The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$HEIA : Mort subite owner Heineken is correcting 2009 cycle

Read MoreIn recent days, the dutch stock Heineken has attracted a reasonable public attention as it also owns the Mort subite brand. In popular culture, the beer Mort subite goes with the Corona beer. “For 2x Coronas one can obtain 1x Mort Subite (sudden death, cardiac arrest) for free”. From the February 2020, the Heineken stock […]

-

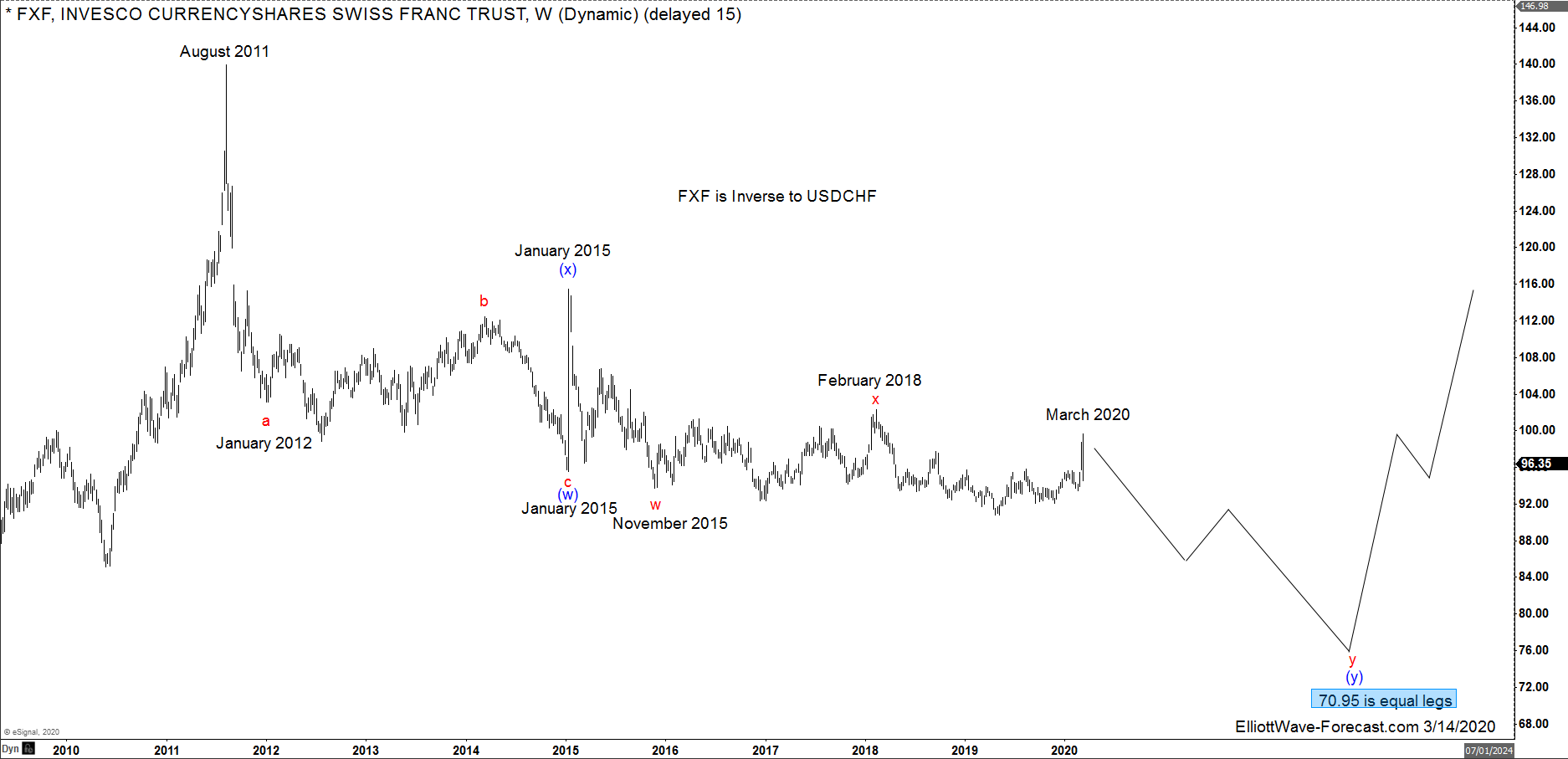

$FXF Longer Term Cycles and Elliott Wave

Read More$FXF Longer Term Cycles and Elliott Wave Firstly there is data back to when the ETF fund began in 2006 as low as 78.43. Data correlated in the USDCHF foreign exchange pair suggests the FXF high in August 2011 is also the lows of a cycle lower from the all time in the USDCHF. In this instrument there […]

-

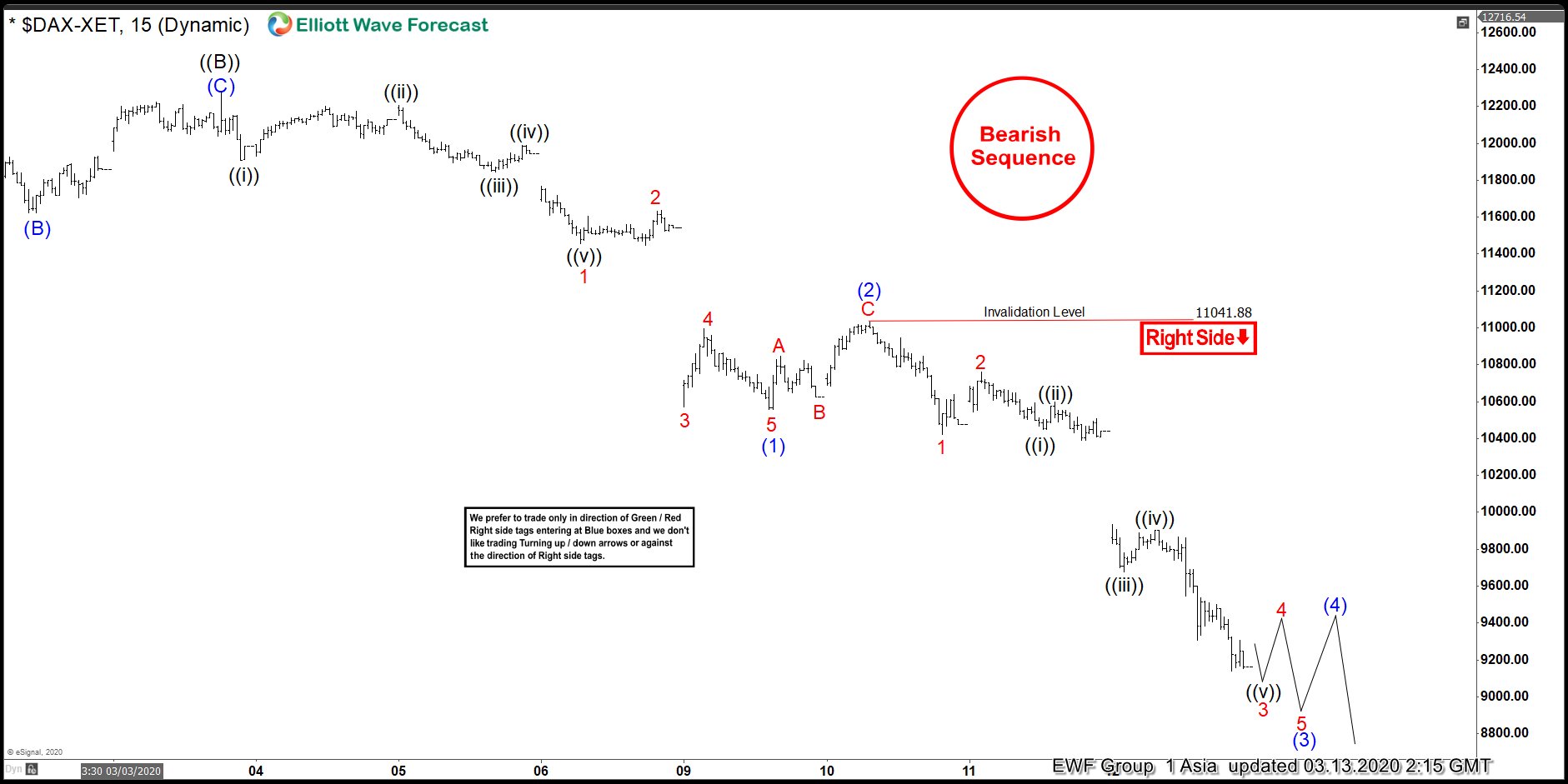

Elliott Wave View: DAX Has Reached Minimum Target

Read MoreDAX has reached the minimum target from Feb 19 peak and may see slowing down of the selloff and consolidate soon. This video look at the elliottwave path.

-

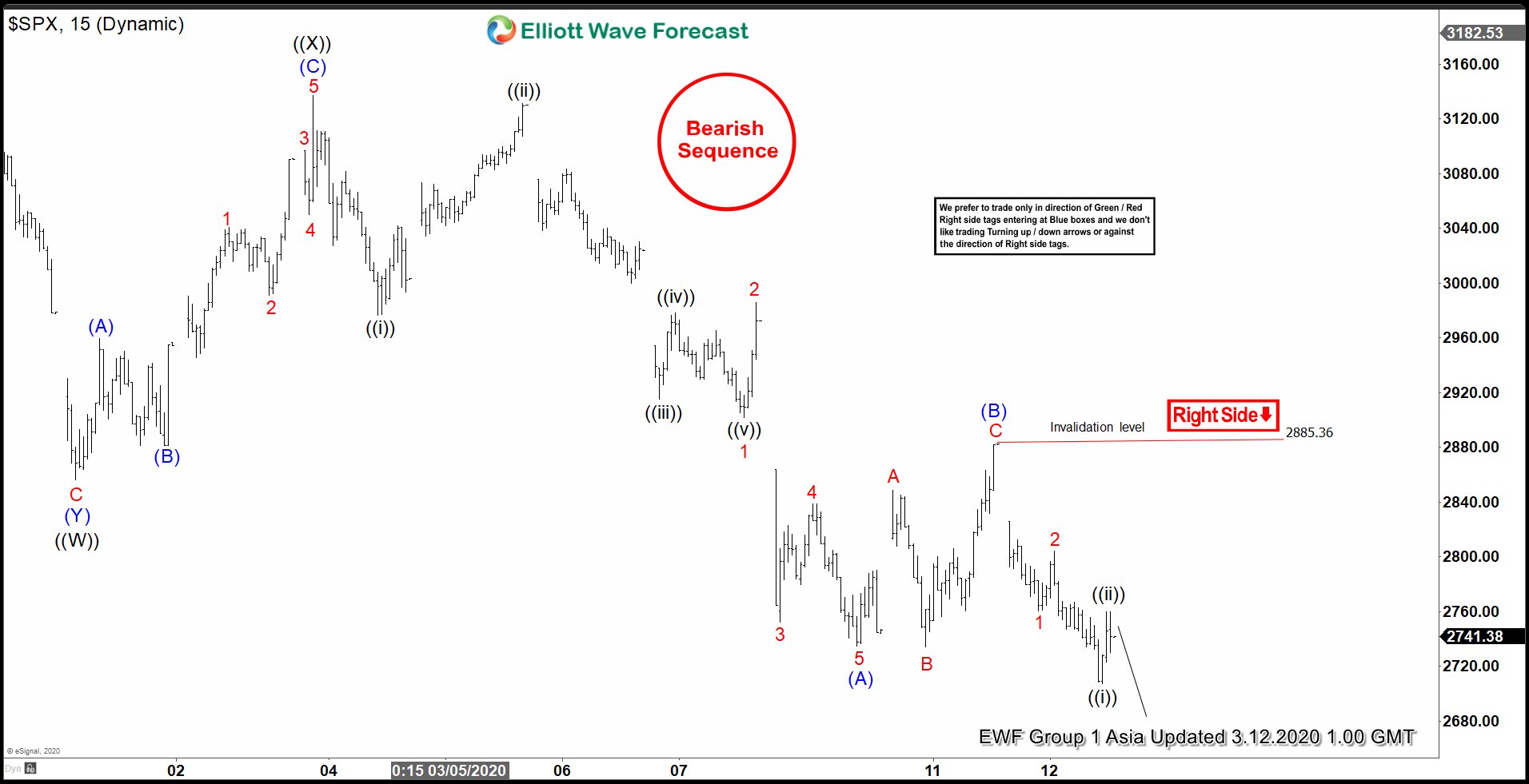

Elliott Wave View : S&P 500 (SPX) Reaching Inflection Area

Read MoreShort term Elliott Wave view in S&P 500 (SPX) suggests cycle from February 19, 2020 high is unfolding as a double three Elliott Wave structure. Down from February 19, 2020 high, wave ((W)) ended at 2855 low. The bounce in wave ((X)) ended at 3136 high. From there, the Index has extended lower and broken […]