The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

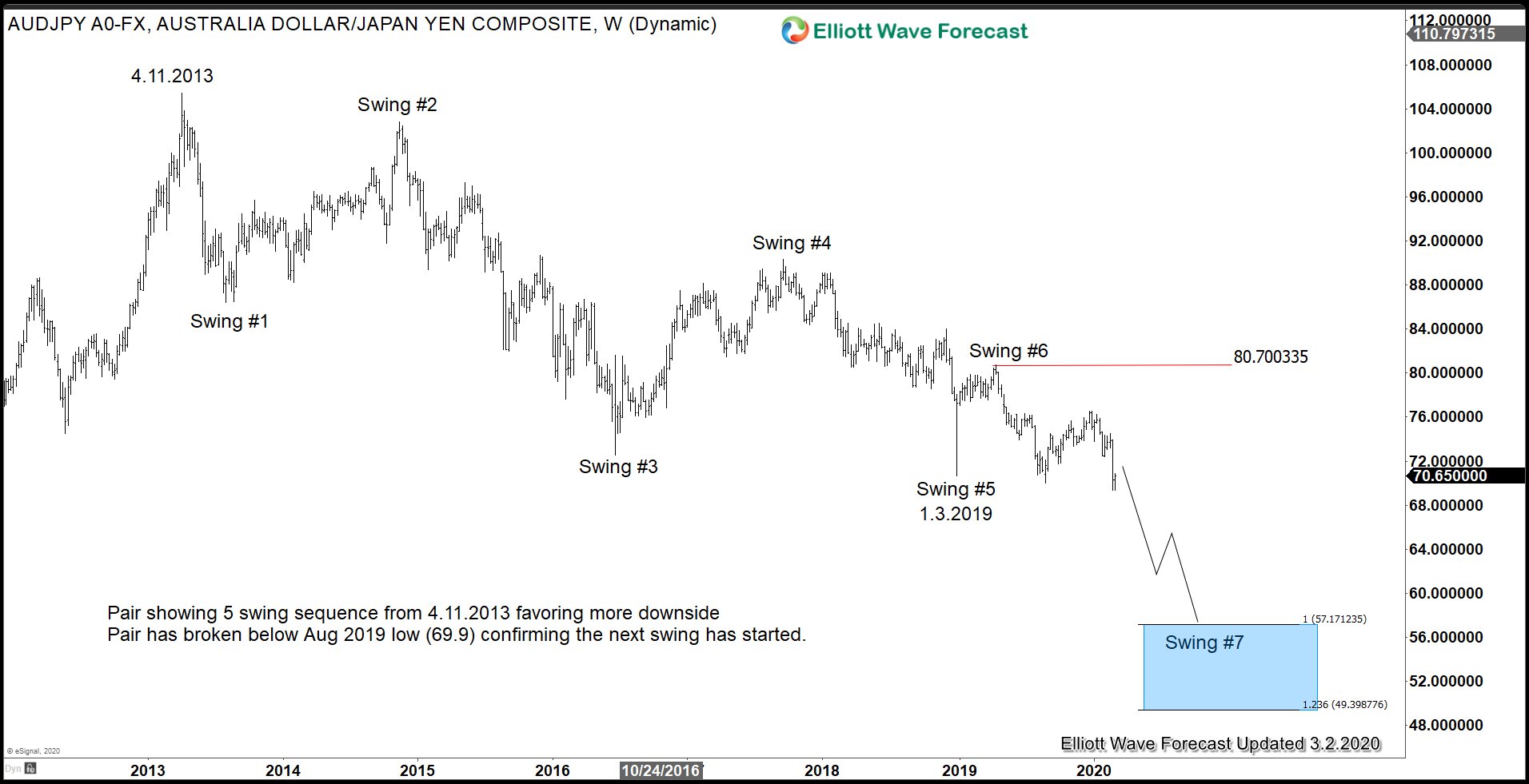

AUDJPY at 11 Year Low Amidst Coronavirus Fear

Read MoreAUDJPY sank to 11 year low last week as the market is pricing in a drastically lower Australia’s growth outlook. The coronavirus outbreak around the world has disrupted everything from travel, supply chain, and daily activities. The virus first originated in Wuhan, China and has infected 81,000 people globally and killed more than 2700 people. […]

-

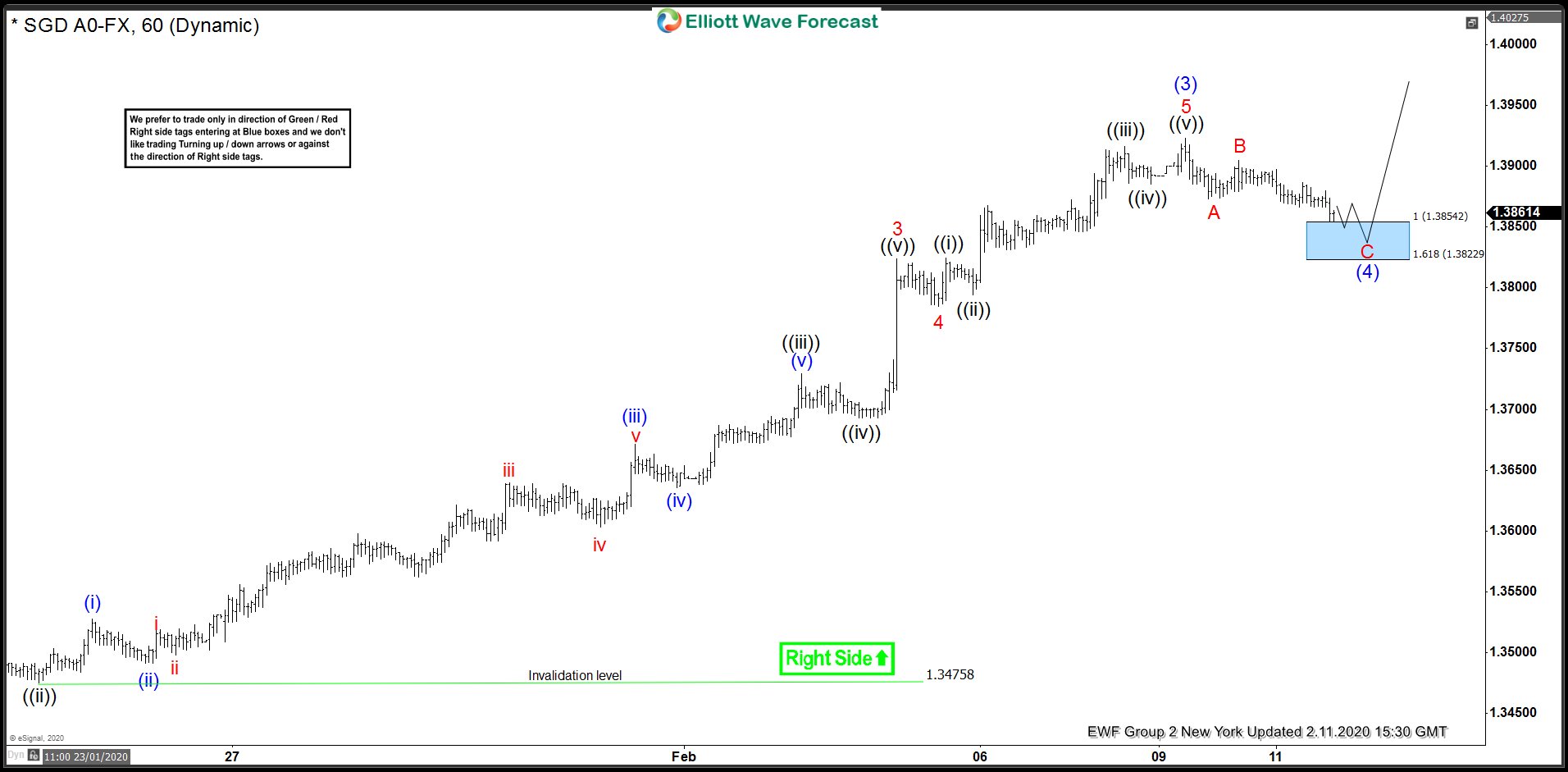

USDSGD Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. USDSGD is another forex pair that we have been trading lately . In this technical blog we’re going to take a quick look at the Elliott Wave charts of USDSGD , published in members area of the website. As our members know, USDSGD is showing bullish impulsive sequences in the cycle from […]

-

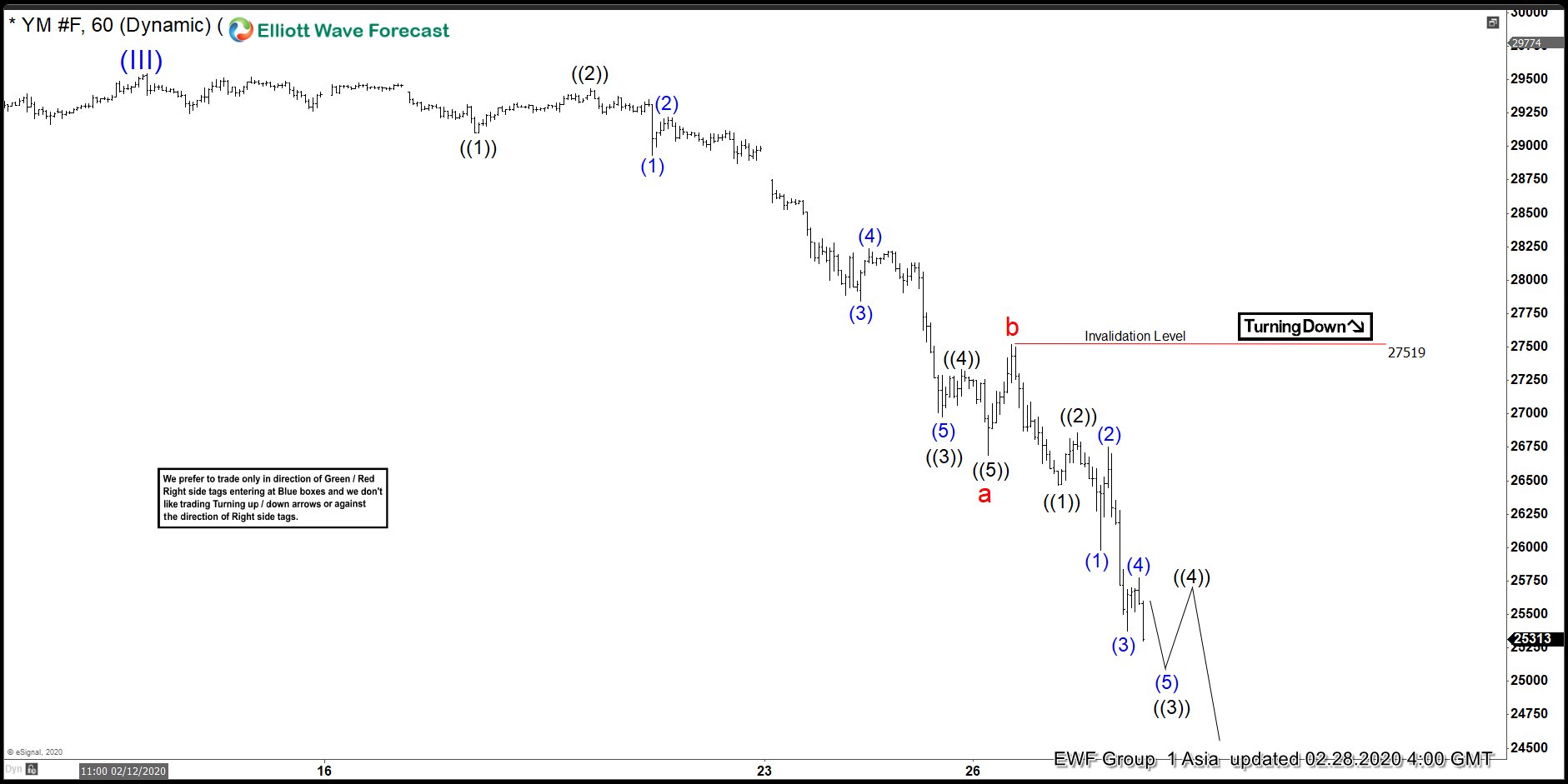

Elliott Wave View: Dow Jones Futures (YM_F) Target Lower

Read MoreThis article and video look at the short term Elliott Wave path for Dow Jones Futures (YM_F) and the downside target of the recent selloff.

-

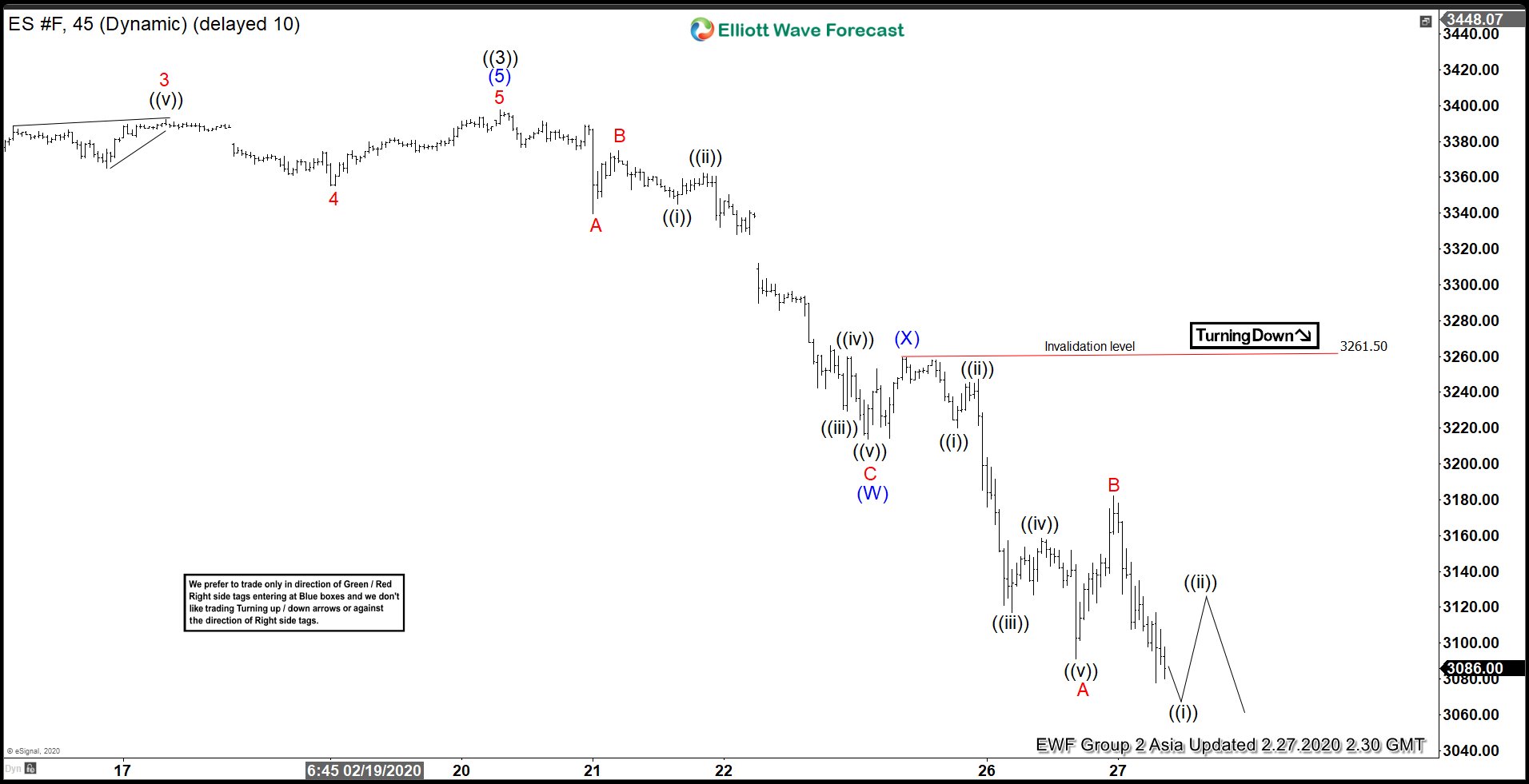

Elliott Wave View: S&P Futures ($ES_F) Downside Target

Read MoreIn this article & video, we look at S&P Futures ($ES_F) target to the downside as well as longer time frame using Elliott Wave.