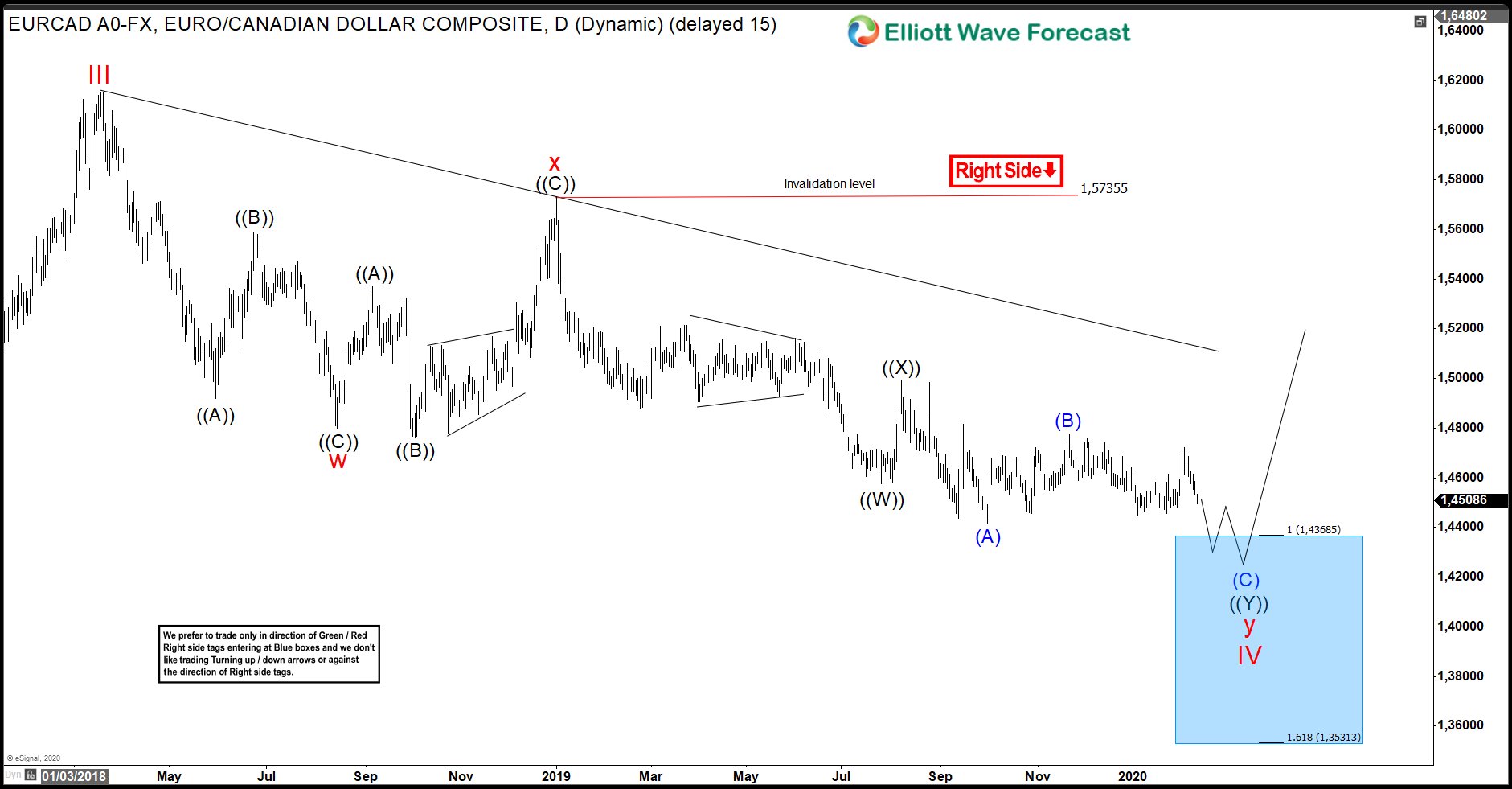

EURCAD Incomplete Sequence Keeps Sellers In Control

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of EURCAD. Based on the daily chart shown below, the pair is doing a correction in wave IV right now. The correction is unfolding as a double three and has an incomplete sequence. It has not reached the 100% -161.8% extension […]

-

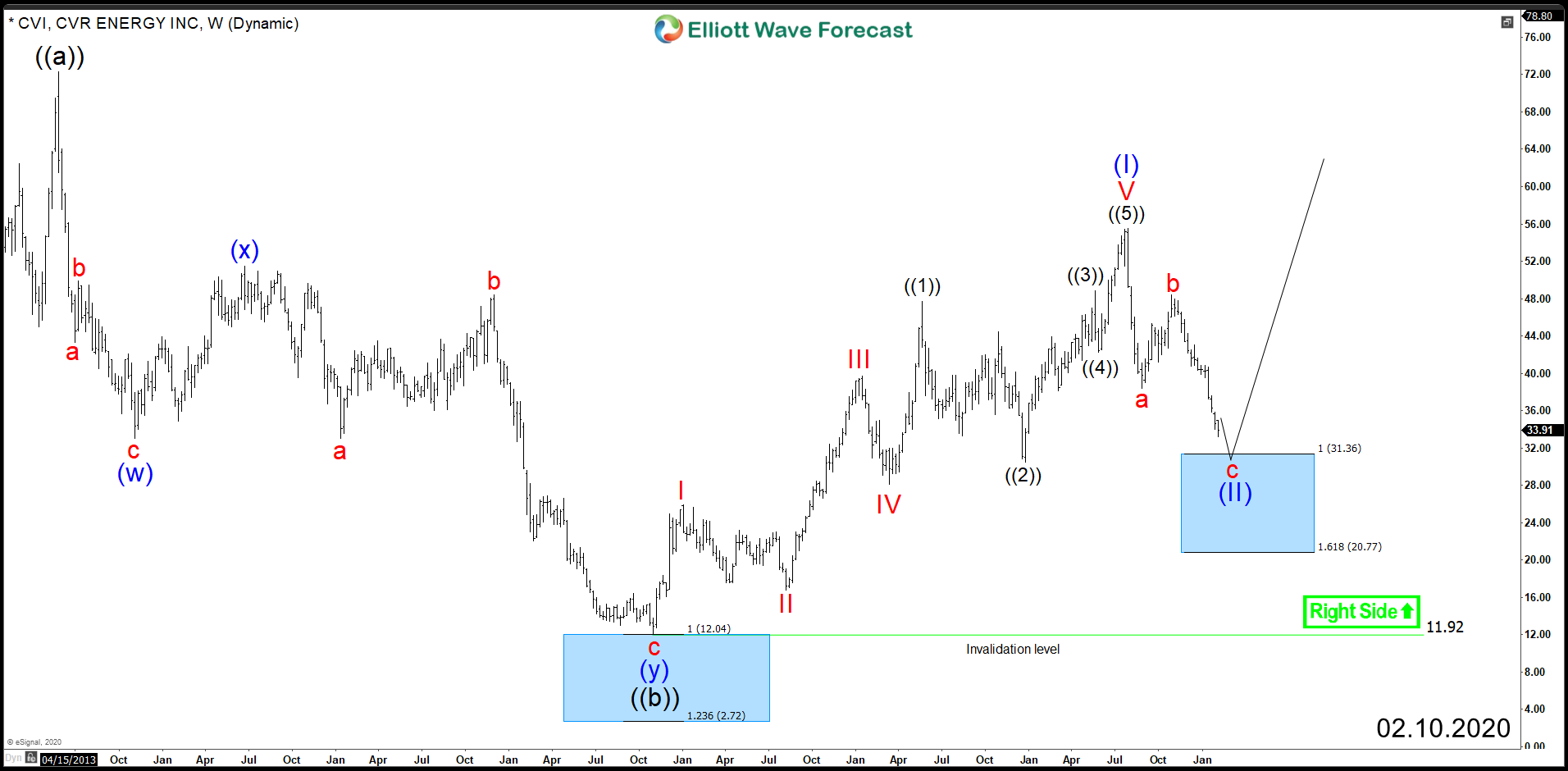

CVR Energy (NYSE:CVI) – Recovery on the Horizon

Read MoreCVR Energy (NYSE:CVI) lost almost 40% of it’s value since July of last year, as the stock started correcting the impulsive 5 waves advance from 2016 low. The correction taking place is unfolding as 3 waves Zigzag structure which can ideally find support at equal legs area $31.36 – $20.77 from where a reaction higher […]

-

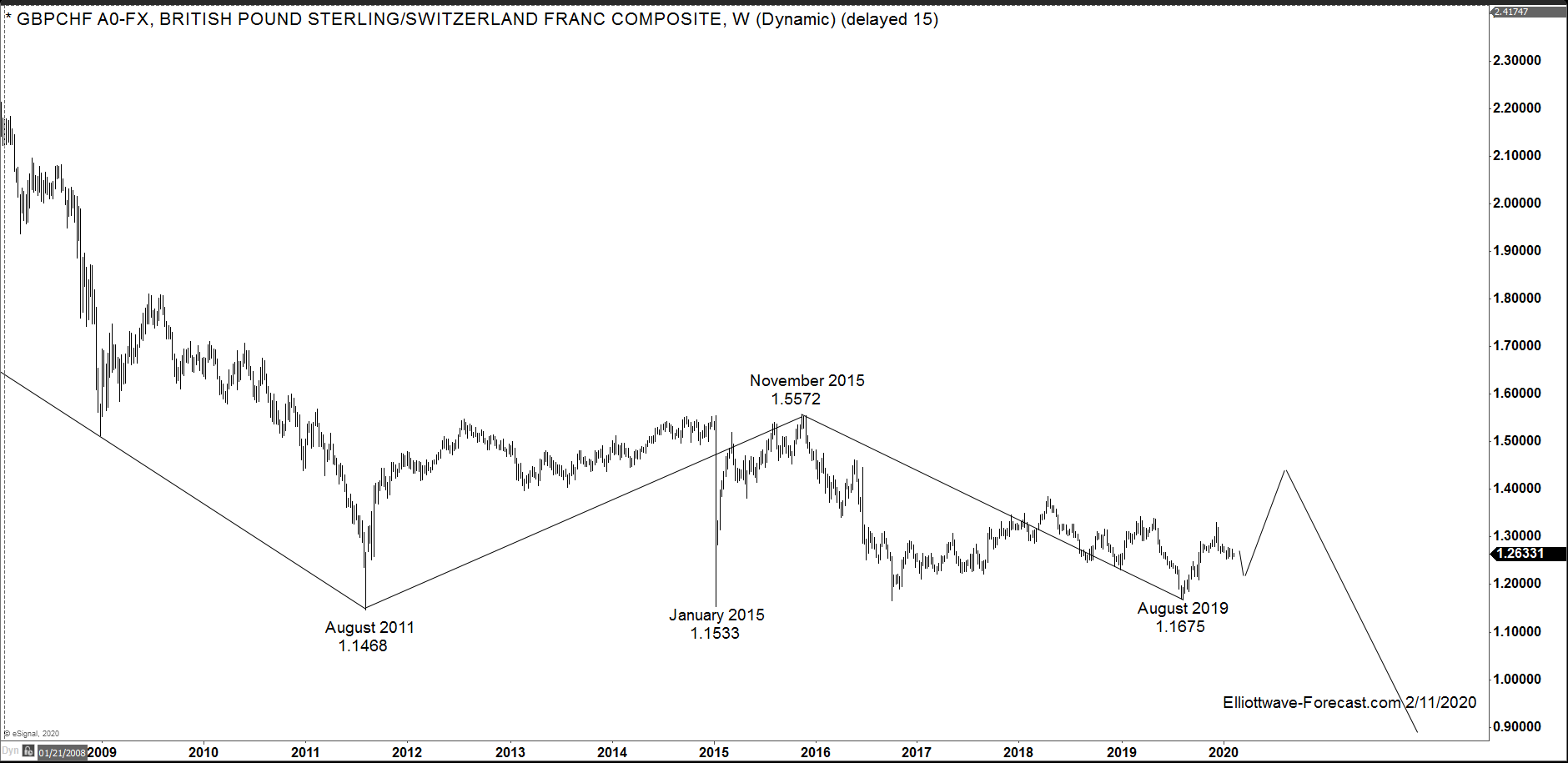

$GBPCHF FX Pair Long Term Cycles & Swings

Read More$GBPCHF FX Pair Long Term Cycles & Swings Firstly as seen on the monthly chart below there is data back to the early 1970’s readily available in the pair. It obviously had a central bank intervention during the month of October 1974 where price topped out at 6.3387. Most all Elliott Wave practitioners are geared […]